How To Get The Best Mortgage Rate Available

If you own a home and haven’t refinanced yet, you’re probably paying too much. Zillow found that homeowners who did take out new loans over the past year saved $300 or more per month.

But even though mortgage rates have ticked down, lenders won’t necessarily feel obligated to offer you the lowest interest rate available. Scoring a great rate on a refi usually requires a little effort on your part.

The mortgage market is extremely competitive, so dont jump at the first attractive offer you see. Check mortgage rates from at least five lenders to compare your options and find the loan that best fits your budget.

But be warned: It will be hard to secure a low rate if youre carrying multiple high-interest debts. Payments to multiple creditors can gum up your homebuying plans, so consider taking out a lower-interest debt consolidation loan. Youll reduce your interest costs and wipe out your debt faster.

If refinancing your mortgage doesn’t seem like the right move, you have other ways to cut the cost of homeownership. When the time comes to buy or renew homeowners insurance, getting quotes from multiple insurers might save you hundreds of dollars.

Advice For Mortgage Shoppers

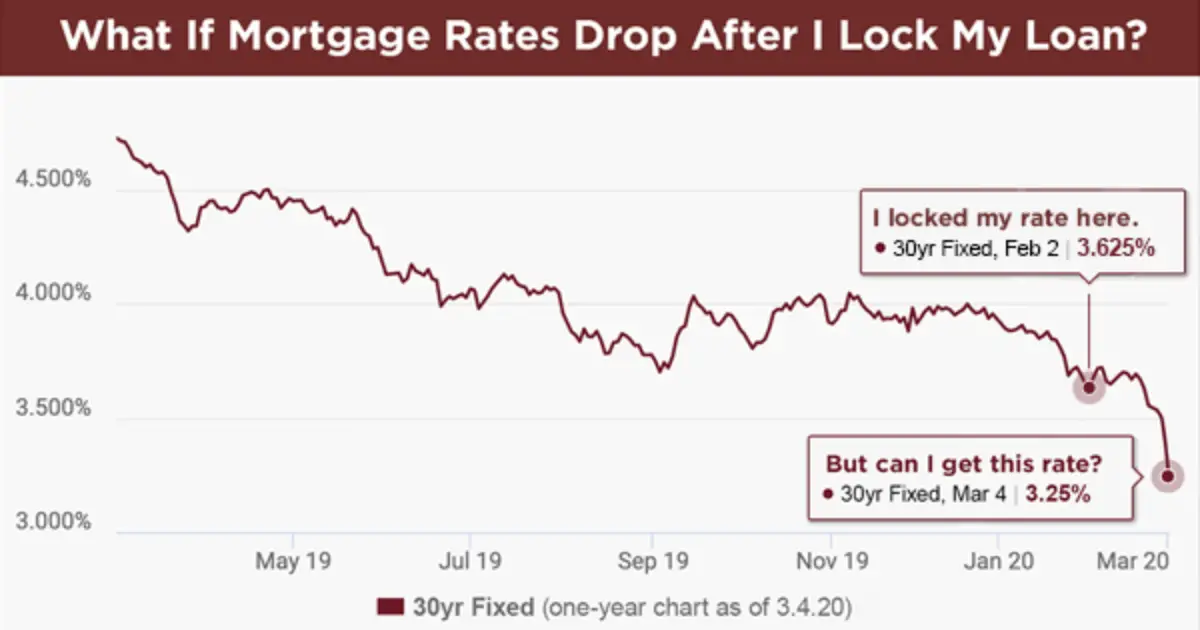

For those in the market for a new mortgage, and who are leaning towards a variable rate, experts recommend obtaining a rate hold as soon as possible.

I would say act sooner rather than later. Basically, this is not a time to think, said Stillman. Lock it in now and if something changes your mind, you can change your mind. But theres a good chance its not going to be available .

McLister advises the same, whether youre shopping for a fixed rate or a variable.

Fixed rates arent rising like variable rates, not yet, he noted. But theres a risk they could. Get a rate guarantee soon if you need a fixed mortgage in the next four months.

Overpaying On Interest Because You Want No Closing Costs

A refinance may not require any cash to close. One way lenders make up for this expense is to give you a higher interest rate. Lets say you have two options: a $200,000 refinance with zero closing costs and a 5% fixed interest rate for 30 years, or a $200,000 refinance with $6,000 in closing costs and a 4.75% fixed interest rate for 30 years.

Assuming you keep the loan for its entire term, in scenario A, youll pay a total of $386,511. In scenario B, youll pay $381,586. Having no closing costs ends up costing you $4,925 over the life of the loan.

