Using Apr To Compare Mortgage Offers

Comparing APRs is not the best way to evaluate mortgage offers. Instead, itâs more useful as a regulatory tool to protect consumers against misleading advertising.

Federal Regulation Z, the Truth in Lending Act, requires lenders to disclose a loanâs APR when they advertise its interest rate. As a result, when youâre checking out lendersâ websites to see who might give you the best interest rate, youâll be able to tell from looking at the APR if the lender with the great interest rate is going to charge you a bunch of fees, making the deal not so great after all.

Page 3 of the loan estimate that lenders are required to give you when you apply for a mortgage shows the loanâs APR. By comparing loan estimates , you can easily compare APRs.

Still, most borrowers shouldnât use APRs as a comparison tool because most of us donât get a single mortgage and keep it until itâs paid off. Instead, we sell or refinance our homes every few years and end up with a different mortgage.

If youâre looking at two loans and one has a lower interest rate but higher fees, and the other has a higher interest rate but lower fees, you might discover that the loan with the higher APR is actually less expensive if youâre keeping the loan for a shorter term, as the table below illustrates.

Using The Mortgage Apr Calculator

Here’s how it works:

Your mortgage APR will automatically display and be updated by the calculator as you enter or change information. The “Total Payments” chart will show your total interest and principle costs for the life of the loan, while “Principle Balance by Year” will chart the gradual decline of loan principle as you pay the loan off over the term of the loan.

Do I Need To Pay A High Mortgage Interest Rate

You can usually pay discount points to lower the interest rate you’re offered. These points are essentially a form of prepaid interest. One point equals 1% of the total loan balance, and it lowers your interest rate for the life of your mortgage. The amount it lowers your rate depends on your individual lender and the market at the time.

This is often referred to as âbuying down your rate.â Calculate your break-even point to determine whether this is the right move for you. Will you be in the home long enough to make it worthwhile? The longer you plan to live there, the more paying discount points makes sense.

You can also negotiate your mortgage interest rate. It doesn’t hurt to ask whether the lender can make a better offer. You could save a significant amount of money over the term of the loan.

You May Like: How Much Mortgage Can You Get

Additional Mortgage Loan Fees

In addition to the mortgage interest rate, the APR includes the costs involved in getting your mortgage loan. Because mortgage interest rates and APRs can differ drastically with the addition of certain fees, it’s best to only compare interest rates to interest rates and APRs to APRs. This gives you an accurate picture of what you’re getting and helps you pick the best option for your budget and income. Here are some of the fees your APR may include:

- Loan processing fee

- Points, origination and discount fee

- Pre-paid interest

- Private mortgage insurance

- Loan application fee

It’s best to check with each lender for a breakdown of the costs for their advertised APR. It’s also important to note that there may be other fees for securing a home loan that the APR might not cover, such as:

What Is Apr And How Does It Affect Your Mortgage

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Annual percentage rate, or APR, reflects the true cost of borrowing. Mortgage APR includes the interest rate, points and fees charged by the lender. APR is higher than the interest rate because it encompasses all these loan costs.

Heres a primer on the difference between APR and interest rate, and how to use it to evaluate mortgage offers.

» Looking for information on?

Recommended Reading: What Can You Qualify For Mortgage

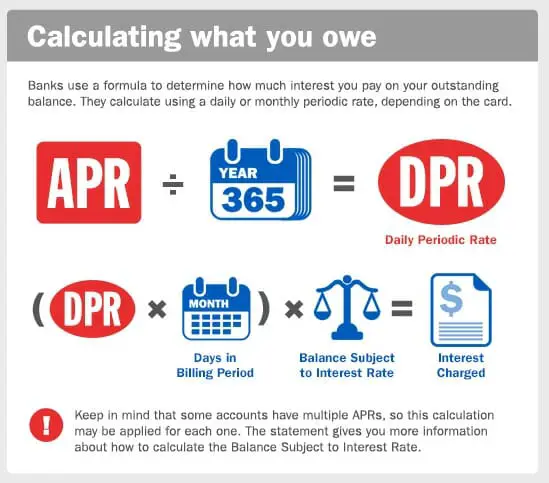

How Banks Calculate Apr

Though credit card APRs can vary significantly, almost all start with the U.S. Prime Rate, which is the interest rate financial institutions charge their customers for lending products. Credit card issuers add a small fee on top of that, called a margin, to the prime rate to get the APR. That margin varies depending on the type of card, the cardholders and how the card is used. Its important to understand that economic conditions can cause the prime rate to fluctuate. That means APRs tied to the prime can change as well. Some banks offer fixed-rate credit cards, so the APR wont fluctuate with changes to an index rate.

