What Term Should I Choose

The most common term length in Canada is 5 years, and it generally works well for most borrowers. Lenders will have many different options for term lengths for you to choose from, withmortgage ratesvarying based on the term length. Longer terms commonly have a higher mortgage rate, while shorter terms have lower mortgage rates.

Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

How To Set Up A Biweekly Mortgage Payment Plan

If your lender allows biweekly payments and applies the extra payments directly to your principal, you can simply send half your mortgage payment every two weeks. If your monthly payment is $2,000, for instance, you can send $1,000 biweekly.

In general, you wont need to involve your lender in order to start making payments this way, according to David Reischer, attorney and CEO of LegalAdvice.com.

It is simply unnecessary to involve the lender in changing the loan terms so that a borrower must make a payment every two weeks instead of the normal payment due once a month, explains Reischer. If a borrower wants to make an extra payment to accrue the benefit of a biweekly mortgage plan, then they can simply send a payment every two weeks instead of the payment due every 30 days.

You can also divide your monthly payment by 12 and park that amount in a savings account each month, then send the accumulated amount to your lender as an extra payment at the end of the year.

No matter how you do it, Heintz says you should be sure to make it absolutely clear that this entire amount goes toward your principal balance. Otherwise, your lender might return the extra amount or forward it to your next payment, which negates the goal of biweekly payments.

To confirm your biweekly mortgage payment plan works the way you intend it to, make sure that:

In addition, make sure your lender confirms any extra payments are being applied to the principal in a timely manner.

Don’t Miss: What’s Considered A Good Mortgage Interest Rate

Mortgage Payment Frequency Options

Your mortgage payment amount and how often you make payments depends on the mortgage payment frequency option you choose. For an introduction on the different mortgage payment frequency options in Canada, watch the video below.

Here is a summary of the different mortgage payment frequencies:

| Amont paid |

|---|

| 52 |

The Arrival And Subsequent Embrace Of The 30

At first, it wasnt at all clear the 30-year mortgage would dominate the marketplace. While the FHA cleared the way for its eventual arrival, 15- and 20-year mortgages initially held sway in this new era. In fact, the 30-year mortgage wasnt officially authorized by Congress until 1948 and 1954 .

Given these facts, its not surprising that for much of the 1930s1950s, the 15-year mortgage was the go-to option for many homebuyers. It was only when the Fed began raising interest rates in the mid 50s that it became abundantly clear to the FHA that a longer loan term could help offset these spikes. Homebuyers also appreciated the lower monthly payments that the 30-year model provided. Lenders however, took some persuading.

Thats why Fannie Mae were so important to the success of the 30-year mortgage: Through buying and guaranteeing conventional mortgages, they all but eliminated lender risk, providing incentives to keep loans flowing out to homebuyers. Suddenly, 30-year mortgages were everywhere. And first-time homebuyers were the grateful recipients.

Since the early 1960s, the 30-year fixed rate mortgage has been the clear choice of most homebuyers across the country. There are ample reasons for this, including the following key benefits:

You May Like: How To Have Pmi Removed From Mortgage

How To Change To Biweekly Mortgage Payments

Some lenders have to grant permission before you can switch to biweekly payments. If approved, there are two things to keep in mind. First, your biweekly payments won’t be applied to your account until you’ve reached your full monthly payment amount. Also, during your first month of enrollment, youll likely need to pay both your regular monthly payment plus your two half payments.

Some lenders charge fees to change payment agreements, while others do not. When you talk to your lender, find out if fees are associated with making the switch.

If your lender does not agree to the biweekly payment terms that you propose, simply pay extra every month to get the same benefits. You can also save up and make an extra payment every year, rather than every month. When you make any kind of extra mortgage payment, make sure it’s being applied to your loan principal rather than the interest.

Its important to note that certain mortgages don’t permit early payoffs. When early payoffs aren’t allowed, lenders may charge fees known as prepayment penalties. These fees may equal the amount of interest youre eliminating. If you aren’t sure if your mortgage allows early payoffs, look over your contract or talk to your lender.

How Do You Apply For A Mortgage

Mortgages are available through traditional banks and credit unions as well as a number of online lenders. To apply for a mortgage, start by reviewing your credit profile and improving your credit score so youll qualify for a lower interest rate. Then, calculate how much home you can afford, including how much of a down payment you can make.

Read Also: What Is The Mortgage Rate For Bank Of America

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Recommended Reading: How Much Per Month Is A Mortgage

Waitdid Someone Say 40

If youve been primarily wrestling with the pros and cons of both the 30- and 15-year mortgages, theres a new option you might want to also consider if youre financially distressed: the 40-year mortgage.

Essentially, the 40-year mortgage is designed to help homeowners currently in forbearance keep their homes by transitioning them into a longer loan term with lower payments. Its not a refi, its what’s called a loan modification and it will be extended by Ginnie Mae to homeowners who currently have an FHA, VA or USDA loan. While these federal agencies have yet to officially approve the 40-year loans, it is Ginnies intention to roll out this program in Currently, there are nearly 2 million loans in forbearance.

