Con : There May Be A Set

Some financial institutions will charge you a set-up fee to participate in a biweekly mortgage payment plan. Additionally, there may be an associated fee for each transaction . Some banks do offer this service for free, but its best to check with the financial institution currently servicing your mortgage.

How Do I Create My Own Biweekly Mortgage Payment Plan

Once you confirm your lender or servicer allows biweekly mortgage payments and doesnt charge fees or prepayment penalties, calculate your biweekly mortgage payment to ensure you pay the correct amount every two weeks. Additionally, instruct your lender to apply the extra payments to the principal instead of interest.

How Smart Are Biweekly Payment Plans

A biweekly plan will save you a lot of interest over the life of your loan, but it’s only a smart move if the extra payments work for you. You’re essentially paying the equivalent of one additional mortgage payment each year, so you should be sure you can budget for that. It’s also smart to compare your interest savings to what you could potentially earn by investing that extra payment instead.

Also Check: Is It Good To Pay Off Mortgage Early

Should You Split Your Monthly Payment

When you start paying back your loan payments, on longer loans the majority of your monthly payments will be interest. The larger your loan balance, the more interest you will pay. As your principal is paid down, your interest payments will decrease, as well, and the ratio of your payments will shift toward paying more principal each month.

One popular way that some homeowners & other borrowers pay down their principal more quickly is to make biweekly payments. Instead of paying one monthly payment, they pay half the payment twice a month.

Biweekly Mortgage Payments: An Easy Trick To Do Them For Free

Youve probably already heard the claims. That a biweekly mortgage can save you thousands of dollars.

And that biweekly mortgage payments can shave years off the life of your loan and help you accrue equity in your home super fast.

Well, its true! Pardon the exclamation point. You probably thought I was going to say it was a bunch of baloney like most gimmicks you hear about.

But no, its legit, and its pretty straightforward too. Its just basic math, which well get into below.

Its also fairly easy to set up a biweekly mortgage plan, which requires a payment every two weeks as opposed to every month.

In short, biweekly mortgage payments are a sort of accelerated mortgage payoff system that allow you to make an extra monthly payment each year and in turn save money on interest and pay your mortgage faster.

As noted, the way it works is rather simple.

Also Check: How To Calculate Interest Only Mortgage Payment

Biweekly Mortgage Payments Require Discipline

- The one main drawback to biweekly payments

- Other than putting more money into your home

- Is that they require discipline from the borrower

- Since its totally voluntary unlike say a 15-year fixed that requires larger payments

The only drawback to doing it yourself is the old self-discipline issue. Can you trust yourself to make the higher payment each month? Will you remember to do it?

Luckily, these days you can set up automated payments from your checking account for free, so it shouldnt be too much of a problem either way.

And you have the benefit of backing out at anytime if your financial situation changes for any reason.

You dont have to nail it down to an exact science either. You can always pay an extra $100, $200, or $300 a month if youd like. Find a number that works for you and stick to it.

Or make extra payments throughout the year based on your income fluctuations. If youre determined to pay your mortgage off, every little bit helps. You can even round up your payments.

You dont need to enroll in a mortgage acceleration program or hire a certified mortgage acceleration specialist to help you figure out how to make your loan amortize more quickly.

Its really quite simple. Dont fall for gags that require you to pay an extraneous set-up fee or a transaction fee every time you make a payment. Your goal is to pay less, not more!

And dont confuse biweekly mortgages with bimonthly mortgages.

Vehicle And Driver Hire

Our first class fleet of luxury high specification features S class, E class & Viano SUV Mercedes vehicles. If there is a particular vehicle you require, Bentley, Rolls Royce etc, please just ask.

We have a full range of saloons, limousines and SUVs available for all occasions. All vehicles are provided with a professional chauffeur, to cater for your needs so that you arrive in style feeling refreshed, taking the stress out of driving yourself or using public transport.

If you have your own vehicle, why not try our driver/Chauffeur hire service. To drive for you on that special occasion, business trip or the day to day family errands. VIP driver hire is available on a weekly, daily or hourly basis.

