What Is A Wrap

A mortgage is a security interest that is attached to a piece property, and is paid for with borrowed money. This security interest acts as collateral for the repayment of a loan that was borrowed in order to pay for the property. An example of this would be when a person wants to buy a house, and they do not have enough of their own money to purchase the house outright.

A bank or other lender will provide the money, and a mortgage is placed on the property. If the borrower defaults on their loan, the lender has the legal right to take possession of that property so that they can attempt to reclaim some of the lost money. A mortgage serves as a sort of lien on the property.

A second mortgage is a mortgage loan secured by real estate that already has a mortgage attached to it. Second mortgages are referred to as such because of where it is in line to be paid in case of foreclosure. During foreclosure proceedings, liens on the property are paid off in order of seniority. As the first mortgage on the property will be paid off first, the second mortgage will be paid off after the first mortgage.

First mortgages use the property as collateral for the loan, while second mortgages often involve borrowing against the equity in the home. Equity is calculated by the loan to value ratio or, the difference between the market value of the home, and what is currently owed on the home.

Substitution Of Collateral Clauses

Some investor-buyers on a wrap include a substitution of collateral clause in their wrap notes allowing for the property to be freed from the wrap lien so long as a different property of reasonably equivalent value is substituted in its place. If the wrap buyer-borrower is a real estate investor with multiple properties this could be a useful strategy so such a clause should be included.

Risks Of Using A Wraparound Mortgage

The due-on-sale clause on the mortgage is a risk that can destroy a wraparound agreement before it commences. If the initial contract between the bank and the seller has a due-on-sale clause, then the bank may call the mortgage due and requires the seller to clear the balance. In case the seller is unable to pay off the debt, the bank can foreclose on the property, and both the buyer and the seller will remain with nothing. When a seller has more equity in a property, then the risks of issuing a wraparound mortgage becomes high. Meaning, when the buyer defaults on the payments, the seller will still have to pay the superior mortgage to the lender. Also, the buyer must pay a certain amount of legal fees so that he can foreclose on the buyer. The bank can foreclose on the seller in case he is unable to cater to the expenses. For the buyers, their major risk factor is when the seller defaults on his mortgage payments. To lessen this risk, the buyer can craft the mortgage documents in a way that he can directly pay the sellers lending institution. By doing this, the bank credits the payments against the sellers payment agreements.