The hope is that lenders will make these terms available so people can remain in their homes and gradually get their finances in order after dealing with the unforeseen economic consequences brought on by the COVID-19 pandemic. Unlike the 30-year or the 15-year fixed rate mortgage, this is not a new offering for the general public, but rather a tool to be used if youre nearing default and have no other option. More information can be found on the Ginnie Mae website.

What Age Is Debt Free

Kevin O’Leary, an investor on Shark Tank and personal finance author, said in 2018 that the ideal age to be debt-free is 45. It’s at this age, said O’Leary, that you enter the last half of your career and should therefore ramp up your retirement savings in order to ensure a comfortable life in your elderly years.

Read Also: What Documents Are Needed To Get A Mortgage

Extra Payments Compound Principal

- If you make extra mortgage payments

- Your principal payment can compound

- In the sense that a lower outstanding balance

- Will lower each subsequent interest payment

However, if you paid an extra $100 each month on top of your required mortgage payment, the principal portion would start compounding.

In month one, youd pay $1,532.25, with $1,000 going toward interest and $532.25 going toward the principal balance.

This wouldnt provide any extra benefit in the first month because youd simply be paying $100 extra to get $100 more off your principal balance.

However, in month two the total interest due would be calculated based on an outstanding balance that is $100 lower. And because payments dont change on a mortgage, even more money would go toward the principal balance.

The second payment would be $998.23 in interest and $534.02 in principal.

Meanwhile, those making the standard monthly payment with no extra amount paid would pay $998.56 in interest and $433.69 in principal.

Thats more than a $100 difference, $100.33 to be exact. And over time, this gap will widen. In month 60, the principal payment would be $121.70 higher on the loan where youre paying an extra $100 per month.

So the benefit of paying extra increases more and more over the life of the loan and eventually allows the mortgage to be repaid early.

Does Refinancing Lower My Interest Payments

Many people refinance their mortgages in order to get better terms on their loan, such as a better interest rate or a better loan term. In some cases, they may be able to do both. Doing so may lower your monthly payment, which can cut the amount of interest you pay each month. You’ll also see a drop in the total interest you’ll pay over the length of your loan.

You May Like: Can I Take Out Money From My Mortgage

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

The Time Of The Month When You Close

The time of the month when you close impacts how much time will be between closing and your first payment. For instance, if you close on May 3, your first payment may not be until July 1.

This doesnt mean youre skipping a payment. Youll prepay the interest for May 3 31 when you close. Planning your closing date in the beginning of the month means youll need to bring more money to the closing table.

However, it gives you more time between closing and paying your first mortgage payment.

Recommended Reading: How Does The Fed Rate Affect Mortgage Rates

Are Mortgages Compounded Monthly

- Most mortgages dont compound interest

- But they are calculated monthly

- Meaning the interest due for the month prior

- Will be the same whether you pay early or late within the grace period

As noted, traditional mortgages dont compound interest, so there is no compounding monthly or otherwise.

However, they are calculated monthly, meaning you can figure out the total amount of interest due by multiplying the outstanding loan amount by the interest rate and dividing by 12.