Read Also: Is There Interest On A Reverse Mortgage

Why Switch To Biweekly Payments

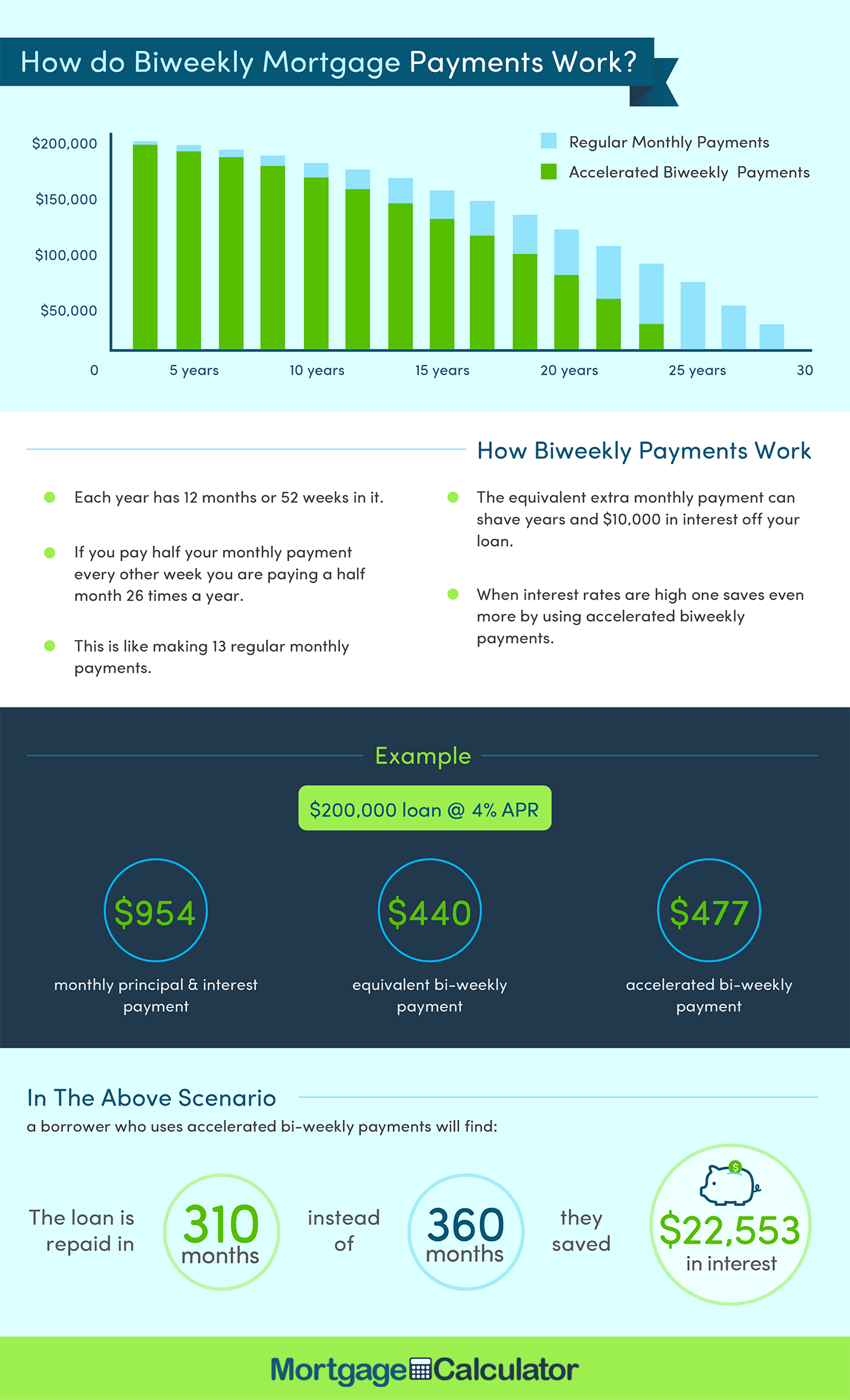

If you pay your mortgage monthly, like most homeowners, youre making 12 payments a year. When you enroll in a biweekly payment program, youre paying half your monthly amount once every two weeks instead. There are 52 weeks in a year, so this works out to 26 biweekly payments or, in effect, 13 monthly payments.

Because youre making the equivalent of 13 monthly payments each year, youll pay less total interest while lowering your principal balance at a much quicker pace, says Joe Zeibert, senior director of Ally Home, a division of Ally Bank in Charlotte, North Carolina.

Zeibert gives the example of a 30-year fixed loan of $250,000 at a 4% interest rate. Biweekly payments would save a borrower nearly $30,000 in interest charges and have the loan paid off in five fewer years, he says. Even if homeowners stayed in their home for only seven years, they would still save several thousand dollars in interest charges while paying off $10,000 more in principal, which they could then use toward a larger down payment on their next home, Zeibert says.

What Is Difference Between Bi

While standard bi-weekly mortgage means half of the monthly payment 24 times, accelerated bi-weekly mortgage requires the same payment but 26 times in a year.

The standard bi-weekly mortgage results in the same amount of money paid in a given year, with accelerated bi-weekly mortgageyou pay an extra monthly payment per year, leading to a faster mortgage amortization and lower interest cost.

Note that in the US, the two mortgage schemes identically refer to the accelerated amortization schedule, as opposed to Canada, where they associate with different schedules.

