Can You Pay Off Your Mortgage Early

In most cases, homeowners can pay off their mortgage early, provided you follow certain ground rules and make sure the terms of your loan.

The first step is to recognize how your payment works. Early in a 30-year loan, the bulk of the payment goes toward loan interest. As the loan is closer to completion, the bulk goes toward the amount you borrowed, or the principal. But if the principal is lowered through extra early payments, the interest paid also is lowered. Paying down principal in the long run will reduce the total interest paid on the loan.

The more the principal is paid, the more the homeowner builds equity in the home. To easily figure the equity, calculate a fair price you feel the home is worth then subtract the loan balance. If a home could be sold for $300,000 and you have $150,000 left on the loan, you have $150,000 in equity.

When considering paying the mortgage early, be sure you know the answer to a question that many, especially first-time homebuyers, often do not consider: Is there a prepayment penalty on your loan? Many lenders do not have this penalty, but those that do will charge for making early payments. If you have any uncertainty, call your lender to ask specifically about prepayment penalty.

Once that question is answered, be sure to tell your lender if and when you make extra payments that you want that money applied to principal.

Whats An Example Of Amortization

Lets say you work with a top agent to buy a $300,000 house with a 20% down payment . To cover the rest, you take out a 15-year fixed-rate mortgage at a 3.5% interest ratethats a total home loan of $240,000.

Using our mortgage calculator, your monthly mortgage payment would be $1,716 . Later, well show you how to calculate this monthly payment manuallyif youre interested .

To calculate the amortization on this example, lets plug these numbers into the formula we mentioned above:

- $240,000 x 3.5% = $8,400

- $8,400 / 12 = $700

- $1,716 – $700 = $1,016

So, for your first month of making payments, that $1,716 monthly payment will be split into $700 for interest and $1,016 for principalwhich will drop your $240,000 loan balance to just under $239,000.

Refinance With A Shorter

A shorter term on the mortgage means it goes away sooner, but at the cost of a much higher monthly payment and perhaps some out of pocket closing costs. Examine the loan closely.

The monthly payment on a 30-year, $200,000 mortgage at 2.5% would be $790 a month.

The monthly payment on a 15-year, $200,000 mortgage at 2.25 % would be $1,310.

Thats another $520 a month to finish paying off your mortgage 15 years sooner.

30 Years vs 15 Years of Payments| 30 Years of Payments |

|---|

| $235,830 |

| *For a $200k mortgage |

The bottom line on this decision is the bottom line: Can you afford the higher monthly payment of a 15-year loan, or are you better off contributing extra each month when you can to a 30-year payment?

Read Also: When To Refinance Your Mortgage Dave Ramsey

How Ill Pay Off My Mortgage 10 Years Early

Your mortgage will be the largest debt youâll ever take on, but that doesnât mean you should resign yourself to being in debt for the next 25 years. There are several steps you can take to pay off your mortgage quickly.

The first thing you can do is shop around for the best mortgage rate using a mortgage broker. Even a one percentage point difference in your interest rate will save you thousands of dollars in interest charges over a 25-year amortization.

Another way to reduce the overall cost of your mortgage is to pay off your mortgage early. This is a popular strategy in Canada. A Mortgage Professionals Canada report finds that most recent homebuyers expect to repay their mortgages in 19.2 years.

I plan to pay off my 25-year mortgage 10 years early. Letâs look at three strategies Iâll use to accomplish this goal.

Choose an accelerated payment schedule

When you take on a mortgage, you must make regular payments to repay the principal and interest thatâs accumulated. There are different payment schedules to choose from, such as:

- Monthly

- Weekly

- Accelerated weekly

MonthlyâYour mortgage payment is withdrawn from your account once a month. Letâs use the example of the home I plan to buy next year: I plan to purchase a home worth $300,000 with a $35,000 down payment. At 2.49% interest, my monthly payment would be $1,214. If I choose a monthly payment schedule, $1,214 would be withdrawn from my account once a month.

$1,214 x 12 ÷ 26 = $560.31

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

You May Like: Which Bank Is Best To Get A Mortgage

Should You Pay Off Your Mortgage Faster

The answer to this question depends on the interest rate for your mortgage. In modern times when the pandemic and slowed economy have pushed interest rates so low, its not a bad idea to keep the 30-year mortgage.

One extra payment per year on a $200,000 loan at 2.75% interest only reduces the mortgage by three years and saves $12,000 in total interest.

Taking the monthly payment and investing it conservatively means you earn 4% per year on the investment, which means you gain $21,000 in interest over 30 years which means that by investing you are $9,000 ahead.

Thats a conservative figure on the investment, but everyone must remember that investment carries risk, and gains may not be steady. That being said, a 30-year loan at 2.75% is as close to free money as weve seen in a long time, so any gains on an investment should top that interest rate.

The surest way to reduce total interest is to transform a 30-year loan into 15 years. However, the budget must be able to afford the extra monthly payment.

In order, the considerations should go this way:

The worst, absolute worst, option would be to take money that could be used in important and vital ways and spending it lavishly on belongings and wasteful material goods. Is it worth buying that extra big-screen TV or more expensive car when it comes at the expense of a secure retirement or a year of college for your son or daughter?

