What Are The Benefits Of An Adjustable

The predictability of a fixed-rate loan can be better if you prefer to always know what your payment will be. If you are looking for a lower payment, an adjustable rate can offer that in the beginning, just know that it can go up or down at adjustment periods. ARMs do come with caps limiting the amount by which rates and payments change so you are protected from potential steep increases.

How Does An Index Affect My Interest Rate

For adjustable rate loans and lines of credit, lenders typically calculate your interest rate using two numbers: the index and the margin. The index is a benchmark interest rate that reflects market conditions, and changes based on the market. There are many indexes in the marketplace. Currently, common indexes include LIBOR, the U.S. Prime Rate, and the Constant Maturity Treasury Index . You can look up rates for common indexes in newspapers or online.

The margin is the number of percentage points added to the index by the lender to get your total interest rate.

Index + Margin = Your Interest Rate

For example, you could have a mortgage with an interest rate of LIBOR, plus 2 percent. Or you might have a credit card with an interest rate equal to the U.S. Prime Rate, plus 9 percent.

Expect To Pay Off Mortgage During Teaser Period

Finally, if you expect to pay off the mortgage during the teaser period, an ARM can make sense. You save money on interest and you dont have to worry about the rate adjusting higher because you have the loan paid off.

This is a big if, and experts warn that life events could derail this plan. But if you know for sure you can pay off the loan during the teaser period, it could be worth the risk, says Parker.

Also Check: Recast Mortgage Chase

What Do I Need To Know If I Have A Loan Or Line Of Credit Based On Libor

If youd like to check whether your loan or line of credit may be impacted, you can look at your loan contract. Your loan contract tells you whether your interest rate is fixed or adjustable. If its adjustable, the contract should list which index is used to calculate your interest rate.

If you have questions about the impact of this transition on your loan or line of credit, you can call your lender or servicer for more information. Because lenders and servicers are currently planning for this transition, they might not have answers to all of your questions at this time. More information will be available as the transition gets closer.

The Daily Journal Of The United States Government

Legal Status

This site displays a prototype of a Web 2.0 version of the daily Federal Register. It is not an official legal edition of the Federal Register, and does not replace the official print version or the official electronic version on GPOs govinfo.gov.

The documents posted on this site are XML renditions of published Federal Register documents. Each document posted on the site includes a link to the corresponding official PDF file on govinfo.gov. This prototype edition of the daily Federal Register on FederalRegister.gov will remain an unofficial informational resource until the Administrative Committee of the Federal Register issues a regulation granting it official legal status. For complete information about, and access to, our official publications and services, go to About the Federal Register on NARA’s archives.gov.

Legal Status

Read Also: Recasting Mortgage Chase

Some Warning Signs For Arms

The situation described in the paragraph above is called a carryover and it is one of the many terms and conditions of ARMs that are missed or misunderstood by consumers. Like any contract, it is wise to read and understand all the terms and conditions of an ARM before you sign.

Many people like the low, teaser rates offered by ARMs and think they will be out of the house before the adjustable rate period takes over and higher monthly payments come due.

That may be the case, but if you cant sell your home or the value of the home declines, or for whatever reason decide to stay, you should consider in advance what the highest payment youll have to make will be and whether you think you can afford it.

Here are some terms you should be familiar with if you plan to go with an ARM.

The bottom line for adjustable rate mortgages is to be careful what you sign up for.

When interest rates are as low as they have been the last decade, consumers typically choose a 30-year fixed mortgage for the safety and security of know the monthly payment will never change.

However, as interest rates rise, ARMs can accommodate those who want low payments early in the loan or who dont expect to live in the home for 30 years.

