Is There Any Advantage To Paying Pmi

Paying PMI comes with one major benefit: the ability to buy a home without waiting to save up for a 20 percent down payment. Home prices are continuing to climb, hitting an all-time high of more than $329,000 for an existing property as of April 2021, according to the National Association of Realtors. A 20 percent down payment at that price would be more than $65,000, which can seem like an impossible figure for many first-time homebuyers.

Instead of waiting while saving, paying PMI allows you to stop renting sooner. Homeownership is generally an effective long-term wealth building tool, so owning your own property as soon as possible allows you to start building equity sooner, and your net worth will expand as home prices rise. If home prices in your area rise at a percentage thats higher than what youre paying for PMI, then your monthly premiums are helping you get a positive ROI on your home purchase.

How To Stop Paying Pmi

You can remove private mortgage insurance in the following ways:

- Build equity in your home over time. Your mortgage servicer is legally required to stop charging PMI premiums once your balance hits 78 percent of the original loan.

- Contact your servicer when you have 20 percent equity. You can press fast-forward on that automatic PMI cancellation when your balance reaches 80 percent of the original loan. At this point, you can request to cancel PMI.

- Get your home appraised. Reaching that magic 20 percent equity marker doesnt just involve paying down your principal over time. If your homes value has appreciated since you purchased it, you can contact your lender to request a professional appraisal. According to HomeAdvisor, an appraisal will cost around $340 a small price that can quickly be recouped after a few months of cheaper payments.

- Refinance your mortgage. Refinancing your mortgage is another option that will include an appraisal. This process costs quite a bit more, but it can make sense if your original mortgage had a high interest rate. Use Bankrates refinance calculator to estimate if refinancing is the right move for you.

How To Avoid Pmi

How you can avoid PMI depends on what type you have:

- Borrower-paid private mortgage insurance, which youll pay as part of your mortgage payment.

- Lender-paid private mortgage insurance, which your lender will pay upfront when you close, and youll pay back by accepting a higher interest rate.

Lets review how each type works in more detail, and what steps you can take to avoid paying either one.

Also Check: Does Pre Approval For Mortgage Affect Credit

Conforming Loans With Private Mortgage Insurance

Conforming loans get their name because they meet or conform to Fannie Mae or Freddie Mac guidelines for the loan amount and the borrower’s creditworthiness.

Conforming Loan Insurer

A loan conforming to Fannie Mae or Freddie Mac’s standards is not insured by either Fannie or Freddie. PMI is not government insured it’s backed by private companies.