What’s The Difference Between Aprc And Apr

There are a lot of acronyms flying about when looking at any personal finance products, and mortgages are no exception. APR stands for annual percentage rate.

Broadly speaking, APR does the same job as APRC its a single figure that considers both the interest rate and any fees when you borrow money.

The main difference between the two is that APRC looks at the fact that the interest rate is likely to change.

This is why APRC tends to be used when looking at mortgages. APR is something you see more commonly with personal loans and credit cards.

Read Also: How To Get Approved For A Higher Mortgage

Whats The Difference Between Apr And Apy

While an APR represents the amount of interest and fees on a loan that the borrower must pay, an annual percentage yield, or APY, reflects how much interest someone earns on an investment or savings account over one year. An APY factors in the accountâs interest rate and compound interest, which is helpful in determining the growth of an investment.

What Is 0% Apr

Many advertisements offer deals such as “0% APR for 12 months.” These types of offers are designed to get you in the door so that lenders can eventually charge you interest after the promotional period is over. If you pay off your balance within that time frame, then you don’t have to pay interest on it. If you have a balance left after the 0% APR promotional period is over, then you’ll have to pay a high interest rate on what’s left.

These 0% APR offers can help you save money on interest, but you may still pay other fees to borrow. For example, your credit card might charge a balance transfer fee for you to pay off balances on other credit cards. The fee might be less than youd pay in interest with the old card, but youre still paying something. Likewise, you might pay an annual fee to the credit card issuer, and that fee is not included in the APR.

It is possible to pay absolutely nothing and take full advantage of a 0% APR offer, but you have to be diligent to pull this off. Its essential to pay off 100% of your loan balance before the promotional period ends and to make all of your payments on timeif you dont, you might pay high interest on any remaining balance.

Deferred interest is not the same as 0% interest. These programs are often advertised as no interest loans, and they’re especially popular around the winter holidays. However, you will pay interest if you fail to pay off the entire balance before the promotional period ends.

Read Also: What Are Discount Points In A Mortgage Loan

Why Should I Look For A Low Apr Card

Low APR credit cards are good for steady and planned borrowing and are useful cards to have in your wallet for the long term.

To borrow without paying any interest, consider a 0% purchase card. The 0% interest is only applicable for a limited period of time. After that, the card reverts to a relatively high APR.

What Is A ‘good’ Or Low Apr

0% purchase credit cards often charge around 21%-23% APR after the interest-free period ends.

Any credit card offering lower than 21% is cheap relative to the market trend. Anything over 24% is towards the expensive side.

If you pay your balance off each month the APR will not be as important. However, if you forget to pay it off and you are paying a high APR, the interest charges will rack up.

Some store cards have higher APR rates than traditional credit cards.

Higher rates for credit cards are usually more likely for bad credit and credit builder cards, which can have anything between 24%-50% APR. If you have to get one of these cards, try to repay in full to avoid having to pay these high rates.

Premium credit cards that offer big rewards on your spending often have high APR rates too.

Recommended Reading: Should I Buy Down Mortgage Rate

Defining Apr And Interest Rates

What does APR really mean? To find out, you first have to know what it stands for. APR stands for annual percentage rate. It represents the total yearly cost of using credit. Although APR and interest rates are interconnected, they are not always identical.

- For credit cards, APR is exactly the same as the annual interest rate on an account.

- For loans, however, APR may also include some standard financing fees., such as loan processing and underwriting fees.

This guide from Debt.com will teach you everything you need to know about APR.

What Other Factors Should I Consider When Looking For A Mortgage

While the APR makes it easier to compare mortgage offers, there are many factors to consider when getting a mortgage loan. These include the size of your down payment, closing costs and money you’ll need to set aside to furnish and maintain your home. The mortgage rate and payment calculator is a good place to start.

