In Shortkeep Everything For Taxes When Selling A Home

Sure, it might mean holding onto a stack of papers and receipts, but when it comes time to file your taxes, you never know what might come in handy.

Aside from the major home sale documents that are necessary for when you report your home sale on your taxes, keep any receipts and proof that you lived in your home just in case. And remember, speak with a tax professional and a top real estate agent to help you get through your taxes and your home sale with ease.

Header Image Source:

How To Claim Refinance Tax Deductions

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

The Tax Cuts and Jobs Act of 2017 had several implications for refinancing. Understanding the new tax rules can help you minimize your tax burden after you refinance your house. Well talk about some of the deductions you can claim on your federal taxes after a refinance, and how long you can claim them.

Tax Prep Checklist: What To Gather Before Filing

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Whether you hire a professional or do it yourself, you need certain information and documentation to file your tax return. Heres a tax prep checklist most taxpayers might need to complete the job.

Also Check: Reverse Mortgage On Condo

% Free Fed & State Plus A Free Expert Review With Turbotax Live Basic

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Know which dependents credits and deductions

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

-

See which education credits and deductions you qualify for

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Documents For Claiming Tax Credits

Tax credits are more advantageous than deductions because they subtract directly from what you owe the IRS, whereas claiming tax deductions only reduces your taxable income.

Claiming some tax credits will require that you receive a Form 1098 for the paid expenses, most notably those that are available for education. Prior to tax season, youll want to keep detailed records of what you spend so you can support claiming other credits. Some tax credits are supported by your income documentation and your tax return.

A few of the more well-known individual tax credits that are available for the 2021 tax year include:

- Adoption credit: For a portion of expenses you paid to adopt a qualifying child

- American opportunity and lifetime learning credit: For qualifying educational expenses for you, your spouse, or your dependents, reported to you and to the IRS on Form 1098-T

- Child and dependent care credit: For expenses you paid for care by another individual for your child or disabled dependents so you could go to work, look for a job, or attend schoolyoull need the care providers tax identification number or Social Security number

- Earned income tax credit: For taxpayers with lower income

- Recovery rebate credit: For economic stimulus payments you were entitled to receive in 2021 but did not

- Savers credit: For contributions made to qualifying retirement plans

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

Home Equity Loan Or Heloc Interest Deduction

Prior to the 2017 Act, homeowners could deduct interest on up to $100,000 of home equity debt, and it did not matter how the funds were used. Today, you can no longer deduct interest for home equity debt – regardless of when that debt was incurred – unless the loan proceeds are used to “buy, build, or substantially improve a qualified home”, according to the IRS.

Purchase money second mortgage interest qualifies for the deduction. So does the interest on a home equity loan to renovate your house. But borrowing to make repairs does not qualify. Note also that just because you were able to deduct interest on a home equity loan taken out before the passage of the Tax Cuts and Jobs Act does not mean you can continue to take the deduction. You can continue to deduct your interest only if the debt qualifies under the Act today.

Related: How to Lower Your Property Taxes

What Is A 1098 Tax Form From College

Form 1098-T is used by colleges and universities to report payments received by students for qualified tuition and other expenses, like scholarships and grants. It is filed with the IRS by the educational institution, and the student receives a copy. Taxpayers use the info on Form 1098-T to claim an education credit on Form 1040 .

Also Check: Chase Recast Calculator

Tax Deduction For A Home Mortgage

When you buy a house, you can receive a myriad of tax deductions. These include mortgage interest and points you paid to receive a lower interest rate. You can also deduct the property tax you paid during the year as well as any mortgage insurance premiums the lender required if you didnt make a large down payment. First-time homebuyers may be able to receive credits that can increase your tax refund.

How Does A Refinance In 2021 Affect Your Taxes

It used to be that being a homeowner could offer some big tax advantages, not the least of which are perks related to that mortgage you pay every month. With the Tax Cuts and Jobs Act changing certain aspects of the tax code starting a few years back, it’s much less of a certain thing than it used to be.

If you refinanced your mortgage in 2021, there are some specific “dos” and “don’ts” you need to know prior to filing your income taxes, as well as a few pointers that might help you lower your tax bite.

What follows may help to reduce your federal income taxes and get you prepared for mortgage-related tax issues in 2021 and beyond.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans

What To Bring To Your Accountant At Tax Time

Youll need all this information and documentation whether you prepare your tax return yourself or if you decide to use a tax professional. The difference with the professional is that youll have to take all pertinent information with you to your appointment or gather it together in advance to send through fax or electronically. Youll also need some additional documentation if youre using a tax professional for the first time.