PMI Cost for Conforming Loans

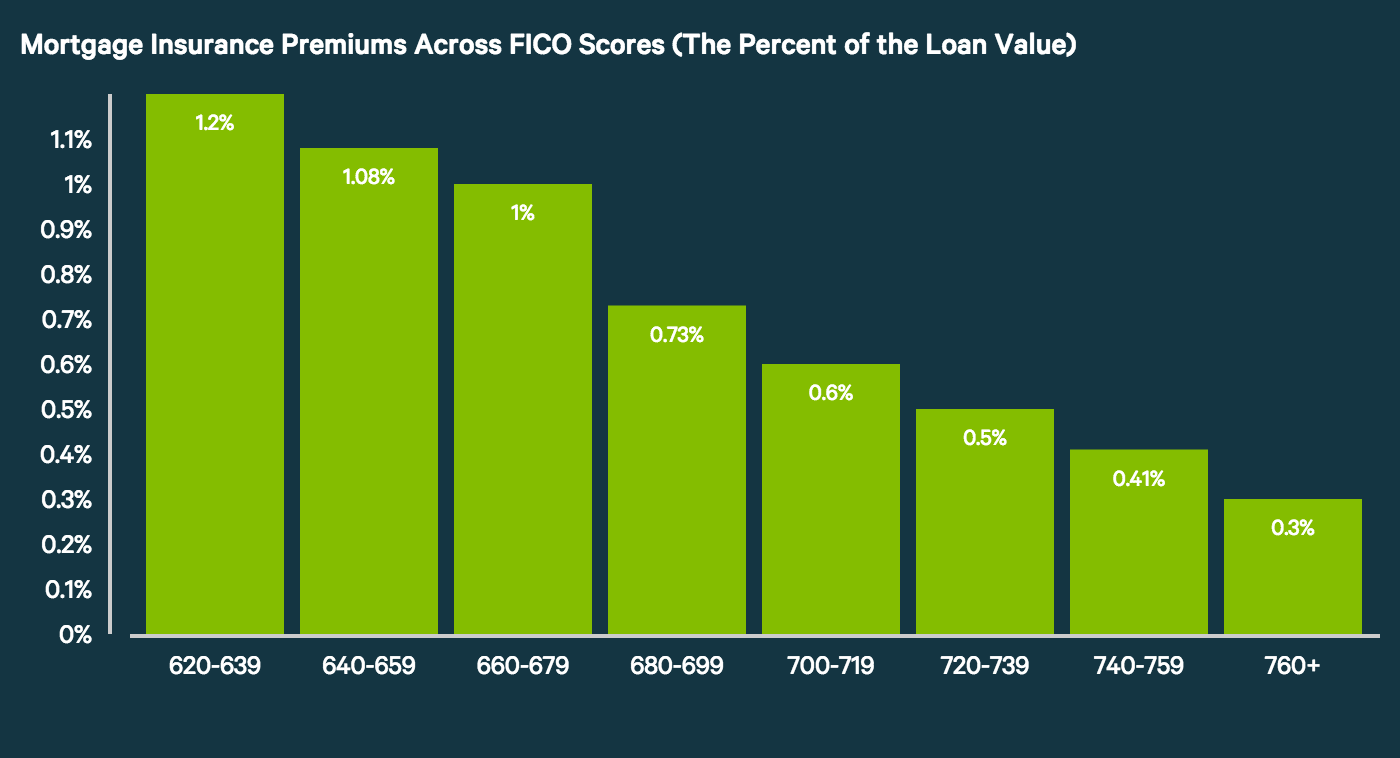

PMI is generally cheaper than the mortgage insurance premiums on FHA loans. How much a borrower will pay for PMI depends on the loan type, down payment percentage, property type, location and other factors.

Mortgage Vs Life Insurance: Which Is Best

timer

If no one mentioned it during the course of financing your new home, the term mortgage insurance could be an unwelcome surprise that stretches a tight budget even tighter.

But it also comes strongly recommended, because it protects your investment if you die. Industry expert Yousry Bissada calls it peace of mind for the family.

If something happens to you, the mortgage is paid and your family wont be out on the street.

Many homebuyers, especially first-timers, are already reeling from the myriad tasks and decisions to worry about with insurance.

Pretty much everything is brand new, sympathizes Cobourg realtor Dale Bryant. Theres so much to think about and do. But after all that, you want to protect your home.

Related: Mortgage life insurance: Why I passed

Heres where things get complicated, starting with the terms mortgage insurance,mortgage life insurance and creditor insurance, which all mean the same thing. You can buy that coverage from the financial institution thats lending you the mortgage money. The premiums are usually tacked on to your mortgage payments.

But you can, instead, buy term life insurance for the amount of the mortgage from an insurance broker or agent. Either way, your mortgage is paid off if you die. But there are significant differences between the two options.

Related: Why 30-year-olds need life insurance

All this means there are many factors to consider in deciding on the best way to protect your home.

Insurance facts

Read Also: What Is The Federal Interest Rate For Mortgage

Mortgage Protection Insurance Death Benefit

First, the mortgage company or lender is the beneficiary in a mortgage protection insurance policy. That means the death benefit bypasses your family and goes straight to the mortgage lender to pay off the mortgage.

And speaking of the death benefit, because itâs used to pay off your mortgage balance in most cases, it usually decreases after the first five years of coverage to match your remaining mortgage payments.

