How To Make A Payment

Just as you might go online to make a car insurance or phone bill payment, you can pay your mortgage in the same way. You can still make payments by mail or phone, but the ease and convenience of paying online makes it a more favorable option among most homeowners. One reason for this is the ability to set up automatic payments, either through your bank or directly with your lender.

You should keep in mind that mortgage payments sometimes change. The amount necessary for taxes and insurance may go up or down every year. The same is true if youre in an adjustable-rate mortgage at the end of its fixed period. By setting up an automatic payment through a lender as opposed to the bank, you can make sure the payment isnt too low and that youre not overpaying when your escrow or rate goes down.

How To Pay Your Property Taxes

There are two ways you can pay property taxes. First, you could pay your property taxes directly to your city. These taxes probably wont be due every month, so you should include them in your budget. This means you wont be caught without the cash to pay them.

The second option is to have your lender collect a portion of your property taxes from you every month. Your lender will collect this with your monthly mortgage payment. It will then give your property tax payment to the municipality on your behalf. If you already own a home, ask your lender if your mortgage payment includes property taxes.

You May Find It Easier To Budget

According to the U.S. Department of Housing and Urban Development , the median monthly mortgage payment in 2019 was $975. That same year, the median household income was $68,703 this means that mortgage payments accounted for more than 17% of the average familys budget.

Its no surprise then that making a lump sum mortgage payment each month can sting, especially when it represents such a large chunk of your income.

If nothing else, biweekly mortgage payments take the stress out of those big payments. If youre paid biweekly, splitting your mortgage payment makes even more sense just send in a check each time you get paid, if thats the due date you agree on with your lender.

This strategy helps you stay on top of your budget and eliminate financial stress. And rather than letting that money sit in your bank account until your due date rolls around , making biweekly payments may also keep you from overspending.

Recommended Reading: Does Rocket Mortgage Affect Your Credit Score

Ready To Refinance Your Mortgage

If you want to refinance to a mortgage you can pay off fast, talk to our friends at Churchill Mortgage. The home loan specialists at Churchill Mortgage show you the true costand savingsof each loan option. They coach you to make the best decision based on your budget and goals.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

What Factors Affect The Amount Of Interest You Pay

The following factors will affect the amount of your mortgage interest payments:

- The mortgage interest rate. This is the rate the lender charges you as the cost of financing. Even a small difference in the interest rate can add up to thousands over the life of the loan.

- The prime interest rate. The interest rate on your loan is often connected to the prime rate, or overnight rate, set by the Bank of Canada. The prime rate dictates the rate banks lend money to each other overnight. If you have a variable interest rate, paying attention to the prime interest rate can help you predict what your interest rate will do.

- The amount you borrow. The more you borrow from your bank, the more interest youll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000.

- The outstanding loan amount. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

- The loan term. The time you take to pay off your loan will affect the amount of interest you pay paying your loan off over a shorter period of time will minimize your interest.

Don’t Miss: How Much Income For Mortgage Calculator

How To Pay Your Mortgage With Online Banking

The easiest option for most homeowners is to pay for their mortgage through either their bank or mortgage lender or servicers website. Online payments are fast, free and efficient, and paying online means you can decide when you want to make the payment, maintain a record of when it was made and ensure that it is paid by the due date.

Depending on the lender or bank, payments can also be automated without you having to log into a website each month.

Going to your lender or loan servicers website and making the payment puts you in control of the timing, says Greg McBride, CFA, chief financial analyst for Bankrate. The downside is that this is something else each month you need to do or be reminded to do.

