What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. That’s why it’s so important to establish and maintain the highest rating possible.

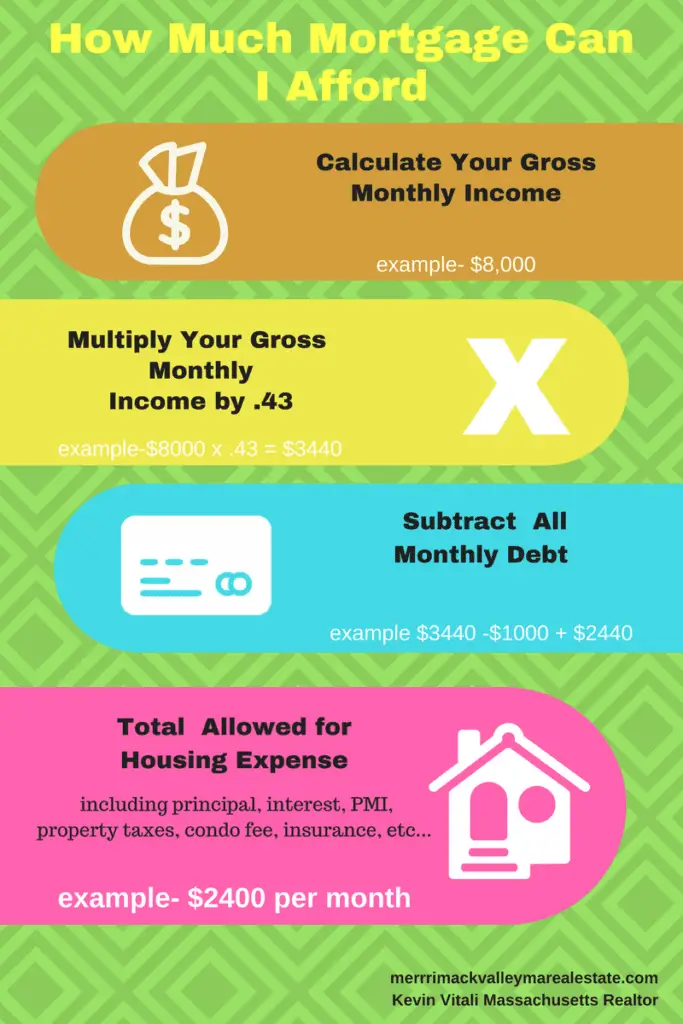

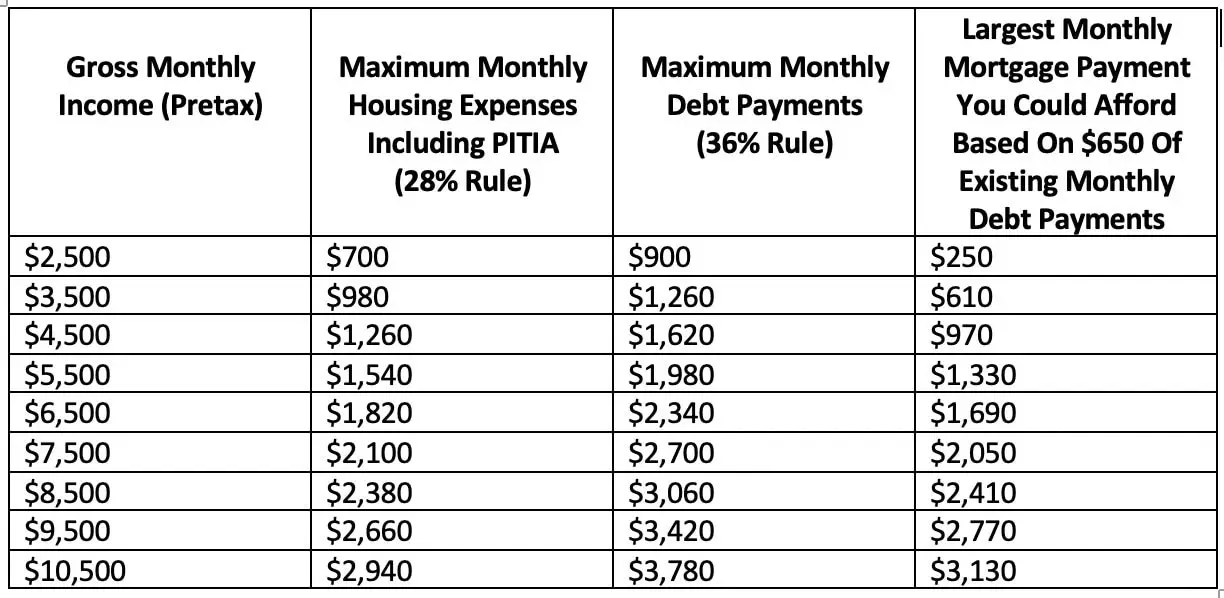

A Simple Formulathe 28/36 Rule

Here’s a simple industry rule of thumb:

- Housing expenses should not exceed 28 percent of your pre-tax household income. That includes your monthly principal and interest payments plus all the such as property taxes and insurance.

- Total debt payments should not exceed 36 percent of your pre-tax incomecredit cards, car loans, home debt, etc.

Rbc Royal Bank Mortgage Affordability

Before you get a mortgage from RBC, it is important to know how RBC calculates your mortgage affordability. RBC takes into account the following factors:

- Your household income

- Your down payment

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

If your down payment is less than 20%, RBC’s mortgage affordability calculator also considers your mortgage insurance premiums. Unlike some other mortgage affordability calculators, RBC’s mortgage affordability calculator does not take into account your location for property taxes and utility costs.

RBC calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 32% and a maximum total debt service ratio of 40%. These ratios are more strict than CMHC regulations, but you may still be able to get a mortgage with RBC even if you exceed these limits.

Another factor in determining your mortgage affordability is your down payment. According to RBC, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Also Check: Which Mortgage Lenders Use Transunion

Factors In Your California Mortgage Payment

Your monthly mortgage payment will consist of your mortgage principal and interest. On top of that bill, youll have to consider property taxes and homeowners insurance as two more recurring expenses.

