How Long Have They Been In The Industry

While everyone starts somewhere, there is a learning curve when it comes to buying real estate notes.

A learning curve you dont want to be a part of.

When choosing a note buyer, find one that has been in the industry for several years.

They have already had their learning experiences, leaving them with the expertise needed to set up a successful deal.

How To Find Mortgage Notes With Little To No Budget & Get Them To Say Yes To Your Offers

Tara MastroeniPublished: October 27, 2014 | Updated: December 11, 2021

For note brokers without a budget, effectively marketing your note business and getting the property seller to yes to your note offer can be difficult tasks. However, even if you are just starting out and dont have a budget, there are many ways to successfully find sellers and accomplish these goals.

Youre always going to have an investment of some sort, says Abby J. Shemesh, founder and managing partner of Amerinote Xchange. Its either going to be the time that you put into it or money that you can invest into the advertising of your business.

Mr. Shemesh has worked in the note buying and note brokerage industry for over a decade. Over the course of his career, he has learned the best ways to find notes without a budget and how to get property sellers to sell their mortgage notes. He recently shared his experiences and expertise in the note brokerage industry at the Paper Source Note Symposium in Las Vegas . There he shared the ins and outs of finding property sellers, reaching out to leads, and closing deals.

Here are some of the best ways to find notes and close sales without any budget from Mr. Shemesh:

To view a full video presentation on this subject, please feel free to watch below, or read the bullet points below.

If you have any questions or you want to Broker a Note With Us, please contact Amerinote Xchange.

Contact Us for a Quote

Search Leads To Find Buyers On Linkedin

The other thing you can do is look for leads and this is going to give us individual results for individual people. Again, Im going to start with acquisitions.

As mentioned above, accounts are organizations and leads are people.

These people would like to hear from you if you are finding deals that would apply to them, it is in no way an imposition for you then to reach out to them about the sorts of deals that youre turning up.

Now heres what I recommend you do because if you look at the image above, weve got 2,595 total results, 106 of whom have changed jobs in the past 90 days.

What that means is that if theyve just changed jobs, these are people who are probably looking to look good, looking to get a name for themselves at their new company and if youre going to show up and bring real deals to them, especially if youre bringing deals direct from lenders, like commercial note deals, yours is going to be a very welcome call.

You dont have to get too tricky about this.

Someone who says hes director of acquisitions and says hes looking for self storage and theyre in the area that Im shopping in. Well, just reach out to them directly.

Connect with them on LinkedIn and say

Hey, I noticed that youre in acquisitions for XX. Id like to understand a little bit more about your acquisition criteria because I am turning over deals like this, because Im doing this kind of prospecting on a regular basis.

Dont overcomplicate what youre saying to acquisitions folks

Read Also: Chase Recast Calculator

Determinants Of Mortgage Type

For the most part, it is the mortgage note which determines the “type” of mortgage:

- if the note has a fixed interest rate and payments, then the loan is a fixed-rate mortgage loan

- a fixed interest rate with adjusting payments is a Graduated Payment Mortgage

- a floating interest rate and payment amount indicates an adjustable-rate mortgage

- an amortization schedule longer than the maturity date indicates a balloon payment mortgage

- when the payment schedule calls only for interest and no principal, thus leaving behind the full principal due at maturity, the loan is an interest-only loan

- a payment adjustment frequency less than the interest rate adjustment frequency implies a mortgage which allows for negative amortization

Ways To Find Mortgage Notes On A Low Marketing Budget

Tara MastroeniPublished: September 21, 2016 | Updated: December 10, 2021

It seems like circular reasoning. To be a highly successful mortgage note investor, you need to market your services to generate leads. However, in order to pay for marketing campaigns that produce the best results, you need significant investment capital. To get the funds, you need to market your services to generate leads, and so on.

If youre just starting out, how can you go about finding mortgage notes for sale on a low budget? Here are some strategies for success.

In a recent interview with DailyProperties.com, founder and CEO of Amerinote Xchange Abby Shemesh, helped answer this question by listing five lead generation strategies you can use to build your note buying business and eventually position yourself to pay for marketing that takes your company to the next level.

2. Attend Real Estate Business Events

When youre finding mortgage notes for sale, another way to generate leads is to attend local real estate industry events, such as mortgage broker conventions and real estate law and finance meetings. Network with mortgage brokers, real estate attorneys, and other industry professionals whose clients may own mortgage notes that they wish to liquidate for a lump sum.

