Those Who Dont Plan On Owning The Home Longer Than The Recovery Period

The takeaway from the example above is that if you expect to be in the home less than 9.5 years, paying discount points to lower the rate wont make financial sense.

At least thats the case if you will need to pay the discount points yourself. If theyll be paid by the seller or by a gift from a family member, taking the discount will absolutely be worth doing.

Otherwise, it will only make sense if you expect to be in the home for longer than the recovery period.

Upsides And Downsides To Paying Discount Points

Again, by lowering your interest rate, your monthly mortgage payments also go down. So, you’ll have extra money available each month to spend on other things. Also, if you pay for discount points and itemize your taxes, you can deduct the amount at tax time .

But the money you pay for points, like the $3,000 paid in the above example, might be better used or invested somewhere else. So, be sure to consider whether your expected savings will exceed what you might get by investing elsewhere.

What You Need to Knowand DoBefore Taking Out a Mortgage

Getting a mortgage isn’t too difficult, but it will involve some effort on your part. If you’re planning on taking out a loan to buy a home, you can take certain steps to ensure the process goes smoothly and that you fully understand the transaction.

Instead of buying points, some borrowers choose to make a larger down payment to lower the monthly payment amount. In some cases, making a down payment large enough so that you can avoid paying for private mortgage insurance might be money better spent than using your money on points.

Also, a larger down payment helps you build equity faster. However, buying mortgage rate pointsboth discount points and origination pointswon’t increase your equity in the home. Or, you could choose to make extra payments on your mortgage to build equity in your home quicker and pay off the mortgage early.

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

For many borrowers, however, paying for discount points on top of the other costs of buying a home is too big of a financial stretch, and buying points might not always be the best strategy for lowering interest costs.

It may make financial sense to apply these funds to a larger down payment, says Boies.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

Recommended Reading: Can You Add Money To Mortgage For Improvements

A Guide To Basis Points

Whether youre familiar with financial terminology or have never heard of the term basis point before, its a good idea to understand the basics of basis points they can affect your monthly mortgage payments. You may also want to know how they work in the context of interest rate changes when youre buying a home.

Heres what you need to know the basis point definition, how to calculate them and more.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

What Are Negative Points

Negative points are essentially rebates that lenders pay to real estate brokers or borrowers to help them afford closing on mortgages that they issue. This system allows some qualified borrowers, who could not otherwise afford the expense of closing costs and settlement fees, to be able to purchase a homeusually in exchange for paying a higher rate of interest over the life of the loan.

Negative points are usually expressed as a percentage of the principal loan amount, or in terms of basis points . They can be contrasted with discount points, also called closing points, which are purchased upfront as pre-paid interest by borrowers to lower their monthly cost over the term of the mortgage.

Also Check: What Will My Monthly Payment Be Mortgage

What Are Points In Real Estate

If you are purchasing or refinancing a home, chances are you have learned a lot of new terms. One of those may be points. But what exactly are points in a real estate deal?

Points are referred to as mortgage points or sometimes discount points. Points are a fee that a borrower pays to the lender to get a lower interest rate. One point costs one percent of your overall mortgage amount.

You will pay this fee up front, but secure a lower interest rate for the rest of your payoff period . This can result in savings over the long-term, even though you pay more initially.

How Discount Points Affect Your Mortgage Rate

When discount points are paid, the bank collects a one-time fee at closing in exchange for a lower interest rate over the life of the loan.

However, the size of your interest rate reduction will vary by bank.

This is one of the reasons why its important to shop for your best mortgage rate. Different banks will offer different rate reductions in exchange for paying points.

As a rule of thumb, paying one discount point lowers a quoted mortgage rate by 25 basis points .

Different banks will offer different rate reductions in exchange for paying points. So shop around carefully.

However, paying two discount points will not always lower your rate by exactly 50 basis points , as you would expect. Nor will paying three discount points necessarily lower your rate by 75 basis points .

In addition, banks consider discount points to be a form of prepaid interest, which is tax-deductible for eligible tax filers.

So for some mortgage borrowers, theres an added tax advantage to buying points, as well discuss more below.

However, you dont pay for discount points to get the IRS tax break. You pay to get the mortgage rate break.

For more information about the discount point mortgage tax deduction, speak with a professional tax advisor.