About The Author

Find A Lower Interest Rate

Work out what features of your current loan you want to keep, and compare the interest rates on similar loans. If you find a better rate elsewhere, ask your current lender to match it or offer you a cheaper alternative.

Comparison websites can be useful, but they are businesses and may make money through promoted links. They may not cover all your options. See what to keep in mind when using comparison websites.

You May Like: What Is A Va Mortgage Rate

How Would You Use The Money You’d Be Saving On Monthly Payments

If you’re paying off your mortgage early so you can have more monthly cashflow, you should have an idea of how you’ll use that extra money. If you want to cut out your $900 mortgage payment and invest $900 per month in its place, that could be a good use of the money.

Ultimately, it’s up to you how to spend the extra cash. But if you can’t think of what you want to do with the money, or if you’d spend it on frivolous purchases, paying off your mortgage early might not be the best financial move.

Popular Articles

Hit The Principal Early

Over the first few years of your mortgage, it may seem that you are only paying interest and the principal isnt reducing at all, says Nila Sweeney, managing editor or Property Market Insider. Unfortunately, youre probably right, as this is one of the unfortunate effects of compound interest. So you need to try everything you can to get some of the principal repaid early and youll notice the difference.

Every dollar you put into your mortgage above your repayment amount attacks the capital, which means down the track youll be paying interest on a smaller amount. Extra lump sums or regular additional repayments will help you cut many years off the term of your loan.

Read Also: How Does A Heloc Work To Pay Off Mortgage

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Early Mortgage Payoff Calculator

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Recommended Reading: How Much Is A Habitat For Humanity Mortgage

Do You Have Other Debts To Pay Off

The general rule of thumb is that you should focus on paying off higher-interest debt before lower-interest debt. You may be paying a higher rate on a credit card or private student loan than on your mortgage, so you’d benefit more by paying those off early.

Don’t pay so much toward your higher-interest debt that you risk defaulting on mortgage payments, though. Yes, , and the issuer may take legal action if you default on card payments. But defaulting on mortgage payments can be an even bigger risk, because you could lose your home.

There’s no clear right or wrong answer about whether or not you should pay off your mortgage early. It depends on your situation and your personal goals.

Try Refinancing From Fha Loan To Conventional Loan

Federal Housing Administration loans help millions of Americans secure affordable homes. FHA loans are backed by the government to help consumers purchase houses with low down payments . Loan rates are also typically competitive at the beginning of the term.

Conventional home loans only require property mortgage insurance if the loan balance is above 80% of the home’s value. As the homeowner pays down their loan the insurance requirement is dropped. FHA loans charge an annual mortgage insurance premium which must be paid for the entire life of the loan. MIP is around 0.80 to 0.85 percent of the loan value. This premium cannot be canceled and must be paid yearly until the end of the mortgage.

Is There a Way to Eliminate PMI?

Yes. You can get rid of the PMI cost if you refinance from FHA to a conventional loan. To do so, you must raise your credit score to qualify for refinancing. At the very least, you should have a 620 credit score to obtain a conventional loan. But the higher your credit score, the more favorable rates you can get . This helps lower your current interest rate once you shift to a conventional loan. But again, if you shorten your term to 15 years, be ready for higher monthly payments.

To learn more about when to refinance, read our feature on top reasons for refinancing.