Also Check: How Much Would A 100k Mortgage Cost Monthly

Variable Vs Fixed Apr

A variable APR means that the rate youll pay can change over time, as market conditions change. Variable rates are influenced by the prime rate, which is the industry benchmark rate at any given time. A fixed APR means that youll pay the same interest rate throughout the life of the loan, regardless of market fluctuations. Credit cards have variable APRs, while vehicle loans and personal loans often have fixed rates. Mortgages are available with either fixed or variable rates, but no matter which you choose, the higher your credit score, the lower the rate youll usually get.

How Do I Find Personalized Mortgage Rates

Finding personalized mortgage interest rates is as easy as talking to your local mortgage broker or searching online. While most factors that impact mortgage interest rates are out of your control, rates still vary from person to person. Lenders charge higher home mortgage rates to borrowers they deem riskier. So having a high credit score will get you the best interest rates. Lenders also look at how much you are borrowing compared to the homes value this is known as loan-to-value, or LTV. Youll get a better rate when the LTV is below 80%. So if your future home has a value of $200,000, youll get the best rates if the loan is for $160,000 or less.

When shopping around for the best rates, consider a variety of lenders, like local banks, national banks, credit unions, or online lenders. Be sure to compare interest rates, fees, and other terms of the mortgage. Also, mortgage rates are constantly changing, so getting rate quotes from multiple lenders in a short time period makes it easier to get an accurate comparison. If thats too much legwork, you could work with a mortgage broker. Mortgage brokers dont directly issue loans. Instead, they work with lenders to find you the best deal. But their services arent free. They work on commission, which is usually paid by the lender.

Recommended Reading: What’s Refinancing A Mortgage

Tips For Obtaining A Lower

How do you get a low APR credit card? Thereâs no single answer. But maintaining a good credit score can make you a better candidate for cards with low APRs and additional benefits.

Thereâs no magic formula for building credit, but these principles from the CFPB may help:

Whats A Representative Apr

If you search for a loan, say on a price-comparison site, the different loan options are often ranked by representative APR.

The clue is in the word representative. When a loan is advertised with a representative APR, it means that at least 51% of customers receive a rate that is the same as, or lower than, the representative APR although not everyone within the 51% will necessarily get the same rate.

It can be easy to assume that the lender with the lowest representative APR you find advertised will give you the best rate. However, when you apply, its likely youll receive a personal APR based on your circumstances. This could be the same, higher, or lower than the representative APR.

Watch our video for a simple breakdown of APR. It could help you to understand loan rates in more detail before you borrow any money.

Recommended Reading: How Much Percent Of Income Should Mortgage Be

Compare Loans Using Apr

When youre shopping for the best deal on a loan, compare APRs rather than interest rates. Fees may vary widely from lender to lender, so using the all-inclusive APR should provide you with a more meaningful comparison. Borrowers sometimes believe that the loan with the lowest interest rate is their best choice, only to discover later that the fees charged on that loan outweigh any cost savings in interest.

- Will the lender be charging you simple interest or compound interest ?

- Is the interest rate fixed or variable ?

- What fees and other costs will be included?

- What is the loans repayment term?

Also Check: Rocket Mortgage Conventional Loan

Where Can You Find Your Apr

Banks and lenders are required to display APR information prominently. You can find your APR on your loan estimate, lender disclosures, closing paperwork or credit card statement. On your credit card statement, its usually at the bottom and is often labeled interest charge calculation or something similar.

Recommended Reading: How Much Mortgage Do I Qualify For

Using The Loan Estimate To Compare Mortgage Offers

When you apply for a mortgage, the lender is required to give you a three-page document called a Loan Estimate. Page 3 of the Loan Estimate has a “Comparisons” section that lists not only the APR but also how much the loan will cost in the first five years: the loan costs, plus 60 months of principal, interest and any mortgage insurance.

In the earlier example, Loan A would cost $62,033 in the first five years, and Loan B would cost $62,290. So Loan A would cost $257 less in the first five years. Even though Loan A has a higher APR, it would be the better deal if you kept the loan for just five years.

When you get multiple loan offers, line up the “Comparisons” sections of the Loan Estimates side by side to help you decide.