You May Like: What’s The Interest Rate On A 15 Year Mortgage

Mortgage Rates Are Near All

“If you’re not containing the virus, you can do all the great monetary policy in the world,” Rogoff says. “All the great fiscal policy, design everything well. If you’re not winning the war, you’re losing.”

In other words, low interest rates are great. But if the country can’t crush down the number of new coronavirus cases, the economy can’t recover.

High Ltv Refinance Option And Freddie Mac Enhanced Relief Refinance

High loan-to-value mortgage loans are those in which the amount owed on the mortgage is nearly equal to or exceeds the home’s appraised market value. These high LTV loans are considered high risk to lenders since a default or nonpayment by the borrower could result in the lender losing money if the bank forecloses and sells the home for less than the loan amount given to the borrower.

Unfortunately, Fannie Mae and Freddie Mac have temporarily suspended mortgage loan refinances under the high loan-to-value programs. All high LTV refinances must have had their applications dated on or before June 30, 2021, and must be purchased or securitized on or before Aug. 31, 2021. Historically, these Fannie Mae and Freddie Mac programs were designed to replace theHome Affordable Refinance Program , which expired on Dec. 31, 2018.

HARP was set up to help homeowners who could not take advantage of other refinance options because their homes had decreased in value. Its goal was to improve a loans long-term affordability to help prevent people from losing their homes to foreclosure. Only mortgages held by Fannie Mae or Freddie Mac were eligible. Still, they also had to have a loan origination date on or after Oct. 1, 2017, and borrowers had to be current on their payments.

Also Check: Can I Qualify For A Mortgage With A New Job

Should You Always Choose The Cheapest Rate

The lowest rates are sure to be tempting, but they may not be all that they seem.

Lenders are increasingly charging up-front fees as high as £1,499 on their market-leading deals. A higher fee allows lenders to battle to offer lower rates, but increases the overall cost of borrowing for the person taking on the mortgage.

Weve found that in some cases, borrowers could be better off in the long run taking a more expensive rate with a lower fee.

David Hollingworth says: Lenders may consider using higher arrangement fees to help them depress the headline rates further. Fortunately, most offer a range of options including slightly higher rates with smaller or even no fee, so it should be possible to find the right overall fit.

Why Your Mortgage Rate May Be Higher Than Current Mortgage Rates

Not all applicants will receive the very best rates when taking out a mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location, and the loan size will affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their realtors. Yet this means that they may miss out on a lower rate elsewhere.

Last year, Freddie Mac reported that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

Recommended Reading: How To Track Mortgage Interest Rates

Why Rates Arent Expected To Keep Falling

Sam Khater, Freddie Macs chief economist, says rates are likely to go back up in large part because of the Federal Reserve. The central bank recently announced plans to scale back its pandemic-era strategy of buying billions of dollars’ worth of mortgage-backed securities each month to help stimulate the economy and keep rates low.

We expect future upticks due to stronger economic data and as the Federal Reserve pulls back on its stimulus, Khater says. That said, the housing market remains favorable for consumers, as rates remain below pre-pandemic levels and continue to support sustainable purchase and refinance opportunities.”

The Fed will likely raise interest rates by the middle of next year, further pushing up mortgage costs, adds Nadia Evangelou, senior economist and director of forecasting for the National Association of Realtors. The trade group expects 30-year fixed rates to average 3.5% by the second quarter of 2022.

Despite the recent drop, Peter Warden, editor of The Mortgage Reports, says mortgage rates should follow a “strong and persistent upward trend,” due to the Feds plan, higher inflation and a healthier economy amid lower daily COVID-19 cases.

“An improving economy almost always brings higher mortgage rates,” Warden writes.

Is The Boc Not Telling Us Something

Theres a widening chasm between what the Bank of Canada is telling Canadians about inflation and what corporate leaders expect. The following chart aint pretty, and it contrasts starkly with the BoCs inflation outlook. This graph from CFIB shows that businesses now plan to boost prices by 4.7% in the next 12 months. That is not only 135% more than…

Also Check: How To Shave Years Off Your Mortgage

Final Reason Why Mortgage Rates Dont Fall As Quickly

Although mortgage rates have fallen to 8-year lows, with the way things are going, I believe there is a ~90% chance mortgage rates across all durations will eventually fall to all-time lows like U.S. Treasury yields.

The reason why I dont think theres a 100% chance all mortgage rates fall to all-time lows is because banks, like gas stations make their own bets too. And some banks might just keep their mortgages rates higher on the expectation that Treasury yields will come back up so they can make greater profits.