Your tax preparer will require identifying information for you, your spouse , and your qualifying dependents, if applicable. This means Social Security cards, although you can typically take a copy of your most recent years tax return instead. This will detail all your identifying information unless youve since acquired another dependent who wasnt listed on that return.

Of course, you wont have to bring all of this with you if youre using the same professional youve used before. Theyll already have everything at their fingertips.

Its a good idea to take your previous years tax return with you to meet a tax professional, even if you have Social Security cards for everyone in your family. This should give your tax preparer an accurate picture of your personal tax situation, in addition to the identifying information it includes.

While it may seem like a lot of paperwork, gathering and organizing it will be worth it, especially if your tax situation is complex and requires a great deal of documentation.

Determining How Much Interest You Paid On Your Mortgage

You should receive Form 1098, the Mortgage Interest Statement, from your mortgage lender after the close of the tax year, typically in January. This form reports the total interest you paid during the previous year if it exceeds $600.

You don’t have to attach the form to your tax return, because the financial institution must also send a copy of Form 1098 to the IRS, so the IRS already has a copy.

Make sure the mortgage interest deduction you claim on Schedule A matches the amount thats reported on Form 1098. The amount you can deduct might be less than the total amount that appears on the form, based on certain limitations.

Keep Form 1098 with a copy of your filed tax return for at least three years. Keeping copies of your filed returns will help in preparing future tax returns.

Recommended Reading: Does Rocket Mortgage Sell Their Loans

Documentation Needed To Claim Mortgage Interest As A Tax Deduction For An Owner

Related Articles

The IRS allows you to deduct up to 100 percent of the interest you paid on your mortgage each year, even if you bought your home using “owner financing.” Know the rules and secure the appropriate documentation to file with your tax return to claim mortgage interest as a tax deduction on your owner-financed home.

Tip

Owner financing differs from traditional financing offered by institutional lenders because you make your mortgage payments to the previous owner of the home, not a mortgage company. An owner who provides financing must file certain documentation with the IRS as a traditional lender would.

Track Paperless Records As They Come

Paperless banking may have turned shoe boxes into receipt relics of the past, while your online statements often contain key backup records for potential deductions such as:

- Gambling winnings and losses

- Property tax expenditures include for your auto.

Many of us ignore the line items from these statements until we start our annual tax-filing ritual. But you may save time by taking a few extra minutes each month to jot down tax-related information including:

- Expense title

- Dollar amounts

- Dates

Create a spreadsheet dedicated to tax records. Throughout the year, consider downloading and printing online documents that will be available for only a limited time.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Tips On Rental Real Estate Income Deductions And Recordkeeping

If you own rental real estate, you should be aware of your federal tax responsibilities. All rental income must be reported on your tax return, and in general the associated expenses can be deducted from your rental income.

If you are a cash basis taxpayer, you report rental income on your return for the year you receive it, regardless of when it was earned. As a cash basis taxpayer you generally deduct your rental expenses in the year you pay them. If you use an accrual method, you generally report income when you earn it, rather than when you receive it and you deduct your expenses when you incur them, rather than when you pay them. Most individuals use the cash method of accounting.

Below are some tips about tax reporting, recordkeeping requirements and information about deductions for rental property to help you avoid mistakes.

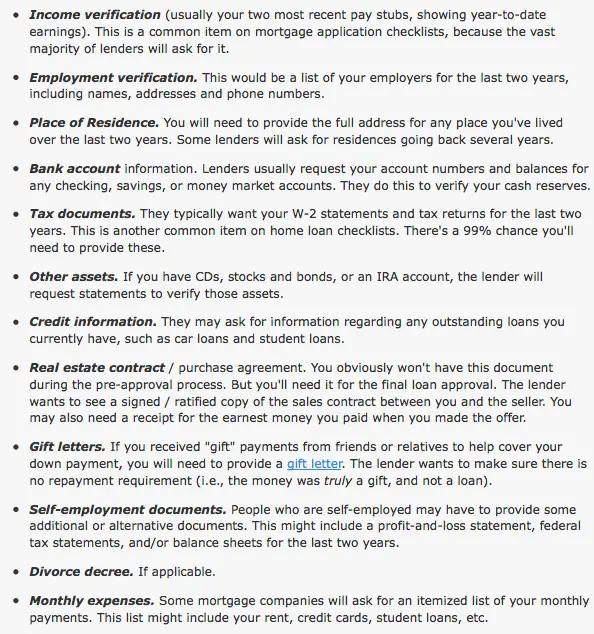

What Do Mortgage Lenders Look For On Your Tax Returns

When you apply for a mortgage, your lender is likely to ask you to provide financial documentation, which may include 1 to 2 years worth of tax returns. Youre probably wondering exactly how those tax returns can affect your mortgage application. Well break it down for you.

