Va Loan Vs Conventional Loan Faqs

Is a VA loan better than a conventional loan?

A VA loan is one of the best mortgage options in the market if youre eligible, that is. Only veterans, active-duty servicemembers, and some surviving spouses can qualify for these zero down loans.VA loans dont require mortgage insurance, and borrowers with full entitlement dont have loan limits, either. They can also be more affordable for homebuyers with lower credit scores, as conventional loan interest rates can be higher for borrowers with credit scores under 680.But conventional loans offer a lot of benefits as well. The minimum down payment is just 3%, and the private mortgage insurance requirement ends when you reach 20% home equity. If you put down 20% on a conventional loan, you dont have to pay PMI at all.In the current housing market, some sellers prefer offers with conventional loans to those with VA financing.

What are the disadvantages of a VA loan?

VA loans have strict property requirements that can make for a tough appraisal process, especially if the home is older and hasnt been well-maintained. You can only use a VA loan to buy a primary residence, whereas conventional loans may be used to finance vacation homes and investment properties.

Why are VA home loans bad?

Is It Worth Refinancing A Va Loan

Refinancing with a VA refinance loan may get you a better interest rate or a lower monthly payment. If you currently have an adjustable-rate mortgage, refinancing through an IRRRL can allow you to lock in a fixed rate and consistent monthly payment. Compared with a typical refinancing, the IRRRL is indeed streamlined.

Am I Eligible For An Irrrl

You may be eligible for an IRRRL if you meet all of the requirements listed below.

All of these must be true. You:

- Already have a VA-backed home loan, and

- Are using the IRRRL to refinance your existing VA-backed home loan, and

- Can certify that you currently live in or used to live in the home covered by the loan

Note: If you have a second mortgage on the home, the holder must agree to make your new VA-backed loan the first mortgage.

You May Like: How Much Mortgage Do You Pay A Month

Apply For A Credit Limit Increase

This might sound counter productive, but hear me out, when you apply for a credit increase, that doesn’t require a hard pull on your credit, it lowers your credit to debt ratio, which is a factor in calculating your credit score.

The credit to debt ratio is a number that creditors use to determine how much of your credit you are currently using.

If you are using too much credit, your score will start to go lower however, if you get a credit limit increase, this would decrease that amount and help your score improve.

The main factor with choosing this route is to NOT use the new credit.

Va Mortgage Rates Today

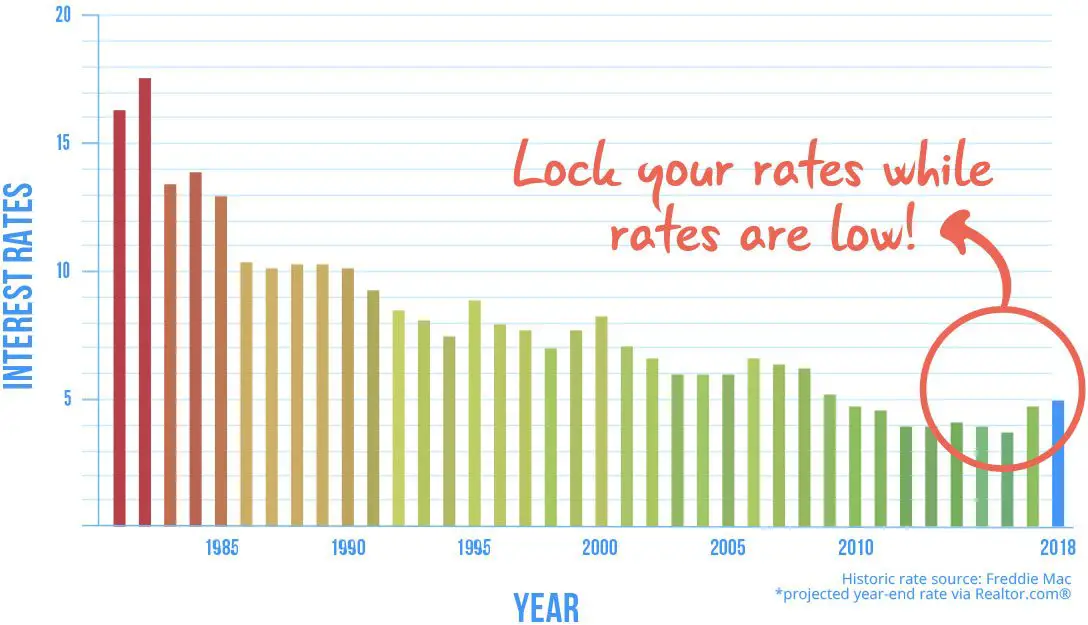

Mortgage rates overall are currently at an all-time low due to nationwide economic issues stemming from the coronavirus pandemic. However, due to the already-low nature of VA home loan rates, VA mortgage rates have experienced little change over the last couple of months. The average VA loan interest rate as of July 8, 2020 is 2.5% for a 30-year fixed mortgage. The average VA loan interest rate as of August 21, 2020 is 2.890% for a 30-year fixed mortgage.