How Does Paying Down A Mortgage Work

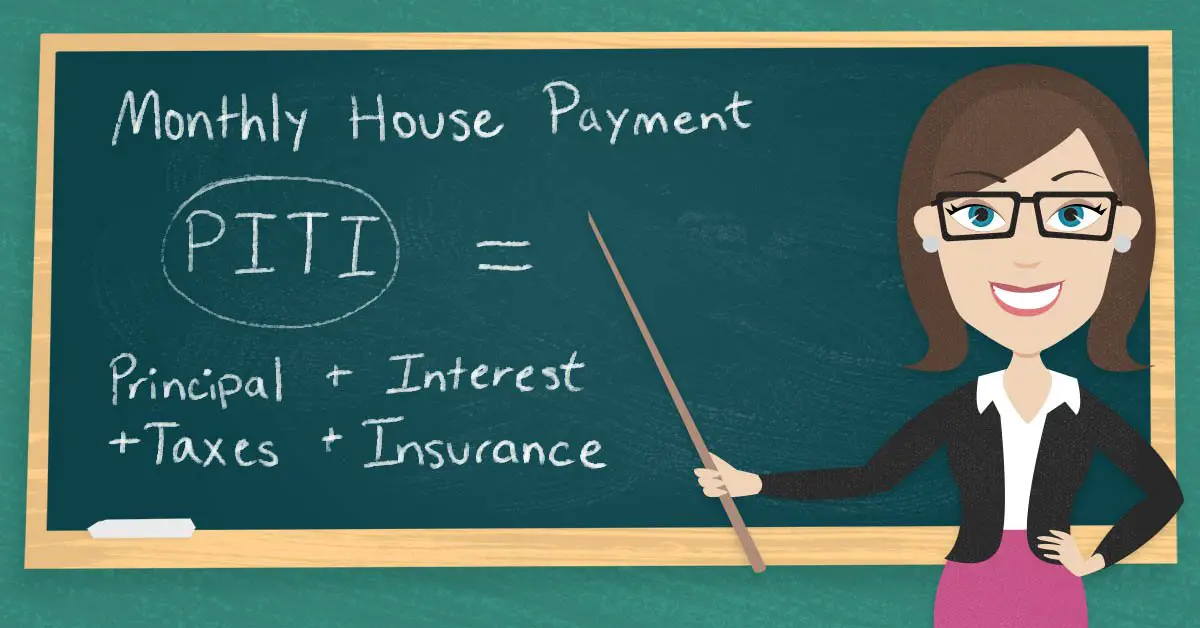

The amount you borrow with your mortgage is known as the principal. Each month, part of your monthly payment will go toward paying off that principal, or mortgage balance, and part will go toward interest on the loan. Interest is what the lender charges you for lending you money.

Most peoples monthly payments also include additional amounts for taxes and insurance.

The part of your payment that goes to principal reduces the amount you owe on the loan and builds your equity. The part of the payment that goes to interest doesnt reduce your balance or build your equity. So, the equity you build in your home will be much less than the sum of your monthly payments.

With a typical fixed-rate loan, the combined principal and interest payment will not change over the life of your loan, but the amounts that go to principal rather than interest will.

Heres how it works:

In the beginning, you owe more interest, because your loan balance is still high. So most of your monthly payment goes to pay the interest, and a little bit goes to paying off the principal. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower. So, more of your monthly payment goes to paying down the principal. Near the end of the loan, you owe much less interest, and most of your payment goes to pay off the last of the principal. This process is known as amortization.

Don’t Miss: Is Citizens Bank Good For Mortgages

What Is A Prepayment

Want to know how a prepayment is different from a principal and interest payment? A prepayment is a lump sum payment of any amount in addition to regular scheduled payments. Like it sounds, prepayment means paying your debt down early.Whether you make one or multiple lump sum payments, a mortgage prepayment on the principal amount leaves you with a smaller debt, and over time, less interest to pay.

How Many Times Can You Refinance Your Home

For the most part, you can refinance your mortgage as many times as you like. Some lenders have rules and time limits in place for refinances , but these vary and arent set in stone.

The exception is if youre applying for a streamline refinance on an FHA or VA loan. According to the rules, at least 210 days must have passed from your closing date and at least six months since the first payment was due in order for you to qualify with an FHA or VA loan.

Regardless, that doesnt mean its always the right time to refinance. There are certain times when mortgage refinancing might be a smart move and many others when you may want to hold off in order to get the best terms and rates.

Learn More: How to Refinance Your Mortgage in 4 Easy Steps

Recommended Reading: Are Mortgage Discount Points Worth It

Property Taxes For First

In most cases, if youre a first-time homebuyer, your lender is going to require that you pay your property taxes through your mortgage. There are two primary reasons for this. First, if you have a down payment of less than 20%, you wont have enough equity in your home for your lender to consider allowing you to pay your property taxes yourself. Most lenders require you to have 20% equity or more.

Some lenders also require you to pay your property tax through your mortgage if you are a first-time homebuyer. The logic behind this decision is that because you are a new homeowner, you may not be familiar with when property taxes are due, and your lender doesnt want to take the chance that your city will put a lien on your home.

What To Expect When Discharging Your Mortgage

A mortgage discharge is a process involving you, your lender and your provincial or territorial land title registry office.

This process varies depending on your province or territory. In most cases, you work with a lawyer, a notary or a commissioner of oaths. Some provinces and territories allow you to do the work yourself. Keep in mind that even if you do the work yourself, you may have to get documents notarized by a professional such as a lawyer or a notary.

Recommended Reading: Can There Be A Cosigner On A Mortgage

How To Pay Off A 30

A few options exist as realistic ways to pay off a mortgage sooner than the 30-year term.

Options to pay off your mortgage faster include:

- Adding a set amount each month to the payment

- Making one extra monthly payment each year

- Changing the loan from 30 years to 15 years

- Making the loan a bi-weekly loan, meaning payments are made every two weeks instead of monthly.

There are advantages to each approach. The choice comes down to careful study and a decision based on your financial position and the benefits of paying off a mortgage early.

Reasons To Make Biweekly Mortgage Payments

There are several benefits of paying a mortgage biweekly. While it may require a little extra work on your end, at least in the beginning, you may find it completely worthwhile.

Here are the top five reasons to consider paying your mortgage every two weeks, and what they can do for your finances.

Read Also: Can You Write Off Points On A Mortgage

Should You Make Biweekly Mortgage Payments

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you buy a home with a mortgage, your payments are due monthly by default. In an effort to pay off their mortgages faster and pay less in interest over the loans lifetime, some homeowners choose to make biweekly payments instead.

But depending on how your biweekly payments are handled, they may not help you make the dent in principal you intend. Heres what you need to know if youre considering switching from monthly to biweekly payments.

