The End Of The Fixed Period

Fixed-rate mortgages

When your fixed period ends the rate will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Tracker mortgages

The tracker mortgage will track the Bank of England base rate for a 2-year fixed period, then it will move to the HSBC Standard Variable Rate, unless you switch your HSBC rate.

Current standard variable rate

|

Our current standard variable rate for residential mortgages is 6.29%, effective from 1 December 2022. These rates only apply when a fixed or tracker rate no longer applies. |

Historical Home Loan Variable Rates Compared To Fixed Rates

The data set includes 3 year fixed rates back to 1990. We have plotted this data against historical Australian interest rates for the period.

We consider 3 year interest rates to be relevant because in Australia the average home loan runs for between 3 and 4 years before it is refinanced, paid out or the property/properties the subject of the loan are sold .

Clearly, you will have been worse off if you selected a 3 year fixed rate loan at any time up until about November 2001. This is because if you fixed a rate until then, the trend was for rates to be reducing and so a fixed rate loan would have missed out on the trend downwards.

If you fixed rates up until 3 years before the peak you would have been fine .

If you fixed at any time between these dates you will have been locked into that interest rate and you would have been likely to miss the period of lower interest rates between about October 2008 and July 2010.

If you fixed interest rates at about July 2007 , the variable rates that applied when your loan came out of its fixed rate period would have been about the same .

It is also interesting to compare how often the fixed rate exceeds or is exceeded by the variable rate. Since September 2010, 3 year fixed rates have been less than variable rates. With the recent COVID QE response from the RBA by reducing the 3 years official rate to be the same as the cash rate, fixed rates will be low for some time.

Dont Miss: Rocket Mortgage Loan Types

How To Shop For The Best Mortgage Rate

Getting an optimal rate on a home loan can save you a significant amount of money over time. Here are some tips that can help you get the best rate possible for your situation:

- Keep your eye on rates. Mortgage rates are constantly changing. Keeping a close watch will make it easier to find and lock in a better rate.

