When To Consider A 15

If you currently have a 30-year mortgage and have room in your budget for a higher monthly mortgage payment, refinancing to a 15-year fixed-rate loan can make good financial sense. Youll still have the stability of knowing that the monthly payment wont change, while getting the benefit of a lower interest rate. Plus, youll pay off your home faster, freeing up money for other financial goals like saving for retirement when you do. Keep in mind that you need to show the lender that you have enough income to cover a higher payment in order to qualify for the new loan.

On the other hand, if your main goal is to achieve the lowest possible payment, you’re better off refinancing to a 20- or 30-year mortgage. While starting fresh with a new long-term loan isnt the right tactic for everyone, it is an option, especially if you need to trim monthly expenses.

What Is The Minimum Downpayment For 15

For primary home purchase on a conventional 15 year mortgages, the homebuyer will need a minimum of 3% down-payment if they are a first time homebuyer or 5% down payment if they are not a first time homebuyer. If they plan on buying as a vacation home, they will need 10% down-payment and if they are buying a home as a rental then they will need a minimum of 20% down-payment.

What’s The Difference Between A Mortgage Interest Rate And Apr

When searching for rates, you’ll probably see two percentages pop up: interest rate percentage and annual percentage rate .

The interest rate is the rate the lender charges you for taking out a mortgage.

The APR takes the rest of your house payments into consideration, such as private mortgage insurance, homeowners insurance, and property taxes.

The APR gives you a better idea of how much you’ll actually pay on your home.

Don’t Miss: How Much Mortgage Do You Pay A Month

When You Should Refinance

The ultimate goal of a refinance is to make a less than desirable mortgage better by locking in a 15-year fixed-rate mortgage with a new payment thats no more than 25% of your take-home pay.

Refinancing makes the most sense if you fall into one of these categories:

- You have an adjustable-rate mortgage .

- You have an interest-only loan.

- Your mortgage has more than a 15-year term .

- You have a high-interest rate loan.

If youre stuck in a 30-year mortgage with high interest rates, the gains you make by refinancing to a 15-year fixed-rate mortgage make it a no-brainer.

Yes, it might mean a slightly higher monthly payment. But isnt it worth it if you can pay off your house years earlier and save thousands of dollars in the process? Thats a win-win!

Just dont forget to factor in the closing costs of a mortgage refinance, which can cost 36% of the loan amount.

Homes Not In Designated High

The limits in the first row apply to all areas of Alabama, Arizona, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Texas, Vermont, Wisconsin & most other parts of the continental United States. Some coastal states are homes to metro areas with higher property prices which qualify the county they are in as a HERA designated high-cost areas.

The limits in the third row apply to Alaska, Guam, Virgin Islands, Washington D.C & Hawaii.

