How Do I Find Current 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. In the filters above, enter a few details about the loan youre looking for, and youll get a personalized rate quote in moments, without providing any personal information. From there, you can start start the process of getting approved for your home loan. Its that easy

A 30-year fixed-rate mortgage is the most common term of mortgage. It provides the security of a fixed principal and interest payment, and the flexibility to afford a larger mortgage loan because the payments are more affordable theyre spread out over three decades.

How Do You Lock In Your Va Loan Interest Rate

Buyers have to be under contract in order to be eligible for a rate lock. Once thats in hand, the timeline can vary depending on a host of factors, including the type of loan, the overall economic environment and more.

If you’re ready to see where rates are right now, or if you have more questions, contact a home loan specialist at 1-800-884-5560 or start your VA Home Loan quote online.

There’s no obligation, and you’ll be one step closer to owning your brand new home.

What Are Mortgage Points

Also referred to as discount points, mortgage points are a fee borrowers pay lenders in order to receive a lower interest rate. In other words, you are prepaying interest for a period of time in order to pay less on the overall lifetime costs of your loan.

One mortgage point costs 1% of your loan amount. For instance, if you take out a loan for $600,000, youll pay $6,000 to reduce your rate by 0.25%. It may not seem like a huge amount, but it can add up to tens of thousands of dollars in interest over the life of the loan.

For example, you take out a $600,000 mortgage with 20% down and at an interest rate of 3.25%. With a 30-year jumbo loan, youll pay $272,036.52 in interest. In contrast, if you paid $6,000 to lower the rate to 3%, youll end up paying $248,531.77 in interest, a savings of $23,504.75.

Don’t Miss: Reverse Mortgage For Mobile Homes

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage point . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Recommended Reading: How Does Rocket Mortgage Work

Are Interest Rate And Apr The Same

Borrowers may notice some lenders offer interest rates and annual percentage rates that are similar, but they are in fact two different things. The interest rate, expressed as a percentage, is the amount a lender intends to charge borrowers for the amount lent . The APR, also expressed as a percentage, includes the interest rate plus all lender charges rolled into the loan, such as application fees, broker fees, origination fees, and any mortgage points.

What Are The Different Types Of Mortgages

Mortgages come with all sorts of different interest rates and terms. These influence how long it will take to pay off your loan and how much your monthly payments will be.

These are some of the most common types of mortgages home buyers use:

Fixed-rate mortgage

A fixed-rate mortgage has a set interest rate for the life of the loan. With this type of loan, your mortgage rate will never change. Your overall monthly payments could still fluctuate based on property taxes or other factors. But a fixed rate locks in how much youll pay in interest over the course of your loan. And if interest rates drop to below your current rate, you can refinance to a lower rate.

Two of the more popular mortgage terms for fixed-rate loans are 15- and 30-year mortgages.

An ARM is usually a 30-year term loan with an interest rate that changes over time with market averages. When the interest rate changes depends on the loan. Common ARM terms are 5/1, 7/1, and 10/1. The first number designates the first year your interest rate will change, and the second number is how frequently the interest rate resets after the first time. So a 5/1 ARM adjusts the rate after 5 years and then annually after that. Most ARMs reset annually after the initial adjustment.

Government-backed loan

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

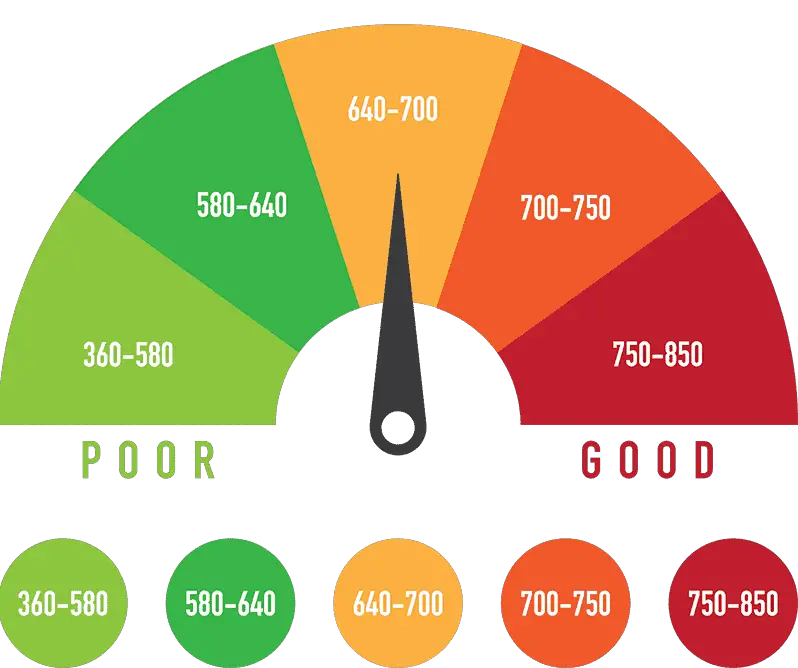

Tips To Boost Your Credit Score

And, of course, you can boost your credit score through your own efforts. Read How to raise your credit score fast for helpful tips.

