Table Of Maximum Age Limits For Mortgages

| Age of borrower applying for mortgage | Likelihood of acceptance |

| Getting a mortgage with no age limit | Low |

Find out what kind of mortgage deal you might be able to get by talking to one of the expert mortgage brokers we work with. As whole-of-market brokers they have access to specialist lenders you wont find on the high street. Make an enquiry and well match you with a broker with the right experience to help.

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youâll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Dan is a lawyer and financial planner living in Williamstown, Massachusetts. With experience in tax and estate planning, trust administration, â¦Learn More

Include All Your Income

Your lender will ask you questions about your income and assets when you apply for a new mortgage or to refinance your loan. However, lenders dont only consider income from employment when they review your application. Maximize your chances of getting approved by including all streams of income with your application. Some income your lender might consider includes:

- Social Security payments

- Military pension payments and benefits

- Income from rental properties you own

- Payments from your IRA, 401 or other retirement accounts

- Royalty income from patents

The specific streams of income you can include in your application can vary from lender to lender. The most important factor is that the income you have is set to continue consistently. Your lender may exclude certain streams of income that arent long-standing. For example, your lender probably wont consider alimony as income if it is set to end in 12 months.

Recommended Reading: What Is A Mortgage Modification Agreement

What Is The Maximum Home Loan Age

Theres no widely accepted, industry-standard maximum age limit at which you can qualify for a home loan.

Australias anti-discrimination legislation, namely the Age Discrimination Act 2004 and National Consumer Credit Protection Act 2009, prevents lenders from discriminating against mortgage applicants due to their age.

However, lenders also have a responsibility to ensure that anyone they lend money to can comfortably afford to repay the loan without experiencing any undue financial hardships.

In the past, most Australian lenders did not place any age limits on their mortgages. But in recent years a small number of lenders, including Bank of Queensland and loans.com.au, have introduced age limits on some of their home loans. Where maximum age limits apply, they typically range from 65 to 75 years.

The older you are, the more criteria may apply when you are trying to obtain home loan approval.

Can You Get A Mortgage As A Senior

When it comes to getting a home loan in retirement, mortgage lenders look at a lot of numbers to decide whether a borrower is qualified but age isnt one of them. The Equal Credit Opportunity Act makes it unlawful to discriminate against a credit applicant because of age.

I once did a 30-year mortgage for a 97-year-old woman, recalls Michael Becker, sales manager and loan originator at Sierra Pacific Mortgage in Lutherville, Maryland. She was lucid, understood what she was doing and just wanted to help out a family member some cash out of her home, and had the income to qualify and the equity in the home she owned it free and clear so she was approved.

When seniors apply for a mortgage, lenders look at the same criteria as they do for any other borrower, including:

- Debt-to-income ratio

- Income and other assets

The minimum credit score to get a conventional loan backed by Fannie Mae or Freddie Mac is 620, although that score wont qualify you for the best rates. A DTI ratio as high as 50 percent might be allowed, but lenders prefer to see you spending less than 45 percent of your monthly income on debt payments, including your mortgage.

The same underwriting guidelines apply to retirees and seniors as does to everyone else, Becker says. They must have the capacity to repay the loan that is, have the income and assets to qualify.

You May Like: What Is A 30 Year Fixed Jumbo Mortgage Rate

Can You Get A 30 Year Mortgage At Age 55

4.2/530year mortgagecanageyears

Beside this, can I get a mortgage at 55 years old?

Age is just a number, or so the saying goes, but it does matter if you’re applying for a mortgage. If you’re aged 55 and over and want a mortgage or to remortgage into retirement, you may struggle to get the loan you want.

Additionally, what is the maximum age to get a mortgage? Normal Mortgages with Maximum Ages Above 75Most lenders require that a borrower pays off their mortgage before they reach 75, although there are some lenders with higher age limits that offer mortgages up to 80, 85 and 90. There are even a few that have raised their age limits to 95.

Hereof, can I get a mortgage at 54 years old?

As you are 54 some lenders may only lend for an 11-year term, so your mortgage would only last until you are 65, but others will lend for the more usual term of 25 years. If you choose a term that takes you past your retirement date think about whether you will be able to afford the repayments after you retire.

Should you buy a house at age 55?

Buying a home after 55 is a major decision that is sure to impact your retirement. Investopedia suggests that when deciding to buy a home after 55, you should first consider other mortgage options that would work better, and determine if paying off the mortgage is more important than maximizing your retirement savings.

How To Qualify For A Mortgage At Age 60+

Since there is no mortgage age limit what does it take to qualify for a mortgage at a later age? A Plano mortgage company or lender will want proof that you can afford your monthly payments after retirement, and make them on time. Generally, they look at your debt to income ratio, your credit score, and your gross monthly income. For retirees, mortgage companies look at income resources other than salaries. These may include social security, income from retirement and investment accounts and pensions. Seniors may have the additional advantage of having a longer and stronger credit history than younger applicants just getting started on their careers and jobs.