When you attend real estate events, its a good idea to distribute printed materials that explain your note buying business and articulate why note holders should use your services as note buyers.

About Amerinote Xchange

You May Like: Recasting Mortgage Chase

How To Send A Written Request For Qualification Of Loan Modification

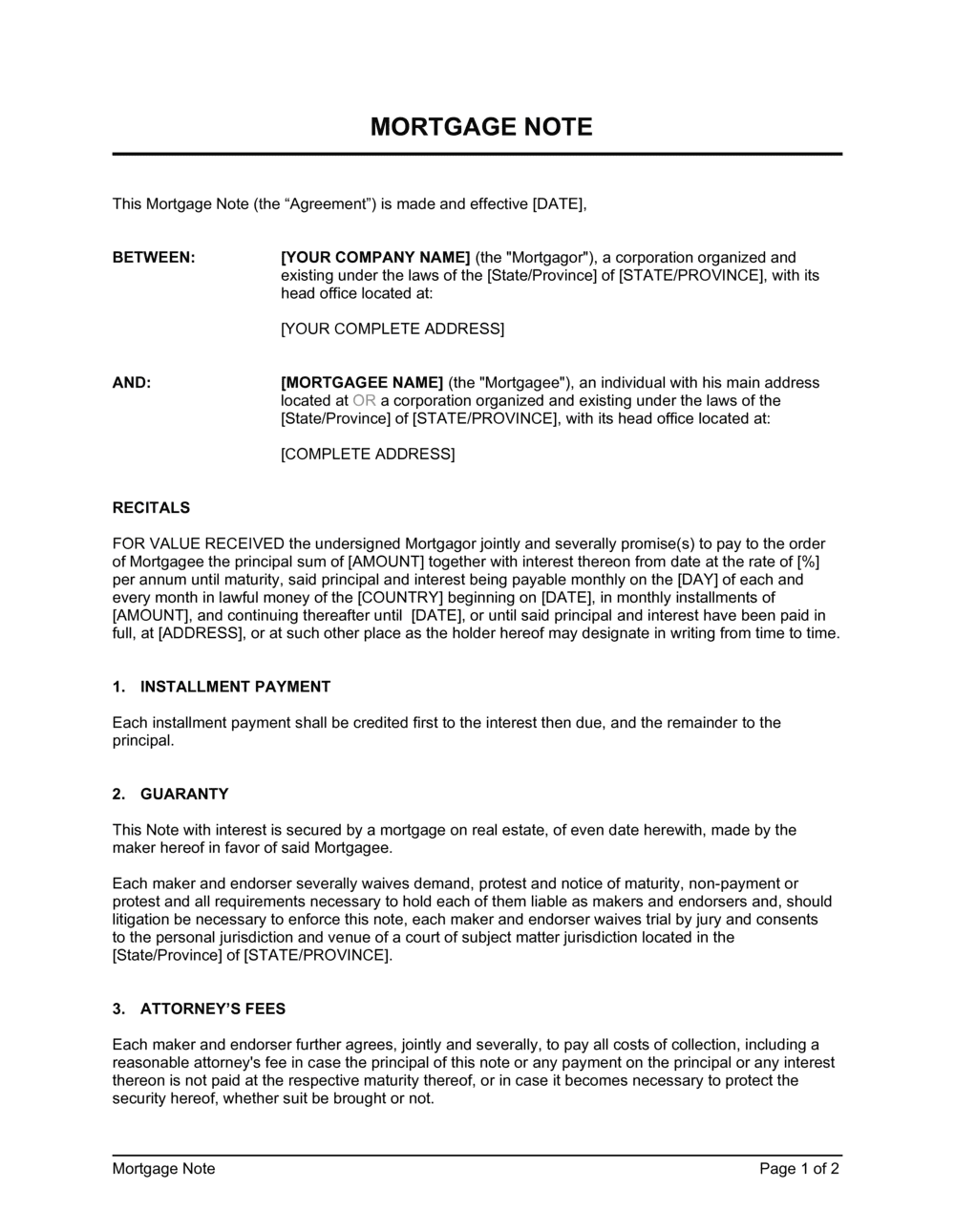

A mortgage promissory note is the agreement you sign at a mortgage closing which obligates both you and your lender to abide by the terms set out in the agreement. At a typical closing, three copies are usually signed: one for the lender’s records, one for your records and one that is to be recorded at your local registry of deeds. If you need additional copies of your mortgage note, there are a couple different ways to get them.

Mortgage Notes And Deed Of Trust

In some state, mortgages are called deeds of trust.