Recommended Reading: Which Is Better 30 Or 15 Year Mortgage

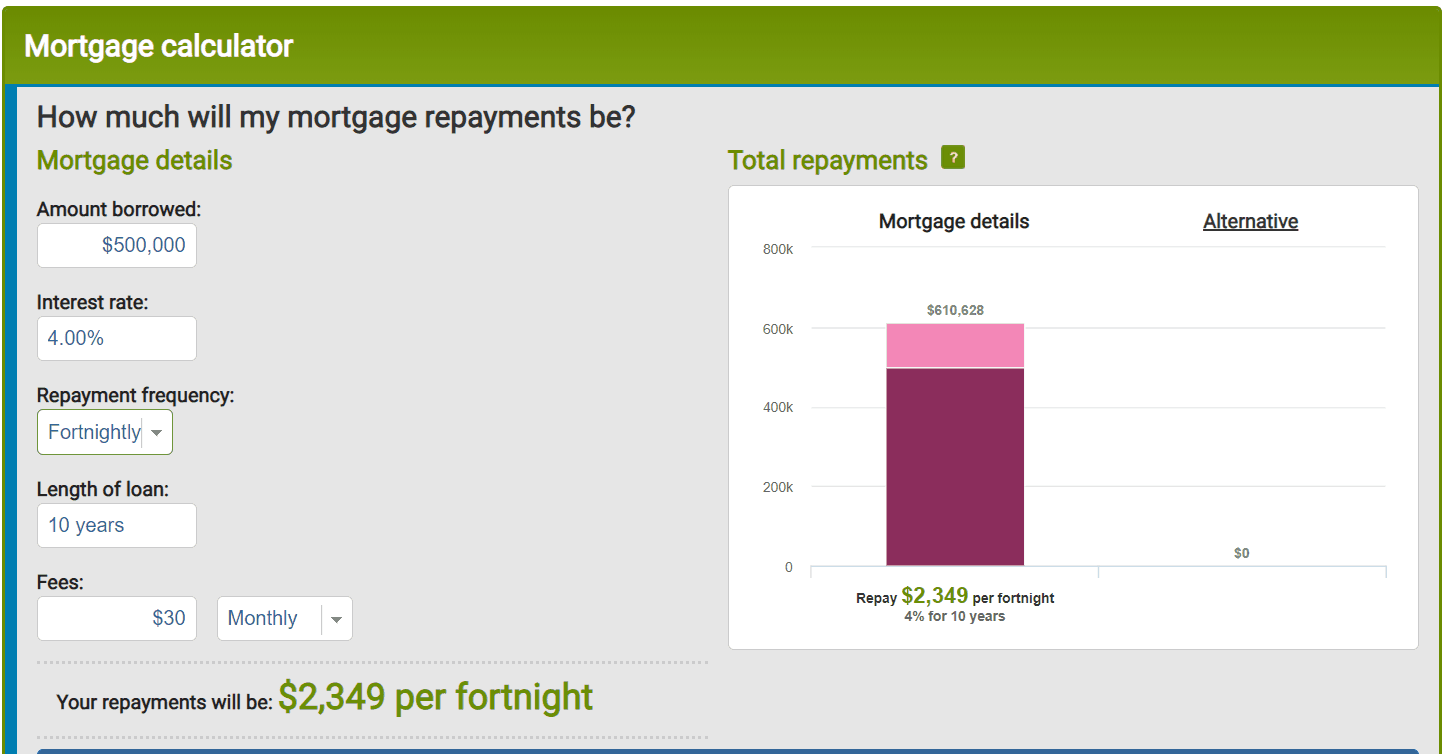

Help With Our Mortgage Balance Calculator

Using our Mortgage Balance Calculator is really simple and will immediately show you the remaining balance on any repayment mortgage details you enter.

To use it, all you need to do is:

- Enter the original Mortgage amount

- Enter the monthly payment you make

- Enter the annual interest rate

- Enter the current payment number you are at – if you are at month 2, enter 2 etc.

- Your current balance will be shown – this may be different to a balance you quote from your lender as they may have fees or other charges they apply when giving a settlement figure.

Have a look at our other Mortgages calculators

Why Is Amortization Important

Remember, an amortization schedule shows you how much of your monthly payment goes toward principal and interest. It helps you see a full view of what itll take to pay off your mortgage.

As with any type of goal setting, an amortization table gives you a game plan and the confidence to take on the mammoth task of paying off your house.

Don’t Miss: How Much Of Your Monthly Income For Mortgage

How To Pay Off Your House Faster

Understanding amortization can help you get creative with paying off your mortgage early. For example, you could throw extra payments at your mortgage that go toward the principal instead of the interestwhich would also save you thousands of dollars!

To see how this plays out, try our mortgage payoff calculator. Lets use the same example from earlier of the $240,000 mortgage at a 15-year term with a 3.5% interest rate.

After 15 years paying the minimum monthly payment of $1,716, youll have paid nearly $69,000 in total interest. But if you squeeze another $100 out of your monthly budget to make your monthly payment $1,816, youll save more than $5,000 in interest and be debt-free a whole year sooner!

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Recommended Reading: Does Discover Bank Do Mortgages

Additional Ways To Find Your Mortgage Balance

Mortgage companies will send out a mortgage statement â electronically or by mail â on an annual basis. These statements reveal the mortgage balance, number of payments that were made, and interest charged.

But what if you want to proactively find your exact mortgage balance â as stated by your mortgage company? Two popular options include:

- â Your mortgage company can give you your mortgage balance over the phone. Simply call and ask.

- Go online â Your mortgage company website will probably show your mortgage balance. You’ll have to create an online account â with a login and password â that will enable you to view your mortgage balance anytime you wish.

Factors To Consider When Paying Off The Mortgage Early

Living without any debt is an exciting goal, but paying off your mortgage needs to be done right. Here are some important considerations:

- Will you incur penalties for overpaying your mortgage?Some mortgage lenders have prepayment penalties or other loan terms designed to prevent you from prepaying. Make sure to contact your lender and read the fine print in your mortgage contract to determine if this applies to you.

- Do you have credit card or any other debts? Many other types of debt, like credit card debt, have higher interest rates. It’s usually more advantageous to pay off any consumer debt before you pay off the mortgage.

- Have you set aside a sufficient emergency fund? It’s generally a good idea to set aside money in an emergency fund to cover expenses that are not included in your budget or to protect from a rainy day. Build a solid financial foundation first!

- Is your debt oppressing you? Some people feel debt rules their lives. If debt is stressing you out, use the Mortgage Payoff Calculator to calculate how much extra money you need to put toward your mortgage every month to get out of debt sooner.

Once you’ve determined that you’re ready to pay off your mortgage, it’s time to start reaping the benefits!

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

Don’t Miss: How Soon You Can Refinance Your Mortgage