Where To Find A Qualified Home Inspector

Finding a qualified home inspector can be as simple as asking your real estate agent, though it doesnt hurt to do your own research. Its best to find someone knowledgeable or better yet certified considering a home inspection is such a crucial part of the homebuying process

To find a reputable home inspector, use ASHIs home inspector search tool or NACHIs list of certified home inspectors. Youll find more details about an inspectors experience and construction background through these organizations.

Why Its A Good Idea

At the Home Buying Institute, we strongly encourage buyers to have inspections prior to purchasing a house.

Unless you work in the construction industry, you probably dont have the knowledge or expertise to evaluate the condition of a home on your own. Thats where the inspector comes in. These individuals are trained to evaluate all aspects of a house, including the roof, foundation, electrical and plumbing system, and more.

And when you consider the fact that home inspections usually cost around $300 to $400, the decision becomes even easier. Thats a small price to pay for peace of mind. Buying a house is a huge investment, so you want to do some due diligence before sealing the deal. And that includes having the property thoroughly inspected both inside and out.

Final Thoughts On Home Inspections

A home inspection is a crucial part of the home buying process. It gives you a more intimate look at the condition of your home. During a home inspection, an inspector walks through your home and tests all of your homes appliances, systems and structure. Though a home inspection isnt a requirement before you can get a mortgage, you should still get one. You should also have your real estate agent write an inspection contingency clause into your offer letter.

There are a few things you can do to improve your results as a seller when inspection day arrives. Make sure that your home is clean, and youve made all the necessary repairs. If youre the buyer, choose a reliable and certified home inspector and attend the inspection personally. Remember to review the results before you move onto closing.

Don’t Miss: What Is Needed For Mortgage Application

Buying A Home And Need Help

Since youre reading this article,you are probably interested in buying a home.

If you need advice, a rate quote,or any other service, click the link below to request personalized help foryour home buying goals.

Popular Articles

Step by Step Guide

How Do You Write A Counter Offer After A Home Inspection

After a home inspection, you can ask your broker to negotiate any necessary repairs with the sellers or ask the sellers to lower the price so you can fix the problems yourself. Getting quotes from local contractors will help you write out a counter offer based on estimates, but a buyer should be aware that a seller is not obligated to fix anything.

You May Like: How Much Is The Mortgage On A $300 000 House

Who Needs To Be There During The Inspection

Generally, you and the inspector will be at the house during the inspection. A home inspection is a great opportunity to learn more about the home you’re about to buy. For example, you’ll find out where the electrical panel is and where the gas and water shut-offs are located. You’ll also learn a bit about how the water heater and HVAC systems work.

Having the chance to ask questions about your possible new home and getting them answered by an expert is invaluable. Make sure you pay careful attention, snap relevant photos and take copious notes.

Electrical Heating Plumbing And Ventilation

Electrical

- Make sure that all wiring in the home is in good condition and that there are no exposed splices

- Double-check that the main electrical panel can be easily accessed

- Verify that there are ground fault circuit interrupter outlets in the bathrooms and in the kitchen

Heating

- Make sure that there is no damage to the furnace or air conditioner and that they work

- Verify that thermostats and heat pumps are in working order

Plumbing

- Check if there is any rust on the water heater

- See if there are any pipes that are leaking or damaged

- Find all the water shut-off valves, because youll want to turn off the ones that supply water outside in the winter to prevent any pipes from being frozen

Ventilation

Also Check: How Much Money Should You Spend On Mortgage

The Home Inspection Process: Basic Information

A home inspection consists of a certified home inspector walking through a home and examining all of the areas of the property. It helps both the buyer and the seller determine any parts of the home that may be in need of repair and locate any particular safety issues. If any issues are found within the home, the buyer can attempt to negotiate the original offer and request that necessary maintenance be made. The home inspection takes place after the buyer has made an offer on the home and before the closing of the sale, helping the buyer make a better-informed decision about purchasing the home.

Scott Ludwig Of Great Northern Survey Explains To Us The Difference Between A Mortgage Inspection Plan And A Certified Plot Plan And What You Need To Do If You Want To Know Your Properties Boundaries

We sat down with Scott Ludwig from Great Northern Survey, a Registered Professional Land Surveyor, to discuss the ins and outs of Mortgage Inspection Plans.

Mortgage Inspection Plans, commonly known as “Plot Plans”, are required by most Lenders prior to closing on a home. The banks and Title Insurance Companies want reassurance that there aren’t obvious encroachments and to know whether or not the subject property is in a flood plain and would require flood insurance.

According to Ludwig, one problem is that most people use the term plot plan interchangeably between Mortgage Inspection Plans and Certified Plot Plans when they are two completely different things with different purposes.

Don’t Miss: Does Chase Allow Mortgage Recast

Home Inspection Tips For Buyers

It might go without saying, but the best thing you can do to ensure a successful home inspection is to enlist the services of a reputable home inspector. Ask your real estate agent if they have someone they can refer, and do your own research to make sure theyre a good fit for your needs. A quick search online may turn up reviews from other homebuyers. You can also confirm that your home inspector is indeed licensed . Some states, such as California, do not currently require home inspectors to have a license. However, they may be certified by a trade association anyway.