You May Like: How Do I Get A Mortgage Statement

How To Change To Biweekly Mortgage Payments

Some lenders have to grant permission before you can switch to biweekly payments. If approved, there are two things to keep in mind. First, your biweekly payments won’t be applied to your account until you’ve reached your full monthly payment amount. Also, during your first month of enrollment, youll likely need to pay both your regular monthly payment plus your two half payments.

Some lenders charge fees to change payment agreements, while others do not. When you talk to your lender, find out if fees are associated with making the switch.

If your lender does not agree to the biweekly payment terms that you propose, simply pay extra every month to get the same benefits. You can also save up and make an extra payment every year, rather than every month. When you make any kind of extra mortgage payment, make sure it’s being applied to your loan principal rather than the interest.

Its important to note that certain mortgages don’t permit early payoffs. When early payoffs aren’t allowed, lenders may charge fees known as prepayment penalties. These fees may equal the amount of interest youre eliminating. If you aren’t sure if your mortgage allows early payoffs, look over your contract or talk to your lender.

Drawbacks To Biweekly Payments

One drawback to biweekly mortgage payments is that some lenders may charge fees to enroll in their biweekly payment plan. When it comes to fees, you should crunch the numbers to confirm you’ll still get ahead financially by paying biweekly.

Another factor worth noting is that biweekly payments won’t enhance your credit score. While they won’t negatively affect your score, the credit bureaus use 30-day time frames when they analyze credit data to set ratings. Therefore, you’ll make out the same, credit rating-wise, with monthly or biweekly payments.

Don’t Miss: Where To Prequalify For A Mortgage

Hire Close Protection In London & Uk

Our professional close protection operatives are accustomed to working with high-profile, high-risk individuals and high-net-worth families who have fast-paced, demanding lifestyles. Our close protection security experts have vast experience and knowledge of London, they can assist with your social life management, table reservations, shopping trips, and general day-to-day activities. Naturally, they are all trained in conflict management, physical defence, and advanced first-aid for your peace of mind. Our bodyguard services in London and throughout the UK stands out for their professionalism and efficiency. We also provide female bodyguards, who are often requested and highly sought after for their soft skills and overt presence.

How To Start Paying Your Mortgage Biweekly

![Biweekly mortgage calculator with extra payments [Free Excel Template] Biweekly mortgage calculator with extra payments [Free Excel Template]](https://www.mortgageinfoguide.com/wp-content/uploads/biweekly-mortgage-calculator-with-extra-payments-free-excel-template.png)

To start biweekly payments, you can choose a day between the 1st and 14th of the month, or whatever day best aligns with your pay schedule. This way, you can guarantee that every 14 days following, half of a mortgage payment will be withdrawn from your bank account. You also dont have to worry about sending a check each month, as biweekly payments can be automatically withdrawn from your account.

If youre a current Rocket Mortgage® client, you can start making biweekly payments by signing into your account and adjusting your payment program. In fact, signing up for biweekly payments through Rocket Mortgage® is completely free no extra fees involved.

You May Like: How Much Do I Need To Earn For A Mortgage

Biweekly Mortgage Payments Vs Monthly Payments: An Example

Lets say you currently pay $1,400 on your mortgage at the end of every month. Opting for biweekly payments would divide that amount into $700 payments every 2 weeks. This might seem like a minor change to your repayment plans, but over the lifetime of your loan biweekly mortgages can help you pay off your mortgage loan early, all while cutting down on the total interest youll pay.

Types Of Mortgage Payments

Your mortgage payment consists of two parts: the principal and the interest. The payment frequency you choose will impact the amount of time itll take for you to fully pay off your principal, as well as the amount of interest youll end up paying. You can select from five different payment frequencies:

- Accelerated Weekly

Monthly

The most common way of paying a mortgage is with monthly payments. Under this method, youll make a single payment every month, usually on the 1st, for a total of 12 payments per year. For example, if your mortgage payment is $1,200 per month, youll pay $14,400 in total over a year.

Though paying once a month is convenient for many homebuyers, a major drawback is the large amount of interest that accrues between payments. Following a monthly payment schedule is also the slowest way to pay off your mortgage.

Bi-Weekly

Bi-weekly payment schedules are quite prevalent. Many homeowners receive a paycheque twice a month, so using this payment plan allows them to time their incoming cash flow with their mortgage payment. Bi-weekly payment schedules are determined by multiplying your monthly mortgage payment by 12 and then dividing by 26. Youll make a total of 26 payments per year under this payment method. Using the previous example, this means youll pay $553.85 every two weeks. At the end of the year, your total payments still add up to $14,400.

Check out how a basement suite can help you pay off your mortgage.

Accelerated Bi-Weekly

Weekly

Also Check: Can You Get A Mortgage With No Job

How Biweekly Mortgage Payments Work To Help You Pay It Off Faster

If youd rather pay less interest AND pay off your house faster, youll want to know about biweekly mortgage payments.