Property taxes in California are a relative bargain compared to the rest of the nation. With limits in place enforced by Proposition 13, generally property taxes cannot exceed 1% of a propertys market value. Assessed value cannot exceed increases of more than 2% a year. With those rules, Californias effective property tax rate is just 0.73%. On the local and county level, additional taxes can be levied if you live in a special district thats financing an improvement or other local concern.

Unlike many other states which employ local assessors to determine market value, California bases your initial property tax rate on the purchase price of the property. Each year the value will increase by the rate of inflation, capped at 2%. If the property is your principal place of residence, youre entitled to the homeowners exemption of $7,000 decreased assessed value, which cannot surpass $70 in savings.

As for homeowners insurance, California has reasonable rates. Despite the relatively frequent occurrence of natural disasters, including wildfires and earthquakes, the state has lower insurance costs than half of the nation. The average annual policy is about $1,166 a year, according to Insurance.com data.

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Also Check: How To Apply For A 2nd Mortgage

What To Do Before You Buy

Whatever you can afford, you want to get the best mortgage ratesand you want to be in the best position to make an offer on your house. Make these steps part of your preparation:

- Check your credit score. Your can have a direct affect on the interest rate you’ll pay. Check your score, and do what you can to improve it. You can get a free credit report at AnnualCreditReport.com.

- Get pre-approved. Go to a lender and get pre-approved for a loan before you make an offer on a house. It will put you in a much stronger bargaining position.

Ready To Start Your Home Buying Journey

Whether you’re just thinking about buying or you’re ready to buy, you can get started online!