| Units |

|---|

You May Like: Is Quicken Loans A Mortgage Company

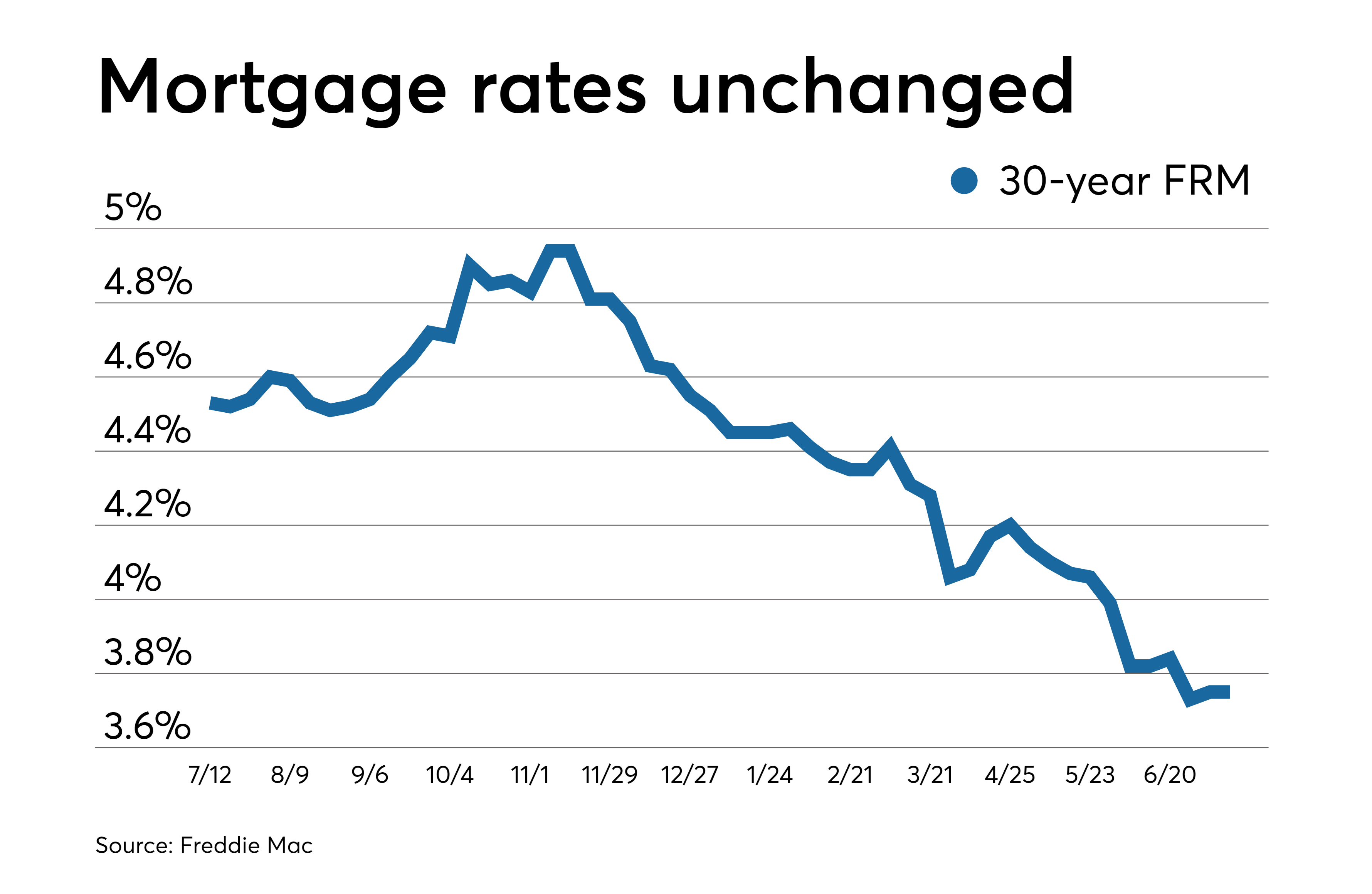

Mortgage Rate Forecast For July 2021

Rates have remained enticingly low throughout the first half of 2021 lower than many experts predicted six months ago. And the outlook for July doesnt call for a radical rate leap, either.But several factors are in play that can easily result in you paying at least slightly more for a purchase or refinance home loan in the coming weeks or months. Thats the consensus opinion among the group of industry pros Bankrate recently polled, who envision mortgage rates edging marginally higher at worst or standing pat over the next month.

Over the next month, rates may rise a bit but will likely be pretty close to where they are today around 3 percent for the 30-year fixed-rate mortgage, says Leonard Kiefer, deputy chief economist for Freddie Mac in McLean, Virginia. While inflation has ticked higher in recent months, many analysts consider much of the increase in consumer prices to be transitory. Thus, even with higher inflation rates, mortgage rates have held pretty steady. Id expect these near historically low mortgage rates to stay through at least early summer.

Learn more about specific loan type rates| Loan Type |

|---|

What Is A Good Loan Term

When picking a mortgage, remember to consider the loan term, or payment schedule. The mortgage terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. The interest rates in a fixed-rate mortgage are stable for the duration of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only stable for a certain amount of time . After that, the rate changes annually based on the current interest rate in the market.

One thing to take into consideration when deciding between a fixed-rate and adjustable-rate mortgage is how long you plan on living in your house. Fixed-rate mortgages might be a better fit for people who plan on living in a home for a while. Fixed-rate mortgages offer more stability over time compared to adjustable-rate mortgages, but adjustable-rate mortgages may offer lower interest rates upfront. If you aren’t planning to keep your new house for more than three to 10 years, though, an adjustable-rate mortgage may give you a better deal. The best loan term all depends on your situation and goals, so make sure to think about what’s important to you when choosing a mortgage.

Read Also: What Are Mortgage Rates Based On

Amerisave Mortgage Corporation Best Non

AmeriSave Mortgage Corporation is an online mortgage lender licensed in every state except New York. It has earned a spot as one of Bankrates top mortgage lenders and best FHA lenders this year.