Recommended Reading: What’s Better Mortgage Broker Or Bank

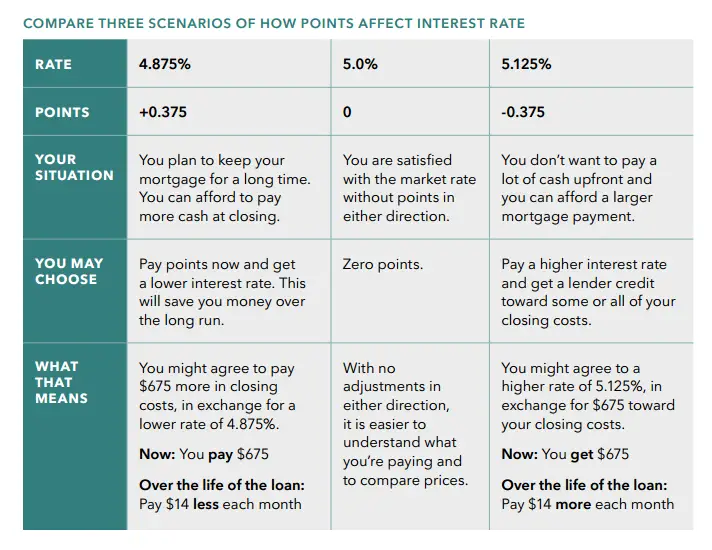

Where To Find Points And Credits On Your Loan Estimate** And How They Affect Your Loans True Cost

Points will be found under Section A on page 2 of your official Loan Estimate. Theyll be shown as a percentage of your loan amount and as the equivalent dollar amount youll pay upfront.

Lender credits are listed under Section J as a negative number. Thats the dollar amount thatll be taken off your upfront closing costs.

When calculating the true cost of your loan, its important to only factor in costs that are mortgage-related . The costs to include are listed in Section D , Section E, and Section J under lender credits.

Simply input information from your official Loan Estimate into the following formula to calculate your true loan cost:

Costs listed under section F and section G are non-mortgage related, and will occur whether you continue with the loan or not. For this reason, they should not be included in calculating the true loan cost.

Have more questions about points and credits, or need help deciding which is right for you and your loan? Were here to help.

*The rate table displayed above is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend. Your loan terms will be different based on current market rates, property type, loan amount, loan-to-value, credit score, debt-to-income ratio and other variables.

**The Loan Estimated displayed in this article is for illustrative purposes only. It does not reflect any specific loan terms and is not a commitment to lend.

- More

The Benefits Of Mortgage Points

People buy points to lower their interest rate and save on the overall cost of the loan.

Points can increase your closing costs by thousands of dollars, but the large upfront cost might be worth it if you stay in the home long enough to see savings from the reduced interest rate. Paying an extra $2,000 upfront could mean tens of thousands of dollars in savings over the course of your mortgage. However, if you plan to sell your home or refinance before your break even, paying for points might not be worth it.

Points can also get you a lower monthly payment. If your monthly mortgage payment puts too much of a strain on your budget, mortgage points could be a way to save. A lower interest rate equals lower monthly payments.

You may even save money on taxes if you decide to purchase mortgage points. Since mortgage interest is tax deductible and points are considered prepaid mortgage interest, you may be able to deduct the cost of the points on your taxes. To understand the deductions you may be eligible for, check out the IRS rules on mortgage point benefits and speak with a qualified tax expert.

Also Check: How Do Rocket Mortgage Rates Compare

Comparing Mortgage Loan Offers

Understanding how points work is just one important factor in your decision. Its also important to know how they work when comparing loan rates. Thats because if two lenders offer you the same interest rate but one is charging a point and the other isnt, the lender that isnt charging the point is offering a better deal.

While youre loan shopping, if two lenders offer you a fixed-rate loan of $200,000 at 4.25%, but one is charging a point for that rate, youd be paying an extra $2,000 upfront with that lender to get the same rate from the other lender for free. Thats why its so important to comparison shop carefully and understand loan terms before you decide on a lenders offer.

What Does Buying Points Mean In A Mortgage

Mortgage points, also called discount points, are an upfront fee that a borrower pays their mortgage lender to cut down the interest rate on their loan.

Borrowers can lock in a lower interest rate on a purchase or refinance loan and pay less on their mortgage over time. This may make more sense for borrowers who plan to stay in their homes for a long time.

Don’t Miss: How Much Does An Average Mortgage Cost

How To Use Basis Points

Basis points evaluate small changes to interest rates or yields. The Federal Reserve sets the federal funds rate, which is a benchmark interest rate that influences how much you pay to borrow money.

Here are some financial instruments that use basis points to measure percentages:

- Corporate bonds

Here are some frequently asked questions regarding basis points and how they work.

How Much Of My Discount Points Are Tax

You dont need to calculate how much of the discount points paid will be tax-deductible the lender will do that for you.

Each year youll receiveIRS Form 1098 from the lender. It will report the interest you pay on the loan during the course of the year. Discount point interest credited to that year will appear in Box 6 of the form.