Also Check: Rocket Mortgage Payment Options

The Bottom Line: Wrap

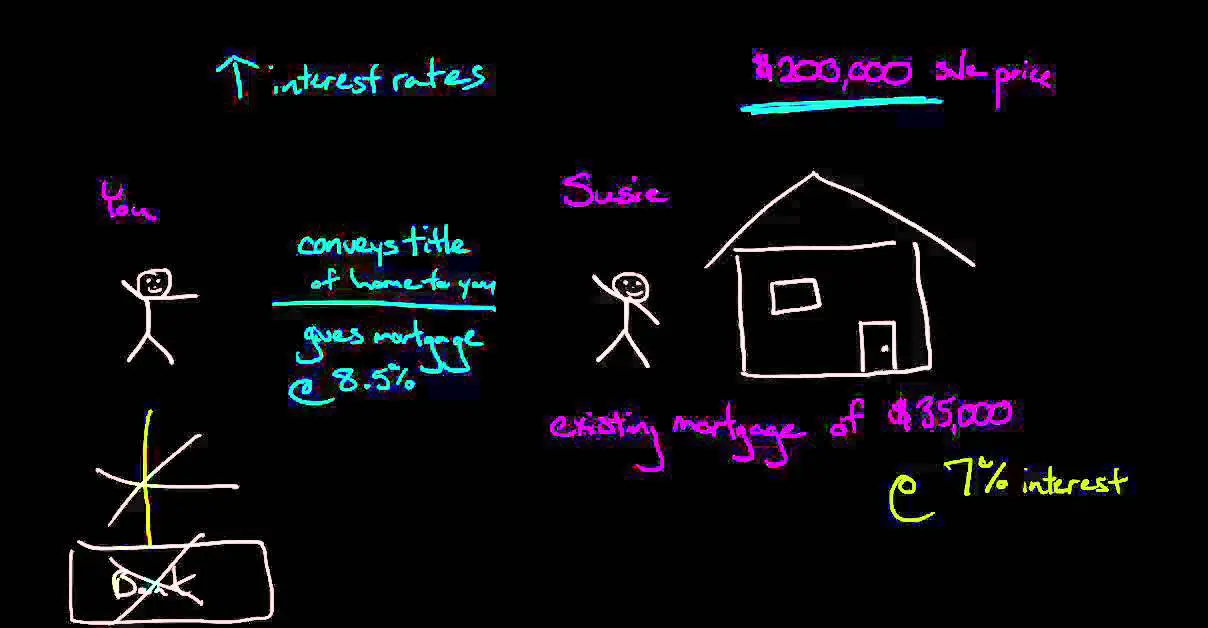

In a wrap-around mortgage situation, the buyer gets their mortgage from the seller, who wraps it into their existing mortgage on the home. The buyer becomes the owner of the home and makes their mortgage payment, with interest, to the seller. The seller uses that payment to pay their existing mortgage to the original lender.

Depending on the terms of the loan, the seller can make a profit from the difference in the two payments, the one to them and the one to their lender. This is typically done by the seller charging more interest on the wrap-around mortgage than the interest charged on the original mortgage.

This loan can be beneficial for both parties but comes with several risks. To mitigate those, the buyer and seller should work with an experienced real estate attorney.

Most homes are purchased through more traditional lending options. If youre in the market for a new house and ready to secure a mortgage with less risk from a reputable lender, get approved with Rocket Mortgage® to begin your home buying journey.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Isnt A Wrap A Breach Of Contract With The Lender What About The Due

A wrap transaction is neither a breach of contract nor a violation of the most commonly used residential due-on-sale clause . This clause merely gives the lender an option to take action if it chooses. In other words, it says that a lender may accelerate. Transfer of title is not prohibited outright and lender may pursue action at the lenders discretion.

Mortgage lenders are not usually interested in foreclosing upon a performing loan on merely technical grounds such as transfer of title by the borrower. However, some will send irate letters demanding that the new owner apply and qualify to assume the loan, threatening that the property could be posted for foreclosure. Even so, statistically speaking, actual acceleration of a performing loan based on due-on-sale seldom happens in todays environment. However, this status quo could change as interest rates climb higher and lenders acquire an incentive to call due low-interest loans and replace them with loans providing a higher return.

You May Like: Chase Mortgage Recast Fee

Benefits Of A Wraparound Loan

Wraparound loans are unconventional, Randall says, but it can be an opportunity for both home buyers struggling to obtain a mortgage and sellers in distress.

Wraparound loans give buyers an alternative way to purchase property when they have a low credit score and dont qualify for a traditional mortgage. Buyers may also be able to negotiate a better price for the home and a faster closing time frame, since theyre working directly with the seller.

So whats in it for the seller? Sellers can negotiate a higher mortgage interest rate on the wraparound loan than the interest they pay themselves. This, in turn, would enable the sellers to earn a profit that could go toward paying off their own loan or other expenses.

A wraparound loan works best for buyers who do not qualify for traditional mortgages with lenders and sellers who arent able to pay their mortgage on their own, explains Brian Walsh, a certified financial planner with the online personal finance company SoFi.

Another benefit for sellers is that they can also complete the sale more quicklyan important consideration if their home has been sitting on the market for a while.

How Wraparound Loans Work

To start a wraparound loan, the buyer and seller agree on a price for the home. Then the seller gives the buyer a loan that covers the difference between the amount owed on the existing mortgage and the homes new sales price.

For example, lets say the balance due on the original mortgage is $100,000, and the buyer agrees to purchase the home for $250,000. The seller would create a second mortgage for the difference, which would be $150,000.

From there, The buyer makes the payments to the seller on the new loan, while the who holds the second mortgage makes the payments on the original first mortgage, says Lucy Randall, director of sales and service operations at the online mortgage company Better.com.

Recommended Reading: Rocket Mortgage Vs Bank

Remedies Of Wrap Buyers/borrowers

If wrap provisions of the Finance Code are violated, a wrap buyer-borrower may bring a lawsuit against the wrap seller-lender to: obtain declaratory or injunctive relief to enforce Code provisions recover any actual damages suffered by the wrap buyer-borrower as a result of the violation or obtain other remedies by using the Deceptive Trade Practices Act, which is a very significant weapon in the hands of a competent plaintiffs attorney. The wrap buyer-borrower who prevails in a suit against the wrap seller-lender may recover court costs and reasonable attorneys fees. TFC Sec. 159.106.

