Why You Might Choose To Stay At The Hartbeespoort Dam

About Us

- Strictest card verification in the industry. Your card is safe with us.

- We don’t store credit card details so they can’t be compromised.

- Responsible travellers buy local. We’re proudly South African!

- Protection from online fraud: all property owners are verified.

- Your privacy guaranteed. We won’t share your contact details. Ever.

- We don’t charge airy-fairy service fees so you save!

Mortgage Insurance Vs Homeowners Insurance

Just like sunscreen protects you from the natural elements, home insurance does the same thing for your house and the items inside. Proper protection is a must, and whether it’s for your skin, your car or your home, its important to research what protection will be best for you.

When you buy a home, especially for the first time, youll hear a lot of terms brought up that you might not understand. Though youve likely done your own research on home insurance, the term mortgage insurance might throw you for a loop. But its just a way for your lender to get some financial sunscreen for your loan. Learn more about this coverage and who is required to get it, below.

Homeowners Insurance Protects You

- You have to buy homeowners insurance if you have a mortgage

- But this type of policy actually protects you in the event of property damage or liability

- So the coverage is beneficial to the homeowner if something catastrophic takes place

- It indirectly protects the lender too because the home serves as collateral for the loan

I assume a lot of individuals get homeowners insurance and mortgage insurance confused, and for good reason.

They sound pretty similar, but dont share much in common.

Homeowners insurance is actually in place to protect YOU, the homeowner, from perils that exist and may cause damage and monetary loss.

So if a fire burns down your home, or a tree crashes through your roof, your homeowners insurance should be triggered.

And the insurance company should pay to fix any damages, less your deductible.

In other words, homeowners insurance serves the owner of the home, not the lender. It also has nothing to do with your home loan, though there is some overlap.

Technically, if you own your home outright, you dont NEED to get homeowners insurance. But youd be pretty foolish not to purchase it if your home has any significant value.

Without it, you could expose yourself to major financial risk, which clearly isnt wise with insurance premiums relatively cheap in the grand scheme of things.

And you certainly wouldnt want to jeopardize your ability to make mortgage payments if all your money was caught up in home repairs.

Read Also: How Many Times Can I Apply For A Mortgage

Lenders Title Insurance Vs Owners Title Insurance

There are two types of title insurance: lenders and owners. Almost every lender will require you to pay for a lenders title insurance policy. This protects the lendernot youfrom incurring any costs if a title dispute pops up after closing.

Owners title insurance is usually optional, but its highly recommended. Without it, youll be left footing the bill for all the costs of resolving a title claim, which could be thousands or even hundreds of thousands of dollars. Even though it can feel like youre hemorrhaging cash when youre closing on a house, a title insurance policy is one of those things that can save you money in the long run.

When you consider the benefits of title insurance and some of the unique aspects of title insurance relative to other kinds of insurance, it is clear why its risky and ill-advised to purchase real estate without a title insurance policy, says Brian Tormey of TitleVest in New York City.

You can purchase basic or enhanced owners title insurance, with the enhanced insurance policy offering more coverage for things like mechanics liens or boundary disputes.

While your title insurance covers you for things such as mistakes in the legal description of your property or human error, be aware that it will have some exclusionsparticularly in cases where violations of building codes occur after you bought your home.

Entrada A Portaventura Park + Ferrari Land + Noche De Hotel 4*

76Mercure Atenea Aventura de 4*PortAventura ParkFerrari LandFechas: FAQs Nosotros

¡Bienvenidos a la mayor comunidad de compras de España!

Más de 2,03 millones de personas como tú, se han unido ya a nuestra comunidad. Juntos hemos compartido más de 434 mil ofertas verificadas y publicado en ellas más de 6,32 millones de comentarios. Juntos compartimos nuestra experiencia, consejos y recomendaciones para nuestras compras.

Estamos entre las aplicaciones mejor valoradas.

- 4,7

You May Like: Which Is Better 30 Or 15 Year Mortgage

Mortgage Insurance Vs Homeowners Insurance: Only One Of Them Protects You

These days, it seems as if you can insure just about anything. Your car, your house, your dog, your phone, and maybe even your hair?

At one time, there was a form of home down payment insurance, which at last glance appears to no longer exist.

While all these new policy options may be perceived as great news! by overzealous insurance agents, for individual consumers its often just more money down the drain.

After all, paying for insurance always feels like a chumps game until you actually need to file a claim, which never seems to happen if you actually have insurance in place.

And if you do file a claim, your insurance rates will go up! What a deal!

When you purchase a home, your insurance needs will certainly rise, which will put even more strain on your already-strained checkbook.

Lets look at two common forms of insurance tied to homeownership, and explore what each actually provides.

