What Is A Good Mortgage Rate

You know what goes into calculating your rate, but what’s the magic number? How low does your interest rate have to be to qualify as good?

Unfortunately, the answer isn’t necessarily all that straightforward. After reviewing all the factors that influence them, youll see that interest rates are complicated. Good is usually a relative term when it comes to rates, so let’s look at a few ways to level-set.

What Factors Determine My Mortgage Rate

Lenders consider these factors when pricing your interest rate:

- Loan term

- Interest rate type

Your . Lenders have settled on this three-digit score as the most reliable predictor of whether youll make prompt payments. The higher your score, the less risk you pose and the lower rate youll pay.

Lenders also look at the amount of your down payment. For instance, if you put 20 percent down, youre viewed as a lower risk, and you might get a lower rate than someone whos financing nearly all of their home purchase. From the lenders viewpoint, the more skin the borrower has in the game, the more likely the mortgage will be repaid on time and in full.

Rolling additional closing costs into the loan affects your mortgage rate as well. With these costs added to what you owe, youll typically pay a higher interest rate than someone who pays those fees upfront. Borrowers might also pay higher rates for jumbo loans mortgages above the limits for conforming mortgages.

Use our mortgage calculator to see how different interest rates, down payments, loan amounts and loan terms would affect your monthly mortgage payments.

Rocket Mortgage Home Purchase Review

Best if:

- You want a self-service, fully digital mortgage process

- You have at least a 580 credit score

- You have a traditional job with a W-2

- Youre not buying a mobile or manufactured home

Rocket Mortgage offers all types of mortgage loans, including FHA, conventional, VA, and jumbo mortgages. You can buy a primary home, second home, condo, or investment property through their online process, but not a mobile home or manufactured home. They also require a credit score of at least 580 to qualify.

One of the biggest perks of Rocket Mortgage is that its online application and pre-approvals are up and running 24-7, so you can apply, gauge your mortgage options, and lock in your rate on your own schedule.

Ultimately, Rocket Mortgage says its best if youre close to purchasing a home before you use its service. If youre six months or more from buying a home, consider using a mortgage calculator to help gauge your price range before you begin shopping for one.

Once youre closer to purchasing, you can apply for a mortgage pre-approval with Rocket .

If youre considering Rocket Mortgage for your home purchase, heres what you should know:

| Mortgage programs | |

| 2% to 5% in closing costs | |

| Min. down payment | Usually at least 3%, though it depends on the type of mortgage loan you choose |

| Min. credit score | |

|

Credible makes getting a mortgage easy

If youre thinking about refinancing with Rocket Mortgage, heres what you need to know:

Also Check: How To Get A 15 Year Fixed Mortgage

How Are Interest Rates Calculated

You may be wondering, how are mortgage rates determined? Your lender calculates your interest rate using your individual data. Every lender uses their own individual formula to determine how much youll pay in interest. Its possible to get 10 different interest rates from 10 different mortgage providers. Lenders also take into account things like current market interest rates and real estate economy conditions when they calculate your rate.

There are a few ways that you can get a lower interest rate from your mortgage lender. Anything that you do to lower the risk for your lender will in turn lower your rate. The first thing that you can do is raise your credit score. Your credit score is a three-digit number that tells lenders at a glance how you use credit. If you have a high credit score, you usually make payments on time and you dont borrow more money than you can afford to pay back.

Lenders see you as riskier if you have a low credit score. You may have a history of missed payments, so a lender may compensate for the risk that your score presents by offering you a higher interest rate.

Here are some ways to raise your credit score:

- Always make your minimum loan and credit card payments on time.

- Limit the amount of money that you put on credit cards.

- Pay down as much of your debt as you can.

- Avoid applying for new loans when youre preparing to get a mortgage.

The Bottom Line On Apr Vs Interest Rate

Youll see two interest rates when you shop for a home: your interest rate and your APR. While your interest rate is the percentage of interest you pay on your loan, your APR includes your interest rate as well as any additional fees or expenses youll pay to your lender. Some of the most common additional fees include brokerage fees, private mortgage insurance and discount points. You can think of your APR as the effective interest rate youll actually pay once you have your loan.

Lenders must tell you both your interest rate and your APR before you close on a loan. You can lower your interest rate by controlling your credit score and choosing a government-backed loan. However, you have less control over your APR because many of these costs are set by the lender. That said, the best way to find a lower APR is to compare similar loan programs with different lenders.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: How To Find Mortgage Payment

The Bottom Line: Mortgage Rates Are Likely To Rise

COVID-19 has had a considerable impact on the U.S. economy, and mortgage rates are no exception. Over the past 18 months, rates have remained low, reaching their lowest historical levels. But as the economy recovers from the pandemic, interest rates are expected to follow suit.