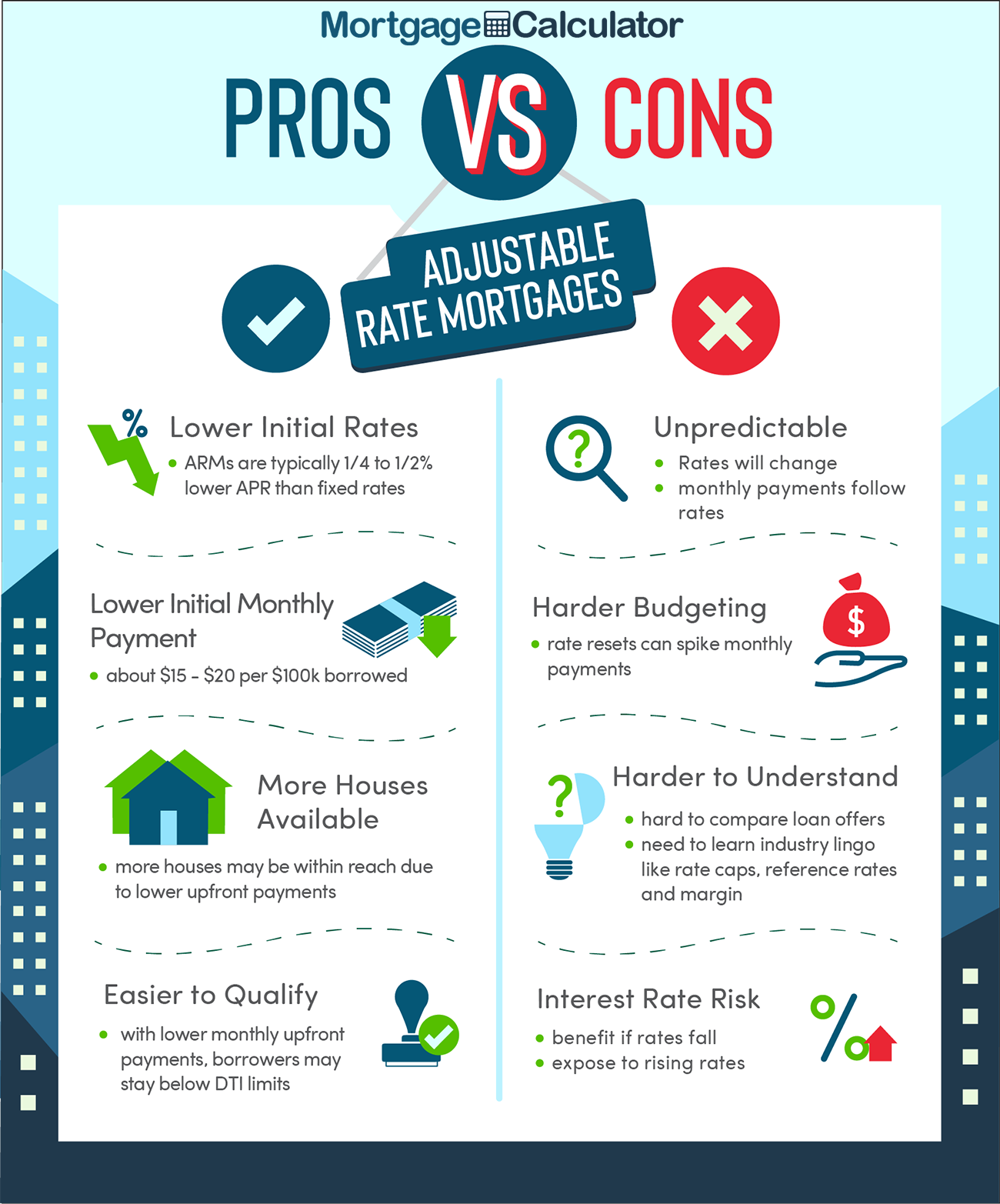

Either way, be certain you understand the pros and cons of adjustable rate mortgages. Before you make a final decision, know the timing sequence for rate adjustments, the caps that apply and what penalties you will pay for not fulfilling the terms and conditions of the loan.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: Can You Do A Reverse Mortgage On A Condo

What If Im Shopping For A New Adjustable

As with any other financial decision, ask questions and consider your options before you agree to loan terms:

- Request quotes from at least three different lenders.