Homeowners Insurance And Your Mortgage

So what does homeowners insurance have to do with getting a mortgage? In most cases, lenders will require you to have homeowners insurance to fund your mortgage. Because they have a financial stake in your home, lenders want to make sure they’re protected if, say, a hurricane levels the property.

How much you’ll pay for it varies depending on where you live, your deductible, the replacement cost of your home and more. The average premium for the most common type of insurance was $1,211 in 2017, according to a National Association of Insurance Commissioners report. Lenders typically fold the premium into your monthly mortgage payment, but you may be able to request to pay it on your own.

Like anything else, it pays to shop around. Look to your state insurance department, consumer guides, and referrals from friends and family to compare rates and get the best deal.

Also Check: How Do Mortgage Companies Decide How Much To Lend

What Is Homeowners Insurance

Homeowners insurance protects your homes structure and your property from most financially devastating losses like fires or storms. Without homeowners insurance, you would have to pay to rebuild your home or replace all your belongings yourself.

Even if your lender does not require you to have home insurance, it is a good financial decision to have coverage. The insurance premium is small compared to the cost of repairing or replacing a home and belongings in case of a loss.

Consult with a trusted insurance professional to buy the right amount of homeowners coverage.

Homeowners Insurance Coverage Vs Mortgage Insurance Coverage

Homeowners insurance provides financial protection for your home and personal property.

Typically, homeowners insurance provides four types of coverage:

- Dwelling coverage: covers the structure of your home if damaged by hazards, such as wind or hail

- Personal property coverage: covers your home contents and personal belongings

- Liability coverage: covers you and your family members from liability lawsuits

- Additional living expenses coverage: covers living expenses if you’re forced to temporarily live outside of your house

Your homeowners insurance policy will only extend each type of coverage up to certain limits. For example, the events, also called “perils,” covered by your homeowners insurance will vary based on the type of policy you purchase.