Experts generally agree that mortgage interest rates are likely to rise, both over the upcoming month and over the rest of the year. Freddie Macs data indicates that rates could rise as much as half a percent before the year ends.

If youve been considering buying a home or refinancing a mortgage, now is a great time to do it and lock in todays low mortgage rates. You can apply today or give us a call at 326-6018.

Get approved to refinance.

A Guide To The Mortgage Rate Lock

4-minute read

Mortgage interest rates can fluctuate rapidly they move up and down from day to day and even from hour to hour. This can impact the amount you pay when you refinance your mortgage. A mortgage rate lock protects you from costly fluctuations and freezes your interest rate while you close on your refinance.

Read Also: How To Sell A Mobile Home With A Mortgage

A Note On Apr And Short

If you’re certain that you’re purchasing your forever home, it makes sense to shop around and choose a mortgage with the lowest APR and more upfront fees because, ultimately, youll pay less to finance your house in the long run.

However, if you dont plan on staying in the home for the long haul, it may make more sense to choose a loan with a higher rate, fewer upfront fees, and a higher APR, because you’ll end up paying less during the first few years of the mortgage.

Pros When Using Quicken Loans

Online Mortgage Process with Live Mortgage Advisors

The Quicken Loans and Rocket Mortgage mortgage application process can either start with a phone call or an online application.

Quicken Loans and Rocket Mortgage Employment/Income Verification

During the underwriting process, where Quicken Loans verifies all your financial information, they will take over the complex process of verification of employment for you. To get a mortgage, you must verify this to prove you can keep up with mortgage payments. By submitting your employers phone number, Quicken Loans will verify its legitimacy and then verify your employment over the phone or through a written request. During the mortgage process, Quicken Loans mayre-verify your employment to ensure that your employment status has not changed during your mortgage application. This process is done behind the scenes and you do not have to worry about it. However, you should keep in mind that getting a new loan or changing jobs could affect your mortgage application.

Quicken Loans and Rocket Mortgage Products

Quicken Loans and Rocket Mortgage offer many different types of home loans that cover a wide range of situations, which include:

- 30-Year Fixed Mortgages

You May Like: Can You Write Off Points On A Mortgage

When Not To Refinance

There are several reasons to avoid refinancing to a 15-year fixed-rate mortgage. Ideally you want to see an interest rate drop of around 2% from your current mortgage rate. You should hold off on refinancing if interest rates are going up.

You should also hold off on refinancing if you aren’t planning on staying in the home long enough to recoup the costs of the refinance. Refinancing comes with closing costs like home inspections, home appraisals and application fees.

Today’s Featured Mortgage Rates

Get answers to common questions from homebuyers like you.

- What is Mortgage First?

Mortgage First is a preapproval program that allows you to get preapproved on your home loan before you start shopping for your new home.

- What is the advantage to being preapproved?

- What documents do I need to provide to apply for Mortgage First?

You will complete the credit application and provide your income, asset, and credit documentation for review in order to get preapproved.

Don’t see the answer you need?

Call Rocket Mortgage at

Mon.-Fri., 8 a.m. 9 p.m. ET Sat. 8 a.m. 4 p.m. ET

In order to participate, the borrower must agree that the lender, Rocket Mortgage, may share their information with Charles Schwab Bank and Charles Schwab Bank will share their information with the lender Rocket Mortgage. Nothing herein is or should be interpreted as an obligation to lend. Loans are subject to credit and collateral approval. Other conditions and restrictions may apply. This offer is subject to change or withdraw at any time and without notice. Interest rate discounts cannot be combined with any other offers or rate discounts. Hazard insurance may be required.

Qualifying assets are based on Schwab brokerage and Schwab Bank combined account balances, including:

4. “Rocket Mortgage, America’s Largest Mortgage Lender” Based on Rocket Mortgage data in comparison to public data records.

