What Are The Minimum Requirements For A Mortgage Loan Officer

Now let’s see how they can become a loan officer. Earn a bachelor’s degree in finance, banking or economics. Credit institutions require their loan officers to close their businesses because they need the knowledge to analyze financial statements and other business-related documents. Get a license. Federal law requires all loan officers to be licensed by the state.

What Is The Formula To Qualify For A Mortgage Interest

To calculate your mortgage interest, first multiply your monthly amount by the total number of payments you make. Then subtract the principal from that number to get the interest on the mortgage. For example, if you were paying $1,250 per month on a $180,000 loan for 15 years, you would first multiply $1,250 by 15 to get $225,000.

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

Recommended Reading: Rocket Mortgage Payment Options

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

Mortgage Preapproval Confirms Your Home Buying Budget

Its a good idea to figure out how much home you can afford before you start shopping so that you avoid falling in love with a property you wont be able to buy.

In addition to getting an estimate through an online mortgage calculator, you can apply for preapproval with a lender to get a better idea of what they might offer you.

That allows you to search for homes in your price range, and it reassures your real estate agent and sellers that youre in the right ballpark when youre touring homes.

You can get started by requesting todays rates from top lenders.

Read Also: Mortgage Recast Calculator Chase

How Much House Should I Really Afford

- Based on your income, estimate the price you can afford. Okay, you just need to work out a few numbers to figure out how many houses you can afford.

- Increase your deposit.

Conventional loan requirementsHow much down payment is required for a conventional loan? Traditional loans traditionally require a down payment of 5-20% of the purchase price. The down payment reduces the risk to the lender, as borrowers are often less exposed to the risk of default when their own money is at stake.What is the minimum credit score for a conventional loan?Conventional loans are best suited to bor

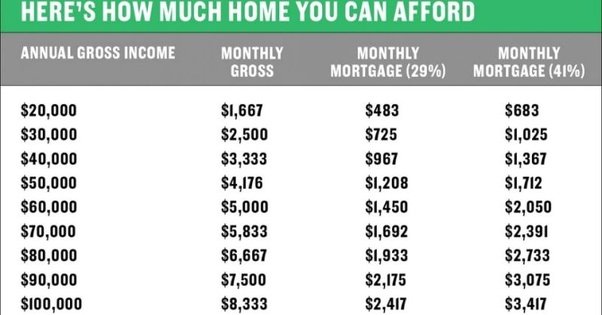

How Can You Estimate An Affordable Property Price

Take 30% of your annual gross income, equate this into a loan amount using an average rate of 2.75%, factor in a 10% deposit, and then use these calculations to estimate a potential purchase price.

Assuming that you dont have any debts or liabilities, and using a rate of 2.75% over a 30-year loan term, here are 3 potential scenarios:

Scenario 1: $50k income

- $50,000 annual gross income at 30% = $1,250 per month.

- With a mortgage at 2.75% p.a. this equates to a loan amount of $305,000.

- With a 10% deposit contribution worth around $34,000, the maximum affordable property price would be $339,000.

Scenario 2: $75k income

- $75,000 annual gross income at 30% = $1,875 per month.

- With a mortgage at 2.75% p.a. this equates to a loan amount of $460,000.

- With a 10% deposit contribution worth around $51,100, the maximum affordable property price would be $511,000.

Scenario 3: $100k income

- $100,000 annual gross income at 30% = $2,500 per month.

- With a mortgage at 2.75% p.a. this equates to a loan amount of $614,000.

- With a 10% deposit contribution worth just over $68,000, the maximum affordable property price would be $682,000.

Read Also: Rocket Mortgage Launchpad

What Is The Formula For Calculating Interest On A Mortgage

The formula to calculate the monthly mortgage payment for a fixed-rate loan is P = L / . This formula can be used to help potential homeowners determine how much they can afford to pay for monthly equity. Before using the formula, it is important to understand the meaning of each variable: C = Interest.

What Is The Required Debt

Online resource Investopiea.com explains that the lower an applicants debt-to-income ratio, the greater the chances that the borrower will be approved for a credit application.

As a customary rule, 43 percent is the highest debt-to-income read DTI ratio a borrower can have and still be qualified for a mortgage.

However, lenders prefer a debt-to-income ratio lower than 36 percent, with no more than 28 percent of that debt as a mortgage or rent payment.

In reality, though, the maximum DTI ratio varies from lender to lender.

You May Like: What Does Gmfs Mortgage Stand For

How Much Will Savings Of$ 60 000 Grow Over Time

How much will savings of $60,000 grow over time with interest? What if you add to that investment over time? Interest calculator for a $60k investment. How much will my investment of 60,000 dollars be worth in the future? Just a small amount saved every day, week, or month can add up to a large amount over time.

Who Has The Easiest Home Loans To Qualify For

Who is easier to qualify for? Look for lenders from the FHA, VA, and USDA. You can only get an FHA, VA, or USDA mortgage through approved lenders. Tolerance for bad credit varies. FHA, VA, and USDA lenders may impose stricter lending standards in addition to the formal guidelines. Traditional loans compete. The same credit problems that have not occurred in the past.

Also Check: Does Rocket Mortgage Sell Their Loans

Can I Invest Making $60000 A Year

Yes! You can invest while making any salary. I would recommend investing at any and every stage of your life. If your dollars arent working for you, they are working for someone else.

Start out investing what you feel comfortable with and go from there. Look into all of your investing potentials and do your own research. You will be amazed at how many options are out there to invest in.