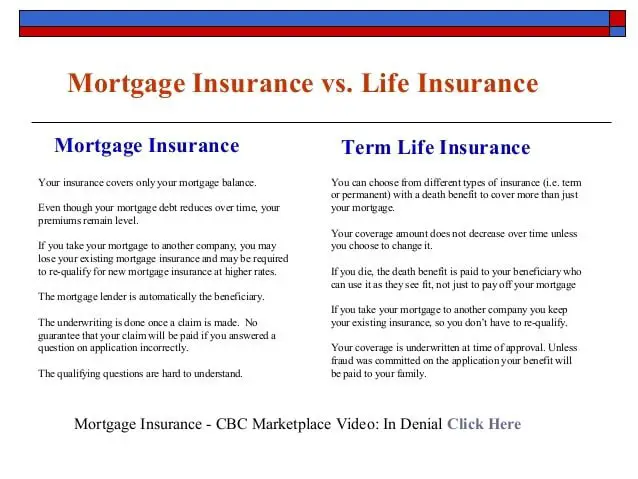

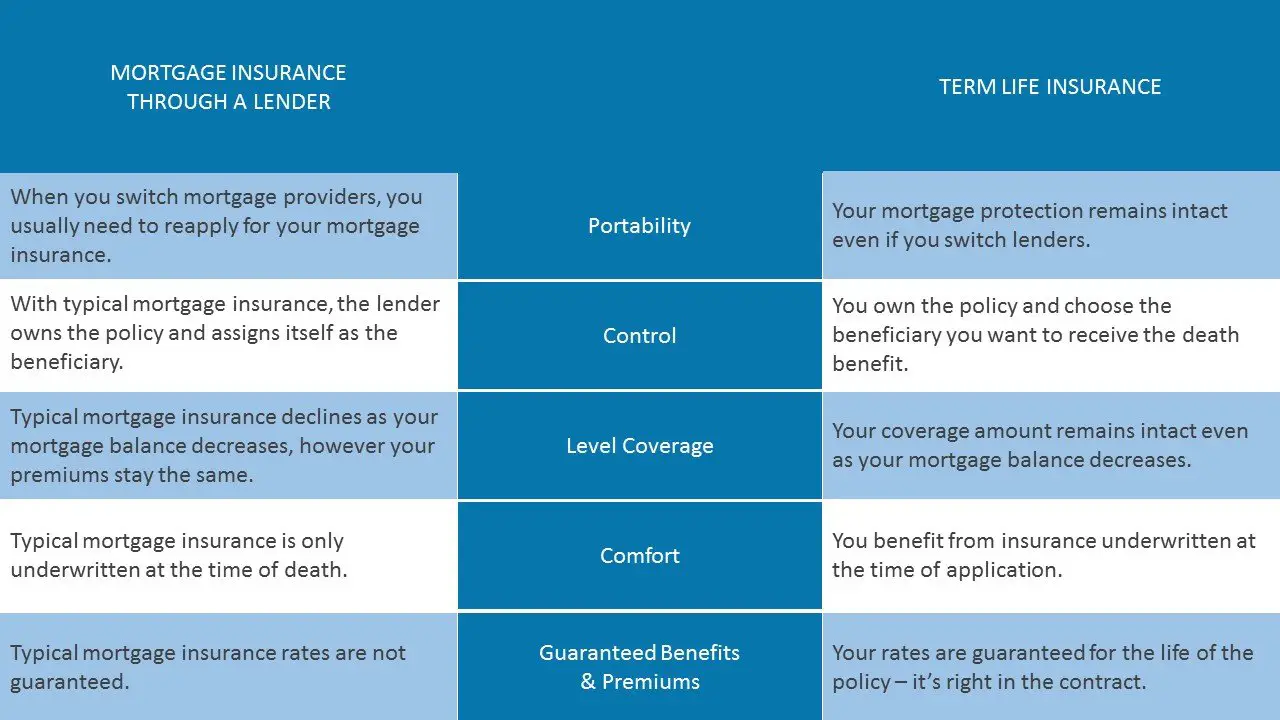

Mortgage insurance, on the other hand, provides financial protection to a mortgage lender against the risk that a borrower will default on the mortgage.

Whereas homeowners insurance will protect both the borrower and, indirectly, the lender’s assets, mortgage insurance solely protects the lender’s asset: the repayment of the mortgage loan. In order to compensate for the extra risk engendered by the lender’s higher exposure, lenders typically require mortgage insurance when a borrower makes a smaller down payment.

Read Also: Why Do I Pay Escrow On My Mortgage

Whats The Difference Between Mortgage And Home Insurance

Mortgage insurance and home insurance arent the same thing. While theyre both types of insurance, one protects your lender and one protects you. To make sure youve got the coverage you need, take the time to know the difference between the two.

Home insurance provides you with protection for your dwelling, belongings and liability. On the other hand, mortgage insurance protects the lender from financial losses should you be unable to pay your mortgage each month. As you probably already know, home insurance is mandatory. But mortgage insurance? Thats a different story.

Do I Need Homeowners Insurance

You need homeowners insurance to get a mortgage. Lenders require you to have homeowners insurance until your loan is paid off. This requirement is outlined in the terms of your mortgage. There are two main reasons why you need homeowners insurance to get a mortgage:

- To protect you. As a homeowner, you are covered if your home is damaged.

- To protect your lender. Insurance also protects your lender’s financial interest in your property.

Be sure to ask your lender when to provide proof of insurance. While some lenders allow buyers time to secure home insurance, others may require you to have it before closing.

Read Also: How Much Mortgage Can I Get On 50k Salary

Key Mortgage Lender Requirements For Homeowners

Is Homeowners Insurance Included in a Mortgage? No, homeowners insurance isnt included in your mortgage. Mortgage Insurance vs Home Insurance.

Hazard insurance is part of a homeowners insurance policy it is not a separate coverage type. Hazard insurance is essential to keeping you, your family, and your

What Is Life Insurance

An individually owned life insurance policy provides tax-free money following the death of the insured. It can be used to pay off your mortgage, either in whole or in part.

Life insurance may completely pay off this obligation if the borrower passes away while theres still an outstanding balance, says Peter Wouters, director of tax, retirement and estate planning services at Empire Life Insurance Company in Burlington, Ont. Your family may otherwise not be able to afford the mortgage payments or be able to stay in the family home. Any extra amount left over may be used by the beneficiaries of your choice for other needs.

You may consider critical illness coverage to cover your mortgage as well, he adds. Disability insurance tied to mortgage insurance may cover a couple of years worth of mortgage payments, giving you and your family breathing time to decide what to do longer term.

Don’t Miss: How To Remove Pmi From Mortgage Payment

How Is Homeowners Insurance Different From Mortgage Insurance

While homeowners insurance covers you if something goes wrong with your home, mortgage insurance protects the lender if you’re unable to pay your mortgage. If you run into a situation where you can’t make your mortgage payments, the mortgage insurer will take over, which guarantees that the loan gets paid.

In most cases, you don’t have a choice of whether you pay mortgage insurance: If you can’t make at least a 20% down payment on your home purchase, the lender will require it.

This is no small consideration. The national median price for a single-family home in the first quarter of this year was $274,600, according to the National Association of Realtors. A 20% down payment works out to nearly $55,000. For many would-be buyers, that’s a huge barrier to homeownership. So while it can be costly, mortgage insurance is often worth the price for borrowers who need it to get into their desired home.

What Are Mpi And Pmi Insurances

PMI is slightly different from mortgage insurance or MPI . This is often optional and would be required to make the mortgage payments if you pass away, become unemployed, or are disabled.

On the other hand, if you make a small down payment, your lender would require you to purchase private mortgage insurance.

Although similar, MPI and PMI secure two different parties. PMI is designed to secure the lender if the buyer fails to make the payment. On the other hand, MPI would ensure your mortgage payments if you run out of luck following accidents or unfavorable incidents.