Biweekly mortgage payments are an easy way to save massive money on interest without breaking the bank!

Especially since only making your standard house payment for 30 years can cost thousands of dollars in interest.

Read Also: How Is Home Mortgage Interest Calculated

Consider Your Other Debts

Lets say your mortgage interest rate is 4% and your other debts include an auto loan at 2%, a student loan at 6% and a at 16%. Putting extra money toward your mortgage wont save you as much as putting extra money toward your student loan or credit card which have higher interest rates. Retiring those debts faster will likely have a greater financial benefit in the near term.

Don’t Miss: Can I Refinance My Mortgage With The Same Bank

Can We Supply Female Operatives

Yes, Intelligent Protection has a vast network of Female bodyguards from around the world. Often clients with young families like to have the peace of mind that a gentle, more covert approach is being taken to their childrens security. This is a role that lends itself well to female operatives as described in our article: The Surge of Female Bodyguards.

Should I Make Biweekly Mortgage Payments

Your home is likely the biggest purchase you will ever make. Even with an interest rate in the single digits, this can often mean tens or hundreds of thousands in interest charges over the life of your repayment a significant chunk of change that you probably wouldnt mind keeping in your pocket.

Luckily, lenders like Rocket Mortgage® make biweekly payments simple for clients. Thanks to Rocket Mortgage®, these borrowers can set up biweekly mortgage payments for free online. There are no prepayment penalties or fees for setting up a revised payment schedule, either, so youre able to automate the process and save yourself money with just a few quick clicks.

What could you do with those kinds of savings? For other articles like this one, check out our free personal finance resource center for more information.

Apply Online with Rocket Mortgage®

Don’t Miss: How Much Take Home Pay For Mortgage

Avoid Partial Mortgage Payments

- Before you implement a biweekly payment plan

- Make sure the lender will accept partial payments

- Or that any extra payments beyond the total amount due

- Go toward the principal balance

One final note: Be careful not to make a partial mortgage payment to your mortgage lender as it could result in some unintended consequences.

At worst, the mortgage company may send your payment back if its not made in full. This could result in a late fee and a possible credit ding if you dont make the full payment in time.

In other words, making two half mortgage payments a month probably wont go well. But you can always call your lender or loan servicer and ask if you can pay your mortgage every two weeks just to be sure.

For the record, mortgages are generally calculated monthly , so making a half payment early wont result in any additional savings. And 24 half payments is just 12 full payments, so you wont do yourself any favors.

Assuming they do hang onto your partial payment, they may place it in a suspense account, where it will remain until enough money comes along to make at least one full payment.

So if you make another partial or full payment after sending the initial partial payment, theyll only apply the funds if the total is enough to make one full payment.

This is why companies offer biweekly programs to avoid any misunderstanding with your lender if you send in two payments that are supposed to cover your full payment and a surplus toward principal.

One Of The Best Security Companies You Will Find Uk/worldwide

![Biweekly mortgage calculator with extra payments [Free Excel Template] Biweekly mortgage calculator with extra payments [Free Excel Template]](https://www.mortgageinfoguide.com/wp-content/uploads/biweekly-mortgage-calculator-with-extra-payments-free-excel-template.png)

UK Personal Protection Ltd provide tailored Bodyguard Services, Close Protection Services, VIP Luxury Services and Security Consultancy to corporate, high net worth and celebrity clients, government departments and any legitimate persons requiring protective services, worldwide.

Close Protection London, UK & Worldwide.

UK Personal Protection Ltd personnel include former Secret Service Agents, Special Security Forces of UK, USA and the Middle East, Official Agency Operatives, Protective Service Agents and Instructors from the most prestigious Dignitary Protection, Law enforcement, Security, Emergency Services & Intelligence Agencies in the world.

Bodyguard London, UK, Worldwide

Fully integrated VIP Protection Team, comprising of driver, bodyguard, residential security officer and a dedicated security contract manager if required

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

You May Like: When You Sign A Mortgage You Are

So What Are The Benefits Of A Biweekly Mortgage Anyway

you can increase the amount of equity in your home at a faster rate you can save money by paying less interest on your mortgage you can reduce the term of your mortgage and own your home sooner your mortgage payments are automated and made simple more frequent payments decrease the outstanding principal loan balance faster

Biweekly Mortgage Payments: Do They Make Sense For You

Biweekly payments can help you save money by paying extra principal throughout the year.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as Credible.

Paying your mortgage biweekly is a strategy that can reduce your principal balance faster and cut your total interest costs, allowing you to own your home debt-free sooner. However, it might not be as effective as you think because of how mortgage servicers can handle extra payments.

Heres what you need to know about biweekly mortgage payments:

Dont Miss: Can You Apply For A Mortgage Before Finding A House

Read Also: Can You Use Mortgage Loan For Renovations