Low Mortgage Rates Mean A Lower Mortgage Payment

Most notably, low mortgage rates can give you a lower monthly payment than youd typically see when purchasing a home. Heres an example: Taking out a $200,000 mortgage loan at a 2.87% interest rate would run you around $829 per month .

On a loan with 2018s average rate of 4.54%? Youd pay $1,018 per month almost $200 more.

What Is The Cheapest Mortgage For First

In general,interest rates are highest for buyers with a deposit of between 5% and 10%, as there are fewer lenders willing to accept customers at the riskier end of the market.

For first-time buyers with a 10% deposit, the cheapest rate is 1.23% for a two-year fix with Dankse Bank .

For those with a 40% deposit, the cheapest rate is 0.99% from Progressive Building Society .

Those with a 25% deposit will find the cheapest rate is also with Progressive, at 0.99%. Yorkshire Building Society offers the next-cheapest rate 1.12% for a two-year fix with a product fee of £1,495.

Aside from comparing interest rates, it is important to look at mortgage fees some deals charge upfront or exit fees, while others dont.

It is often the case that headline-grabbing low rates also come with the highest fees, which can make a significant difference to the overall amount you pay over the term of the deal.

If you are looking for help to get on the property ladder, check out whats the best ISA for first-time buyers.

Typical Ontario Mortgage Amounts

Finding the right mortgage has a lot to do with determining what you can afford. And that depends on where you live.

Below are typical mortgage amounts for someone putting down 20% in select Ontario cities. Theyre based on a 30-year amortization and average purchase prices as tracked by the Canadian Real Estate Association :

- Barrie and District: $570,800

| 2,130 | 0.10% |

Thanks to Ontarios stable economy and housing market, it tends to have lower arrears rates than other provinces.

Don’t Miss: How To Get Preapproved For A Mortgage With Bad Credit

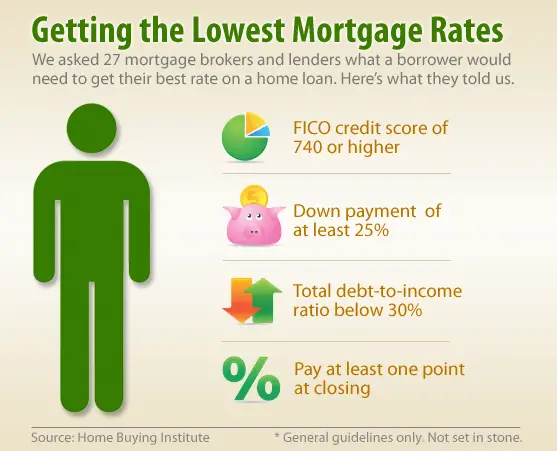

How Do You Qualify For The Best Mortgage Rates

Getting the best mortgage rates requires five main things:

How Does The Loan Term Impact My Mortgage

When picking a mortgage, it’s important to consider the loan term, or payment schedule. The loan terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are the same for the life of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only the same for a certain amount of time . After that, the rate fluctuates annually based on the market interest rate.

One thing to take into consideration when deciding between a fixed-rate and adjustable-rate mortgage is how long you plan on living in your home. For those who plan on staying long-term in a new house, fixed-rate mortgages may be the better option. While adjustable-rate mortgages might offer lower interest rates upfront, fixed-rate mortgages are more stable over time. If you don’t have plans to keep your new house for more than three to 10 years, however, an adjustable-rate mortgage might give you a better deal. The best loan term is entirely dependent on an individual’s situation and goals, so make sure to take into consideration what’s important to you when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

Don’t Miss: How 10 Year Treasury Affect Mortgage Rates

Factor: Mortgage Vs Refinance

Mortgages on refinances, for example, usually cost more than mortgages for purchases. Thats because refinances are deemed higher risk and because refinances cannot be default insured.

Jargon Buster:Default insurance protects the lender in case you dont pay your mortgage. Insurance is either:

- Optional , or

- Mandatory .

Mortgage Rates By State

Real Estate Economist and Associate Dean in Florida Atlantic University’s College of Business

With mortgage rates near historic lows, what can homebuyers do right now to ensure theyre getting the best deal when purchasing a home?

Individuals should begin their mortgage search before they begin their home search. This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly.

What causes mortgage rates to rise or fall?

Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board’s response to COVID-19 in efforts to keep financial markets open. When it begins to taper significantly, mortgage rates will rise.

Should current homeowners consider refinancing with rates that are this low?

Also Check: Chase Recast Calculator

Conforming Vs Jumbo Loans

Conforming loans are for amounts that fall below Fannie Mae and Freddie Macs established limits. Jumbo loans exceed that limit, which is $548,250 for a single-family home in 2021.

Jumbo loans are generally more difficult to get and come with higher interest rates. But if your dream house is $600,000, youll likely need a jumbo loan.

Posted Rates Vs Best Rates

When comparing bank mortgage rates, itâs important to know that these rates represent the banks’ posted mortgage rates. The posted rate is simply the rate that the bank is advertising in public. However, banks are often able to offer even lower rates, in order to secure a borrower’s business. You may be able to access these discounted rates through negotiation, or by reaching out to a representative mortgage broker. Some banks offer rates several percentage points below what is posted, so it’s worth taking the time to see if you can get a better offer.

Read Also: Reverse Mortgage Manufactured Home

Factor: The Home Value

Home values under $1 million often fetch better rates. Thats because:

- theres less competition for $1 million+ mortgages

- theres no way to default insure them , and

- there are fewer ways to raise capital for such super-jumbo mortgages.

As a result, those loans cost incrementally more.

Rate Tip: Your home value is always confirmed with an appraisal or the lenders automated valuation tool.

Impact On Monthly Payment

Suppose you started the home search process when interest rates were 4%. You saw a one-bedroom condo for sale for $100,000. You calculated your 30-year monthly mortgage payment on $80,000the amount you would be mortgaging after a 20% down payment and your closing costs. Your monthly payment would be $382.

You decide you can do better than this payment and rate, so you wait six months and the interest rate drops to 2%. However, a condo in the neighborhood you want now costs $120,000. You put down 20% plus closing costs, and you are left with a mortgage of $96,000. Your monthly payment on a 30-year mortgage is $355. Your payment dropped by $27. A mortgage calculator can show you the impact of different rates on your monthly payment.

If real estate prices had not risen in your prospective neighborhood from the $100,000 price point with which you started and you had snagged a 2% interest rate, your monthly mortgage payment would have been $296. You can gather the following pieces of information to put into a mortgage calculator to see what your payments would be.

Recommended Reading: Rocket Mortgage Loan Requirements

Is Renting The Answer

Renting has its advantages, like not having to pay property taxes or homeowners insurance, especially if youre not yet committed to where you want to live longterm.

But its similar to leasing a car, according to Meyer. You pay every month to own nothing at the end of the day.

With the supply of available forsale listings so low and purchase prices continuing to climb, rent prices are also surging.

Now, the average renter faces even larger monthly costs and a higher rate of appreciation than homeowners.

Redfin found the average monthly rent grew to $1,985 in November, up 6.8% monthly and 20.5% annually. Comparatively, borrowers who put 5% down had a median payment of $1,551, which grew 1.1% from October and 19.9% from the year prior.

| Rental market summary |

| 19.9% |

With housing costs growing at such a rapid rate, inflation reached 6.8% in November and hit its highest level since 1982.

Many consumers were priced out of the forsale marketplace and then turned to the rental market. That heightened demand and the anticipated elevated inflation rate will push up rent prices and could make it more financially challenging than buying.

First inflation came for the forsale housing market, and now it is coming for the rental market, said Fairweather.

Anyone who bought a home before this year can pat themselves on the back because their mortgage payments are fixed, meaning their biggest recurring expense is immune to inflation.

Today’s Mortgage Rates Move Lower

The interest rate on a 30-year fixed-rate mortgage decreased to 3.627% today, down 0.086 percentage points from yesterday. Thirty-year refinance loans are also seeing lower rates, coming in at 3.76%.

Mortgage rates remain low historically speaking. For borrowers with good to excellent credit planning on buying a house or refinancing their home loan, low rates and affordable monthly payments are available.

- The latest rate on a 30-year fixed-rate mortgage is 3.627%.

- The latest rate on a 15-year fixed-rate mortgage is 2.558%.

- The latest rate on a 5/1 ARM is 2.307%.

- The latest rate on a 7/1 ARM is 3.652%.

- The latest rate on a 10/1 ARM is 3.616%.

Money’s daily mortgage rates reflect what a borrower with a 20% down payment and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Freddie Mac’s weekly rates will generally be lower, since they measure rates offered to borrowers with higher credit scores.