What Is Mortgage Insurance

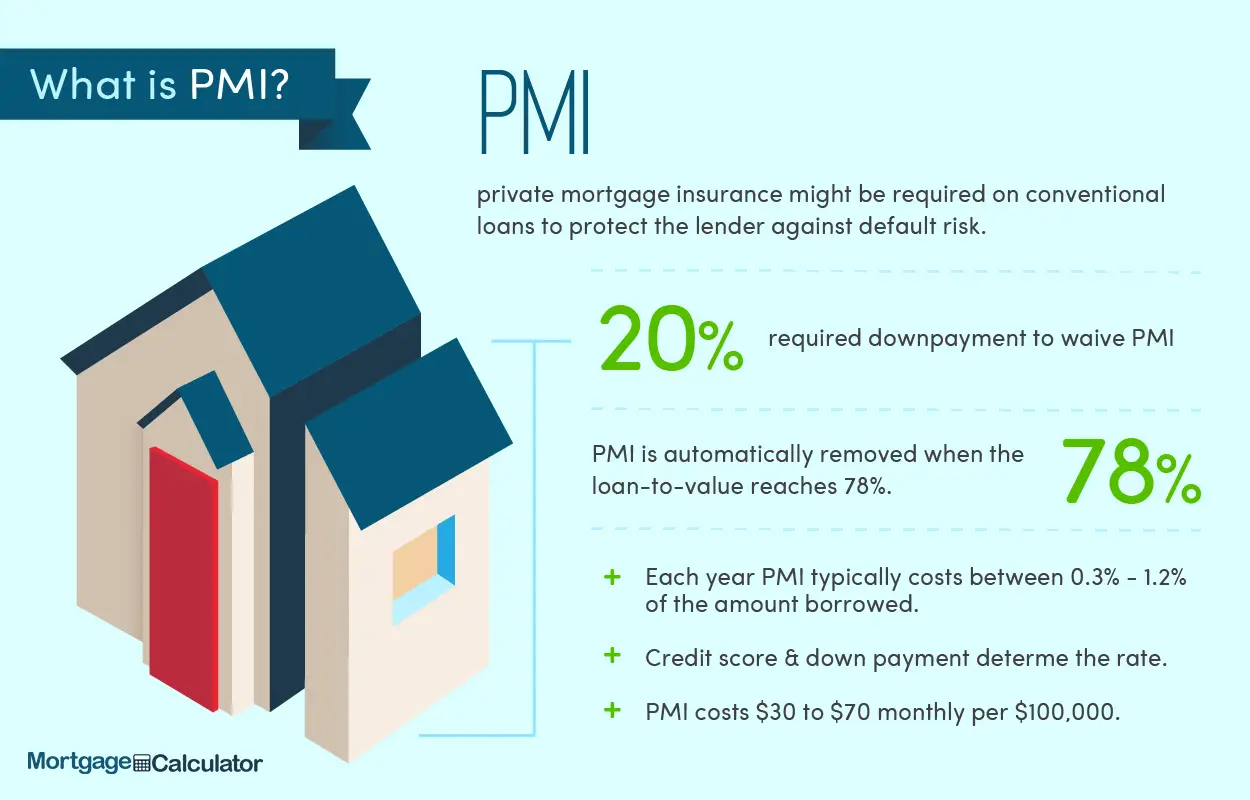

Mortgage insurance shouldnt be confused with homeowners insurance. Homeowners insurance is meant to protect you from financial loss if theres an issue or damage on your property. Mortgage insurance, on the other hand, is designed to protect your lender if you cant repay your loan.

Heres the difference in how each type of insurance works:

- Homeowners insurance: Youll purchase this insurance to cover damage and liability on your property. If your home is burglarized, damaged in a storm, or experiences some other issue, your insurance will help cover the costs.

- Mortgage insurance: When you get a mortgage loan, your lender might require you to pay for a mortgage insurance policy. In the event you fall behind on your mortgage, the lender calls on that policy to recoup their losses.

Good to know:

Learn More: How to Buy a House

Don’t Miss: Is Closing Cost Part Of Mortgage

Types Of Private Mortgage Insurance

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

If you’re making a down payment of less than 20% on a home, it’s essential to understand your options for private mortgage insurance . Some people simply cannot afford a down payment in the amount of 20%. Others may elect to put down a smaller down payment in favor of having more cash on hand for repairs, remodeling, furnishings, and emergencies.