You May Like: How To Determine Ltv Mortgage

How Do Va Loan Rates Compare With The Rest Of The Market

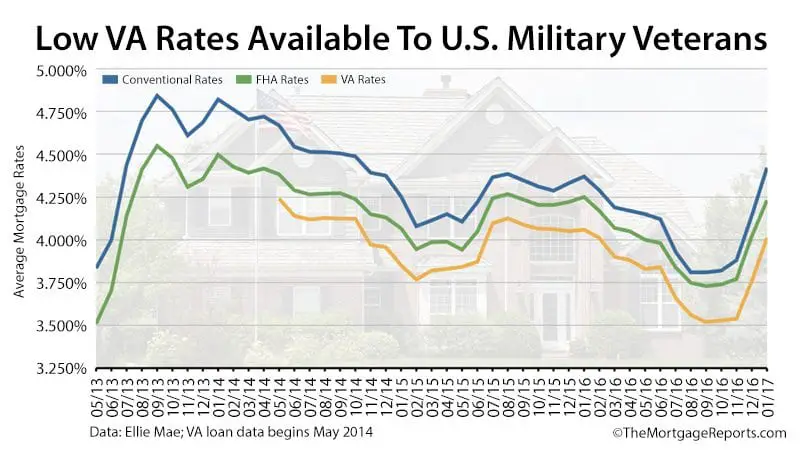

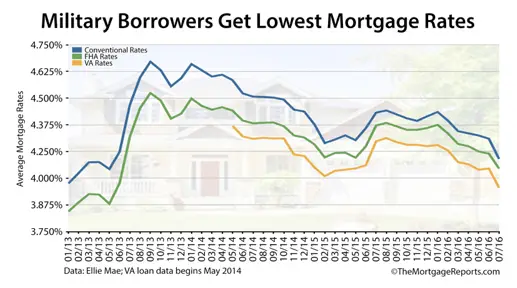

Like all mortgage rates, the VA loan rate you get will depend on the lender and your personal financial profile. Youll typically need a good credit score, stable income, and a low loan-to-value ratio to get the best rates.

In general, average VA loan rates tend to be lower than average conventional loan rates. However, exact rates may vary by lender, so make sure youre shopping around to get the best deal.

Va Loan Borrowing Costs

Interest rates reflect the cost of borrowing money. Your credit score, the type of loan youre seeking, the lender youre talking with and other factors can all play a role in what rate you get quoted. Every buyers situation is different.

One of the benefits of VA loans is they typically feature lower average interest rates than other loans, including conventional. The interest rate will directly affect your monthly payment.

Its important to understand that the VA doesnt set interest rates. Lenders set their own rates, based in part on whats happening in the mortgage bond market. VA loan rates can change multiple times in a single day, and two different lenders may quote you two very different rates.

When youre talking with lenders about rates, its also key to make sure youre comparing apples to apples. Make sure lenders are quoting you a rate based on the same credit score and loan amount, and ask for the rate without paying any discount points. A discount point is equal to 1 percent of the loan amount, and its cash paid at closing to buy a lower interest rate.

You can for qualifying Veterans United borrowers.

Also Check: Is Fairway Mortgage A Broker

Best Va Loan Rates Of 2021

Veterans United won best overall for VA loan rates because this lender specializes in VA loans, veterans are their primary clients, and they have many loan program options.

-

No minimum credit score disclosed

-

Only 30 year terms

Founded in 2002 and built for veterans, Veterans United Home Loans was honored in 2019 by the Department of Veterans Affairs for issuing the official 24 millionth VA mortgage for the 75-year-old VA program. Veterans United closed more VA loans than any other lender in 2016, 2017, 2018, 2019, and 2020.

Veterans United won best overall because they were founded for veterans and service members and they continue to be solely focused on this consumer category. The companys website and support staff lead the veteran from loan eligibility to if necessary, and then quoting. They have no-down-payment programs and programs tailored for first-time homebuyers.

The company offers nine VA loan programs. Their six 30-year programs include a Fixed-Rate program, a Streamline Interest Rate Reduction Refinance Loan , 30-Year VA Cash-Out, VA Fixed Jumbo, 30-Year Streamline Jumbo, and 30-Year Cash-Out Jumbo.