Don’t Miss: Can You Refinance A Mortgage Without A Job

Will Mortgage Rates Go Up In 2022

The Federal Reserve has been aggressively buying assets, including mortgage-backed securities, to help the US economy during the COVID-19 pandemic. This has been one factor keeping mortgage rates low.

In early November, the Fed announced that it will begin tapering asset purchasing. Then it said in December that it will be tapering purchasing at twice the speed than it originally predicted, and it plans to increase the federal funds rate three times in 2022.

Average mortgage rates have ticked up a little recently, and the Fed’s announcements indicate that mortgage rates could continue to gradually increase in 2022. You may want to lock in a low mortgage rate if you’re worried about rates going up this year.

What Affects Your Mortgage Rate In Canada

There are a few different types of mortgage interest rates in Canada: Fixed interest rates, variable interest rates, or a hybrid combination of the two. These mortgage rate options will affect how your interest rate changes over time. Your mortgage rate will also be affected by certain factors that your mortgage lender will look at.

Read Also: Rocket Mortgage Qualifications

How Are Mortgage Rates Determined

In general, mortgage rates are determined by economic factors. These include the Federal Reserve benchmark interest rates and the job market. Mortgage rates aren’t directly tied to Fed rates, but they tend to trend in the same direction. If the job market is poor and fewer people are working, rates will drop to attract buyers.

Lenders then look at factors like credit score and history, income, and total debts to determine what mortgage rate to offer specific borrowers.

Qualifying For A Lower Mortgage Rate

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

Read Also: Rocket Mortgage Requirements

The Latest Rates On Adjustable

- The latest rate on a 5/1 ARM is 2.307%.

- The latest rate on a 7/1 ARM is 3.652%.

- The latest rate on a 10/1 ARM is 3.616%.

The interest rate on adjustable-rate mortgages will be fixed for a number of years before it becomes variable and starts resetting regularly. A 5/1 ARM, for instance, will have a fixed rate for five years before it starts changing every year. An ARM could be a good option if you don’t plan on staying in the home long-term or are planning on refinancing, as the initial interest rate tends to be very low. However, once the rate becomes adjustable, the rate could see a big increase.

How Can You Apply For A Mortgage Rate

If youre asking yourself, What mortgage rate can I get? your best bet is to evaluate your finances and apply for a mortgage. Before you apply for a mortgage rate, ask yourself these questions:

- What can you afford monthly?

- Could you adapt if mortgage rates rise?

- What is the current trend of rates, and will that continue?

- How long will you live in the home you purchase?

- Where will you be living?

With those questions, you can help yourself eventually choose what type of loan is best for you. Since that and other factors weve mentioned before impact your mortgage rate, expect to provide financial information as you seek what a lender can offer you.

You May Like: Rocket Mortgage Vs Bank

How Historical Mortgage Rates Affect Home Purchases

Lower mortgage interest rates encourage home buying. Low rates mean less money paid to interest. This translates to a lower payment. Mortgage lenders determine how much you can borrow by comparing your income to your payment. With a lower monthly payment, you may be able to afford more house.

Even if rates slightly rise, an adjustable rate mortgage can still offer extremely low mortgage rates. The interest rates on ARMs adjust over a period of time. You may be able to get into a lower rated ARM now, then change the loan before it adjusts. Talk to your lender about the possibility of converting your ARM to an FRM if rates go lower.

Open Vs Closed Mortgages

If youâre wondering whether to get an open or closed mortgage, the answer is, while an open mortgage may make sense in certain circumstances, the overwhelming majority of Canadians opt for a closed mortgage. While open mortgages have extra flexibility that you might need, closed mortgages are by far the more popular choice not only due to their lower rates, but also because most home buyers do not intend to pay off their mortgages in the short term. Moreover, fixed-rate open mortgages do not exist and variable-rate mortgages are very rare. The most common type of open mortgage is the Home Equity Line of Credit . Below are some quick facts about the differences between open and closed mortgages, and you can also find more detailed information about them here.

Recommended Reading: Rocket Mortgage Payment Options

Is 325% A Good Mortgage Rate

Let’s preface this by mentioning that some borrowers are scoring rates in the 2s. Others, meanwhile, also timed the process right and locked in a 3% mortgage rate.

But don’t be discouraged if you end up with a 3.25% rate. Even a 0.75% difference, when compared to a 4% rate, will prove to be worthwhile in the long run.