What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Your Maximum Monthly Debt Payments

Finally, your total debt payments, including your housing payment, your auto loan or student loan payments, and minimum credit card payments should not exceed 40% of your gross monthly income. In the above example, the couple with $80k income could not have total monthly debt payments exceeding $2,667. If, say, they paid $500 per month in other debt , their monthly mortgage payment would be capped at $2,167.

This rule means that if you have a big car payment or a lot of credit card debt, you wont be able to afford as much in mortgage payments. In many cases, banks wont approve a mortgage until you reduce or eliminate some or all other debt.

How Much House Can I Afford Based On My Income

To calculate how much house can I afford, a good rule of thumb is using the 28%/36% rule, which states that you shouldnt spend more than 28% of your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans like auto and student loans.

Don’t Miss: Do Mortgage Lenders Work On Saturdays

Find Your Home Buying Budget

Its definitely possible to buy a house on $50K a year. For many borrowers, lowdownpayment loans and down payment assistance programs are making homeownership more accessible than ever.

But everyones budget is different. Even people who make the same annual salary can have different price ranges when they shop for a new home.

Thats because your budget doesnt just depend on your annual salary, but also on your mortgage rate, down payment, loan term, and more. Heres how to find out what you can afford.

In this article

How Much Of A Mortgage Can I Afford Based On Monthly Payment

To calculate how much house can I afford, a good rule of thumb is using the 28%/36% rule, which states that you shouldnt spend more than 28% of your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans like auto and student loans.

Read Also: What Will Be My Mortgage

Can I Buy A House With 10k

Conventional mortgages, like the traditional 30-year fixed rate mortgage, usually require at least a 5% down payment. If youre buying a home for $200,000, in this case, youll need $10,000 to secure a home loan. FHA Mortgage. For a government-backed mortgage like an FHA mortgage, the minimum down payment is 3.5%.

How Can I Drop An Ltv Band

To drop a loan-to-value band youll need to secure a larger deposit or increase your equity, which will allow you to secure a smaller mortgage in relation to the value of your property. If you cant afford a larger deposit, the only other way to secure a lower LTV is to buy a cheaper property, which would mean your deposit takes up a higher proportion of the propertys value and would reduce your LTV accordingly.

Also Check: Is Quicken Loans A Mortgage Company

What Income Do You Need To Get A 250k Mortgage

In the past, mortgage lenders tended to use quite a basic formula to decide how much they were prepared to lend to a potential house buyer, which was mostly based on a standard income multiple. This means they would simply take your income and multiply it by 3-4 times to give a maximum figure. However, since the Mortgage Market Review in 2014 a focus has been put on affordability and stress testing. Lenders now take a more sophisticated approach, taking into consideration your existing financial commitments, spending habits, as well as whether you could afford the repayments if interest rates by a significant amount – around 3% – during the lifetime of the loan.

However, while lenders take a more holistic approach to considering your mortgage application, your income still plays a key part in determining how much you are likely to be allowed to borrow. The multiple varies from lender to lender, but tends to be between 4-4.5 times income. This means to secure a £250,000 mortgage, you would need to be earning between £55,556 and £62,500, either solely or together with another applicant for a joint mortgage.

Some lenders are prepared to offer higher income multiples, particularly for first-time buyers or for those in certain professions that have a clear salary rise trajectory, such as a doctor or solicitor. For details of the lenders that offer higher income multiples and the criteria they impose, read our article “How much can I borrow on my my mortgage?“

What Are Hoa Fees

Homeowners association fees are common when you buy a condominium or a home thats part of a planned community. Generally, HOA fees are charged monthly or yearly. The fees cover common charges, such as community space upkeep and building maintenance. When youre looking at properties, HOA fees are usually disclosed upfront, so you can see how much the current owners pay per month or per year. HOA fees are an additional ongoing fee to contend with, they dont cover property taxes or homeowners insurance in most cases.

Read Also: Who Should You Get A Mortgage From

How Does Income Affect Your Mortgage Application

Income is one of the main considerations for mortgage providers because its a good indication as to whether your salary will allow you to keep up with your mortgage payments.

Lenders calculate affordability by looking at your monthly income against your outgoings to find your debt-to-income ratio. The lower the ratio the higher your creditworthiness is likely to be rated, because it means you have more disposable income available to pay off a mortgage.

Can I Buy A House With 20k Income

The DTI is the total house payment including taxes, insurance and mortgage insurance if any, plus any debt payments, divided by your gross monthly income. Lenders can approve conventional loans with a DTI up to 50%. You have no debt and a 3% down payment. Youll qualify for a home of about $200,000.

Also Check: What Are The Home Mortgage Rates

Can I Offer Less Than My Pre

Anyone can make an offer, preapproval letter or no. But your offer is likely to be taken much more seriously by the seller and real estate agent if you have one. Indeed, the seller might accept a lower offer with a preapproval letter than from someone with only a prequalification letter or no letter at all.