- Ask lenders about the various loan options they offer, including fixed interest rate options.

- If you are considering an adjustable rate loan, make sure you are confident you know what your maximum payment could be and that you can afford it.

Key Features Of Adjustable Rate Mortgages

The three important features that should be recognized when issuing an ARM are:

1. Introductory rate

3. Conversion option

In the beginning, lenders will offer an introductory rate that is below their prime ratePrime RateThe term prime rate refers to the interest rate that large commercial banks charge on loans and products held by their customers with the highest credit rating. for a fixed time. After that periods ended, the ARM will convert to an indexed rate thats been agreed upon. It is referred to as the actual rate.

In many cases, some lenders will allow the borrower to convert their adjustable-rate mortgage from a variable rate into a fixed rate after the introductory period. However, additional costs may be incurred.

Don’t Miss: How Does Rocket Mortgage Work

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

I Already Have A Mortgage So Does This Affect Me

While its primarily used in corporate financial transactions, currently LIBOR is also written into many consumer loans which means that the switch might affect those borrowers.

In fact, it is estimated that there are approximately $5 trillion in consumer loans based on LIBOR. This includes financial products such as credit cards, student loans, car loans and personal loans, along with ARMs. While fixed-rate mortgages wont be affected, its estimated that about half of the $1 million-plus mortgages are ARMs based on LIBOR rates. Thats a sizable percentage of U.S. loans, many of them concentrated in geographic areas where housing is expensive and homeowners are carrying jumbo mortgage balances.

If you have a loan set to LIBOR, during the transition, you might see some movement in your bills as your loans could be affected , and that could affect your budget if you typically carry large balances. However, huge swings arent expected, and yet its always wise to be prepared.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: Rocket Mortgage Loan Types

Is An Arm Or Fixed

Choosing between an ARM and a fixed-rate mortgage is all about risk versus reward. With a fixed-rate mortgage, the borrower locks in a rate for the life of the mortgage. With an adjustable-rate, the borrower takes on the risk of their rate rising in the future. In exchange for the increased risk, the borrower typically gets a lower starting interest rate.

Whether an ARM or fixed-rate mortgage is better depends on your individual financial situation, goals, and tolerance for risk. For most people, the chance of getting a slightly lower interest rate up front isnt worth the instability of an ARM or the risk of significantly increased costs in the future. This is especially true in the current rate environment, where low rates across the board mean that the difference between fixed and ARM rates may be minor.

Also, with a fixed-rate mortgage, you have the flexibility to choose a shorter repayment term, like a 15-year loan. Compared to a 30-year mortgage, a 15-year home loan will have a lower interest rate but higher monthly payments. You may potentially pay more per month, but borrowers are willing to do this to pay off the debt faster and save thousands of dollars in interest payments over the life of the loan, says Nadia Alcide, a mortgage professional with Mortgage Biz of Florida. And the option to take a shorter term mortgage isnt typically available with an ARM.

Figure 4 Implied Future Interest Rates For Ohio Libor

The subprime set of mortgages, on the other hand, undergoes a much more rapid decline in its average interest rate within a short period by the beginning of 2009, most of the 1.75 percentage-point gap in the two alternative indexes has been realized. Thats because most of the subprime loans in this sample had already experienced their initial rate-reset by July 2008, and nearly 90 percent would have done so by the end of 2008. Interestingly, in our data, caps and floors appear to affect the simulated interest-rate paths for prime and subprime loans very little.

How important are these different interest-rate paths for mortgage-holders? For a typical subprime borrower, the divergence of the two rate paths quickly translates into a monthly payment difference of about $100 for every $100,000 of remaining principal . For prime borrowers, the resulting difference is less dramatic, but still meaningful, rising to roughly $50 by the end of 2009. In the aggregate, these differences would cost Ohios Libor-based ARM-holders roughly an additional $34 million in 2009 alone, should current interest-rate trends continue, with about 55 percent of this burden being shouldered by subprime borrowers.