The two operate essentially the same way, but while mortgages have mortgage notes, which name two parties â borrower and lender, deeds of trust have a separate promissory note that names three parties âborrower, lender, and trustee.

When you take out a mortgage, you hold the property title. The mortgage note, filed with the local government, ensures that if you donât pay, the lender can sue you through the court system to start foreclosure. This is called judicial foreclosure.

If you have a deed of trust, instead of you holding the property title, the trustee hold the title until the loan is repaid. If you donât pay, the trustee may start the foreclosure process without going through court. This is called non-judicial foreclosure.

Get your finances right, one money move at a time. Sign up for our free ebook.

An ebook to e-read while youâre e-procrastinating everything else. Download âFinance Your Futureâ today.

Get your copy

Don’t Miss: Mortgage Recast Calculator Chase

What Are The Expenses Of Owning A Mortgage Note

Expenses are rather low with mortgage notes, especially compared to rental property.

Most people hire a third-party servicing company to handle the loan. The servicing company keeps records of the payment history, can collect payments on your behalf, provides the borrower with their balance and statements, and separates the interest and principal received in each payment.

While you can service a loan yourself, this industry is heavily regulated. To keep your risk mitigated, we suggest paying the low monthly cost, which can range from $20 to $40. The servicer can deduct the fee from the buyer’s mortgage payment, making it even easier.

Nonperforming loans have more costs associated with them. There are legal fees involved with regaining the title, as well as securing and maintaining the property.

Additionally, the borrowers may not have paid their taxes or insurance in several months or years — those payments become the responsibility of the bank or noteholder.

Experienced note buyers factor these costs into their offer price and know exactly how much they expect to spend.

Sale Options When Selling A Mortgage Loan

How to sell mortgages? There is a wide range of options available to sellers who decide to take their debt instrument to market:

Read Also: What Does Gmfs Mortgage Stand For

How To Find Buyers On Linkedin

In todays market you should have no problem finding buyers for your deals. The world is teeming with cash as I write this. When that changes Ill update this post

In this video, I show you how to use LinkedIn to find buyers for your commercial notes or for really any other types of assets that youre looking to sell.

If you just getting started, then you probably dont have your own capital to do the sorts of acquisitions that youd like. And so the next best thing to that is fee income.

What that means is that youre going to go out and youre going to find deals and then either partner in them and write yourself into a little piece, carve off some for yourself or, finally, get fees for brokering the assets.

This is true whether youre talking about notes or real estate. Lets just dive in!

If you dont have LinkedIns Sales Navigator, I highly suggest that you go ahead and upgrade your LinkedIn membership for it. If you can possibly afford it, then you should definitely sign up for Sales Navigator. Its a much more powerful tool, and LinkedIns been really kind of cracking down more and more on free and making it so that you have to pay in order to get sort of the good tools. So you may as well just go ahead and do that if youre serious about your business.

What Happens When Someone Is On The Deed But Not The Mortgage

Generally, your name is on the deed to the home, then you you own an interest in it. The bank cannot foreclose since you did not transfer your interest to the bank. This means that you still own your share of the home. … The lender would only have the interest of the person who signed the mortgage .

Don’t Miss: Who Is Rocket Mortgage Owned By

What If The Borrower Prepays

If a borrower makes early payments in addition to their monthly payments, they may have to pay penalties. These penalties can differ among states. People choose to prepay so that they can pay off their mortgage early or make lower interest payments.

Be sure to investigate your state and local laws to understand if there are laws prohibiting loan prepayment penalties. It may not make financial sense to make early payments or prepay your mortgage.

Why Sell Your Mortgage Note

Many lenders have various reasons to sell a mortgage they own on the secondary market. Their motivations are certainly different but the end result is one in the same.

For a private corporation or individual lender that holds a mortgage note, the reasons for selling usually fall under one or more of these categories:

- To alleviate a imminent financial necessity

- To recycle capital into a new investment with a higher rate of return

- To relieve collection concerns and chasing payments from borrowers

- Receive medicaid approval for senior living facility

- Lifestyle change such as a new home or luxury purchase

- To mitigate against bankruptcy or foreclosure concerns that may arise

- To exit a capital partner out of a business relationship

Recommended Reading: Rocket Mortgage Qualifications

Hedge Funds And Private Equity Funds

Hedge funds and private equity funds pool money from investors, letting them amass the millions of dollars of purchasing power needed to directly buy a group of loans from a lender. Most funds have a set strategy for their notes, so they sometimes sell loans that dont fit their parameters on the secondary market.