Private Mortgage Insurance

Private Mortgage Insurance Protects The Lender While Mortgage Insurance Protection Is For The Borrower

By Amy Loftsgordon, Attorney

Many homeowners are confused about the difference between PMI and mortgage protection insurance. These two kinds of insurance are very different, and it’s important to understand the distinction between them.

It’s not uncommon for homeowners to mistakenly think that PMI will cover their mortgage payments if they lose their job, become disabled, or die. But this belief isn’t correct. PMI is designed to protect the lendernot the homeowner. On the other hand, mortgage protection insurance will cover your mortgage payments if you lose your job or become disabled, or it will pay off the mortgage when you die.

You May Like: What Is The Benefit Of Refinancing A Mortgage

What Is Mortgage Redemption Insurance

Mortgage Redemption Insurance is a life insurance policy that helps repay your mortgage balance in the event of your death before the housing loans full repayment. MRI is designed to protect your home from foreclosure as it will take out your outstanding debt if you die.

Just like any other insurance policy, MRI covers a set amount and duration. It dictates how much of your mortgage can be covered and for how long. The higher your premium is, the better your coverage will be.

However, keep in mind that just because you have an MRI doesnt mean your outstanding housing loan balance will be paid in full. It will still depend on the kind of coverage you have. If you chose an MRI with the cheapest premium, the coverage would be minimal as well.

Which Type Of Mortgage Insurance Do You Have

If you have an FHA loan, you have a Mortgage Insurance Premium .

If you have a conventional loan and you put less than 20% down on your home, you have Private Mortgage Insurance .

You can also sign on to Wells Fargo Online® and visit the Escrow Details page of your mortgage account to learn which type of mortgage insurance you have.

Don’t Miss: How To Mortgage Property In Monopoly

What Should I Consider Before Applying For A $400000 Mortgage

Its important to fully understand the costs of a mortgage before applying for one. Before applying for a $400,000 mortgage, make sure youve figured out how much you have saved for a down payment on a home. This will help you determine what loans you may be eligible for. Different loan programs have different requirements. Also determine what payment amount fits comfortably in your monthly budget.

You can use a site like Credible to quickly gauge what mortgage interest rates you may qualify for, helping you determine how much you can afford.

As you compare loan offers from different lenders, be sure to ask about things like fees and prepayment penalties. A prepayment penalty is a fee you pay if you pay off your mortgage early, which can make it difficult to refinance down the line. Some lenders also charge an origination or underwriting fee, which can be steep.

Disability Waiver Of Premium Rider

If you become disabled, premium payments will be temporarily waived until you have recovered.

However, applicants can also get additional coverage riders. Because mortgage protection insurance limits the term length of policies to better match with mortgage terms, you wonât have the flexibility of a traditional term life insurance policy. You can choose to add 15 or 30-year riders to increase the term of your policy if needed.

Mortgage protection insurance protects your familyâs housing if you die prematurely and haven’t paid off your mortgage. But because it doesnât cover other vital costs, such as bills and everyday expenses, itâs best to buy a traditional term life insurance policy instead. If you are ineligible for term coverage, a mortgage protection insurance plan is a good backup.

Don’t Miss: What Is Congress Mortgage Stimulus Program

Do Other Loan Types Require Pmi

The above article discusses mortgage insurance for conventional home loans. There are 3 popular government-sponsored home loan programs also worthy of consideration.

- VA loans – veterans and active duty military

- USDA loans – rural areas

- FHA loans – low to moderate income

VA loans are offered to active duty military members, national guard members and military veterans. They do not require mortgage insurance as they are insured by the United States Department of Veterans Affairs. While these loans do not have an ongoing insurance requirement there is an upfront funding fee.

FHA loans& USDA loans both require insurance coverage, though for these loan types it is called mortgage insurance premiums instead of PMI. The following graphics highlight how mortgage insurance work for these loan types.