You May Like: What’s A Good Ltv For Mortgage

Points Are Tax Deductible

The cost of mortgage points does not differ by type. If one lender has a one-point origination fee and one-point discount fee for a certain rate and a second lender has no origination fee and a two-point discount fee, the cost is the same. The one difference for the borrower is that origination-fee points are not tax-deductible and discount points may be tax-deductible. Buying down a mortgage using points will result in interest savings several times greater than the cost in points if the mortgage is paid in full.

Are Mortgage Points Tax Deductible

Because the cost of discount points represents prepaid interest, points are deductible for taxpayers who itemize. Though, the loan must be secured by your main home and meet some other criteria. You generally have to deduct them over the life of the loan though sometimes, you can deduct the points in the year you pay them. But you can usually only deduct points paid on up to $750,000 of mortgage debt.

Example. Say you take out a $1,000,000 mortgage loan and purchase one point for $100,000. You’ll only be able to deduct $75,000 the remaining $250,000 isn’t tax-deductible.

In some cases, the seller will agree to pay for points to incentivize a buyer. Points are deductible in this situation, too.

According to the IRS, origination fees are also tax-deductible, but points paid for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, and attorney fees, aren’t.

Read Also: How To Become A Mortgage Broker In Massachusetts

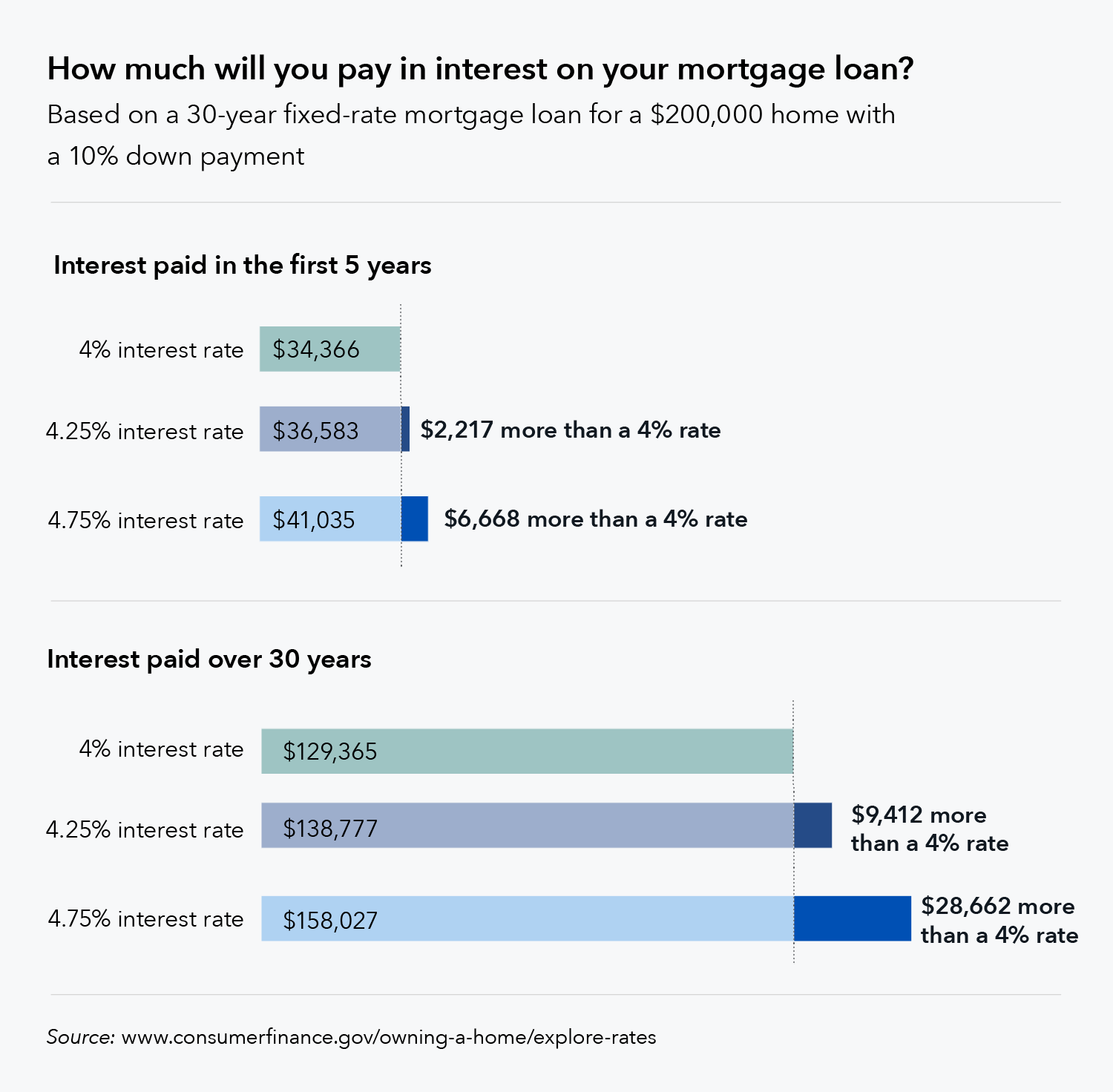

Why Does The Difference Of One

A fraction of a percent doesnt seem like much, but a hundredth of a point on a mortgage can mean tens of thousands of dollars over time.