The Lighthouse Program offers free credit counseling as well as tools to improve your credit score and financial profile.

Consumers can get service online or by phone from one of their 24/7 operators at 800-884-5560.

The Va Loan Guaranty Explained

The amount veterans can borrow without a down payment is based on the VA Loan Guaranty, which is the key to how VA home loans work. The VA doesn’t actually make loans for veterans itself, but instead guarantees part of the loan amount on approved mortgages issued by authorized lenders. This typically is 25 percent of the purchase price, up to the limits described above. So if a VA borrower defaults on a $400,000 mortgage, the VA will pay the insurer up to $100,000 to cover losses not recovered through foreclosure.

For the lender, the VA’s guaranty is like having a 25 percent down payment as a hedge against default. So the VA borrower gets all the benefits of a hefty down payment low interest rate, easier qualifying, no recurring fees for private mortgage insurance without having to put out the cash. Of course, he or she is still responsible for paying off 100 percent of the loan.

If you don’t borrow the maximum you’re allowed without a down payment, you’ll still have some of your VA Loan Guaranty remaining, which you could apply toward buying a second or vacation home. The formula for figuring how much of your guaranty you have left is fairly complicated though, as it depends on the lending limits for the county where you bought your first home and the one where you plan to buy a second. A VA lender can help you with this calculation.

More information: The VA Entitlement explained

Also Check: What Does A Mortgage Consist Of

How Soon Can You Refinance A Va Loan

When you do a VA cash-out refinance from one VA loan to another, there’s a minimum period that must elapse between loan closings. At least 210 days must pass between the first payment of the original loan and the closing date of the new loan, and you must have made at least six monthly payments on the original loan.

Va Home Loan Benefits

The goal of the VA loan program is to make homeownership more accessible for veterans and service members.

As such, VA loans offer unique benefits not available to most other borrowers.

These loans are especially attractive for first-time home buyers, since you dont need to worry about saving for a down payment.

Although theyre backed by the federal government, VA loans are offered by private lenders. That means youre free to shop around and compare mortgage companies to find the lowest rate.

Recommended Reading: What Is The Mortgage Payment On 240k

What Is A Good Va Mortgage Rate

Many factors influence the mortgage rate youre offered, including the economy, your financial details and the lender. The best way to find out if youre being quoted a good VA mortgage rate is to apply with multiple lenders. When you make lenders compete, you can compare loan offers and determine which has the best combination of rate and fees.

With aLoan Estimatefrom each lender compared side-by-side, youll be able to see which lender is giving you a good mortgage rate combined with the lowest origination fees.

United Wholesale Mortgage Best Non

United Wholesale Mortgage is a wholesale lender available in all states and Washington, D.C. As a borrower, you wont be able to refinance your VA or other type of mortgage directly with this lender, since it works solely with brokers and other types of lenders.

Strengths: You can refinance your current VA loan into one with a lower interest rate, often in less than 20 days.

Weaknesses: United Wholesale Mortgages minimum credit requirement for a VA loan is 620, which can be higher than some competitors standards. In addition, because it is a wholesale lender, you wont have direct access to its products.

Also Check: How Much Would A 70000 Mortgage Cost

What Are The Drawbacks Of A Va Loan

This all sounds great so far, right? But if you dig a little deeper, youll find some serious problems with this type of loan.

The zero down payment leaves you vulnerable. A small shift in the housing market might leave you owing more on your home than its market value! That means you could get stuck with the home until the market recovers or take a financial loss if you have to sell the house in a hurry.

Youre required to pay a VA loan funding fee between 1.25% and 3.3% of the loan amount.7On a $300,000 loan, that fee can be anywhere from $3,750 to $9,900. And the fee is usually included in the loan, so it increases your monthly payment and adds to the interest you pay over the life of the loan. Plus, you might need to factor in origination fees from the lender. Yikes!

The lower interest rates on VA loans are deceptive. While interest rates for 30-year VA loans are usually equal to or slightly lower than 30-year conventional fixed-rate loans, neither loan is a good option. Both will end up costing you much more in interest over the life of the loan than their 15-year counterparts. Plus, youre more likely to get a lower interest rate on a 15-year fixed-rate conventional loan than on a 15-year VA loan. We can prove it.

A VA loan can only be used to buy or build a primary residence or to refinance an existing loan. So you can forget trying to buy an investment property or vacation home with one.

Donât Miss: What Is Better Refinance Or Home Equity Loan

If You Have To Do A Hard Pull

Having a different mixture of credit will also help you in obtaining a higher credit score.

Loans, credit cards, lines of credit, home loans and auto loans are all seen as different types of credit and having a good mixture will aid in helping your score.

If you are going to have a few hard hits on your credit, make them worth it.