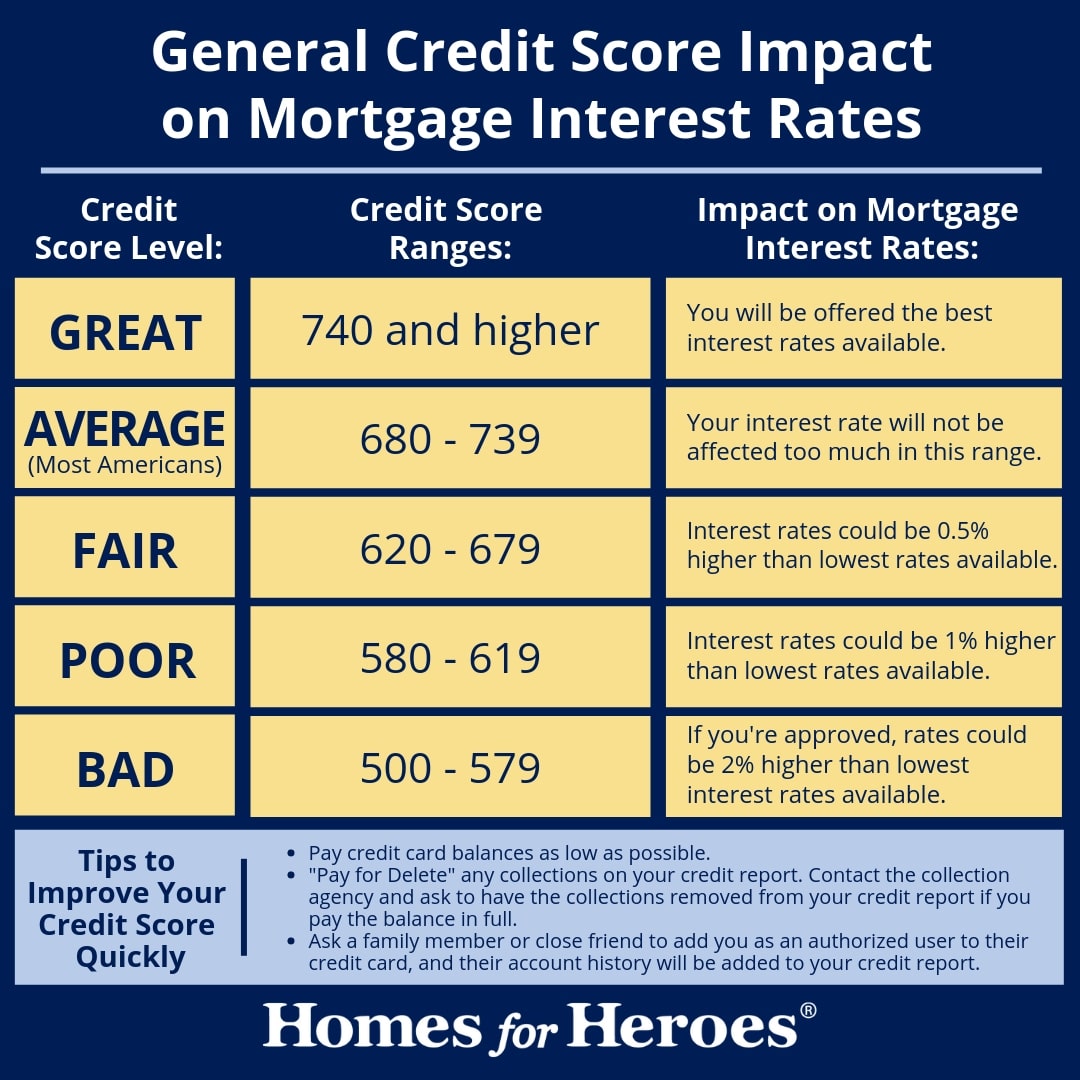

- Check your credit. When you apply for a mortgage, the lender will review your credit to determine your creditworthiness as well as your interest rate. In general, the higher your , the better your rate will be. To get an idea of where you stand, check your credit before you apply and dispute any errors with the appropriate credit bureau to potentially boost your score.

- Shop around and compare lenders. Consider options from as many mortgage lenders as possible to find the best deal for you. Prospective buyers have saved more than $1,500 over a loans term by getting two quotes from lenders, and saved roughly $3,000 when they sought five quotes, according to Freddie Mac.

Also Check: How Long Do You Have To Pay Private Mortgage Insurance

The Driving Force Behind Mortgage Rates

Mortgage rates are a substantial element of the home buying process. While you likely know what a mortgage rate is if you have begun your home purchase journey, understanding what drives those rates may not be familiar territory.

The average interest rates affixed to home mortgages often fluctuate based on a few different factors. Understanding these can help you better comprehend when your chances increase for a lower interest rate.

What Is The Best Mortgage Loan Type

![Home Mortgage Rates by Decade [INFOGRAPHIC] Home Mortgage Rates by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/home-mortgage-rates-by-decade-infographic-real-estate-with-keeping.png)

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt-free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the loans life. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes.

Regardless of what loan type you go with, remember, its not the loan you have to keep forever. Even if you stay in the same home for the rest of your life, you can refinance your mortgage to take advantage of better terms or rates.

You May Like: What Is The Mortgage On A 900 000 Home

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much youll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Recommended Reading: Do Mortgage Lenders Verify Tax Returns

What It Means For The Market

Mortgage rates donât directly impact home prices, but they do influence housing supply, and this plays a big role in pricing. Existing homeowners are less likely to list their properties and enter the market as mortgage rates rise. This reluctance creates a dearth of properties for sale, driving demand up, and prices along with it.

Homeowners are more comfortable selling their properties when rates are low, which sends inventory up. It turns the market in the buyerâs favor, giving them more options and more negotiating power, but that can depend on how much rates rise. It can stifle demand if rates rise for too long or get too high, even for the few properties that are out there. That would force sellers to lower their prices in order to stand out.

Money’s Daily Mortgage Rates For December 1 2022

Almost all loan types inched higher yesterday, according to Money’s daily mortgage report.

The average rate on a 30-year fixed-rate mortgage increased by 0.026 percentage points to 7.826%. Rates on adjustable-rate loans also increased across the board. On the other hand, the rate on a 15-year fixed-rate loan moved down.

- The latest rate on a 30-year fixed-rate mortgage is 7.826%.

- The latest rate on a 15-year fixed-rate mortgage is 6.217%.

- The latest rate on a 5/6 ARM is 7.215%.

- The latest rate on a 7/6 ARM is 7.281%.

- The latest rate on a 10/6 ARM is 7.242%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on mortgage application data submitted to Freddie Mac by thousands of lenders across the country. The weekly rate averages are based on applications for conventional, conforming loans for borrowers with excellent credit who made a 20% down payment and no longer include discounts for points/fees paid.

You May Like: How To Create A Mortgage Payment Calculator In Excel

Mortgage Insurance: What You Need To Know

Mortgage insurance helps you get a loan you wouldnt otherwise be able to.

If you cant afford a 20 percent down payment, you will likely have to pay for mortgage insurance. You may choose to get a conventional loan with private mortgage insurance , or an FHA, VA, or USDA loan.

Mortgage insurance usually adds to your costs.

Depending on the loan type, you will pay monthly mortgage insurance premiums, an upfront mortgage insurance fee, or both.

Mortgage insurance protects the lender if you fall behind on your payments. It does not protect you.