Also Check: What Is A 5 1 Arm Mortgage

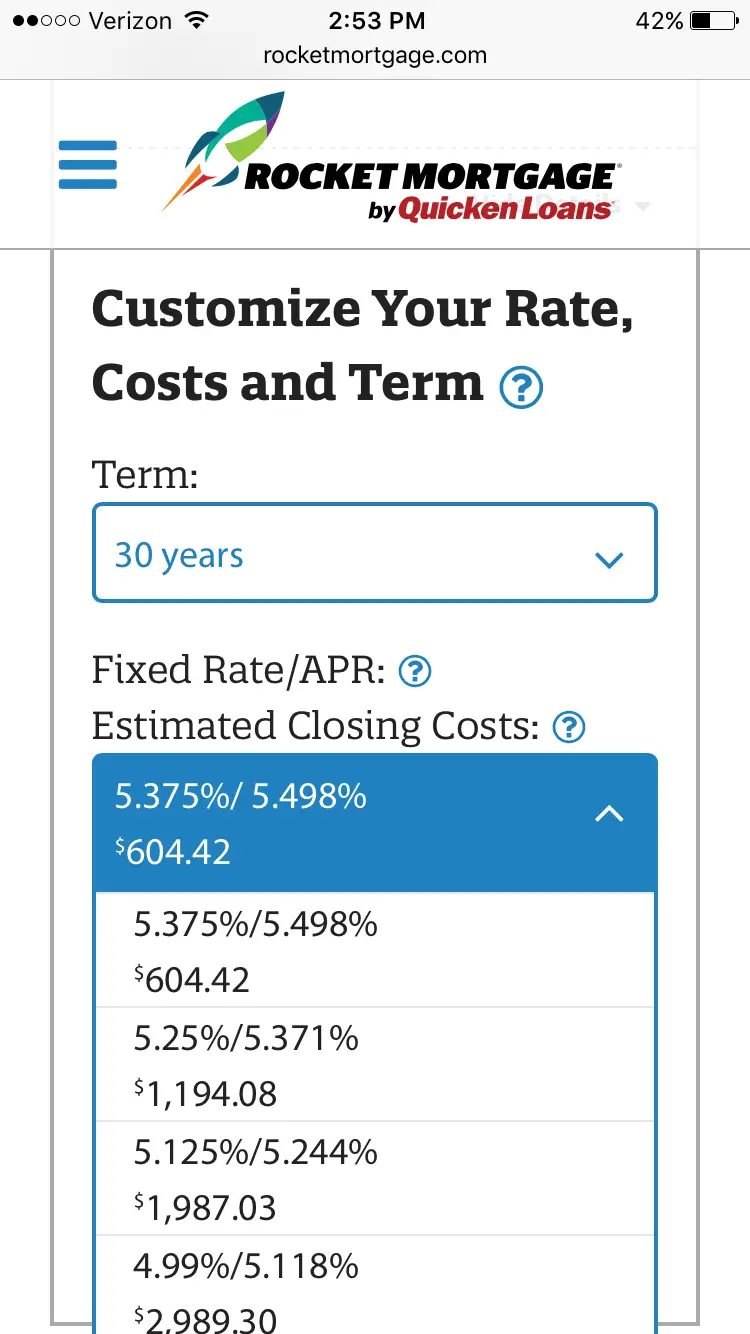

How Are Rocket Mortgage’s Rates Compared To The National Average

Rocket Mortgage rates trend about the same as the national average. The day we checked, Rocket Mortgage’s advertised rate on a 30-year fixed-rate mortgage was just 4/100ths higher than Freddie Mac’s published national average rate. Keep in mind, though, that other lenders who advertise lower interest rates may charge higher fees. The number you want to look at when you compare loans is the APR or annual percentage rate. That number will be a little higher than the interest rate, and reflects the true cost of the loan.

Can Rocket Mortgage Be Trusted

Millions whove seen the popular ad campaign are asking, Can I trust Rocket Mortgage? The short answer is Yes, but with a couple warnings. The tables below have the quick info on trust and Rocket Mortgage. We cover their Better Business Bureau A+ score, customer reviews, web reviews and more.

Rocket Mortgage is the famous 8 minute mortgage company with the high profile ad campaign. It turns out their trust level is actually quite high. The highest BBB rating possible and years of customer satisfaction awards are reasons Rocket Mortgage can be trusted. Points against them are reports of higher than average interest rates and a lawsuit by the U.S. Government.

Also Check: How Much Usda Mortgage Can I Qualify For

Rocket Mortgage Review: Full Approval In Just 8 Minutes

Do you know how long it takes for the space shuttle to reach orbit? Apparently it takes just eight minutes, the same amount of time it will take borrowers to get a full mortgage approval online via Rocket Mortgage.

At least, this is the powerful claim the company is touting via a new online mortgage approval engine that promises to shake up the age-old, and very stale home loan process. They created quite a stir during their Super Bowl ad as well.

The company launched the end-to-end online product in late 2015 in what appeared to be a direct response to the many online mortgage startups now in existence.

Essentially, parent company Quicken Loans didnt want to get left behind, and in fact, wanted to be a leader in the new digital mortgage world. So far, it seems to be working.