The Mortgage Affordability Calculator estimates a range of home prices you may be able to afford based on the accuracy and completeness of the data and information you enter. The results are intended for illustrative and general purposes only, and do not constitute, nor should they be relied upon as financial or other advice. To discuss your full range of home-buying options, please contact your branch or call

The results are calculated and generated based on the accuracy and completeness of the data and information you have entered and provide an estimate only. The results are intended for illustrative and general information purposes only, and do not constitute, nor should they be relied upon as, financial or other advice. The interest rate shown is calculated either semi-annually not in advance for fixed interest rate mortgages or monthly not in advance for variable interest rate mortgages. These rates are only available for already built, owner-occupied properties with amortization periods of 25 years or less. Any application is subject to credit approval. For more information, please contact us to discuss your home-financing options.

Recommended Reading: What Required To Refinance A Mortgage

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

You May Like: How To Become A Mortgage Broker In Fl

To Calculate Your Total Debt Service Ratio:

Now, on top of your housing costs listed above, lets assume your non-housing related debts come in at $800 per month . Your TDS ratio would fall within the limit, at 41%.

When it came to buying my own place, I was well within these numbers, but how much I could end up spending on a new mortgage still made me squeamish. Already in my 40s, shouldnt I be paying off my mortgage instead of adding to it?

Thats not reality, says Calla. As difficult as it might be, she says its important to not compare yourself to others. Make the decisions that best suit your lifestyle and goals.

How Much House Can You Afford Calculator

Figure out whether your dream home fits your actual budget.

CNET’s mortgage calculator can help you figure out how much home you can afford by collecting some basic financial information, layering in some regional home sales data and calculating an estimated monthly mortgage payment. Keep in mind that this calculator can only provide an estimate, and that your actual monthly payment will depend on your specific financial situation, the property, your state of residence and your lender’s particular terms and conditions.

You May Like: Can You Get A Mortgage On Disability

Td Bank Mortgage Affordability

Before you get a mortgage from TD Bank, it is important to know how TD calculates your mortgage affordability. TD takes into account the following factors:

- The location of your future home

- Whether your future home is a detached home or condo

- Your household income

- Your down payment

- Your monthly bills and expenses including groceries, transportation, shopping, and insurance.

- Your monthly debt payments to loans and lines of credit including credit cards, car loans, student loans, and leases.

Your location and property type are used to provide estimates for your potential property taxes, utilities, and condo fees.

TD calculates your mortgage limit using the current qualification rate and a maximum gross debt service ratio of 39% and a maximum total debt service ratio of 44%. This means that your mortgage payment, property tax, heating costs, and half of your condo fees cannot take up more than 39% of your gross income. In addition, this amount plus your total debt payments cannot take up more than 44% of your gross income.

Another factor in determining your mortgage affordability is your down payment. According to TD, home buyers must have a minimum 5% down payment for homes worth less than $500K. For homes between $500K and $1M, home buyers must have at least 5% for the first $500K and 10% for the remaining amount. For homes worth more than $1M, home buyers must have a minimum 20% down payment.

Details Of Minnesota Housing Market

Minnesota, also known as the North Star State, has just 5.6 million residents, according to the Census Bureau. In comparison, thats about 65% of New York Citys population. What Minnesota lacks in population, however, it makes up for in size. The Canada-bordering state is the 12th largest in the U.S. by size, encompassing roughly 86,900 square miles. While much of the land is farm or forest, you will find a number of metro areas in the state. The largest cities in Minnesota are Minneapolis, St. Paul, Rochester, Duluth and Bloomington. The twin cities of St. Paul and Minneapolis are on the southeastern side of the state and border Wisconsin. Duluth is northeast and borders Lake Superior. The most northern and southern and western parts of the state have the least number of residents.

Minneapolis and St. Paul experienced an extreme shortage of homes available for sales, according to the University of St. Thomas Real Estate Analysis. In St Louis County, home to Duluth, the median home value is $152,000. In Ramsey County, home to St. Paul, the median home value is $219,400.