Strengths: Like other lenders, AmeriSave Mortgage Corporation offers both rate-and-term and cash out refinancing, with a fast prequalification process. The lender also offers a Rate Match Guarantee, which either matches a competitors rate or pays you $500.

Weaknesses: The lender charges a $500 application fee.

What Is The Difference Between A Fixed And A Variable Interest Rate At Td

A fixed interest rate means your interest rate, along with your principal and interest payments, will stay exactly the same during your mortgage term.

With a variable interest rate, your interest rate can fluctuate based on changes in our TD Mortgage Prime Rate. While your payments will remain the same, the amounts from each payment that go toward the principal and interest can vary.

Recommended Reading: What Is The Most Accurate Mortgage Calculator

Is It Harder To Qualify For A 15

On paper, its no harder to qualify for a 15-year mortgage loanthan a 30-year one. Guidelines vary by loan type ,but within each program, requirements for a 15- and 30-year loan are generallythe same.

For instance, a 15-year FHA loan will likely require acredit score of at least 580, down payment of 3.5%, and debt-to-income ratiobelow 50%, just like a 30-year FHA mortgage.

But in reality, its much harder to qualify for a 15-yearloan because of the higher monthly payments.

A bigger mortgage payment means your home loan will eat upmore of your monthly income. This will have an impact on your debt-to-incomeratio.

For most home buyers, a 15-year mortgage payment plus existing debts will take up more than 43% to 50% of their monthly income, which is the maximum DTI range most lenders allow.

If youre set on a 15-year mortgage but have a tightermonthly budget, paying down existing debts before you apply for the home loancould help you qualify.

Are The Lowest Mortgage Rates Usually Online

For the last few years, the best rates in Canada have usually been found online. Thats because internet-based lenders have been more competitive and often accept smaller profit margins. Even big banks are now joining the bandwagon with special pricing for online mortgage shoppers. RATESDOTCA tracks dozens of lenders and aggregates the best deals all in one place.

Don’t Miss: When Does A Reverse Mortgage Make Sense

When Is A 15

A 15-year mortgage is a smart option for borrowers who want to save money on interest and can afford the larger monthly payments and are still able to meet their other financial goals and responsibilities. Its also smart for people who have a steady and reliable income.

For instance, borrowers who want to take out a 15-year mortgage but cant afford to set aside money in their retirement accounts or savings goals like creating an emergency fund, should probably stick to a longer-term mortgage . That way, the lower monthly payments allow them more wiggle room in their monthly budget.

For borrowers who have variable income or sporadic income sources, a 15-year mortgage makes sense if there is a realistic plan. In other words, borrowers need to account for the fact that they may not make enough in any given month to make the monthly payments. Having a plansuch as having larger reserves in savingscan ensure borrowers can still make on-time payments and not put their home at risk.

If you make sure you have a plan, the savings are worth it. Lets say you have a $300,000 mortgage and the rate is 4.25% for a 30-year term, compared to 4.00% for a 15-year term. By the end of the 30-year term, youll have paid $231,295.08 in interest compared to $99,431.48, a savings difference of $131,863.60. Thats pretty significant.

How Does A 15

A 15-year fixed-rate mortgage offers a generic, structured plan for financing a home: You get a mortgage for a set term at a set interest rate, and lenders require a down paymentusually between 520%.

The only thing that varies within fixed-rate mortgages is the length of the mortgage term. You can stretch your monthly payments anywhere from 10 to 50 years, but the two most common term options are the 15-year and 30-year fixed-rate mortgages.

There are two basic components to every fixed-rate mortgage loan: the principal and the interest.

- The principal is the amount you borrow to purchase your home.

- The interest is the amount you pay to compensate the lender for taking the risk of lending that money to you.

So, in order to borrow money, you have to spend more money. But if you opt for a 15-year fixed mortgage, there is a silver lining: Youll have fewer interest payments!

Recommended Reading: Can You Refinance Mortgage With Poor Credit

What Are The Differences Between 15

A 15-year mortgage’s monthly payments are higher than a 30-year mortgage, often significantly higher. A 30-year mortgage allows a borrower to stretch out payments over a long time and keep more of their monthly earnings. A 30-year mortgage has a higher interest rate than a 15-year mortgage, and you will pay more in interest rather than principal payments on a 30-year mortgage.

Benefits Of A 15/15 Arm

There are a few big benefits to a 15/15 ARM compared with other mortgages.

First, the initial interest rate is typically lower than what youd get from a 30-year fixed mortgage, allowing you to save money over at least the first 15 years of the loan.