Rocket Mortgage Wants To Be The Cool And Easy Mortgage

- Rocket Mortgage is essentially a brand-name home loan that exudes speed and simplicity

- The company relies on the latest technology to target Millennials and Generation Z home buyers and homeowners

- Those who prefer to use smartphones and texts to get things done as opposed to speaking to humans

- They compete with other disruptors in the space that are trying to accomplish the same thing with so-called digital mortgages

The nascent space is still in its infancy, but there are already multiple players Quicken needs to keep its eye on, including the likes of Better Mortgage, Lenda, Sindeo, SoFi, LendingHome, and many others, some of which are popular with Millennials thanks to offerings like student loan refinances and the like.

Most of the startups above consider themselves online mortgage lenders that cut out the middleman , while promising to make home buying or refinancing a lot easier than it has traditionally been.

Quicken seems to have taken notice with their latest move, referring to themselves in the press release as the nations leading FinTech mortgage lender.

Short for financial technology, FinTech is the latest buzzword taking Silicon Valley by storm. It basically describes any financial company harnessing the power of the Internet to conduct business more efficiently.

Quicken Loans claims it took more than 500 Detroit-based developers and various other employees some three years to completely redesign the highly complex mortgage process.

Also Check: Can You Refinance Your Mortgage

How Is Apr Calculated

Unfortunately, you have less control over your APR compared to your interest rate. Your lender controls the other factors that go into your APR, like discount points and broker fees.

Though there are some things you can do to lower your APR, such as avoiding private mortgage insurance by offering at least 20% down, the best way to get a better rate is to compare lenders. When using APR to compare rates, be sure to compare apples to apples as far as loan programs. Basically, dont compare the APR on a 30-year fixed mortgage with one lender and a 5/1 adjustable rate mortgage with another, as its not an equal comparison.

Quicken Loans Vs Rocket Mortgage

It may seem confusing to see two related mortgage companies operating separately. But there is a clear distinction between the two. Quicken Loans is a mortgage lender and has its own website. Quicken Loans operates entirely independently from Rocket Mortgage and your loan application process could just be with Quicken Loans.

On the other hand,Rocket Mortgageis a company created by Quicken Loans to help improve the online mortgage application process. Quicken Loans uses Rocket Mortgage to approve mortgages quickly and easily. They even say that it can approve a mortgage in just 8 minutes. If you choose to apply for a mortgage with Rocket Mortgage, Quicken Loans will still be your mortgage lender, but the entire transaction will be with Rocket Mortgage. This means that from your perspective, you only interact with Rocket Mortgage, but behind the scenes, your loan is still financed by Quicken Loans.

Quicken Loans is going to change its name to Rocket Mortgage effective on July 31, 2021. This means that all mortgages offered by either of the two companies will be under Rocket Mortgage.

Read Also: What Salary Do I Need For A 200k Mortgage

Prime Rate: What It Is And How It Affects You

What is the definition of prime rate and how does it impact current mortgage rates and loan products? If youre shopping for a new home or interested in making a real estate investment, youve no doubt heard the term thrown around. As it turns out, the prime rate defined equates to the best interest rate at which any given financial institution will lend money to its most creditworthy and trusted clients.

In effect, the prime rate is the best possible rate that these financial providers are willing to offer borrowers on any sums lent. However, it is not generally available to average everyday consumers. But at the same time, shifting prime rates can also produce a trickle-down effect that impacts the interest rates charged on mortgages, credit cards and other financial instruments. Noting this, its important to understand how the prime rate works as you set about reviewing various credit and loan options.

What Kind Of Mortgage Can I Get With Rocket Mortgage

You can generally apply for all the same loans offered by Quicken through Rocket Mortgages online application system. Therefore, you have plenty of options whether youre looking for a conventional loan, or something more specialized for your situation. Your loan options include:

Fixed-rate mortgage: This popular mortgage type locks in your interest rate for the entire life of the loan. This means your monthly principal and interest payment stays the same, which many find useful for budgeting and planning. You will find the standard 15-year and 30-year fixed-rate mortgage options. This is also the type of loan YOURgage uses, but with adjustable terms.

Adjustable-rate mortgage: This type of mortgage, the ARM, does just what the name suggests: adjusts the interest rate. When you reach the end of your initial fixed-rate term, your interest will go up or down once per year. Youll find five-year or seven-year ARMs at Quicken and Rocket.

Federal Housing Administration loan: An FHA loan helps those with limited down payment funds and lower credit scores qualify for a home loan. Quicken states that credit scores as low as 580 may qualify for a loan, but it will depend on your situation. Your options include 30-, 25-, 20- and 15-year fixed-rate terms as well as five-year ARMs. If you qualify, you can buy a home with as little as 3.5% down.

Refinance: Rocket Mortgage has refinancing options for a conventional refinance.

Don’t Miss: What Is The Most Accurate Mortgage Calculator