A few of the most impactful steps you can take to raise your credit prior to applying for a mortgage include:

You should also order a copy of your credit report from AnnualCreditReport.com. That site is owned by the Big 3 credit bureaus. And youre legally entitled to a free copy of your report each year.

Many reports contain errors. And it can take months to get them corrected. So start the process early.

What Is A Jumbo Mortgage

A jumbo mortgage, or jumbo loan, is a type of loan that exceeds value limits set by the Federal Housing Finance Agency . These types of mortgages arent guaranteed, purchased, or sold by Fannie Mae or Freddie Mac, both government-sponsored entities.

These limits vary based on where you livein general, areas with a higher cost of living will have higher limits. As of 2022, FHFA set the conforming loan limit at $647,200 for most of the U.S. counties. There is an exception where there are higher home values and the limit is increased to $970,800. Anything above these numbers is a jumbo mortgage.

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Is The Lowest Ontario Mortgage Rate The Best Rate

Not always. The lowest rates usually come with more limitations. These restrictions can cost you much more than the small rate savings. Such terms are common with low frills mortgages and typically kick in when you try to port, break or increase the mortgage after closing. When comparing mortgage rates, dont be afraid to ask potential lenders questions to ensure you understand the terms and conditions of your mortgage.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

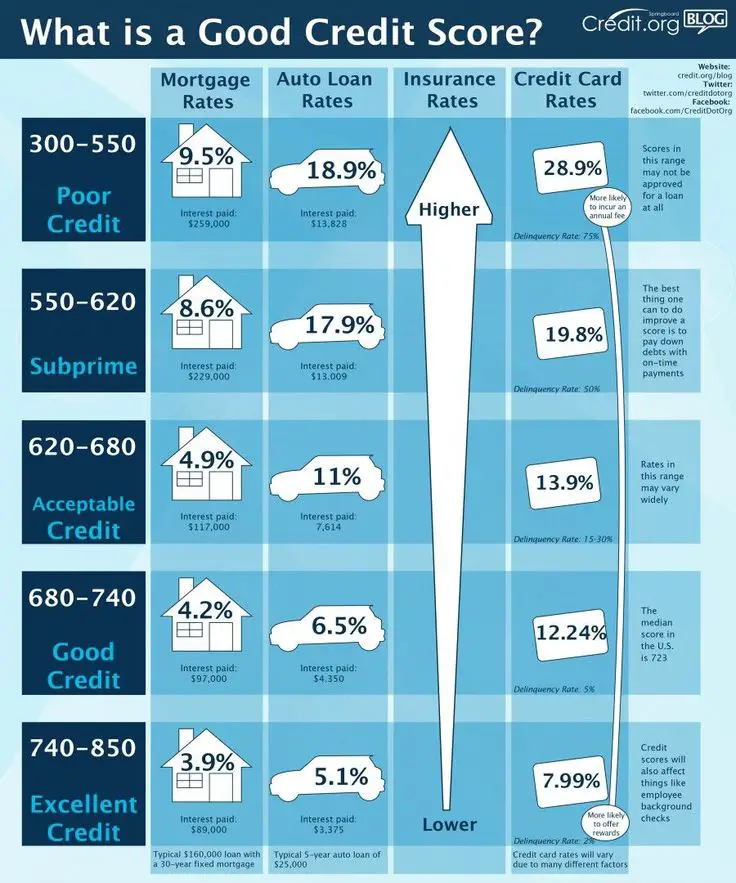

The lower the rate, the less youll pay on a mortgage. Todays rate environment is considered extremely well-priced for borrowers. However, depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Don’t Miss: How Does 10 Year Treasury Affect Mortgage Rates

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score between both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

How Do I Calculate Mortgage Payments

For much of the population, buying a home means working with a mortgage lender to get a mortgage. It can be difficult to figure out how much you can afford and what youre paying for.

Using a mortgage calculator can help you estimate your monthly mortgage payment based on your interest rate, purchase price, down payment and other expenses.