An additional remedy is the ability of the wrap buyer/buyer to report a violation to the Finance Commission which may then launch an investigation, although this remedy is limited by Sec. 159.251 to registered wrap lendersa puzzling and unfortunate limitation. The investigatory process is outlined in Sec. 159.252:

Information obtained during a Finance Commission investigation may be shared with a state or federal agency. TFC Sec. 159.252. The clear implication here is that the Commission may make criminal referrals to state and federal prosecutors. This continues the decades-long trend in U.S. law of effectively criminalizing offenses that were previously civil in nature.

Is A Wraparound Mortgage Worth It

A wraparound mortgage can have some solid benefits for both buyers and sellers. If you’re a prospective buyer whos struggling to qualify for a loan, a seller financing option like a wraparound mortgage can help you realize your dream of being a homeowner sooner than if you waited to improve your credit or save up a larger down payment.

But even if you make your payments on time, you face the risk of the seller defaulting on the original mortgagein which case, you’ll be kicked out of the home and it will go into foreclosure. To mitigate this risk, you can request to make your payments directly to the lender, but it’s not always possible.

As a seller, a wraparound mortgage can provide a tidy profit, and if you’re having trouble selling the home, this type of seller financing can open up more opportunities. However, you’re still on the hook to make payments on the original mortgage, even if the buyer stops paying you. And while you won’t be removed from the home if you default , it can damage your credit score and make it harder for you to qualify for other loans.

Before agreeing to a wraparound mortgage, both the buyer and seller should carefully weigh the risks of relying on the other to make their payments on time.

Recommended Reading: Chase Mortgage Recast

Exemptions From Investigation And Enforcement

TFC Section 180.003 provides that certain persons are exempt from the investigation and enforcement provisions: a registered mortgage loan originator when acting for a licensed entity an individual who offers or negotiates terms of a residential mortgage loan on behalf of an immediate family member a licensed attorney who negotiates the terms of a residential mortgage loan on behalf of a client as part of the attorneys representation of the client, unless the attorney either takes a residential mortgage loan application or offers or negotiates the terms of the residential mortgage loan an individual who offers or negotiates terms of a residential mortgage loan secured by lien on the individuals residence an owner of residential real estate who in any 12-consecutive-month period makes no more than three seller-financed residential mortgage loans and an owner of a dwelling who in any 12-consecutive-month period makes no more than three seller-financed residential mortgage loans.

Buyer’s Mortgage Wraps Around Seller’s

In a typical home sale, the buyer obtains a mortgage and uses that money to pay the seller. The seller takes the money, pays off whatever he still owes on his own mortgage and pockets the remainder as profit. In a wrap-around deal, the seller’s mortgage stays in place, and he creates a second mortgage for the buyer, at a higher interest rate than the one on his own mortgage. That second mortgage “wraps around” the first, hence the name. The buyer takes possession of the house and makes monthly payments to the seller the seller uses some of that money to pay his own monthly mortgage bill and pockets whatever is left over as profit.

You May Like: 10 Year Treasury Yield Mortgage Rates

What Is A Mortgage That Is Wraparound If Theres Such A Thing To Be Said About Real

What Is a mortgage that is wraparound? If theres such a thing to be said about real-estate, it is that terminology could often be obscure.

What Is a mortgage that is wraparound? If theres such a thing to be said about real-estate, it is that terminology could often be obscure.

What Is a mortgage that is wraparound? If theres such a thing to be said about real-estate < a href=”https://maxloan.org/installment-loans-ia/”> Iowa guaranteed approval installment loans online< /a> , it is that terminology could often be obscure.

therefore obscure, it may appear virtually indecipherable sometimes.

just take a wraparound home loan, for instance. It might probably seem like a fairly esoteric term, however its really quite typical. Because of the increased interest in seller/owner financed loans, you may end up coming throughout the term. But just what exactly is a wraparound mortgage? How exactly does it gain you? Exactly How simple could it be to have? And much more especially, exactly what are a few of its drawbacks?

You should know about wraparound mortgages if youre a homeowner in Utah who is considering selling your home through owner financing, heres what.

How Common Are Wraparound Mortgage Loans

Wraparound mortgages are not common, and this is mostly because the original lender has to sign off on this secondary form of financing. If the lender requires that the original loan is paid off before the seller is eligible to sell the home, then a secondary or junior mortgage may not be feasible.

The popularity of wraparound loans increases or decreases along with the housing market. When interest rates are low, demand for wraparound mortgages is also low. This is because buyers with lower-than-average credit scores or income levels usually face high interest rates. When interest rates are low, they have a better chance of qualifying for a traditional loan.

However, when interest rates are high, there may be more demand for unconventional financing. Buyers may want to take advantage of a wraparound mortgage when they cant qualify for a traditional mortgage. They also might opt for a wrap loan when the interest rate is better than what they could get on the primary mortgage market.

Its also necessary to consider seller incentives. In a sellers market, a seller will easily find buyers and lucrative offers. They may only be interested in offering seller financing in a buyers market and are looking to increase their options.

Recommended Reading: 10 Year Treasury Vs Mortgage Rates

Example Of A Wraparound Mortgage

For example, Mr. Smith owns a house which has a mortgage balance of $50,000 at 4% interest. Mr. Smith sells the home for $80,000 to Mrs. Jones who obtains a mortgage from either Mr. Smith or another lender at 6% interest. Mrs. Jones makes payments to Mr. Smith who uses those payments to pay his original 4% mortgage.

Mr. Smith makes a profit on both the difference between the purchase price and the original owed mortgage and on the spread between the two interest rates. Depending on the loan paperwork, the home’s ownership may transfer to Mrs. Jones. However, if she defaults on the mortgage, the lender or a senior claimant may foreclose and reclaim the property.

How Does A Wrap

A wrap-around loan takes into account the remaining balance on the seller’s existing mortgage at its contracted mortgage rate and adds an incremental balance to arrive at the total purchase price. In a wrap-around loan, the seller’s base rate of interest is based on the terms of the existing mortgage loan.

Also Check: 10 Year Treasury Vs 30 Year Mortgage

Why Would A Seller Do A Wrap

A wrap seller can often sell at a higher-than-market price. The seller gets some cash today which either goes into the sellers pocket or is used to reduce principal on the wrapped note . The seller is then out from under the payment burden, although he or she must continue to be involved in the mechanics of collecting and forwarding payments to the first lienholder unless a third-party servicer is used. The seller also gets the benefit of any spread between the interest rate on the wrapped note and wraparound note.

Risks Of Wraparound Mortgage

This type of mortgage can be risky for both the buying and selling parties. The buyer is making payments to the seller, not a lender so they are relying on the seller to be trustworthy and pay the mortgage on the home. If the seller defaults the home can be foreclosed on while the buyer is living in it even though they are making payments on time. It is wise to include that a portion of payments be made directly to the lender to help deter fraud.

A seller faces risk if the buyer fails to make payments because the seller is still liable to make mortgage payments. This means the seller needs to make those payments or default on the loan so it hurts your wallet or your credit rating. It could result in needing to take legal action to fix it.

A wraparound mortgage can provide opportunities for both a buyer and a seller where they didnt have one before. However, there are big risks to all parties involved. Buyers can make this an option if they find a seller who is in danger of foreclosing on their home or having trouble selling. Once a property is found where a seller is willing to do a wraparound mortgage the mortgage lender for the home will need to agree. Before stepping into this type of mortgage it is a very good idea to consult a mortgage professional or a real estate attorney for in-depth advice.

For more information on your mortgage options in Omaha or Elkhorn and surrounding areas please contact our office.

Also Check: Can You Refinance A Mortgage Without A Job

Benefits Of A Wraparound Mortgage

A wraparound mortgage allows a buyer to get financing that they might not otherwise qualify for. The buyer might also be able to borrow less enough to cover the remaining loan balance and a small profit for the seller than if they were buying the property with a standard mortgage.

A wraparound mortgage is a good idea when the buyer does not qualify for any mortgage products with lenders, explains Benjamin Schandelson, a mortgage loan originator and head of marketing with MJS Financial LLC in Boca Raton, Florida.

For sellers, the win is the potential for profit.