Hopefully these few tips will help you with increasing your score in the immediate future.

Don’t Miss: When It Makes Sense To Refinance Mortgage

Determine What Type Of Loan You Need

There are several factors that go into determining which type of VA refinance loan is the best for you. A streamline, or IRRRL, loan is the easiest and most affordable option. It has a lower funding fee, and fewer verification requirements. But theres a catch: Youll need to refinance from a VA loan, so if you have a USDA loan or a conventional mortgage, youll need to use a VA cash-out refinance loan instead.

Which Types Of Mortgages Are There

There are several types of mortgage loans, including conventional mortgages, fixed-rate mortgages, adjustable-rate mortgages, FHA loans, VA loans, USDA loans, jumbo loans, 2nd mortgages, and one or more of them could be the right fit for you. A mortgage is a multi-year commitment that involves a significant amount of money, so take your time and review the following to get started.

Don’t Miss: Is Citizens Bank Good For Mortgages

The Bottom Line On Va Home Loans

With their low interest rates, relaxed qualification standards, no down payment requirements and private mortgage insurance needed, VA home loans are exceptional deals for the people who are qualified to receive them. If you or your spouse is a veteran of any branch of the United States military – or if either you are actively serving right now – then you should find out whether or not you qualify. If so, a VA home loan is more than likely going to offer you the most competitive benefits out of any other mortgage product that’s currently available.

The advantages of VA home loans cannot be overemphasized. For borrowers with poor credit or very little spare cash, there’s no other mortgage product out there that comes close to offering the affordable options that VA mortgages do. Weight your options carefully, but be sure to give a lot of consideration to VA home loans.

How Do You Choose The Right Va Loan

When shopping for a VA loan, consider the advantages and disadvantages of this type of loan. For example, although VA loans offer lower interest rates than a traditional mortgage, they are not necessarily the best choice for buying, improving, building, or refinancing rental properties. Read below to find out more about the pros and cons of VA loans.

Advantages of VA loans

- Lower interest rates and credit score requirements than required for conventional loans

- Higher chances of approval despite high debt amount

- No down payment, meaning fewer out-of-pocket costs

- No need for private mortgage insurance or mortgage insurance premium

- More lenient refinance options than conventional loans

- Access to mortgage relief options like mortgage modifications or a forbearance period

Disadvantages of VA loans

- Lenders may have additional requirements for homebuyers since the VA only covers 25% of the loan

- Closing costs arent covered

- The VA funding fee is non-negotiable

- VA loans may exceed the market value of the home after adding up the funding fee

- VA loans cannot be used for rental properties

- The home must pass VA safety requirements, including inspections for termites, water quality, and more

Choosing the Right Lender

When shopping for a VA loan lender, we recommend the following steps.

VA loan terms, rates, monthly payments, and closing costs vary greatly from provider to provider, so having multiple quotes can help you choose the one that hits all your financial goals.

Key takeaways:

You May Like: How Much Per 1000 On Mortgage

What Are The Va Home Loan Limits By Year And County

Find the VA home loan limit for the county your property is in.

2020 VA home loan limits

VA home loan limits are the same as the Federal Housing Finance Agency limits. These are called conforming loan limits.

Go to FHFAs Conforming Loan Limits page

Youâll find the link to this page below.

Scroll to the Previously Announced Loan Limits section

Review the table with past loan limit information.

Find the year with the limits you need

Years are located in the first column, labeled Description.

Read Also: Does Va Loan Work For Manufactured Homes

How Do Lenders Determine Va Mortgage Rates

Current VA mortgage rates are not set by the USAA or the Department of Veterans Affairs. Instead, lenders determine loan rates according to economic circumstances and your financial history. The higher your credit rating, annual income, and debt-to-income ratio, the less risky you will be to insure and the better your rates will be.

Read Also: How Much Is A Mortgage A Month

How Do I Get The Best Va Mortgage Rate

Here are some tips to help you get the best VA home loan deal:

- Take steps to minimize your debt-to-income ratio.

- Try to increase your credit score. Start by reviewing your credit report to make sure it’s accurate.

- Contact and apply for pre-qualification/preapproval with several VA lenders, including banks, credit unions and mortgage companies.

For more information about which lenders to consider, compare our top-rated VA lenders. We explain how to choose a lender and how to apply.

Va Home Loan Credit Score Rate Chart

Below will be loan rates based on credit score and we will keep these standard through this post.

We want to give you an Idea of how much you could be saving if you just increased your score by one group.

If you were to take your score from the low 600’s to a 620, you would be saving an extra $31,348 in payments.

You May Like: How Much Is Mortgage Insurance In Michigan