Lets say youre looking at a $200,000 home with a 30-year loan term. Your mortgage payment would be $718.47 with a 3.5% interest rate.

A basis point jump to 25 basis points to 3.75% means that your payment would jump to $740.98 . Every month, this extra little bit translates to paying over $8,000 more throughout the loan.

Paying attention to basis points even tiny numbers can help you save a lot of money when youre buying a home.

Disadvantages Of Purchasing Points

While lower monthly payments and potential savings over the life of the loan are clear benefits of buying mortgage points, there are some reasons you may be better off not purchasing points.

First, paying one or more points ties up your cash. If youre making a down payment of less than 20% or have less than 20% in home equity when refinancing, youll probably have to pay for private mortgage insurance if you have a conventional loan.

Have a lender or mortgage broker compare the impact of making a larger down payment to reduce or avoid PMI.

In addition, the sample calculation does not consider that you may have better uses for that money for example, paying off high-interest credit card debt, making investments, or saving for future home improvements.

You may also want to use that money to invest in assets other than real estate for diversification, to boost a college tuition fund, or to pad your retirement account.

The money you pay towards lowering your mortgage interest rate may not bring the same rewards as other investment vehicles, but for homeowners who plan to stay put for the long-term, a lower interest rate could be a smart move.

Recommended Reading: How To Get Rid Of Escrow On Mortgage

What Are Origination Points

A different type of mortgage point that you might have to pay is an “origination point.” Origination points won’t reduce your interest rate they’re fees you pay to the lender for agreeing to provide and process your loan. Sometimes origination points are called an “origination fee.” These points vary from lender to lender and are sometimes negotiable, but not usually.

This article focuses mainly on discount points.

The Bottom Line: Mortgage Points Can Save You Money

Though mortgage points and prepaid interest may be right for some borrowers, they dont make financial sense for everyone. To determine whether you can save with discount points, you have to crunch the numbers. Sit down and assess your budget, down payment, loan terms and future plans before you close. Determine your breakeven point and your likelihood of staying in the home to understand if discount points will save you money in the long run when refinancing or buying a home.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Also Check: Can I Get A Mortgage Before I Sell My House

How Much Money Can You Save Buying Mortgage Points

Is purchasing points beneficial if you keep your new home for five years? You can figure it out by using a mortgage calculator.

Suppose it costs two points to reduce the interest rate on a $400,000 30-year fixed-rate loan from 4.5% to 4.0%. Your monthly mortgage payment for principal and interest would drop by $117 with the lower rate .

After five years, with the 4.0% home loan, youll have paid $76,370 in interest payments, plus $8,000 in mortgage points, for a total of $84,370. Youll have reduced your principal balance by $38,210.

With the 4.5% loan, youll have paid $86,236 in interest. Youll have reduced your principal balance by just $35,368.

In this case, then, it will cost you $1,888 less over five years if you pay the discount points. But thats not all. Youll have reduced your balance by an extra $2,842. So your total savings in five years is $4,730.

One more advantage of paying mortgage points is that, since they represent prepaid interest, they are typically tax-deductible

Some Lenders Also Offer Negative Mortgage Points

You also have the option with some lenders to apply negative points to your mortgage. Essentially, this means you increase your interest rate in order to get a credit you can use to cover closing costs.

For example, if you were taking out a $250,000 mortgage and you applied a negative mortgage point, your interest rate might rise from 3.00% to 3.25% — but you would get a $2,500 credit to cover costs at closing.

While negative points make your home cost more over time, they can sometimes make it possible to afford to close on a home when you otherwise would be tight on cash. Just be aware that it’s a costly option.

In the above example where you raised your rate from 3.00% to 3.25%, your $250,000 loan would result in a monthly payment of $1,088 and the total cost of your mortgage would be $391,686.

Compare that with a monthly payment of $1,054 and a total cost of $379,444 if you hadn’t applied negative points. You’d pay $34 more each month and $12,242 more over 30 years in exchange for having gotten $2,500 up front.

Read Also: How Much Of My Budget Should Go To Mortgage