How To Use The Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be.

As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income.

So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

Read Also: How To Apply For A 2nd Mortgage

How Much Can I Borrow For A Mortgage Based On My Income

Prior to 2014 lenders would use an income multiplier to help decide how much you could borrow on a mortgage. Now lenders need to show that the mortgage is affordable and that you could continue to pay your mortgage should there be a rise in interest rates, or you have a significant change in circumstances such as losing your job or having a child.

Lenders also have regulatory restrictions that limit their new lending above 4.5x salary to a maximum of 15% of all new mortgage loans. This means lenders can be very specific in deciding exactly which borrowers they want for these mortgage deals.

To find out more take a look at our What are mortgage affordability checks guide.

Can I Include Overtime Payments When Calculating How Much I Can Borrow For A Mortgage

This depends on both how regular your overtime is and the attitude of the lender concerned. Some lenders will not consider any additional income you may receive through overtime, while others may accept all or 50% of this income. Any earnings from overtime to be included as part of your mortgage application will need to be regular or guaranteed and be evidenced.

If however overtime is something you only get occasionally then the lender may not take it into account at all. This is where a mortgage broker can help they will know which lenders are more likely to accept overtime as part of their income calculations.

Recommended Reading: How To Read A Mortgage Loan Estimate

Dont Overextend Your Budget

Banks and real estate agents make more money when you buy a more expensive home. Most of the time, banks will pre-approve you for the most that you can possibly afford. Right out of the gate, before you start touring homes, your budget will be stretched to the max.

Its important to make sure that you are comfortable with your monthly payment and the amount of money youll have left in your bank account after you buy your home.

Can I Buy A House With No Savings

A no-down-payment mortgage allows first-time home buyers and repeat home buyers to purchase property with no money required at closing, except standard closing costs. Other options, including the FHA loan, the HomeReady mortgage, and the Conventional 97 loan, offer low down payment options with a little as 3% down.

Also Check: How Does The Interest Work On A Mortgage

Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

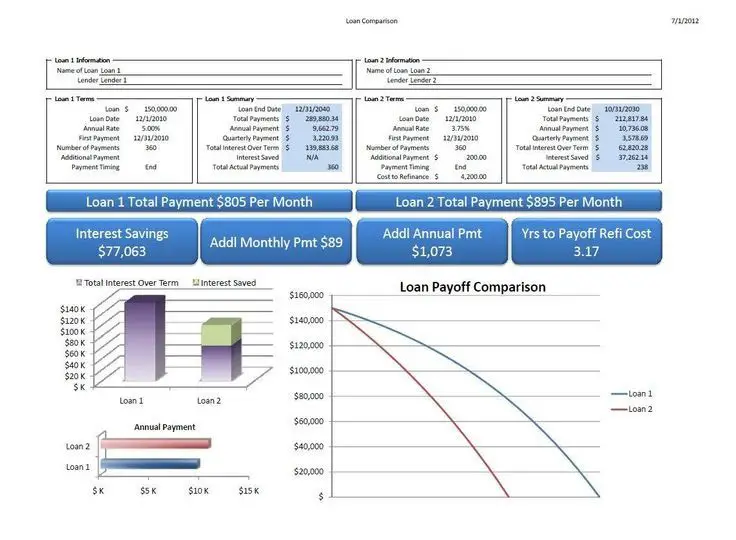

Amortization Schedule On A $250000 Mortgage

An amortization schedule spells out the annual principal and interest costs for each year of a home loan and can be a good way to gauge the long-term costs of financing your house.

As the examples below show, your monthly mortgage payments go mostly toward interest at the beginning of your loan and more toward principal further into your term.

Heres what an amortization schedule for a 30-year, $250,000 loan looks like, assuming a 4% APR:

| Year |

|---|

| $0.00 |

Read Also: How To Sell A Mobile Home With A Mortgage

How Much Will A 250000 Mortgage Cost

If you get a mortgage for £250,000 the cost can vary depending on the type of mortgage you take out. If you have a fixed rate mortgage, you will be paying the same amount each month, no matter what happens. However, if you take out a variable rate mortgage, your monthly payments can fluctuate.

With fixed rate mortgages, you agree an initial interest rate usually for a period of between 2 and 5 years and then after this, you would revert to a higher rate unless you then arrange a new mortgage with a lower interest rate.

As well as being able to get a mortgage with a good interest rate, the length of mortgage term will also have a huge impact on how much you will be paying each month. People often choose to take a mortgage over a longer period to make it more affordable, as the loan is spread out over a longer time.

If you want to quickly clear your mortgage without making overpayments, you would need to take out a shorter mortgage term. The difference in the overall costs between a 25 and 30-year mortgage would be significant, so you have to weigh up whether you would rather pay less each month or pay less interest over the term.