What Is The Difference Between A Mortgage Note And A Promissory Note

Even though a promissory note and a mortgage note are often considered the same, that is not always the case.

A promissory note is a document that outlines the terms to pay back the lender/lending institution. It includes things like the interest rate and method of payment.

These two documents will often accompany each other. However, these two documents are not too different from one another.

There you have it. Now you have a better idea of what this important document is, what it does, and what makes it different from a promissory one.

Hopefully, all of this information has helped you gain more insight into what these legal documents are so you can recognize them when youre buying your very first home.

Recommended Reading: Rocket Mortgage Requirements

What Is The Difference Between A Note And A Loan

What is the difference between a Promissory Note and a Loan Agreement? Both contracts evidence a debt owed from the Borrower to the Lender, but the Loan Agreement contains more extensive clauses than the Promissory Note. Further, only the Borrower signs the promissory note while both parties sign a loan agreement.

Buying A Performing Mortgage Note

Lets say you find a private mortgage note that the seller needs to get rid of. The note is secured by a mortgage on a single-family home. The property originally sold for $150,000 and the borrower put down $15,000. That means the original loan was for $135,000. The note is a 5% fixed-rate 30-year loan, making the borrowers payment each month $724.71.

The borrower has been paying the loan for seven years and is current. So, at the time you’re evaluating the note, the unpaid balance is $118,725.68. There are still 276 months left.

You decide you’ll only buy this note if you can receive a 10% return on your money, or a 10% yield to maturity, so you offer $78,162. Thats $40,563 less than the current unpaid balance, or a 34% discount to the face value of the note.

This may seem like a big loss, but the seller gets $78,162 immediately and has already collected $60,875 in principal and interest to date. If the seller takes the cash now, he or she is essentially collecting $146.97 less per month from the borrower’s P& I payment over the remaining 23 years.

If the seller needs the cash, they may accept that offer. In that case, you receive a nice 10% internal rate of return and a passive $724.71 of cash flow each month, provided that note keeps performing for the remaining 23 years.

Recommended Reading: How Much Is Mortgage On A 1 Million Dollar House

How To Buy A Mortgage Note From The Bank

Steve Byrne is founder of EquiSource and has been in commercial real estate investment, management and finance for nearly 40 years.

getty

Investing in mortgage notes is an appealing alternative to purchasing properties outright and becoming a landlord. However, unlike a hard real estate purchase, you dont own the property when you secure a mortgage note. Instead, you become the borrowers new creditor by taking the banks place in the transaction.

If you are looking for passive income without purchasing a physical property, mortgage notes can be an ideal real estate investment. You will receive a monthly income in the form of principal and interest repayments on the underlying mortgage. Depending on your long-term strategy, you have the option to hold the note until maturity or resell it in the secondary market.

What is a mortgage note?

A mortgage note is simply a promissory note used exclusively in real estate transactions. As the name suggests, it represents the borrowers promise to the note holder that they will repay the obligation. These mortgage notes are typically not listed in the public record but are nonetheless legally binding documents.

Once the borrower signs the required documentation and provides the note, the lender holds the paper until the borrower makes the final loan repayment. However, while the loan remains outstanding, the lender can sell the note on the secondary market.

The Lse Alumni Turning Their University Into A Startup Powerhouse

Mortgage notes can be structured in several ways but are usually broken down into the following categories:

Secured: This means an asset of some value collateralizes the loan. In the case of a mortgage note, the asset is the property. If a borrower is unable to fulfill their repayment obligations, the note holder acquires the property.

Unsecured: There is no collateral posted. These notes typically come at a cheaper price because of the higher inherent risk.

Private loan: This is a note agreed to between the borrower and a private investor. A borrower typically chooses a private investor in lieu of a traditional loan when they have a low credit score or history of non-payments. In these cases, private lenders will ask for a higher interest rate for taking on the added risk.

Institutional loan: This is a standard loan made by a financial institution such as a bank or credit union.

Understand the process of buying a mortgage note.

Once you are aware of how a mortgage note works, you will need to learn how to buy a mortgage note from the bank. Follow this process below and keep in mind some key tips to be successful.

1. Determine your objective.

Before approaching a bank, you should have a real estate investment plan already in place. First, you need to determine your risk tolerance and whether you plan on flipping or holding onto the mortgage note.

2. Find a note to buy.

3. Review the tape.

4. Skip customer service if possible.

5. Determine your bid price.

Recommended Reading: Reverse Mortgage On Condo