Why Should I Use A Mortgage Calculator

What Is The Pmt Function In Excel

The PMT function calculates monthly loan payments based on constant payments and a constant interest rate. It requires three data points:

-

Rate: Interest rate of the loan

-

Nper : The number of loan payments

-

Pv : The principal or current value of the sum of future payments

While optional, there are two additional data points you can use for more specific calculations:

-

Fv : The balance you want to achieve after the last payment is made. If omitted, this value is assumed to be 0, meaning that the loan is paid off

-

Type: Use 0 or 1 to specify whether the payment is timed to occur at the beginning or end of the period

You May Like: How To Be Mortgage Underwriter

Calculate The Principal Payment Of A Mortgage

PPMT works a bit differently. Since the amount of principal paid changes based on the payment number, the function takes an additional argument . This is the number of the monthly payment. For example, if we calculate the principal payment for the first month of the second year, we will use 13 as the argument.

Ive used the following formula in cell F3 to calculate the principal payment for the first month:

=-PPMT

The arguments used in the formula are:

- I have omitted fv and type.

Note: the minus sign at the beginning of the formula is needed to return a positive number.

As you can see, the sum of principal and interest payments is the same as the amount obtained using the PMT function.

You May Like: Is It Better To Pay Off Your Mortgage Or Not

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

How Do I Make Pmi Payments

There are three primary schedules for making PMI payments. The options available to you will vary depending on your lender.

- Monthly: The most common method is paying PMI premiums monthly with your mortgage payment. This boosts the size of your monthly bill, but allows you to spread out the premiums over the course of the year.

- Upfront: Another option is an upfront PMI payment, meaning you pay the full premium amount for the year all at once. Your monthly mortgage payment will be lower, but you need to be ready for that larger annual expense. Additionally, if you move sometime in the year, you might not be able to get part of your PMI refunded.

- Hybrid: The third option is a hybrid one: paying some upfront and some each month. This can be useful if you have extra cash early in the year and want to limit your monthly housing costs.

Ask your lender if you have a choice for your payment plan, and decide which option is best for you.

Don’t Miss: Are There Different Types Of Reverse Mortgages

Costs Included In Your Monthly Mortgage Payment

Here are two formulas to visualize the costs that are included in your monthly mortgage payment:

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also homeowners insurance, property taxes, and, in some cases, private mortgage insurance and homeowners association fees. Heres a breakdown of these costs.

Refinance To A Shorter Term

Another option involves refinancing, or taking out a new mortgage to pay off an old loan. For example, a borrower holds a mortgage at a 5% interest rate with $200,000 and 20 years remaining. If this borrower can refinance to a new 20-year loan with the same principal at a 4% interest rate, the monthly payment will drop $107.95 from $1,319.91 to $1,211.96 per month. The total savings in interest will come out to $25,908.20 over the lifetime of the loan.

Borrowers can refinance to a shorter or longer term. Shorter-term loans often include lower interest rates. However, they will usually need to pay closing costs and fees to refinance. Borrowers should run a compressive evaluation to decide if refinancing is financially beneficial. To evaluate refinancing options, visit our Refinance Calculator.

Also Check: How Much Would I Pay Monthly On A Mortgage

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary the amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

How To Use Credit Karmas Simple Loan Calculator

Whether youre thinking of taking out a personal loan for debt consolidation or a student loan for college costs, you probably want a sense of how much your loan will cost over time.

Our loan calculator can help you understand the costs of borrowing money and how loan payments may fit into your budget. It takes into account your desired loan amount, repayment term and potential interest rate. Youll be able to view an estimated monthly payment, as well as the amortization schedule, which provides a breakdown of the principal and interest you may pay each month.

Keep in mind that this loan payment calculator only gives you an estimate, based on the information you provide. Loan fees like prepayment penalty or origination fee could increase your costs or reduce the loan funds you receive. This loan payment calculator also doesnt account for additional mortgage-related costs, like homeowners insurance or property taxes, that could affect your monthly mortgage payment.

Here are more details on the information youll need to estimate your monthly loan payment.

Read Also: Does My Credit Score Affect My Mortgage Rate

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the “Include Options Below” checkbox. There are also optional inputs within the calculator for annual percentage increases under “More Options.” Using these can result in more accurate calculations.

Non-Recurring Costs

These costs aren’t addressed by the calculator, but they are still important to keep in mind.

How Do I Use The Mortgage Calculator

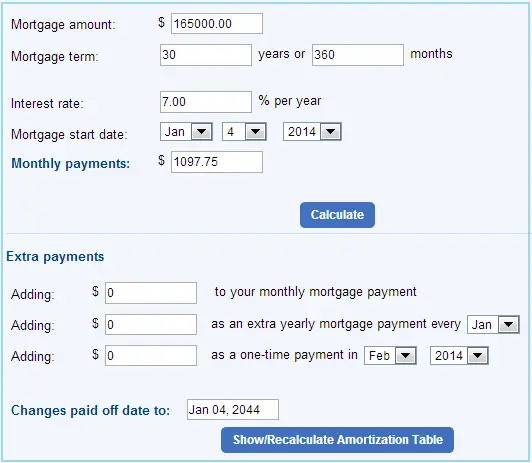

Start by providing the home price, down payment amount, loan term, interest rate and location. If you want the payment estimate to include taxes and insurance, you can input that information yourself or well estimate the costs based on the state the home is located in. Then, click Calculate to see what your monthly payment will look like based on the numbers you provided.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options.