Since it is hard to remove MIP from FHA loans many homeowners who have built up equity in homes purchased with FHA loans later refinance into a conventional loan to remove the insurance requirement.

How The Pmi Calculator Works

NerdWallets PMI calculator uses your home price, down payment, mortgage interest rate, mortgage insurance rate and loan term to estimate the cost of PMI.

Many borrowers dont mind paying PMI if it means they can buy a house sooner. But if the added cost of PMI pushes you over your monthly budget, you may want to shop in a lower price range or postpone homebuying until your financial situation improves.

Recommended Reading: How To Take Out 2nd Mortgage

Fha Mortgage Insurance Premium

If you cant qualify for a conventional loan product, you might consider an FHA loan. Like some conventional loan products, FHA loans have a low-down payment optionas little as 3.5% downand more relaxed credit requirements.

Lenders require mortgage insurance for all FHA loans, which are paid in two parts: an up-front mortgage insurance premium, or UFMIP, and an annual mortgage insurance premium, or annual MIP. Both costs are listed on the first page of your loan estimate and closing disclosure.

Is Mortgage Protection Insurance Worth It

If youâre worried about leaving loved ones with a mortgage payment if you die but canât get a competitive life insurance rate due to age or health issues, a mortgage protection insurance policy may help. Look into different mortgage protection insurance companies before signing up with your mortgage lender to make sure you’re getting the best deal. But first, you should see if youâre eligible for a traditional term life insurance policy.

For most people, a term life insurance policy is the better option. Itâs more affordable, provides more protection, and allows for more flexibility than most mortgage protection insurance companies do. And even if you think an affordable policy is out of reach because of your health, itâs worth getting a free quote â youâll probably be surprised at how competitive your term life insurance rates can be.

Additionally, because your house is such a major investment, youâll probably want to keep protecting it while youâre alive. A homeowners insurance policy protects the structure of your home and any attached property as well as the contents inside of the home, even if youâre still making mortgage payments. That way, if you lose your home or if itâs seriously damaged because of a covered peril, you wonât necessarily lose your investment.

Ready to shop for life insurance?

Read Also: How Much Mortgage Protection Insurance Cost

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

How Do I Know If Pmi Is Right For Me

Private mortgage insurance isntfor everyone, but home buyers should check potential returns before theyautomatically refuse it.

Check your home loan options to see what you can afford and how much mortgage insurance would actually cost you.

Popular Articles

Step by Step Guide

Recommended Reading: Will Mortgage Pre Approval Hurt Credit Score

How Long Does Mip Last

Unfortunately, if you purchased or refinanced with an FHA loan on or after June 3, 2013 and you had a down payment of less than 10%, MIP lasts for the term of the loan. With down payments of 10% or more, you still have to pay MIP for 11 years.

If you havent purchased or refinanced with an FHA loan since June 3, 2013, the outlook is a little better. On a 15-year term, MIP is canceled when your LTV reaches 78%. For longer terms, the LTV requirement remains the same and you have to pay MIP for at least 5 years.

Theres one other way to stop paying these premiums if youre currently in an FHA loan. Assuming you meet the other qualification factors , you can refinance into a conventional loan and request mortgage insurance removal once you reach 20% equity in your home.

Cost Of Mortgage Loan Insurance

The fee you pay for mortgage loan insurance is called a premium. Mortgage loan insurance premiums range from 0.6% to 4.50% of the amount of your mortgage. Your premium depends on the amount of your down payment. The bigger your down payment, the less you pay in mortgage loan insurance premiums.

Find premiums based on the amount of your mortgage:

You can pay your premium by adding it to your mortgage or with a lump sum up front. If you add your premium to your mortgage, you pay interest on your premium. The interest rate is the same rate as youre paying for your mortgage.

Ontario, Manitoba and Quebec apply provincial sales tax to mortgage loan insurance premiums. Your lender cant add the provincial tax on premiums to your mortgage. You must pay this tax when you get your mortgage.

Don’t Miss: How Do You Refinance Your Mortgage