How To Get The Best Interest Rate For My Loan

The best interest rate is often the lowest interest rate. Lower interest can drastically change your mortgage debt over time. Minor changes to your interest rate could mean big savings or significant spendings. If youre trying to answer the question of how much can I spend on a house? it has a lot to do with the interest rate your loan comes with.

So, how do you get the best rate? First is to watch current trends on mortgage rates. Rates are updated daily, so its important to keep an eye on them to know when you call your mortgage lender and ask them to lock you into a newly dropped rate. You should also take control of your credit score. Buyers with higher credit scores get approved for lower rates. You can also buy your interest rate down a point or two by paying extra cash up front. If you dont qualify for a low rate, talk to your lender about buying a point to reduce all future payments.

How Does Your Down Payment Affect Mortgage Affordability

Your down payment plays a big role in your mortgage’s affordability. The size of your down payment affects the amount of the monthly payment you’ll be making to cover the rest of the mortgage amount a bigger down payment decreases your monthly payment and vice versa. So, if you’re worried about your DTI affecting your mortgage eligibility, coming up with a larger down payment can help you qualify.

For example, if you’re buying a $250,000 home with a 4% interest rate over 30 years, a $20,000 down payment would give you a monthly principal-and-interest payment of $1,098. But if you put down $40,000, your monthly payment would drop to $1,003and you’d also save nearly $35,000 in interest over the life of your loan.

While a 20% down payment is a standard recommendation from mortgage experts, it’s not a requirement. In fact, many lenders allow down payments as low as 3% or 5% of the loan amount.

If you don’t have a lot of cash for a down payment and you’re a first-time homebuyer, there are several programs and grants that can provide you with down payment assistance or even loans with no down payment requirement.

Consider more than just your monthly payment as you decide how much money to put down. For example, if you drain your savings for a down payment, you could experience some difficulties if you have a financial emergency in the near future.

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Read Also: Rocket Mortgage Loan Requirements

How Do You Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the top amount you can pay for a house, as well as your estimated monthly payment.

How We Calculate Your Home Value

Mortgage data: We use current mortgage information when calculating your home affordability.

Closing costs: We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

Homeowners insurance: We assume homeowners insurance is a percentage of your overall home value.

Debt-to-income threshold : We recommend that you do not take on a monthly home payment which is more than 36% of your monthly income. Our tool will not allow that ratio to be higher than 43%.

Mortgage Type: The type of mortgage you choose can have a dramatic impact on the amount of house you can afford, especially if you have limited savings. FHA loans generally require lower down payments , while other loan types can require up to 20% of the home value as a minimum down payment.

…read more

| * Includes a $ required monthly mortgage insurance payment.Other Expenses |

| Accuracy Grade*=A |

Rent vs Buy

Recommended Reading: Does Prequalification For Mortgage Affect Credit Score

Is 20000 Enough To Buy A House

Size Of Down Payment Lenders express down payments as a percentage of the total loan. For example, if you buy a home worth $100,000, a 20% down payment is equal to $20,000. … You may qualify for a mortgage with as little as 3% down with a conventional loan. If you choose an FHA loan, you’ll need 3.5%.

Many Americans Spend More Than They Should On Housing These Guidelines Can Help You Avoid That Trap

Buying a new home is a big decision that involves a whole lot of smaller ones. Many people focus on the number of bedrooms or the quality of the kitchen appliances as they contemplate where they want to live.

But new homebuyers shouldnt let considerations like those persuade them to buy a home thats more expensive than they can comfortably afford.

With home prices on the rise in many parts of the U.S., keeping things affordable is getting harder to do. In May the median listing price for a home rose 6 percent from the previous year, to $315,000, a record high, according to a report by Realtor.com. Meanwhile, the number of homes priced above $750,000 rose 11 percent from a year ago.

Buyers say that those high prices are forcing them to spend more than they planned. One-third of buyers report that they spent more than they expected to on their home, and nearly one-third put down a higher down payment than they anticipated, according to a by CoreLogic, a real estate data analytics firm.