Some of the most affordable places to live in Minnesota, as ranked by our study, are Otsego, Montevideo, Redwood Falls and Austin. This study factored in average closing costs, property taxes, homeowners insurance, average mortgage payment and median income.

Don’t Miss: How Do I Become An Underwriter For Mortgage

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

How Our Mortgage Affordability Calculator Works

This calculator uses your ZIP code to estimate a property tax rate, and your credit score to estimate a mortgage interest rate. It uses your monthly income and your current monthly debt payments to calculate the monthly payments you can afford to stay under a target debt-to-income ratio. Finally, the calculator subtracts your other estimated monthly expenses, such as property taxes and homeowners insurance, to determine your monthly housing budget — and the total home price you can afford.

The formula used is: Monthly payment = – debts – tax – insurance.

Don’t Miss: What Does Points Mean Mortgage

What Can I Afford Calculator

Includes mortgage default insurance premium of $

A maximum purchase price that is over $1,000,000 will use 20% minimum down payment for illustrative purposes, however a higher percentage may be required by your lender. Speak to your lender for exact amount.

Must be a valid email.

Must be a valid 10-digit phone number.

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Also Check: How To Calculate What Mortgage You Can Qualify For

Know Which Mortgage Option Is Right For You

Okay, now lets talk about types of mortgages. Most of them are garbage designed to help you pay for a home even if you cant afford it.

But when you do the math, you find that these mortgages charge you tens of thousands of dollars more in interest and fees and keep you in debt for decades longer than the option we recommend.

Thats why getting the right mortgage is so important! Setting boundaries on the front end makes it easier to find a home you love thats in your budget.

Here are the guidelines we recommend:

- A fixed-rate conventional loan. With this option, your interest rate is secure for the life of the loan, keeping you protected from the rising rates of an adjustable-rate loan.

- A 15-year term. Your monthly payment will be higher with a 15-year term, but youll pay off your mortgage in half the time of a 30-year termand save tens of thousands in interest.

Your mortgage lender will most likely approve you for a bigger mortgage than you can actually afford. Do not let your lender set your home-buying budget. Ignore the banks numbers and stick with your own.

Knowing your house budget and sticking to it is the only way to make sure you get a mortgage you can pay off as fast as possible.

Tips For Buying An Affordable Home

Suppose you qualify for a large home loan. Does that mean you need to borrow the entire amount your lender is willing to loan you? Of course not.

Assessing how much mortgage you can handle requires a bit of a look into your current and predicted future financial situation. Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips.

Also Check: What Is The Mortgage On A 3 Million Dollar Home

Heres How To Calculate Your Mortgage Payment

While there are many costs associated with owning a home, lets start with what exactly makes up a large portion of the cost your mortgage payment.

A mortgage payment is made up of principal and interest . Note that on top of P& I, the monthly mortgage payment can include other expenses, including property taxes, homeowners insurance, and mortgage insurance.

To get an idea of what your mortgage payment could look like, click the icon the lower left-hand side of your screen to plug and play numbers specific to you into the mortgage payment calculator.

How The Loan You Choose Can Affect Affordability

The loan you choose can also affect how much home you can afford:

- FHA loan. Youll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums.

- VA loan. You wont have to put anything down and you wont have to pay for mortgage insurance, but you will have to pay a funding fee.

- Conventional loan. If you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

- USDA loan. Both the upfront fee and the annual fee will detract from how much home you can afford.

Read Also: How Long Is A Mortgage Rate Good For

How Much House Can I Afford With A Va Loan

With a military connection, you may qualify for a VA loan. Thats a big deal, because mortgages backed by the Department of Veterans Affairs typically dont require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors.

Remember to select ‘Yes’ under ‘Loan details’ in the ‘Are you a veteran?’ box.

For more on the types of mortgage loans, see How to Choose the Best Mortgage.