Your credit score will suffer and you may face foreclosure if you dont pay your mortgage on time.

What Do I Need To Refinance My Mortgage With A Fixed Rate Loan

A 30 year mortgage could be very beneficial, but you need to consider how long you plan to stay in your new home. If what matters most to you is having lower mortgage payments each month, you should consider a 30 year fixed rate mortgage with the help of a loan officer.

Read Also: How Much Per Thousand On A Mortgage

Renting Vs Buying A Home

Deciding whether it makes sense to rent or buy is about more than just comparing your monthly rent to a potential mortgage payment. How long you plan on staying in that area should also factor into the decision. Buying a home requires you to pay thousands of dollars in upfront fees. If you sell the house in the next two or three years, then you may not have enough equity built up in the home to offset the fees you wouldnt have paid if you were renting. You also need to factor in maintenance and upkeep costs with owning a home.

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Historical Basic Interest Rates

We have include the historical basic interest rate history in Australia since Sep-1998 because of the increased popularity. Basic products usually dont come with an offset account or linked credit cards but they also in many cases come with any ongoing fees. First Home Buyers are increasingly choosing basic products as its fits well with their requirements of low fees. Over a 30 years loan, the difference in fees between a basic product versus the full featured packaged product can total over $11,000.

Note the RBA stopped publishing the basic rates since Feb-2020.

Dont Miss: Chase Recast Calculator

Don’t Miss: How To Calculate Cltv Mortgage

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

Qualifying For A 30 Year Fixed Mortgage

Those applying for a 30 year or 15 year fixed mortgage will first be required to be preapproved.

Why you should have a credit preapproval:

Read Also: What Apr Means On Mortgage

How Much House Can I Afford

Income is the most obvious factor in how much house you can buy: The more you make, the more house you can afford.

However, it also depends on how much of your income is already spoken for through debt payments as well as your credit score and history. The more debt you have, the less likely you will be approved for a mortgage or one at a lower interest rate. Your credit score also plays a role in that the higher your score, the better loan rate and terms you will receive.

And of course, if you have a larger down payment, it will help you in all these factors for affording a home.

Should I Get An Adjustable Rate Mortgage Or A Fixed Rate Loan

While fixed rate loans have interest rates that stay the same over the life of the loan, an adjustable rate mortgage fluctuates depending on the market, but usually has a cap limiting fluctuation.

While both offer advantages, your circumstances can determine which might be right for you.

An adjustable rate mortgage:

- Can be a popular option for new homeowners as they offergreat upfront savings.

- Have an initial fixed interest period.

- Cap how much a loan can adjust so borrowers can try to plan accordingly.

Consider an ARM if you expect to make more money in the future, plan to move early in the life of your loan,or refinance before your loan adjusts.

There are many types of fixed-interest rate mortgages, including 30-Year and 15-Year mortgages. They offer a clear view of the future, as borrowers are able to more accurately account for costs over the life of the loan. For those who want greater stability when planning their monthly costs, fixed-interest mortgages are popular.

Also Check: How Much Can You Get On A Reverse Mortgage

Historical Home Loan Variable Rates Fixed Rates And Discount Rates

The data set includes the historical discount interest rates back to 2004. Discount rates are the special interest rates that apply to the different packages that the banks offer . In most cases the annual fees range from $350-$395 which gets you a range of loan features and entitles you to the additional discount which in most cases ranges between 0.9% and 1.65%. The variable rates above will typically be circa 1.0%-1.50% lower than above.

Scoring A Low Interest Rate

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

Recommended Reading: How Much Is My Mortgage Going To Be

What Is A Mortgage Rate Lock

A mortgage rate lock is a guarantee that the rate youre offered in your mortgage application acceptance is the one you will eventually pay, assuming you close within a normal period of time and make no changes to your application.

In a period of rising or volatile interest rateslike the current oneit may be wise to lock in a rate that seems affordable for you.

How Is My Mortgage Interest Rate Determined

Lenders determine your mortgage interest rate based on the type of loan you take out, your credit score, and the overall loan amount, as well as your down payment amount and the length of the loan.

- Loan Type: Government-backed loans are handled differently than conventional loans.

- : People with high credit scores generally receive lower interest rates. Although those with lower credit scores may still qualify, their mortgage terms may not be as favorable.

- Loan Amount: Your mortgage rate will be influenced by the total amount of money you need to borrow. Higher amounts tend to suggest higher interest rates.

- Down Payment Amount: A higher down payment can significantly lower your interest rate.

- Length of Loan: Long-term loans tend to bring lower monthly payments with higher interest rates, while short-term loans bring higher monthly payments and lower interest rates.

Don’t Miss: How Does The Fed Rate Affect Mortgage Rates