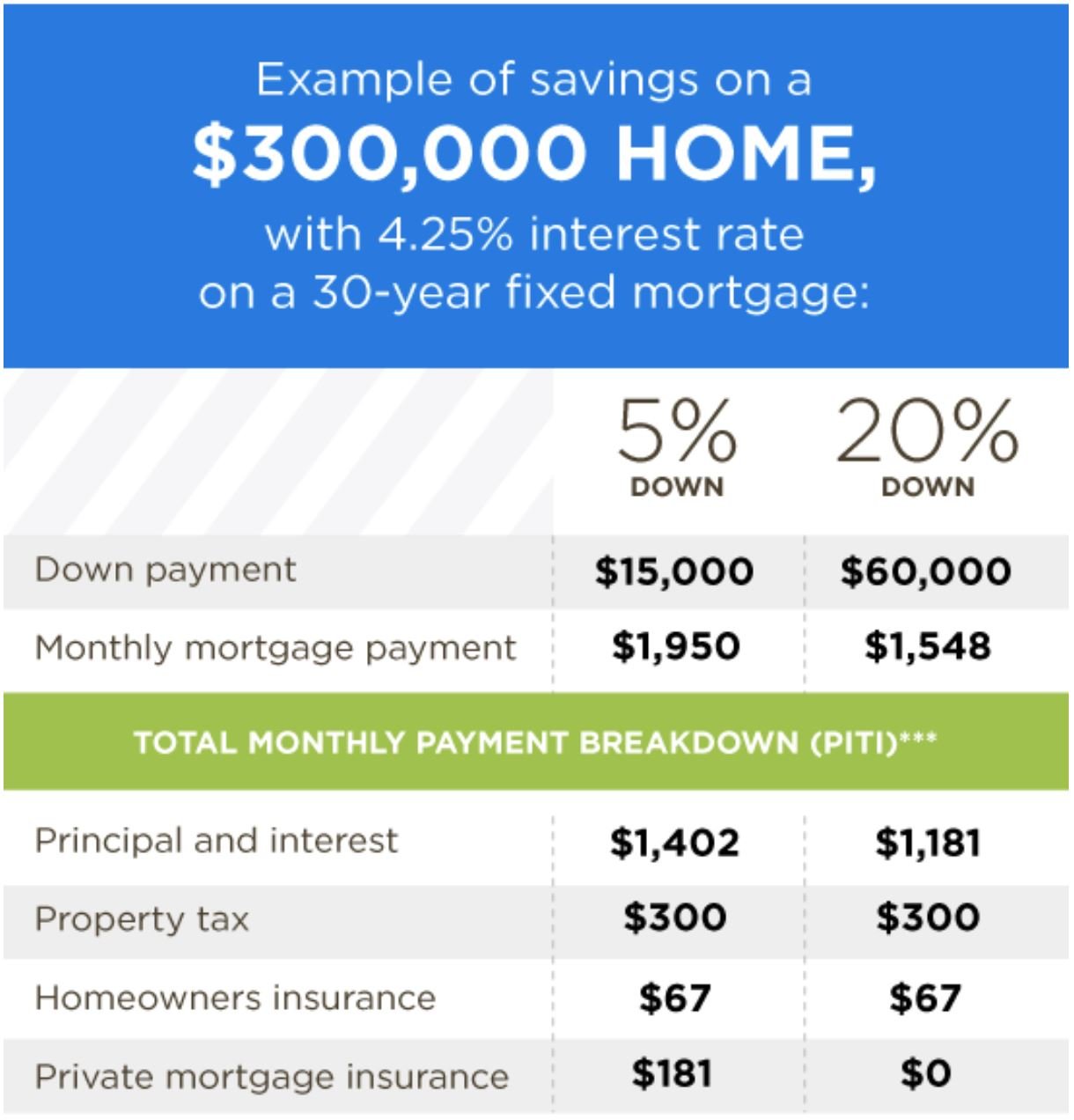

Using our example from above, $300,000 multiplied by 4% and divided by 12 months would be $1,000. That represents the interest portion of the payment only. The $432.15 in principal is the remaining portion, and it lowers the outstanding balance to $299,567.75.

In month two, the same equation is used, this time multiplying $299,567.75 by 4% and dividing by 12 months. That yields total interest of $998.56.

And because the monthly payment is fixed and does not change, that must mean the principal portion of the payment rises. Sure enough, its a slightly higher $433.69.

In other words, the interest due for the prior month is calculated on a monthly, not daily basis. This means it doesnt matter when you pay your mortgage, as long as it is within the grace period.

Generally, mortgage lenders allow you to pay the prior months mortgage payment by the 15th of the month with no penalty, even if the payment is technically due on the first of the month.

How To Choose A Mortgage Lender

You have many options when it comes to choosing a mortgage lender. Banks, credit unions and online lenders all offer mortgages directly, while mortgage brokers and online search tools help you compare options from different lenders.

Its important to make sure you feel comfortable with the broker or company youre working with because youll need to communicate with them frequently during the application processand in some cases, after the loan closes.

You may want to start with the banks or other institutions where you already have accounts, if you like their service. Also, ask your network of friends and family, and any real estate professionals youre working with, for referrals.

You May Like: How Much Would An 85000 Mortgage Cost

Should You Pick A Long Or Short Amortization Schedule

Before deciding on a mortgage loan, its smart to crunch the numbers and determine if youre better off with a long or short amortization schedule.

The most common mortgage term is 30 years. But most lenders also offer 15-year home loans, and some even offer 10 or 20 years.

So how do you know if a 10-, 15-, or 20-year amortization schedule is right for you?

How Do Mortgage Payments Work

When you take out a mortgage, youre borrowing money to buy or refinance a home. You make regular payments to repay this loan, usually monthly. The amount you borrow is the loan principal.

With each payment you make, you’ll be paying off part of the principal amount and part of the interest. The interest is what the lender charges for loaning you money to buy a house.

Depending on the type of mortgage you have, your payments are usually consistent in amount and made monthly. In the beginning, the majority of your payments will be used to pay off the interest on your loan. As this amount reduces, more and more of your payments will start applying to the principal the actual amount you borrowed. This means that for the first few years of your loan, your payments are focused on paying off interest rather than principal.

If you apply additional payments to your principal to bring the amount down, the interest paid on the balance goes down as well because interest is calculated based on the principal balance. The goal for anyone looking to make additional payments on their mortgage should be paying down as much of the principal as possible.

Recommended Reading: What Determines Your Mortgage Rate