Beyond that, you should always make sure that the right to a home inspection is written into the contract as a contingency clause. Its not enough to get a verbal sure thing! from the seller you need the terms and timeframe in writing. This will be especially helpful if it turns out the home is riddled with problems and you need to get your earnest money back. Also, on the off chance that youre buying from a family member/friend/someone you know and trust, you should still insist on getting a home inspection. In fact, if anything, its more important to get a home inspection in these circumstances. Can you imagine how awkward it would be if Aunt Mavis sold you that mid-century modern ranch shed been holding onto for years, and then you moved in and discovered the roof needed $50,000 in repairs?

The Home Inspection: Dos And Donts For Home Buyers

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A home inspection isn’t just your opportunity to ensure that a home is fit for you and your family. Knowing what to look for in a home inspection will help you understand any defects and, if you have enough leverage, assess what repairs should be made on the seller’s dime before moving day.

Use these home inspection tips for buyers to prepare for the inspection and what comes next.

» MORE:What to expect from a home inspection

Read Also: How To Select A Mortgage Lender

What To Do With The Results Of A Home Inspection

You and the seller each receive a copy of the inspector’s report. Where you go from there depends on you, your realtor and the seller. Here are some next steps you can take once youve received the results of a home inspection:

- Go ahead with the purchase as it stands. You’ll know what you’re getting into and have an idea of how much itll cost to make any necessary repairs.

- Ask the seller to make the necessary repairs. This can be made a condition of the closing.

- Use the inspection report details to negotiate a better price with the seller. The inspection report may prove that the roof needs $30,000 in repairs. The seller might reduce the cost of the home to cover those repairs.

- Walk away from the deal. Some purchase contracts have a home inspection contingency that allows you to back out without any penalties or loss of earnest money if the home inspection isn’t satisfactory. This isn’t an ideal solution, but it may be the most affordable option if the needed repairs are expensive.

Home inspections are an important part of the homebuying process. Getting a good idea about the state of the home youre buying means theres less chance of nasty surprises in the near future. You may also want to go over the inspection report with your Home Lending Advisor and discuss your options as you make your way through the homebuying process.

What Does The Home Inspection Cover

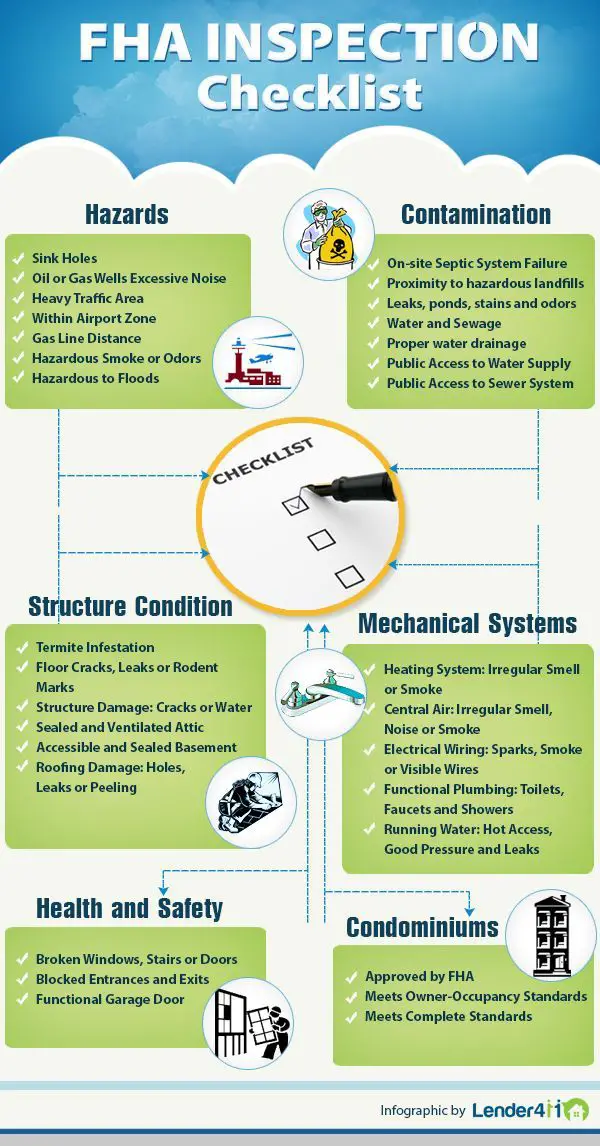

A standard home inspection will go over the homes structure, appliances and major systems to document their condition. This includes going over the foundation, roof and attic, major appliances, electrical, plumbing and HVAC systems.

On average, a home inspection will take 2 4 hours to complete. As the buyer, its a good idea to be present during the home inspection. This is a great opportunity to ask questions about the home.

