Reasons To Include More Than One Name On A Mortgage

There are a few reasons a borrower might want to include more than one name on a mortgage:

- Applying with a co-borrower might make it easier to qualify for a loan. If the co-borrower has good credit and steady income, for example, this can help strengthen your application and improve your chances of getting approved.

- Applying with a co-borrower allows you to put the co-borrowers name on the title. This is important if you plan to jointly own the home. .

Remember co-borrowers are both wholly responsible for loan payments. If one borrower stops paying their share of the loan, the other must continue to pay to avoid damaging their credit or losing the home.

Review Your Spouses Credit Score

Before youre surprised that a mortgage company is going to charge an exorbitant interest rate because your spouse has some unflattering credit issues, its prudent to help him check his credit report first. Americans are allowed one free credit report per year from AnnualCreditReport.com from each of the three major credit bureaus. If he’s already used his annual free report, have him request one from the major credit bureaus using a credit or debit card online.

Can I Transfer A Mortgage If It Involves Bad Credit

Whether youre adding or removing a person from a mortgage, lenders will still carry out their usual checks as a standard procedure. This does involve carrying out credit checks on where the mortgage is being transferred.

Lenders do this so that they can check the financial conduct of the new or existing homeowner.

Often enough, break-ups between couples can sometimes lead to one or both partners ending up with credit issues. Its a common scenario where a divorce or separation has left one or both partners with either CCJs, defaults or a combination of credit issues.

If bad credit is involved, then it does become difficult to transfer. Nonetheless, transferring a mortgage with bad credit is still possible.

Lenders will usually check the severity of the credit issues along with how recent they were. There really is a multitude of possibilities when it comes to bad credit. As a result, its almost impossible to provide you with a tailored answer without speaking to you.

You can make an enquiry to check whether or not a transfer will be eligible.

Recommended Reading: How To Calculate What Mortgage You Can Qualify For

Get A Free Consultation If You Have More Questions About Mortgages Title And Homeownership

Distinguishing between homeownership and liability under a mortgage can be difficult, especially for homeowners who do not buy and sell real estate frequently. There are many advantages and disadvantages to the different ownership structures.

At the Moshes Law, P.C. we are proficient in real estate titling and conveyances. If you have a question regarding ownership of your home or the best approach to take on a future purchase, one of our experienced real estate attorneyswould love to help you.

Why Add Your Partner To Your Mortgage

The only advantage of adding your partner to your mortgage would be if you want to borrow more money and you need your partners income to be assessed as well in order to so. For couples who are planning to start a family and upgrade their home or move to a pricier location, taking on a larger mortgage may be necessary to fund this process.

EXAMPLE Alex and Emma get married

Alex and Emma have been living in Alexs one-bedroom apartment in the inner-city since they got married last year. Emma has been contributing to the mortgage repayments since she moved in but her name is not on the loan as it was taken out before the couple met. With the couple looking to start a family soon, and move closer to Emmas parents for support, they start looking at three-bedroom houses in the suburbs. They determine that they will need to borrow an extra $500,000 to get the sort of home they want and with $300,000 still left on the existing loan they will need to refinance to a loan that allows them to borrow $800,000 all up. Alex knows that he wont be approved to borrow this amount of money with only his income taken into account so Alex and Emma decide to apply for the loan together to provide a more accurate picture of their household income now that they are married.

Pros

- Can base borrowing capacity on two incomes

- Opportunity to shop around for more competitive loan

Cons

- Reduces spouses capacity to take out other loans

- Risk of being rejected if your spouse is not eligible for the loan

Recommended Reading: What Is A Future Advance Mortgage

Would Selling A House Work To Remove A Name From The Mortgage

Finally, in many situations involving a divorce, the couple may decide that neither one of them wants to keep the home, there is always the option of selling the home. This would essentially remove all parties obligations to the mortgage. If the mortgage is considered underwater, a short sale may be necessary to move the property. However, the short sale can significantly impact your credit score, and there are times loan companies request that you pay the difference between the short sale and the balance of the loan.