Read Also: Can You Refinance A Mortgage Without A Job

How Does Libor Affect My Mortgage

When you apply for a mortgage, you might wonder what factors affect the rate you pay. The first metric lenders check to price various types of ARM loans is LIBOR, which serves as a base. Then to more accurately determine your interest rate, they will also consider factors like your debt-to-income ratio amount of down payment and more.

The LIBOR rate isnt the amount youll see in your interest calculation, as its what banks charge each other, not individual borrowers. Instead youll be charged an interest rate indexed to LIBOR and based on your specific circumstances, which impact the lenders judgement about your ability to repay your loan in other words, how much risk they believe they are taking on according to your past experience with credit and repaying your bills.

For example, your rate might be stated as LIBOR + 2, with the LIBOR part as the index, which will vary with economic changes, and the 2 as the margin, which will stay the same.

But heres why it only affects certain types of mortgages. As you were shopping for your loan and talking to a professional about the right financial product for your situation, you were likely offered a wide variety of mortgage loan products, including adjustable-rate mortgages and fixed rate mortgages .

Mortgage Rates For Dec : Interest Rates Climb But You Can Still Get A Good Rate

Are you a homebuyer shopping for a mortgage? Let’s see how your finances could be affected.

A couple of important mortgage rates are higher today. Average 15-year fixed mortgage rates were static, while average 30-year fixed mortgage rates moved up. At the same time, average rates for 5/1 adjustable-rate mortgages increased. Mortgage interest rates are never set in stone, but interest rates are at historic lows. If you plan to finance a home, now might be an excellent time to secure a fixed rate. Before you purchase a house, remember to take into account your personal needs and financial situation, and compare offers from multiple lenders to find the right one for you.

Read Also: Chase Mortgage Recast

What Is A Hybrid Arm

Also contributing to the turnaround is the fact the lending industry is offering more palatable versions of the product to consumers. Todays hybrid ARMs offer a break on interest and a fixed payment amount for the introductory period before reverting to adjustable rates at the 3, 5, 7 or 10-year mark.

Right now, that break doesnt amount to much, given how low interest rates are for 15-and-30-year mortgages. But interest rates have risen steadily over the past year and are expected to continue rising, so the spread between a 30-year fixed rate mortgage and the first few years of an ARM may widen enough to make it even more appealing.

If you are just getting started in the workforce and homebuying market, every dollar counts and ARMs can save a few dollars, at least until the dreaded adjustment period kicks in.

How Are Adjustable Mortgage Rates Calculated

Once the initial fixed-rate period ends, borrowing costs will fluctuate based on a reference interest rate, such as the prime rate, the London Interbank Offered Rate , the Secured Overnight Financing Rate , or the rate on short-term U.S. Treasuries. On top of that, the lender will also add its own fixed amount of interest to pay, which is known as the ARM margin.

Also Check: Can I Get A Reverse Mortgage On A Condo

Other Considerations Before Getting An Adjustable

Due to the low-rate environment were currently in, mortgage rates are likely to rise over time. As a result, both Parker and Mazarra suggest that a fixed-rate might be the better option right now.

Rates could go up soon. So locking in right now makes sense, Parker says. You know your payment wont change, and as rates rise, you wont end up paying more later.

Fixed-rate mortgages are particularly nice when you know youre going to be in your home for an extended period of time, Mazarra says even if you think you could save a few bucks with a lower ARM rate.

If youre buying your 30-year forever home, or buying a home you might move out of but still keep as an income rental property, its not a good idea to take an adjustable-rate mortgage, Mazarra says. If youre buying your long-term home, dont go with an ARM, because you dont want to have to worry about that upside risk.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

You May Like: How Much Is Mortgage On 1 Million