But if they are wrong, they will probably lose a lot of refinance business to their competitors. Which means they will eventually have to lower their mortgage rates as well. to stay competitive.

Finally, some banks will keep their mortgage rates higher than their competitors simply because they are overrun with business. The lender just doesnt have enough personnel to handle all the new refinancing demand. Too much demand is partially why my last mortgage refinance took over four months to complete instead of their promised three months.

Just like how its difficult to time the bottom of the stock market to purchase, its hard to time the bottom of mortgage rates. But unlike with stocks, you know exactly how much money you will save by refinancing a mortgage over a certain period of time once you do the math. You got a bird in the hand.

Filed Under: Mortgages

Current Recommendations:

Mortgage Rate Forecast For Next Week

Despite Thursdays report from the Labor Department, citing unemployment claims dropping to a new pandemic low, it looks like low mortgage rates should remain in place for the remainder of the summer.

Thursdays jobs report was better than expected. Showing that the surge in COVID-19 cases caused by the Delta variant has yet to lead to widespread layoffs.

That said, on Thursday, September 9, Sam Khater, Freddie Macs Chief Economist stated, While the economy continues to grow, it has lost momentum over the last two months due to the current wave of new COVID cases that has led to weaker employment, lower spending and declining consumer confidence.

Therefore, we expect rates to stay in the sub-3% range for next week.

You May Like: What Does Prequalification For A Mortgage Mean

‘devastated’: As Layoffs Keep Coming Hopes Fade That Jobs Will Return Quickly

“In Arlington, restaurants are closing down, Cambridge restaurants are closing down,” he says. “This morning, it was Flat Top Johnny’s, and every day, we hear about something else, local places that I would go that are now gone.”

So for now, Harvard’s Rogoff says the government needs to keep pumping trillions of dollars into the economy with unemployment assistance and other stimulus. But he says it can’t do that forever.

So he’s siding with a growing chorus of prominent economists and business groups who essentially say a stimulus is needed and low interest rates are good, but maybe the single most important thing to help the economy would be much more widespread use of masks across the whole country.

Why Mortgage Rates Dont Drop As Quickly As Treasury Yields

Updated: by Financial Samurai

You know how you see oil prices drop precipitously on the news, yet when you get the gas station to save some money, youre disappointed because gas prices havent gotten much cheaper?

The same thing happens with US Treasury yields and mortgage interest rates . Mortgage rates are largely influenced by the latest 10-year U.S. Treasury bond yield and will move in the same direction. However, given there are so many different types of mortgages and frictions, mortgage rates wont necessarily change by the same magnitude.

The coronavirus-induced market meltdown has sent US Treasury bond yields tumbling to all-time lows. But mortgage interest rates are only at ~8-year lows, not all-time lows.

Some Financial Samurai readers are even saying mortgage rates havent moved down at all or are actually going up as Treasury yields collapse. If you find yourself in this situation, please keep looking.

So why arent mortgage rates going lower as quickly as US Treasury yields? Let me explain.

Also Check: How To Get A Million Dollar Mortgage

Mortgage Rates Drop Below 3% Yet Again

A year ago at this time, the average 30-year fixed-rate mortgage averaged 2.84%

Mortgage rates fell below 3% in the week ending November 10, according to the latest Freddie Mac PMMS mortgage report.

The 30-year fixed-rate mortgage declined to 2.98% last week, falling 11 basis points from 3.09% the week prior. A year ago at this time, the average 30-year fixed-rate loan averaged 2.84%.

Despite the re-acceleration of economic growth, the recent bond rally drove mortgage rates down for the second consecutive week, Sam Khater, Freddie Macs chief economist, said in a statement. These low mortgage rates, combined with the tailwind of first-time homebuyers entering the market, means that purchase demand will remain strong into next year. However, affordability pressures continue to be an ongoing concern for homebuyers.

The decline in rates has also led to a surge in refinancings. According to the Mortgage Bankers Association, the refi index rose 7% for the week ending Nov. 5. Although overall activity remains close to January 2020 lows, homeowners were spurred to act on the decrease in rates, he said.

Mortgage rates have remained low in large part due to the Federal Reserves massive monthly purchases of $120 billion in U.S. Treasury bonds and mortgage-backed securities. The Fed has said that its satisfied that substantial economic progress has been made in the labor market and will begin tapering its asset purchases later in November.