For example, if you have a mortgage of £250,000, on a 2% interest rate you would pay £1,060 per month over 25 years but if you were to have the same interest rate over 15 years, it would be a monthly payment of £1,609.

How Much Income Do I Need For A 250k Mortgage

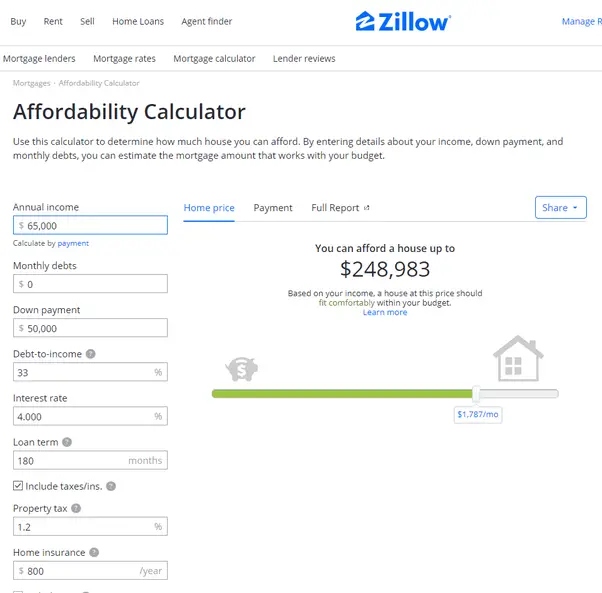

You need to make $76,906 a year to afford a 250k mortgage. We base the income you need on a 250k mortgage on a payment that is 24% of your monthly income. In your case, your monthly income should be about $6,409.

You may want to be a little more conservative or a little more aggressive. Youre be able to change this in our how much house can I afford calculator.

Recommended Reading: Are Mortgage Discount Points Worth It

Increasing Your Down Payment Can Afford You More

If you are able to increase your down payment to 20% you wont have to pay mortgage default insurance and your monthly payments will decrease allowing you to afford more. There are other ways to increase your down payment that we discuss in our Step-by-Step Guide to Saving for a Down Payment.

Ways you can increase your down payment:

- Using the Home Buyers Plan, which allows first-time home buyers to loan themselves funds from their RRSPs

- Using funds from your Tax-Free Savings Account

- Getting a gifted down payment from the bank of Mom & Dad

Be sure to use our Mortgage Affordability Calculator along with the Gross Debt and Total Debt Service equations from above to help you with your budget. When youre ready, book a call with us to discuss your unique financial situation so we can take you one step closer to homeownership!

How Much Do I Need To Earn To Get A Mortgage Of 250000

So, how do you roughly calculate how much income is needed get a £250k mortgage, taking into consideration the standard lender caps?

Supposing you earn an annual salary of £85,000 just over 3x your combined earnings equals £255,000, which should theoretically open you up to a wide choice of mortgage lenders because your income falls within the bracket the majority of lenders will consider.

If on the other hand, you earn £45,000 per year, you would need to find a provider that is willing to loan you nearly 6x your income, which is more difficult to come by.

This table will give you an idea as to how much you may be eligible to borrow based on typical income lender caps:

| Income | |

|---|---|

| £425,000 | £510,000 |

The above table is for demonstrative purposes only and we recommend you contact your lender or broker for the most up-to-date information.

Don’t Miss: What Factors Go Into Mortgage Approval

How Much Would A 20% Down Payment On A Home Cost

There are many additional fees that are associated with purchasing a home. Be sure to budget for these types of costs when making your purchase decision. A down payment of less than 20% often requires PMI which will increase your monthly payment. For a $250,000 home, a 20% down payment would be $50,000.

How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

Also Check: Is Closing Cost Part Of Mortgage

Save Enough Down Payment

Besides checking your income, debts, and credit score, its important to prepare enough down payment. Ideally, financial advisors recommend paying 20% down on your homes value. This eliminates PMI cost and substantially reduces your principal loan amount. For example, in , the U.S. Census Bureau announced that the median sales price for home sales was $330,600. If this is the price of your house, you must prepare a down payment of $66,120.

In practice, however, a 20% down payment is too hefty for most borrowers. Credit reporting agency Experian reported that the average down payment for homebuyers in 2018 was 13%. Meanwhile, those who bought houses for the first time only made a 7% down payment, whereas repeat buyers paid 16% down.

Though paying a 20% down payment may not be required, its still worth making a large down payment on your mortgage. Here are several benefits to paying 20% down on your home loan.

Factor in the Closing Costs

Closing costs are fees charged by lenders to process your mortgage application. This typically ranged between 2% 5% of your loan amount. For example, if your loan is worth $320,000, your closing costs can be anywhere between $6,400 to $16,000. This is a large sum, so be sure to include it in your budget. But the good news is closing costs can be negotiated with lenders. So make sure to talk to them about reducing your fees.