Second, the fixed-rate period is longer than most other ARMs, providing more stability and potentially saving you money if interest rates continue to rise.

Third, given that most people sell their homes within 12 years, odds are that youll never even reach the point where your 15/15 ARM adjusts.

From a lenders perspective, the 15/15 ARM provides two main benefits.

First, most loans are sold shortly after the loan is made, and 15/15 ARMs usually sell for more than 30-year fixed rate mortgages.

Second, there arent many lenders that offer the 15/15 ARM, which means that any lender that does can cater to a specific consumer niche and potentially add to their overall business.

You May Like: Why Do You Need Mortgage Insurance

Key Mortgage Rates Are Down Today After Last Weeks Roller Coaster

Credible Operations, Inc. NMLS# 1681276, Credible. Not available in all states. www.nmlsconsumeraccess.org.

Based on data compiled by Credible, mortgage rates dropped for three terms and held firm for one term since last Friday.

-

30-year fixed mortgage rates: 2.940%, down from 2.990%, -0.050

-

20-year fixed mortgage rates: 2.750%, unchanged

-

15-year fixed mortgage rates: 2.250%, down from 2.375%, -0.125

-

10-year fixed mortgage rates: 2.125%, down from 2.375%, -0.250

Rates last updated on Nov. 1, 2021. These rates are based on the assumptions shown here. Actual rates may vary.

Theres still time for homebuyers to grab a deal, with rates for three out of four mortgage terms falling today. Rates for a 30-year term the most popular have remained below 3% for three straight days. Similarly, 20-year rates have held at or below 2.875% for the last seven days. Rates for 15-year and 10-year terms have been especially volatile, but at 2.250% and 2.125% today, buyers who opt for a shorter term can take advantage of significant interest savings over the life of their loans.

Browse rates from multiple lenders so you can make an informed decision about your home loan.

Wells Fargo Best For Low Fees

Of course, the phrase best for low fees always comes with a catch. In the case of Wells Fargo, that catch may be that you must meet specific parameters to qualify for its favorable terms for a 15-year mortgage rate. First, that theres a 25% down payment, which, among other things, eliminates the requirement to purchase mortgage insurance. Second, the applicant must have a minimum FICO score of 740. Third, the rates assume the purchase of discount points. However, with those elements in place, Wells Fargos deal offers a financially attractive path to homeownership.

Recommended Reading: What Is The Usual Mortgage Interest Rate

How Some Lenders Can Offer Lower Mortgage Rates Than Others

Its always easier to find the lowest mortgage rates than to find the lowest borrowing cost. Thats because lenders like to add gotchyas to their mortgage agreements. These are surprises that boost your cost of borrowing later. Here are four examples of such pitfalls:

Other Mortgage Loan Types To Choose From

Besides conventional 15-year and 30-year fixed-rate mortgages, there are other loan types to choose from when buying a new home or refinancing.

- Adjustable rate mortgagesAdjustable rate mortgages come in 30-year terms. The major forms of these mortgage types are 5/1, 5/6, 7/6 and 10/6. For each of these, the loan starts with a low rate for the first 5, 7 or 10 years, then adjusts every six months to a year for the remainder of the loan. These types of mortgages are great if you don’t plan on staying in the home long-term. Disclaimer: Rocket Mortgage® does not currently offer 5-year ARMs.

- Jumbo mortgages Jumbo loans are typically 30-year loans for expensive properties. Conventional loans have limits on how much you can borrow depending on the average property value where you’re buying. A jumbo loan is an option if the property you’re buying exceeds this limit. Since it’s a higher loan amount and a higher risk for the bank, jumbo loans come with higher interest rates.

- Cash-Out refinance A cash-out refinance is a type of mortgage refinance in which you can turn the home equity you have into cash. You then take on a new mortgage for the rest of what you owe.

Also Check: Are Home Mortgage Rates Going Down

How To Compare 15

When shopping for the best mortgage rate you need to consider the overall cost of the loan, not just the interest rate. Mortgage closing costs can be 3%-6% of the loan amount and the fees you pay vary by lender. The lender with the lowest rate could be more expensive overall if it is charging higher origination fees or adding in discount points. This is why you should compare annual percentage rates , which factor in certain fees in addition to the interest rate, as opposed to just the interest rate.

You can compare interest rates and fees by looking at the Loan Estimate, which the lender must provide within three business days from when you submit a mortgage application. Since all lenders are required to use the same Loan Estimate form, its easy to evaluate multiple offers.