How Do Lending Multiples Work

When it comes to households with two incomes, some lenders offer a choice:

- The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second persons income is £15,000 a lender might offer 4x the first income, plus the second income or

- A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they will actually let you borrow. All income you declare in your mortgage application will need to be proven, usually through you providing your latest pay slips, pensions and benefits statements.

Recommended Reading: Are Discount Points Worth It

Income Is A Significant Part Of Deciding How Much You Could Borrow

Income is crucial for determining how big a mortgage you can have. Traditionally, mortgage lenders applied a multiple of your income to decide how much you could borrow. So, if you earn £30,000 per year and the lender will lend four times this, they may be willing to lend £120,000.

When it comes to households with two incomes, some lenders offer a choice:

The option to add the second income on top of the multiple, so if the main breadwinner earns £30,000 and the second person’s income is £15,000 a lender might offer 4x the first income, plus the second income or

A slightly lower multiple for two incomes than for one. So £30,000 + £15,000 = £45,000. Then £45,000 x 3 = £135,000

Many lenders now only use income multiples as an overall maximum that they will lend, conducting a detailed affordability assessment to decide how much they are willing to lend. This is something that has become particularly strict following mortgage regulations introduced in 2014.

If part of your income is comprised of a bonus or overtime, you may not be able to use this, or if you can, you may only be able to use 50% of the money towards what the lender deems as your income. All income you declare in your mortgage application will need to be proven usually through you providing your latest pay slips, pensions and benefits statements.

Ok So Theyve Got My Information And Done Some Math Now What

From there, the lender will determine what length of loan and interest rate they feel comfortable giving you. To figure this out, theyll take a look at your credit score, which ranges from 300 to 850 . As youd expect, the higher your credit score, the lower the interest rate youll generally get, though the amount of your down payment also gets factored in.

Its difficult to say what constitutes an ideal credit score for taking out a mortgage , but a number between 700 and 740 seems to be a good range. In general 620 is considered the lowest acceptable score that will get you the green light.

If your credit score isnt where you want it, it might be useful to try to boost your number a bit before applying for a mortgage. The difference between a 3-percent and 5-percent rate might not sound huge, but all that interest adds up over the 15 or 30 years of the loan to some pretty significant money.

Don’t Miss: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Next: See How Much You Can Borrow

You’ve estimated your affordability, now get pre-qualified by a lender to find out just how much you can borrow.

-

What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator.

- Award Ribbon

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Pig Refinance calculator

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How Much Mortgage Can I Afford

While the idea of buying a house may sound fun, the actual securing of a mortgage usually isnt. Pretty much nobody looks forward to the day they take out a mortgage. Rarely do you hear someone talk about how much they enjoy going through the mortgage process. Theres good reason for this: taking out a mortgage can be a painful, laborious, even depressing endeavor . All the more incentive to make enough money that you dont even need a mortgage. Odds are, though, youre not in that lucky minority. So instead, were here to help make the process a little easier. Well walk you through the answer to that all-important question, How much mortgage can I afford?

You May Like: Reverse Mortgage On Condo

Increase Your Down Payment

If you have the cash, you may want to up your down payment to 10 or 20 percent. A down payment raises your maximum home price, which may be enough to buy a home that you want.

If you dont have the cash, keep in mind that you can ask relatives for gift money.

You can also apply for homebuyer assistance programs from state and local government programs that provide down payment and closing cost funds. Your eligibility for these programs may vary based on your personal finances.

Do Mortgage Calculators Require A Credit Check

No, you wont need to undergo a when using mortgage calculators, as the only information youre inputting is your basic salary no other personal details are required. This means therell be no searches appearing on your credit report and no impact on your score, but if youre concerned that your current score may be holding you back from getting the best deals, nows the time to work on improving it. Find a free credit check service.

Read Also: How Much Is Mortgage On 1 Million

How Much Would A 100000 Mortgage Cost Per Month

This would depend on the term of the mortgage and the interest rate youre paying, but if we take a typical 25-year mortgage at a rate of 2.5%, your monthly repayment on a £100,000 mortgage would be £448.62. You can find more repayment scenarios by heading to our mortgage repayment calculator.

Cookies

Can My Husband Purchase A Home With One Income

One Spouses Income Doesnt Meet The Requirements According to Villasenor, 2/2/2 is a general rule for all documentation requirements. This simply means that youll need 2 years of W-2s, 2 years of tax returns, and 2 months of bank statements. Depending on your situation, more documentation may be required.

Read Also: Can You Get A Reverse Mortgage On A Manufactured Home

How Much Should I Spend On A House

Anaffordability calculatoris a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, and insurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Read Also: Rocket Mortgage Conventional Loan

Try A 3%down Conventional Loan

Its possible to get a conventional loan one backed by Fannie Mae or Freddie Mac with a down payment as low as 3% of the purchase price. Whats more, that down payment can often be covered with a down payment assistance grant or gift funds from a family member.

Just note that to qualify for a 3%down conventional loan, most lenders require a credit score of at least 620 or 640. For those with lower credit, an FHA loan might be more appealing.

What Rent Can I Afford 50k

Qualification is often based on a rule of thumb, such as the 40 times rent rule, which says that to be able to pay a certain rent, your annual salary needs to be 40 times that amount. In this case, 40 times $1,250 is $50,000. Therefore, if you make $50,000, you qualify for $1,250 per month in rent.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home