There are benefits to getting a new mortgage purchase loan, refinance loan, or home renovation loan in your later years. First of all, if you already have a mortgage, you may benefit from a lower interest rate. Even if there are closing costs involved, if you plan on staying in your home for many more years, a refinance may be an attractive option. Buying a new home may give you security and comfort in your later years, whether you are downsizing from a larger home, or concerned about a rental being sold out from under you in later years and needing to move quickly when you are less physically able.

Also Check: How To Calculate Principal And Interest For Mortgage

Banks Are Wary Of Older First

First home buyers Sarah and Michael were unable to secure a home loan but had no problems getting an investment loan. Can you guess why?

Apparently their age had something to do with it. While banks cannot specifically be “ageist” in a lending scenario, they do take into account the suitability of a loan to the individual, especially around their serviceability.

“A client needs to be able to establish how they will meet mortgage repayments and/or articulate an exit strategy if they are nearer to a retirement,” says Michael Saliba, a Smartline mortgage broker.

When Sarah and Michael applied for their first home loan she was 39 and he was 55. A 30-year mortgage would have seen Michael still paying off his first home loan in his 80s.

As a general rule, investment loans don’t need an exit strategy, as you can sell an investment property when you retire and it doesn’t affect your home.

Under the National Consumer Credit Protection Act, you’re considered to be in financial hardship if you can’t pay off a mortgage without selling your home. On the other hand, you can sell an investment at any time without financial hardship.

This may explain why Sarah and Michael were approved for an investment loan over a home loan.

“Responsible lending requirements mean lenders require borrowers over 50 years old to demonstrate how they will be able to afford their loan repayments in retirement – what is called an exit strategy,” says Steve Jovcevski, Mozo’s property expert.

Can I Get A Mortgage At 60

Yes you can get a mortgage at 60 and even a mortgage over 65. Find out more about mortgages for over 60s

If youre 60 and want a mortgage that must be paid off before you reach 70, its term could be no more than 10 years.

You have a better chance of being accepted if you have a strong and if your income is high enough to easily cover the mortgage repayments.

Why do you need a new mortgage?

-

To remortgage to get a better deal on your current home, especially if a fixed or tracker rate has ended

-

To move house, for example downsizing to a smaller property

Recommended Reading: Which Is Better 30 Or 15 Year Mortgage

Income Ending In Under 3 Years

Home buyers who arent yet retired, but plan to retire soon, may hit a different snag in the mortgage application process.

When you buy a home or refinance, mortgage lenders need to verify your income source will continue for at least 3 years after the loan closes.

Someone retiring in a year or two would not meet this continuing income requirement.

In that case, they would not qualify for a mortgage or refinance loan no matter how high their credit score or how much money they have stashed away in investments and retirement accounts.

The simplest solution to this problem? Dont tell your lender you plan to retire.

Theres nothing on your pay stubs to cue a lender off about retirement plans, so they have every reason to believe your income will continue.

Theres also no guarantee that you will require when planned. Many people change their plans based on the current economy, their investments, or their desire to keep working.

However, youll need to be absolutely certain you can afford mortgage payments with the income youll have in retirement.

If youre in a situation where youve received a retirement buyout or your employer tells your lender about retirement plans, you may not be able to qualify for a new mortgage.

In this case, you may have to wait until youve retired and begun drawing from your retirement accounts in order to qualify based on your assets rather than your income.

Lenders Can’t Turn You Down Because You Are Older But They Will Assess Your Age And Your Years Left In The Workforce

Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it!

There is no maximum age limit set for getting a home loan in fact, people aged well into their 60s and even older may be approved for a home loan.

But when you apply for a mortgage, your lender will assess many criteria, and age can be one of them. They want to be sure that you have the income to support the loan, not just now but well into the future. So how do lenders review your application, and how can you improve your chances of getting an approval?

You May Like: What Does A Co Signer Do For A Mortgage

What Is The Age Limit For Getting A Mortgage

Each lender sets its own age limit for mortgage applicants. Typically, this is either:

- your age when you take out a new mortgage, with the limit ranging from around 70 to 85

- your age when the mortgage term ends, with the limit ranging from about 75 to 95

Regardless of how old you are when you take out a mortgage, youll need to be sure you can afford the repayments throughout the full term, including on any outstanding balance after you retire.

If youre having issues with age limits or repayments, you could consider a lifetime mortgage, which is a type of equity release. However, youll need to bear in mind that releasing equity in your property can affect your eligibility for some state benefits and also impacts on what your estate is worth when you die.

Some lenders offer retirement interest-only mortgages, which allow you to pay off the interest only, meaning your repayments should be lower. The loan amount is usually paid off when the last borrower moves into long-term care or dies.

Equity Release And Mortgages For Over 70s

You could use an equity release mortgage to withdraw part of the share of your home that you own as a lump sum or monthly income. You could then use this to:

-

Pay off your existing mortgage

-

Pay for a major purchase or unexpected cost

-

Fund your retirement

The amount borrowed will be repaid back when the house is sold, usually after the borrower has moved into a care home or passed away.

However, it can be an expensive way to borrow. Find out here how equity release works and see if it is right for you.