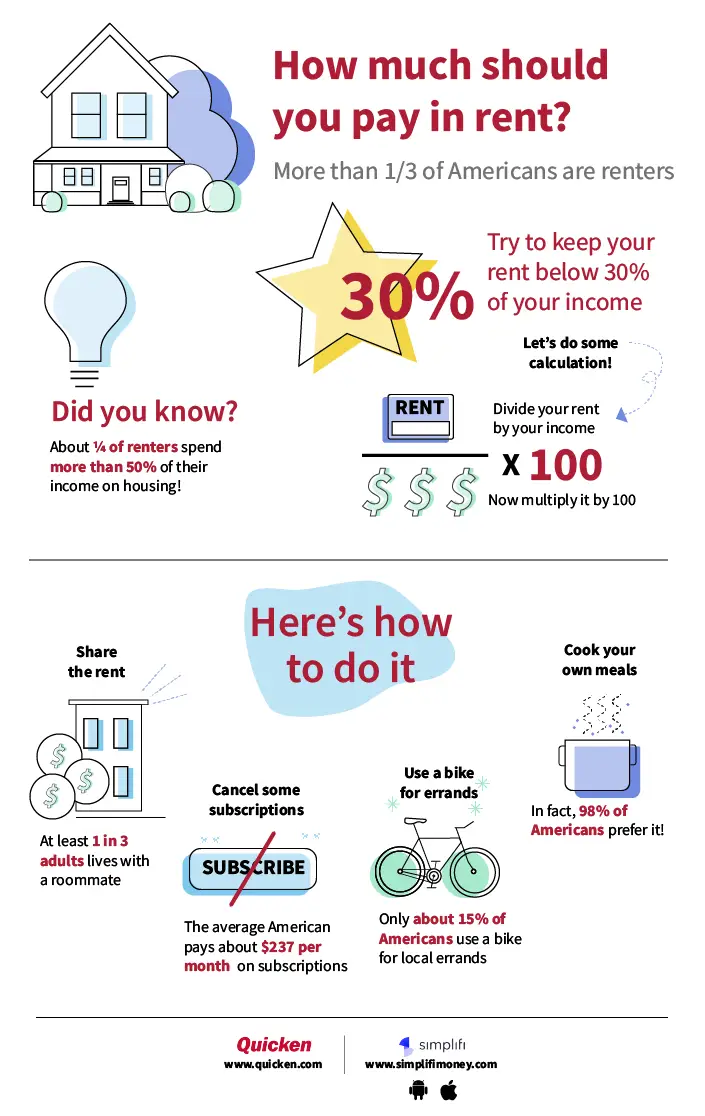

Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget. Yet the average married couple with children between the ages of 6 and 17 spends 32 percent of their budget on housing, and single people spend almost 36 percent, according to data from the Bureau of Labor Statistics.

To make sure you dont spend more than you should, here’s some advice on getting a mortgage you can afford.

Read Also: Rocket Mortgage Payment Options

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Additional Buying Costs To Budget For

There are other costs involved with buying a house that you need to make sure you can afford. They include:

- The total purchase cost. On top of the house price, you may have to pay for Stamp Duty, conveyancing fees, surveying, mortgage fees etc, which can all add up to 7% onto the house price.

- Dont forget the estate agent fees you have to pay if you are selling your existing home

- There are also the costs of furnishing your home. On average, home movers spend £5,000 on new goods.

- The cost of building works. What are the emergency works you have to do that cant be put off such as getting the boiler to work?

Don’t Miss: Reverse Mortgage Manufactured Home

Likely Rate: 3222%edit Rate

Loan details

Down payment & closing costsNerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account the type of card being reviewed and the card’s rates, fees, rewards and other features.

Income and debts

Annual household incomeYour income before taxes. Include your co-borrowers income if youre buying a home together.

Minimum monthly debtThis only includes the minimum amount you’re required to pay each month towards things like child care, car loans, credit card debt, student loans and alimony. If you pay more than the minimum, that’s great! But don’t include the extra amount you pay.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a . As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

For more on the types of mortgage loans, see .

Calculate An Affordable Home Purchase Price

Combine your cash down payment with the amount of money youre prepared to borrow and youll have a maximum purchase price. However, dont hesitate to revise this estimate as you shop for houses and mortgages. Figuring out how much to spend on a house changes as the variables change.

For instance, lets say you get your heart set on a fixer-upper. Youll probably need to reduce the size of your down payment to have more cash available for renovations. Do the homes youre looking at have lower property tax bills or higher association fees than you expected? Have you found the perfect lender offering a lower interest rate?

Go back to the mortgage calculator, and revise your borrowing power.

Also Check: Can You Do A Reverse Mortgage On A Condo

How Do I Get A Mortgage

For everything you need to help you understand what to consider and how to get a mortgage, read our guide: Mortgages made simple.

How Much Is A Downpayment On A 300k House

If you are purchasing a $300,000 home, you’d pay 3.5% of $300,000 or $10,500 as a down payment when you close on your loan. Your loan amount would then be for the remaining cost of the home, which is $289,500. Keep in mind this does not include closing costs and any additional fees included in the process.

Don’t Miss: Rocket Mortgage Vs Bank

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Know All Your Costs When Buying A House

Its not all about your homes purchase price. To secure a loan, most lenders require some amount of downpayment. To finalize the purchase and paperwork, you will pay additional closing costs. Below are the common costs of buying a house.

Your down payment is your skin in the game. It commits you to the mortgage with a significant upfront investment. Among the various loans available, you can find down payment requirements ranging from 3-20% of the homes purchase price. Most experts recommend that you put as much money as you can into your down payment. Most conventional loans require 20% as a downpayment, however, sometimes its simply not possible to save up a 20% downpayment. To work with a down payment less than 20%, youll need to qualify for an FHA, VA, or USDA loan.

A downpayment of 20% has two key benefits:

You May Like: Rocket Mortgage Launchpad

How Much Do You Need To Make To Buy A 1 Million House

Experts suggest you might need an annual income between $100,000 to $225,000, depending on your financial profile, in order to afford a $1 million home. Your debt-to-income ratio , credit score, down payment and interest rate all factor into what you can afford.

Here are 35 high paying jobs without degrees you can attain.

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

Read Also: Rocket Mortgage Loan Types

Cash Reserve And Your Ability To Pay Your Mortgage

| Cash Reserve | |

|---|---|

| $1,425 | 17.5 |

The table above is for a $250,000 home in Kansas City, Missouri. The mortgage payments assume a 20% down payment, and they include property taxes and home insurance.

Think of your cash reserve as the braking distance you leave yourself on the highway – if thereâs an accident up ahead, you want to have enough time to slow down, get off to the side or otherwise avoid disaster.

Your reserve could cover your mortgage payments – plus insurance and property tax – if you or your partner are laid off from a job. It gives you wiggle room in case of an emergency, which is always helpful. You donât want to wipe out your entire savings to buy a house. Homeownership comes with unexpected events and costs , so keeping some cash on hand will help keep you out of trouble.

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

Also Check: Mortgage Recast Calculator Chase

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.