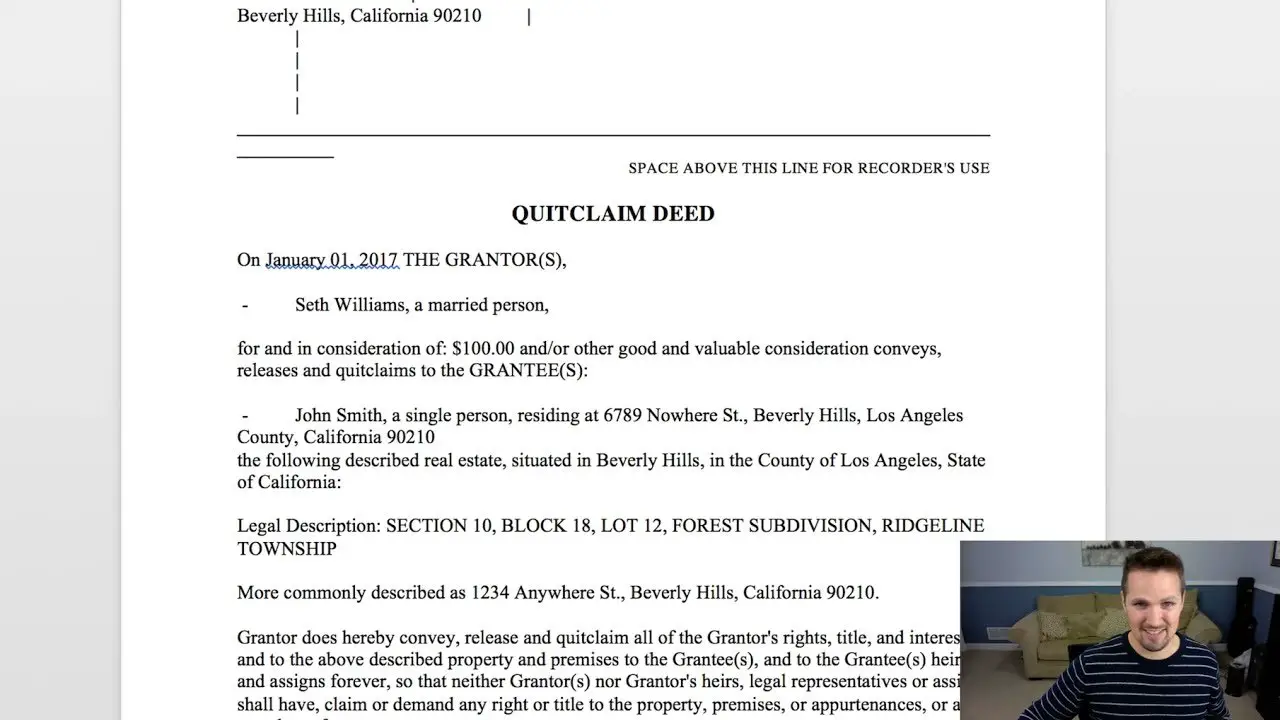

How To Add A Name To A House Title

Adding a name to the title of a house gives that person ownership rights to your home. If your home is owned free and clear, then you’ll just need to complete a new deed in both names that will replace the current deed. If the home has a mortgage, you’ll need permission from the lender before you make any changes to your title.

Recommended Reading: Can You Get Extra Money On Your Mortgage For Furniture

Executing And Recording The Deed

How Do I Add Someone To My Mortgage

Adding someone to a mortgage is probably the most common reason for a mortgage transfer. Couples may be moving in together and want to share the financial costs. Typically, adding a partner to a mortgage involves changing a single mortgage into a joint mortgage.

From a lenders perspective, having another persons name on a mortgage can offer them more security. Nonetheless, lenders will still carry out their usual checks to make sure that the mortgage is affordable for the new homeowner.

You may also be charged stamp duty. This is because the new homeowner is technically purchasing part of your property. Adding a partner to a mortgage also involves making legal changes to the property deeds.

Although a transfer can be carried out at any time, you may be subject to an early repayment charge . This is likely to happen if you carry out a transfer during your existing mortgage term.

If this is the case, its best advised to add your partner when its time to remortgage.

Not only will this save you having to pay an early repayment charge, but you can then take out a new joint mortgage together, rather than making a transfer of equity.

Also Check: What Is The Monthly Payment On A 50000 Mortgage

What Are Quitclaim Deeds

Quitclaim deeds can be a quick way to transfer interest in real property. For instance, if you want to transfer property between family members, a quitclaim deed could be the way to go. They cant be used in a traditional real estate sale, however.

Find out more about what a quitclaim deed is today, then decide if one is right for your situation.

Will I Have To Pay Stamp Duty

In some cases, stamp duty is not payable when a partner is added to a property title. This includes married, de facto and same sex couples. To get this exemption, you’ll need to fill out an exemption form, which is available from your state office of revenue.

There are a number of conditions you need to meet to qualify for this exemption, and these can change from state to state. As mentioned above, always check with your lender before carrying out any transfer of title or mortgage.

More helpful guides on property ownership and titles

Read Also: How Much Usda Mortgage Can I Qualify For

Ways To Hold The Title

The way the names appear on the title affects ownership interest and how the property is transferred upon a co-owner’s death.

- Joint Tenancy means two or more individuals own the home together. An owner’s interest automatically passes to the surviving owner upon death.

- Tenants in Common allows two or more individuals to each** **have a separate, undivided interest in the home. There are no survivorship rights, so the owners can designate beneficiaries to receive their shares of the home upon death. If there are no designated beneficiaries in the will, the court determines which of the decedent’s heirs receive the share of the home based on the state’s laws.

- Community Property is a form of** **joint tenancy only available to married couples in community property states. Each spouse owns half the home and can will their shares to anyone they choose.

- Tenancy by the Entirety is another form of ownership reserved for married couples. Not all states recognize it. Each spouse owns half of the property and can only sell or transfer ownership with the other’s consent. The surviving spouse receives the decedent’s share of the property upon death.

Consider Using An Attorney

You can purchase the appropriate software or a deed form from any office supply store or legal website to create a joint tenancy deed, but consider working with a local estate planning attorney or a real estate attorney instead.