Things That PMI Covers And Cost

PMI provides coverage to the lender against possible losses in case the homeowner stops paying the mortgage. It is necessary to shell out an amount for the insurance, just like a part of the monthly amount for a mortgage. This ensures that the creditor would be secured even if you fail to make the payment.

The amount you need to pay for private mortgage insurance would vary. This is based on several factors like the value of the mortgage, down payment size, and credit score. As a general rule, you need to pay anything between 0.3% to 1.5% a year on the original amount of the home loan. This amount would be split into monthly installments.

Read Also: How Much Second Mortgage Can I Afford

Is Mortgage Insurance Required

Unlike home insurance, mortgage insurance isnt always required. If youre purchasing a traditional loan and plan to put down 20 percent or more of your loan amount, PMI typically wont be required. But if youre putting down less than 20 percent, have a less-than-stellar credit history or youre applying for an FHA loan, this extra protection may be a requirement. This is because most mortgage companies want extra assurance that theyll get their money back. Because of this, your mortgage company will typically choose the PMI provider as well.

Homeowners Insurance Is Almost Always Required If You Take Out A Mortgage

In the strictest legal sense, you most likely can own a home without taking out a homeowners insurance policy. Setting aside for the moment the fact that you almost definitely should have such coverage, even if you dont want it for some reason, youll almost always be required to purchase it if you bought your home with a mortgage, according to the Insurance Information Institute . By contrast, the obligation to take out a mortgage insurance policy is much less of a certainty.

As explained by the I.I.I., private mortgage insurance most often comes into play during situations in which mortgage lenders allow buyers to close on home deals without putting down any considerable stake of equity. The idea of the 20% down payment on a mortgage is by no means an across-the-board truism in the world of residential real estate. Countless mortgages are regularly agreed upon each day in which the buyer puts down 10%, 5% or even as little as 3% to seal the deal. This has allowed more people to buy homes who might have been barred from doing so in the past. But that lower down payment almost always comes with an attached requirement that you take out a mortgage insurance policy.

Technically, a lender can require you to purchase a mortgage coverage policy as a condition of the agreement no matter what your down payment is, but for obvious reasons, buyers who pay 20% up front are almost never asked to do this. Paying anything 15% or greater may also be enough to avoid that requirement.

Read Also: How Long To Pay Off 70000 Mortgage

How Much Does Pmi Cost

The average annual cost of PMI is typically between 0.5% to 1% of the loan amount. A $250,000 mortgage could cost you as much as $2,500 per year or an extra $208 per month. According to the Consumer Financial Protection Bureau, PMI is most commonly paid as part of the monthly mortgage premium, but may be paid as an up-front premium during closing. You can find out your PMI terms by reviewing your loan estimate and closing disclosure.

PMI is arranged by the lender and provided by private insurance companies. A lender may or may not give you payment options, but you may request some. The most common ways to pay for PMI are:

- A monthly premium added to your mortgage payment

- A one-time up-front premium paid at closing

- A combination of one up-front payment and monthly premiums

When Is Mortgage Insurance Required

Typically, you may be required to have mortgage insurance when you take out a mortgage loan and your down payment is less than 20 percent of the purchase amount. The requirement to have mortgage insurance varies by lender and loan product. However, depending on your circumstances, some lenders may allow you to forego PMI even if you make a smaller down payment. Consider asking your lender if PMI is required, and if so, if there are exceptions to their requirement for which you may qualify.

Don’t Miss: Can I Get Preapproved For A Mortgage More Than Once

Mortgage Insurance Protects The Bank/lender

- Mortgage insurance doesnt protect homeowners

- It protects the mortgage lender from payment default

- It exists because theyre taking a bigger risk by offering you a home loan with very little down

- The trade-off is you get a mortgage despite having a sizable down payment

If youve been shopping for a home lately, you may have heard about mortgage insurance.

At first glance, it might sound like something that protects you in the event you cant pay the thing.

But contrary to what you might believe, mortgage insurance doesnt do anything to protect the homeowner.

Conversely, it serves to protect mortgage lenders in the event of borrower default, something deemed necessary when you put down less than 20% on a home purchase.

In short, you pay extra for the additional risk you present to the lender. And until your loan-to-value ratio dips below 80%, youll continue to pay that premium.

If you take out a conventional loan above 80% LTV, youll need private mortgage insurance , which your lender will facilitate when going through the loan process.

If you take out an FHA loan, youll get mortgage insurance through the FHA. And its not avoidable, even if youre able to put down 20% or more.

So we know a little more about mortgage insurance, but lets talk about what it isnt.

It is not insurance that protects you in the event you cant make your mortgage payment.

For example, if you lose your job or fall ill and are unable to make payments, mortgage insurance does not cover you.