» MORE:Biweekly mortgage payment calculator

Equity And Your Refinance

Remember: You need to have equity built up to take cash out against it. You might have less equity in your home than you think if youve taken a cash-out refinance in the past.

Every time you dip into your equity, you reduce the percentage of your home loan that you can use. Most lenders wont allow you to take out 100%. Youll need to do some math and figure out exactly how much equity you have before you refinance.

You May Like: How Does The Interest Work On A Mortgage

Factors That Might Affect Your First Mortgage Payment

Your first payment will be on the first of the month following your first 30 days of ownership, but when you close can change how much time you have between closing and that payment.

You may not be able to change your payment due date, but you can make your payment early, which can have a huge impact on how you pay off your mortgage.

Mistake #: Leaving Yourself Cash

Throwing every extra penny youve got at your mortgage is an aggressive way to get out of debt. It could also backfire. If you dont have anything set aside for emergencies, for example, you could end up in a tight spot if you get sick and cant work for a few months. In that case, you may have to use your credit card to cover your bills or try to take out an additional loan.

If you dont have an emergency fund, your best bet may be to put some of your extra mortgage payments in a rainy day fund. Once you have three to six months worth of expenses saved, you may be able to focus on paying down your mortgage debt.

Also Check: How 10 Year Treasury Affect Mortgage Rates

Mistake #: Not Putting Extra Payments Towards The Loan Principal

Throwing in an extra $500 or $1,000 every month wont necessarily help you pay off your mortgage more quickly. Unless you specify that the additional money youre paying is meant to be applied to your principal balance, the lender may use it to pay down interest for the next scheduled payment.

If youre writing separate checks for extra principal payments, you can make a note of that on the memo line. If you pay your mortgage bill online, you might want to find out whether the lender will let you include a note specifying how additional payments should be used.

How To Set Up A Biweekly Mortgage Payment Plan

If your lender allows biweekly payments and applies the extra payments directly to your principal, you can simply send half your mortgage payment every two weeks. If your monthly payment is $2,000, for instance, you can send $1,000 biweekly.

In general, you wont need to involve your lender in order to start making payments this way, according to David Reischer, attorney and CEO of LegalAdvice.com.

It is simply unnecessary to involve the lender in changing the loan terms so that a borrower must make a payment every two weeks instead of the normal payment due once a month, explains Reischer. If a borrower wants to make an extra payment to accrue the benefit of a biweekly mortgage plan, then they can simply send a payment every two weeks instead of the payment due every 30 days.

You can also divide your monthly payment by 12 and park that amount in a savings account each month, then send the accumulated amount to your lender as an extra payment at the end of the year.

No matter how you do it, Heintz says you should be sure to make it absolutely clear that this entire amount goes toward your principal balance. Otherwise, your lender might return the extra amount or forward it to your next payment, which negates the goal of biweekly payments.

To confirm your biweekly mortgage payment plan works the way you intend it to, make sure that:

In addition, make sure your lender confirms any extra payments are being applied to the principal in a timely manner.

Recommended Reading: What Is Excellent Credit Score For Mortgage

Choose An Accelerated Option For Your Mortgage Payments

An accelerated payment option lets you make weekly or biweekly payments. With this option, youre putting more money toward your mortgage than with a monthly payment.

Accelerated payments can save you money on interest charges. By accelerating your payments, you make the equivalent of one extra monthly payment per year.

Should I Refinance Or Just Pay Extra

With mortgage interest rates near record lows, refinancing your current mortgage might seem like a no-brainer. Millions of homeowners could lower their monthly payments and save on long-term interest.

But what if you already have an ultra-low rate? Or youre nearly done paying off your home loan?

In some cases, starting your mortgage over with a refinance wont make sense. Luckily, you can still save on interest and potentially pay off your home early by paying extra toward your mortgage.

Heres how to choose the right strategy.

Also Check: How Much Is Mortgage Insurance In Michigan

What If I Pay My Mortgage Before The Due Date

- In most cases theres no benefit to paying the mortgage before the due date

- Because theyre calculated monthly using simple interest

- Meaning you wont save money or lose money on interest

- So it shouldnt matter if you pay on the 1st or the 15th, as long as the payment is made on time

Okay, so we know paying late isnt too smart, but what about paying the mortgage before the due date?

You might be thinking, Hey, I can save money on interest if I make my payments on the 20th or 25th of each month, instead of the first of the next month.

Not the case. Your loan servicer may accept payment on that date, but it wont mean youll pay less interest.

The interest is already figured out for the month using the previous months balance, so it doesnt matter if you pay a few days early.

This differs from credit cards and other types of loans, such as HELOCs, where the interest is calculated daily.

If you actually want to pay less in interest on a traditional mortgage, you need to make extra payments to principal.

So if you pay an additional $100 on top of your monthly mortgage payment, your loan balance will be $100 lower for the subsequent month, and that means less interest paid over the life of the loan.

This will also reduce the loan term, meaning your mortgage will be paid off in less time.

Just note that the monthly mortgage payment will stay the same, regardless of whether you make larger payments for a few months here and there.