Presented by: Deluxe

Where Mortgage Rates Are Headed

Mortgage experts offer mixed predictions about the direction of rates in the next week. In Bankrates survey this week, 55 percent of respondents predict rates will stay the same in the coming week , 36 percent say theyll rise and 9 percent predict a decline.

Rates rates will inevitably trend higher in coming months, says James Sahnger of C2 Financial Corp. in Jupiter, Florida. If you havent refinanced, time to get busy doing so.

Also Check: Can I Get A Mortgage With A 660 Credit Score

Current Mortgage Refinance Rates

The average refinance rates for 30-year loans, 15-year loans and ARMs are:

- The refinance rate on a 30-year fixed-rate refinance is 3.57%.

- The refinance rate on a 15-year fixed-rate refinance is 2.633%.

- The refinance rate on a 5/1 ARM is 3.553%.

- The refinance rate on a 7/1 ARM is 3.667%.

- The refinance rate on a 10/1 ARM is 4.08%.

Should You Buy Mortgage Points

Many lenders sell mortgage points . Buying points means youâd pay more up front to lower your mortgage rate which could save you money long-term. A mortgage discount point normally costs 1% of your loan amount and could shave 0.25% off your interest rate.

With a $200,000 mortgage loan, a point would cost $2,000. Buying two points would cost $4,000 which would be due, in cash, when you close the loan. These two discount points would translate into a 0.5% reduction to your interest rate.

Discount points could pay off but only if you keep the home loan long enough. Selling the home or refinancing the mortgage within a couple of years would short circuit the discount point strategy. But if you stayed in the loan indefinitely, you’d reach a break-even point after which the discount points would save you more and more over time.

Often, spending cash on a down payment instead of discount points saves more unless you know for sure you’re keeping the loan for years. If a larger down payment could help you avoid paying PMI premiums, put the money toward your down payment instead of discount points.

Also Check: Does Usaa Have Mortgage Loans

Negatively Impacting Your Long

Refinancing can lower your monthly payment, but it will often make the loan more expensive in the end if youre adding years to your mortgage. If you need to refinance to avoid losing your house, paying more, in the long run, might be worth it. However, if your primary goal is to save money, realize that a smaller monthly payment doesnt necessarily translate into long-term savings.

Why Mortgage Rates Arent Falling As Fast As Us Treasury Yields

Mortgage rates are not falling as fast as Treasury yields due to one main reason: risk.

Its not risk, by you, the borrower who cant wait to refinance their mortgage to save money and improve their monthly cash flow. The risk is felt by INVESTORS of mortgage-backed bonds , who pay a premium for those bonds and expect to recoup that and more over time, through monthly interest payments from borrowers. Most big lenders package their loans and resell them for income and risk-reduction purposes.

But heres the thing. As the homeowner paying the mortgage, you will logically want to PAY DOWN your mortgage faster or refinance your mortgage if you see mortgage interest rates drop. As a result, the MBS investor who paid a premium for your mortgage in hopes of earning higher interest payments for a very long time loses because the premium shrinks or the mortgage is refinanced.

Such an investor is like the homeowner who decides to pay points when refinancing their mortgage to get a lower rate, but who ends up selling the home or paying off the mortgage before its breakeven point. This risk of selling your home sooner than expected is why I prefer a no-cost refinance.

If you have the time and patience, you should always do a no-cost refinance if the new mortgage rate is lower.

Don’t Miss: What To Know About Getting A Mortgage

Will Current Mortgage Rates Last

Mortgage rates have been in a holding pattern for a little over a month. The rise of the Delta variant of the COVID-19 virus has put a damper on the economic recovery and counteracted some of the positive developments that could have pushed rates higher the last few weeks.

This pattern may soon change, however, as COVID infections seem to be plateauing. On the economic front, retail sales, which had been expected to decline, saw a nearly 1% increase in August, which is good news for the economy. On the other hand, Inflation, meanwhile, was a little lower than expected last month.

Why does this matter?

The Federal Reserve has based decisions around tapering its accommodative monetary policy on the strength of the labor market and the economic recovery. The Fed’s position has been that inflation, which is currently over 5% and above the central bank’s target rate of 2%, is temporary. If inflation continues to slow down and other economic indicators, such as employment and retail sales, continue to improve, it could push the Fed to a more aggressive stance on its policy. For now, all eyes will be on the Fed’s upcoming September meeting.

“The fact that interest rates havenât moved much in recent weeks indicates that investors are still waiting for more certainty,” said Matthew Speakman, senior economist at Zillow. “All told, thereâs a good chance that mortgage rates will move notably in the coming weeks, but the juryâs still out on which direction theyâll head.â