To understand the features and risks, ask for a personalised illustration from a lifetime mortgage company. Check that this type of mortgage will meet your needs if you want to move or sell your home or you want your family to inherit it. If you are in any doubt, seek independent advice. Your home may be repossessed if you do not keep up repayments on your mortgage.

Whether you are looking to move up the property ladder, downsize or just relocate we can help you find the right mortgage when you move home.

Also Check: Why Are Mortgage Rates Lower Than Prime

Can I Afford It

If youâre considering taking out a mortgage on your next home, you may be wondering if itâs a wise decision financially for you.Start by looking into how much your current house is worth you will need to generate enough liquid cash from the sale of the house you own now in order to purchase the next one.

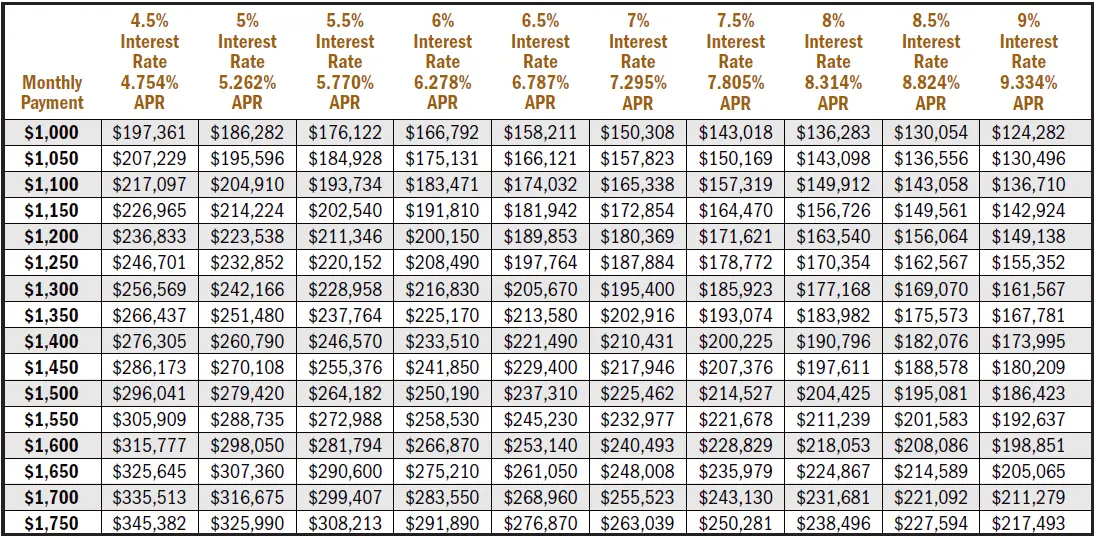

Youâll then want to figure out what you can afford. 30-yearmortgages are often ideal for retirees the payments are smaller, making it easier to manage all the expenses without a steady income.

Of course, there are many other factors to consider that will help you make a sound decision, but calculating how much of your budget you can allot to monthly payments on your mortgage will help you tackle the bigger financial decisions down the road.

How Will I Repay A Retirement Interest

There are two parts to paying off a retirement interest-only mortgage. The interest and the outstanding capital.

During the term of the mortgage, youll make monthly payments to cover the cost of the interest on your loan.

The outstanding capital you still owe will be paid off when the house is sold, you die, or when you move into long-term care.

Also Check: How Much Do I Have Left On My Mortgage Calculator

Can Senior Citizens Get Mortgages

Senior citizens can get mortgage loans just like everyone else it all depends on income, credit score, and cash available. Even seniors into their 90s can get mortgages if they qualify financially.

There are varying reasons for wanting a mortgage. Some seniors may want to downsize to a single-story home or a property that requires less upkeep or perhaps they want to be closer to family.

Some seniors even get mortgages to buy homes for their children who couldnt qualify for a loan.

No matter the reason, senior citizens are more than able to qualify for a mortgage. According to the Federal Trade Commission , elderly people are protected against discrimination from getting a home loan or any kind of credit based on their age. Its called the Equal Credit Opportunity Act, a federal law that protects borrowers against bias due to age, race, color, religion, national origin sex, marital status, or even those who get public assistance.

This means that all seniors are eligible to buy a home if they can qualify.

What About Interest Only Mortgages For Over 65 Year Olds

If you take out an interest only mortgage, you will still need to be able to pay back your interest on a monthly basis.

An interest only mortgage means just that, you only pay back the interest that means if there is anything outstanding on the loan itself you will have to have a plan in place to pay it off when your mortgage term ends.

It may be that you need to consider equity release.

Read Also: What Is The Mortgage Payment On 240k

A Secured Loan For The Over 50s

If you would just like to borrow money, its much simpler if you are a homeowner. You could still be eligible to apply for a secured loan up to around £100,000, by using your home as a deposit against the loan.

However, this should be approached with caution. If you can’t meet your repayments this could lead to you losing your home. You will get a better interest rate if you can show that you have a good credit rating and can handle your finances responsibly.