Why do mortgage lenders request tax returns?

Your tax returns, along with the other financial documents. in your mortgage application, are used to determine how much you can afford to spend on your home loan every month. Because a mortgage commits you to years of payments, lenders want to make sure your loan is affordable to you both now and years down the road.

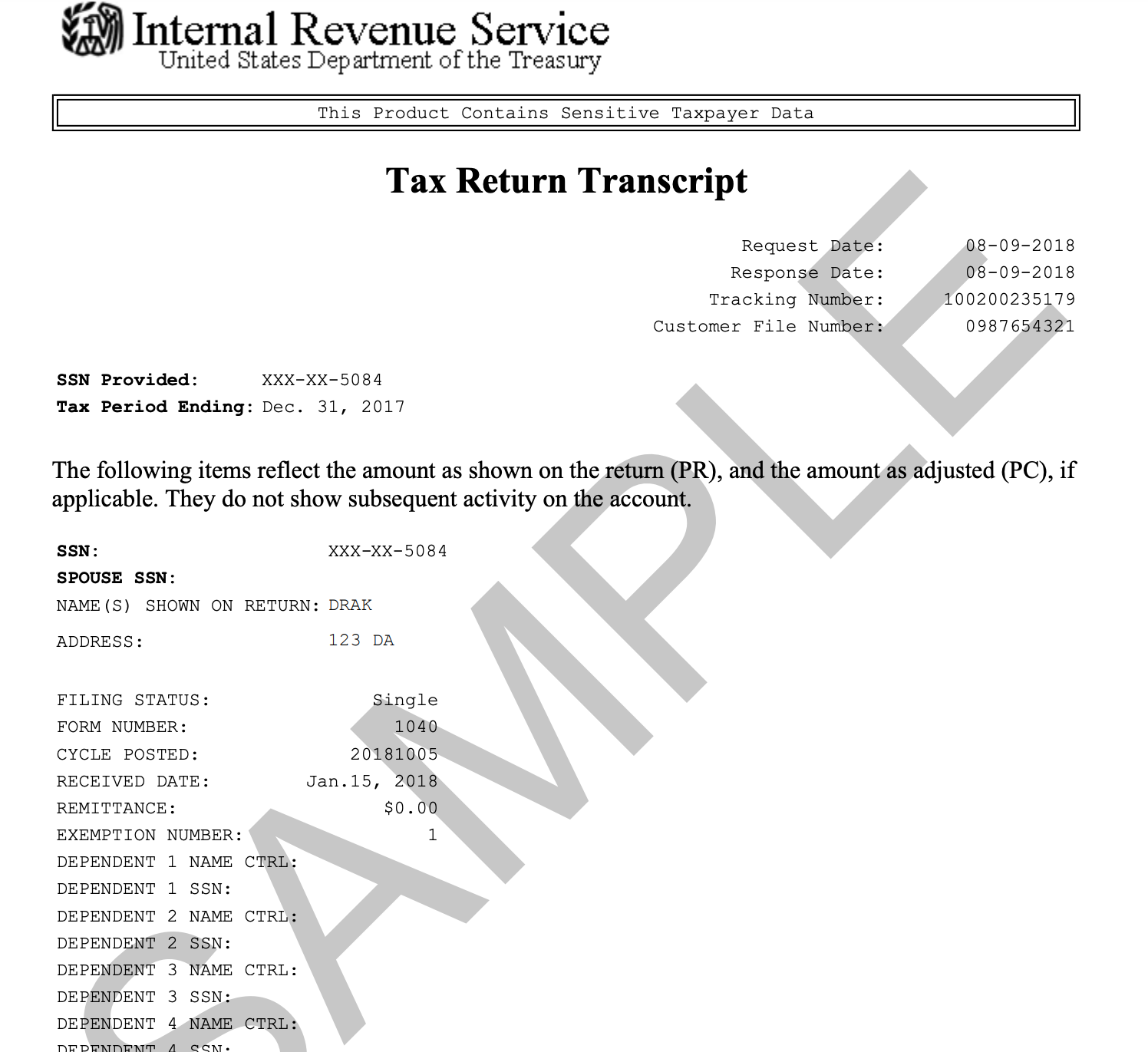

To help calculate your income, mortgage lenders typically need:

- 1 to 2 years of personal tax returns

- 1 to 2 years of business tax returns

Depending on your unique financial picture, we might ask for additional paperwork. For example, if you have any real estate investments, you may need to submit your Schedule E paperwork for the past 2 years. If youre self-employed, you may have to provide copies of your Profit and Loss statements. On the other hand, if youre not required to submit tax returns, lenders may be able to use your tax transcripts instead. If you are self-employed, a business owner, or earn income through other sources , youre more likely to be asked for your tax returns along with additional paperwork. Heres a guide to what documents lenders might need for your specific situation.

- More

Don’t Miss: Chase Recast Mortgage

Find Tax Relief Help That’s Best For You

Services

|

Services

|

Services

|

What Documents Do I Need To File My Taxes

In addition to proof of your identity, and the identities of your family members, documents you should bring to a tax preparer include:

You May Like: Mortgage Recast Calculator Chase

Check Your Standard Deduction

You can only deduct mortgage interest, property taxes and home equity interest if you itemize your deductions. The home office deduction applies almost exclusively to self-employed taxpayers, as you can no longer deduct unreimbursed business expenses.

When should you itemize your tax deductions? Only when your total itemized deductions exceed the standard deduction. Itemized deductions include mortgage interest and property taxes, but also state income tax or sales tax, charitable contributions, and qualifying medical expenses.

Note that many who itemized before the 2017 Tax Cut and Jobs Act no longer do. That is because the standard deduction was increased substantially. Here are the thresholds for 2020:

- $25,100 for married couples filing jointly

- $18,800 for heads of household

- $12,550 for single filers or married filers filing jointly.

The standard deduction for each of these filing classes is increased for homeowners aged 65 or older.

Note that if you are married and filing jointly, one of you can’t take the standard deduction while the other itemizes. You have to both use the same method. In addition, some deductions that you might have taken in the past are no longer allowed. These include: tuition and fees, unreimbursed employee expenses, tax preparation costs and casualty and theft losses.

Closing Costs On A Rental Property

You cannot deduct settlement fees and other closing costs on a primary or secondary home. However, different rules apply for rental properties. The IRS sees the money you earn from renting out a home or condo as taxable income.

You have a lot more leeway when deducting closing costs and other upkeep expenses for a refinance on a rental property. Some expenses you can claim as deductions on a rental property include:

- Attorneys fees

Recommended Reading: Chase Recast

Think Deductions Throughout The Year

Keep a mileage log in your car. Jot down the miles when you use your vehicle for:

- volunteering

- work

- business or medical appointments

Keeping track of parking, bus and taxi fares and tolls can also help you qualify for a deduction.

Hold on to cash receipts that document your transportation, charitable work and other tax-deductible activities. Hold on to any paperwork and documents that arrive in the mail, or receipts needed to prepare the return, even if you’re not sure. It’s always better to have too much information than not enough.

Statements Mailed In January And February

Most of the papers you need to document the income, interest and withheld taxes you report arrive in your mailbox in January, with investment-related 1099s often coming in February. Although the postal service may deliver some of themyour W-2, for exampleemail announcements that the documents are available online may land in your inbox.

Mortgage providers, banks and other financial institutions often post those important 1099 forms on your online account. So its a good idea to create an email tax folder for messages relating directly to tax information.

Don’t Miss: Reverse Mortgage For Condominiums

Filing Your Taxes When You Have No Income

Home \ Blog \ Taxes \ Filing Your Taxes When You Have No Income

Join millions of Canadians who have already trusted Loans Canada

Did you lose your job? Are you on maternity or paternity leave? Are you in-between jobs? Have decided to go back to school in order to further your career once you get back into the workforce? Or have you decided to take an extended sabbatical in order to refresh and take a breather from the everyday hustle and bustle of work-life?

Whatever your reason for not working, you may be wondering whether or not its still necessary to file a tax return. You might think theres absolutely no reason to do so, especially since you did not make any money and therefore have nothing to pay income taxes against. In a sense, you may be right. You technically dont have to file your income taxes if you have no income to claim, but only if other circumstances dont apply.