Also Check: When Am I Committed To A Mortgage Lender

How Big Is The Uk Mortgage Market

Historically across the United Kingdom, around 65 thousand to 70 thousand mortgages are approved each month. This is from a low of around 30 thousand after the 2008 to 2009 global financial crisis. Prior to the recession, the monthly rate was closer to 80 thousand to 130 thousand mortgages completed each month.

The UK Mortgage Market is Over £1.5 Trillion

In the fourth quarter of 2020, there were £76.5 billion new mortgage originations in the UK, according to the Financial Conduct Authority . At the end of the fourth quarter of 2020, there were £1,438.4 billion in unsecuritised home loans outstanding, with £102.956 billion in securitised home loans. Total residential mortgages to individuals summed of £1.541 trillion across 13,404,487 loans in the fourth quarter of 2020.

Overall mortgage debt tends to grow around 3% to 6% per annum, though there can be significant fluctuations in that rate of growth due to factors like BREXIT, the global economic crisis which happened in 2008, COVID-19 lockdowns, etc. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to foreign property ownership, the localised balance between immigration and construction, etc.

How Much Can I Borrow For A Mortgage Based On My Income

Most prospective homeowners will be able to get a mortgage that is two to two-and-a-half times higher than their annual gross income. In other words, if you earn $100,000 a year, you should be able to afford a mortgage between $200,000 and 250,000. It should be noted, however, that this is a general rule.

When you are trying to decide on a house, there are a few factors that you will have to consider. One is what your lender thinks you will be able to affordwhich is calculated by your gross income, front-end ratio, back-end ratio, and credit score. Another factor is what type of house you want to live in, for how long, and what types of consumption you are willing to give up to afford it.

Also Check: Who Offers 20 Year Mortgages

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

Should You Rent Or Buy A Home

Having the ability to buy something does not mean that one necessarily should. Owning a home is both a significant commitment and a serious lifestyle choice. Renting a home is a more flexible arrangement than buying. Here are some factors to consider beyond the above financial ratios.

Do you plan on living in the area for an extended period of time? Real estate transactions are typically large, leveraged, high-friction transactions. Between closing costs, real estate commissions & other related fees, many home buyers may spend about eight or nine percent of the home’s price between buying and selling it. If you live in a place for a significant period of time the home appreciation can more than offset any costs, but if you only live there a couple years before moving again it is likely to cost you as the first few years of a loan’s payments go primarily toward interest.

How secure is your source of income? If your job may require you to move then owning a home may harm your career flexibility. If you are in a field with high employee churn then renting may be a better option.

Will you be adding to your family in the near future? If you buy a house & quickly outgrow it, there’s no guarantee that it will be easy to simulaneously sell your current home and buy a larger one.

Also Check: Should You Buy Down Mortgage Rate

Amortization Schedule For A Variable Number Of Periods

In the above example, we built a loan amortization schedule for the predefined number of payment periods. This quick one-time solution works well for a specific loan or mortgage.

If you are looking to create a reusable amortization schedule with a variable number of periods, you will have to take a more comprehensive approach described below.

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

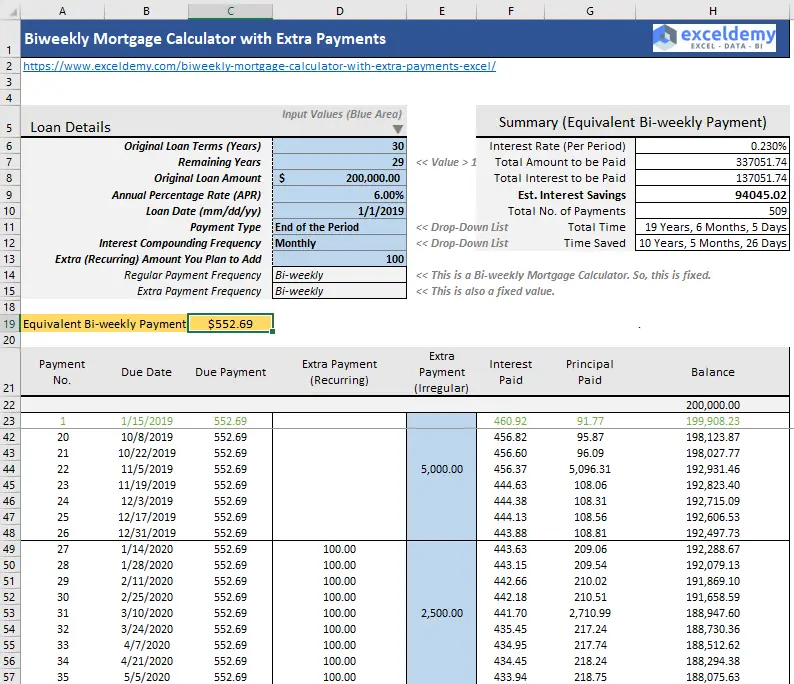

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Also Check: How Many Years Of W2 For Mortgage

Mortgage Down Payment Calculator

With nestos mortgage down payment calculator, we make it easy to figure out the minimum down payment in Ontario, BC, Alberta, Quebec or wherever youre planning on making your home in Canada. Just as our mortgage calculator helps you calculate your mortgage payment when you know your amortization period and mortgage term our mortgage down payment calculator helps you figure out your down payment.

How much is a house down payment? Can you buy a house without a down payment in Canada? These are some of the top questions that people ask when learning to seek out down payment calculators in Ontario, Quebec, BC and Alberta or anywhere else they call home in Canada.

Below you will find our answers to many questions about down payment. We have also added a portion on prepayment options being able to use these to your advantage can make it easier to reduce your total interest over the life of your mortgage if you do not have the money at the time of purchase.