One wrong word or a missing word on your joint tenancy deed can lead to probate of the property.

State laws can be very specific about how a deed must be worded to create rights of survivorship, and these forms and software aren’t always state-specific.

Don’t Miss: How Many Years Left On Mortgage

Consult A Specialist With Experience In This Field

Transferring a mortgage can be simple when the advice you receive is right. Often enough, a lack of experience or approaching an unsuitable lender can result in mortgages being declined.

Mortgage transfers are second nature to our specialists who deal with them on a daily basis and have been doing so for a number of years.

Whether youre adding, removing or replacing someone on your mortgage, our advisors can guide you through the process.

Adding Names To Land Titles In Alberta

Adding Names To Land Titles In Alberta

Many situations come up where people want to add a name to title. This occurs for many reasons. While the process is not difficult or expensive, it poses legal risks. It is important for anyone thinking of adding names to land titles in Alberta to understand these risks. The real estate lawyers at Kahane Law Office in Calgary regularly assist client with making changes to land titles registrations.

Recommended Reading: Can You Get A 30 Year Mortgage On Land

Use A Loan Assumption To Remove A Name From A Mortgage

A loan assumption may be the easiest option for the parties involved and should be your first option. Essentially, when multiple names are on a mortgage, you can tell your lender that you will be taking over the mortgage completely. You can request that they provide you with a loan assumption, which gives one party the full responsibility of the mortgage and removes the other from all the documents. This also has the benefit of being processed faster since it can take a long time to process a refinance. With a loan assumption, the person requesting full responsibility of the loan may request that the interest rate remain the same.

For the other party, it is essential to request a release from liability. If the other party who assumes full responsibility refuses to pay the loan, having a release of liability would prevent the lender from going after you for payments. Keep in mind, many lenders are hesitant to agree to a loan assumption think about it, what incentive does the bank or lender have to remove one person when they currently have two people responsible for the mortgage? Thus, those lenders that do allow for a loan assumption will require proof that the person getting the loan assumption can afford to pay the mortgage on their own.

Adding Someone To An Existing Mortgage

If you want to add someone to your existing mortgage you need to contact your mortgage lender to arrange it. Theyll send you documents to complete, it will be a similar process to a new application, so theyll need to verify affordability, credit history and identity of the person you wish to add some to the mortgage.

Bear in mind that there might be costs involved, which typically includes arrangement fees, legal fees and possibly even additional stamp duty fees. Yeah, more tax it never stops.

You May Like: What To Expect When Applying For A Mortgage Loan

Summary Of Options To Remove A Name From A Mortgage Without Refinancing

Removing a name from a mortgage without refinancing is possible in more than a few ways. Loan assumption is the simplest option, but its not always an option that lenders are willing to agree with. Be sure to speak with the lending company to determine what options are available and how to move forward with removing a name legally and without having to refinance the mortgage.

Get Started On Your Mortgage Transfer

Ready for a free, no-obligation chat with a mortgage expert about your options? Our broker-matching service will pair you up with the best expert for your needs and circumstances.

- Rated 5 star on Feefo

- FCA regulated

About the author

Pete, an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. With plenty of people needing help and few mortgage providers lending, Pete found great success in going the extra mile to find mortgages for people whom many others considered lost causes. The experience he gained, coupled with his love of helping people reach their goals, led him to establish Online Mortgage Advisor, with one clear vision to help as many customers as possible get the right advice, regardless of need or background.

Petes presence in the industry as the go-to for specialist finance continues to grow, and he is regularly cited in and writes for both local and national press, as well as trade publications, with a regular column in Mortgage Introducer and being the exclusive mortgage expert for LOVEMoney. Pete also writes for OMA of course!

Onlinemortgageadvisor.co.uk is an information website all of our content is written by qualified advisors from the front line, for the sole purpose of offering great, relevant, and up-to-date information on all things mortgages.

The Financial Conduct Authority does not regulate some forms of buy to let mortgage.

ref#356671

Recommended Reading: What Is Negotiable On A Mortgage Loan

Tenants In Common Get What You Deserve

If your partner will eventually invest 20% of the propertys value, while youre investing 80%, then you can arrange it so youll get the same shares back if you decide to sell the property. Of course, the slicing of the pie can get more complicated, but thats just the general principle.

As mentioned, you can define share of the property at the outset, which I think is the fairest way of doing it- you get back what you put in.

Disclaimer: I’m just a landlord blogger I’m 100% not qualified to give legal or financial advice. I’m a doofus. Any information I share is my unqualified opinion, and should never be construed as professional legal or financial advice. You should definitely get advice from a qualified professional for any legal or financial matters. For more information, please read my full disclaimer.

Like this post? Then maybe you should so you receive more like it! You can also find me on and join .

About the Blogger

Hi. I’m a Landlord blogger I inconsistently share my useful and useless thoughts on Landlord life. I’ve been in the game for over a decade, but it feels a lot longer.

I try my best to help others as much as possible. Sometimes I’m successful.

To cleanse your sins, feel free to read more about me and my blog. If you like what I do, you may want to consider supporting my addiction .