The inspection report will include the inspector’s professional opinion of the condition of the home with photos and recommendations. Most inspection reports will include the following:

- The status of each problem they noted: Safety issues, major defect or minor defect.

- Recommended replacement or service for appliances and systems.

- Any recommended repairs and upgrades that need immediate attention or routine maintenance.

Weve pulled together the following list based on home inspection checklists for buyers that will give you a birds eye view of what to expect.

Read Also: What Banks Look For When Applying For A Mortgage

Asking For Repairs Or A Discount

If your home inspection report contains significant damage, you may be able to ask the seller to cover the cost of the repairs or negotiate a discount on the purchase price.

Although you cant expect the seller to fix every defect in the home, you can use the information in the inspection report to demonstrate the additional expenses you would have due to the necessary repairs. A good rule of thumb is to only negotiate the cost of major repairs. If it can be described as normal wear and tear, the buyer will likely be responsible for it!

If youre comfortable paying for the repairs yourself, you also have the option to negotiate a reduced sale price based on the cost of the repairs.

Manner And Cost Of Property Inspections

The property inspection will generally be drive-by in nature. The amount charged for each property inspection is typically minimal, costing around $10 or $15. The charges for the inspections are then added to the total mortgage debt.

While this may not appear to be a significant amount, inspections are usually performed monthly or more often, so the charges can add up quickly. Though some courts have found that repeated inspections are not necessary when the loan servicer is in contact with the homeowner, knows the property is occupied, and has no reason to be concerned about the condition of the property.

Recommended Reading: What Information Do You Need To Prequalify For A Mortgage

How Often Do Buyers Back Out After Inspection

As a seller, its important to prepare yourself for the home inspection process, and to know how to negotiate after a home inspection if it comes back with some not-so-great news. After all, among sellers who had a sale fall through, 15 percent were due to the buyer backing out after the inspection report.

Prepare For Closing Day

On the day of closing, all required signors should bring an ID, any necessary funds, and warm up the arm for signing. The settlement company representative explains closing documents and the borrower sign. If it is just a notary closing, ensure that your loan officer, realtor, or settlement company explains the documentation. It would be best if you did not close without a thorough explanation of what you are signing.

Once signed, the funding process takes over. We send funds to the settlement company. Once the settlement company has the funds and the OK, the deed and mortgage are recorded. Thats when the property is officially in the buyers name, and the mortgage is owed! At this moment, the mortgage process is complete.

Hopefully, this has shed some light on what goes on behind the scenes before becoming a homeowner. Now that youre familiar with the mortgage process steps, you will know exactly what to expect and how to prepare. We will be just a click away when youre ready to start your mortgage journey!

Apply online now with our easy QuickStart App or talk to a licensed Mortgage Loan Officer to review which loan is the best option for you.

Don’t Miss: Why Would A Mortgage Be Declined

Do Get A Home Inspection For New Construction

Even if you’re buying new construction, a home inspection should still be on your to-do list. A home inspector may evaluate a home differently than a county or municipal inspector, whose job is to determine whether new construction complies with building codes. At a bare minimum, a home inspector is a new set of eyes double-checking that there aren’t any loose ends .

What Is The Purpose Of A Property Inspection

Inspections are generally ordered automatically once the loan goes into default so the lender can find out whether or not the property is occupied and being appropriately maintained. Properties that are in foreclosure, especially if unoccupied, can often suffer damage from things such as:

- vandals or thieves

Performing routine inspections allows the lender and loan servicer to keep tabs on the property.

Read Also: How 10 Year Treasury Affect Mortgage Rates

When To Schedule A Home Inspection

Schedule a home inspection either prior to or right after you and the seller sign a contract for the purchase of the home. If its completed after signing the contract, then it should take place well within the contingency period you agreed upon in the contract. That way, there’s time after the inspection to address any issues that may come up.

Mortgage Loan Inspection Request

A Mortgage Loan Inspection is prepared for the lender and its title insurer, and should never be used for permitting, boundary line determinations, or construction. The two items evaluated on an MLI determine if a dwelling or on-site improvements used as collateral for the loan being created are in compliance with municipal/local building setback requirements at the time of construction, and if said dwelling or on-site improvements horizontally scale in or out of a Special Flood Hazard Area per the Federal Emergency Management Agencys Flood Insurance Rate Maps. The product is used to evaluate risk on the mortgage loan being created.

We also offer Flood Certificates without performing a formal Mortgage Loan Inspection. A Flood Certificate determines if a dwelling or on-site improvements to be used for loan collateral horizontally scale in or out of a Special Flood Hazard Area. Unlike a Mortgage Loan Inspection, it does not determine compliance with municipal/local building setback requirements. It is used to challenge a flood determination made by another surveyor, a real estate appraiser, or a national flood determination company. Please indicate in the form below if you wish to have a Flood Certificate.

Please provide as much of the below requested data as possible. If you prefer, you can to fax or email . Please feel free to contact us with any questions or concerns.

IMPORTANT: A mortgage loan inspection should never be used for building construction.

Don’t Miss: Can You Refinance Mortgage With Poor Credit