To calculate your monthly mortgage payment, heres what youll need:

- The home price

Also Check: Monthly Mortgage On 1 Million

What Is A Good Mortgage Rate

Average mortgage rates have been at historically low levels for months, even dipping below 3% for the first time earlier this year. Since then, rates have been on a slow but steady increase but are still in the favorable range. If youre considering a refinance, a good mortgage rate is considered 0.75% to 1% lower than your current rate. New homebuyers can also benefit from the latest mortgage rates as they are approximately 1% lower than pre-pandemic rates.

Even if youre getting a low interest rate, you need to pay attention to the fees. Hidden inside a good mortgage rate can be excessive fees or discount points that can offset the savings youre getting with a low rate.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rate and an annual percentage rate . Thats understandable, since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

/1 Arm Rate Trends Upward +001%

The average rate on a 5/1 ARM is 3.91 percent, up 1 basis point over the last week.

Adjustable-rate mortgages, or ARMs, are home loans that come with a floating interest rate. In other words, the interest rate can change intermittently throughout the life of the loan, unlike fixed-rate mortgages. These loan types are best for those who expect to sell or refinance before the first or second adjustment. Rates could be considerably higher when the loan first adjusts, and thereafter.

Monthly payments on a 5/1 ARM at 3.91 percent would cost about $468 for each $100,000 borrowed over the initial five years, but could ratchet higher by hundreds of dollars afterward, depending on the loans terms.

How To Qualify For Todays Best Refinance Rates

Much like when you shopped for a mortgage when purchasing your home, when you refinance heres how you can find the lowest refinance rate:

- Maintain a good credit score

- Consider a shorter-term loan

- Lower your debt-to-income ratio

- Monitor mortgage rates

A solid credit score isnt a guarantee that youll get your refinance approved or score the lowest rate, but it could make your path easier. Lenders are also more likely to approve you if you dont have excessive monthly debt. You also should keep an eye on mortgage rates for various loan terms. They fluctuate frequently, and loans that need to be paid off sooner tend to charge lower interest rates.

Read Also: Chase Recast Calculator

Check Your Mortgage Rates

Your credit score is only one factor that goes into determining your mortgage rate. Other important factors include your loan type, loan term , and the current interest rate market.

If you want to know what rate you qualify for, check with a mortgage lender. You can fill out a quick preapproval application that will give you a good idea of your interest rate, home buying budget, and future monthly payment.

Ready to get started?

How Are Mortgage Rates Determined

Mortgage rates are set by the lender. The lender will consider a number of factors in determining a borrower’s mortgage rate, such as the borrower’s credit history, down payment amount or the home’s value. Inflation, job growth and other economic factors outside the borrower’s control that can increase risk also play a part in how the lender sets their rates. There is no exact formula, which is why mortgage rates typically vary from lender to lender.

Also Check: Chase Mortgage Recast Fee

Find A Mortgage Loan Officer In North Carolina

Our local mortgage loan officers understand the specifics of the North Carolina market. Let us help you navigate the home-buying process so you can focus on finding your dream home.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rate and program terms are subject to change without notice. Mortgage, home equity and credit products are offered through U.S. Bank National Association. Deposit products are offered through U.S. Bank National Association. Member FDIC. Equal Housing Lender

Annual Percentage Rate represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after consummation for adjustable-rate mortgage loans.

The rates shown above are the current rates for the purchase of a single-family primary residence based on a 45-day lock period. These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your guaranteed rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

VA Loans – Annual Percentage Rate calculation assumes a $270,072 loan with no down payment and borrower-paid finance charges of 0.862% of the base loan amount, plus origination fees if applicable.

year U.S. Bank

Choosing The Right Mortgage Lender

The lender or loan program thats right for one person might not be right for another.

Explore your options and then pick a loan based on your credit score, down payment, and financial goals, as well as local home prices.

Whether youre getting a mortgage for a home purchase or a refinance, always shop around and compare rates and terms.

Typically, it only takes a few hours to get quotes from multiple lenders and it could save you thousands in the long run.

Current mortgage rates methodology

We receive current mortgage rates each day from a network of mortgage lenders that offer home purchase and refinance loans. Mortgage rates shown here are based on sample borrower profiles that vary by loan type. See our full loan assumptions here.

Read Also: Can You Get A Reverse Mortgage On A Condo

What Is A Good Jumbo Mortgage Rate

Whats considered a good jumbo mortgage rate will depend on your individual credit profile. Just because you see low advertised rates, doesnt mean you’ll get that rate. The best rates are offered to those who have excellent credit, a sizable amount of assets, and a low debt-to-income ratio, among other factors.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points If a larger down payment could help you avoid paying PMI premiums, for example.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage