Why Is Adopting A Loan Repayment Strategy Important

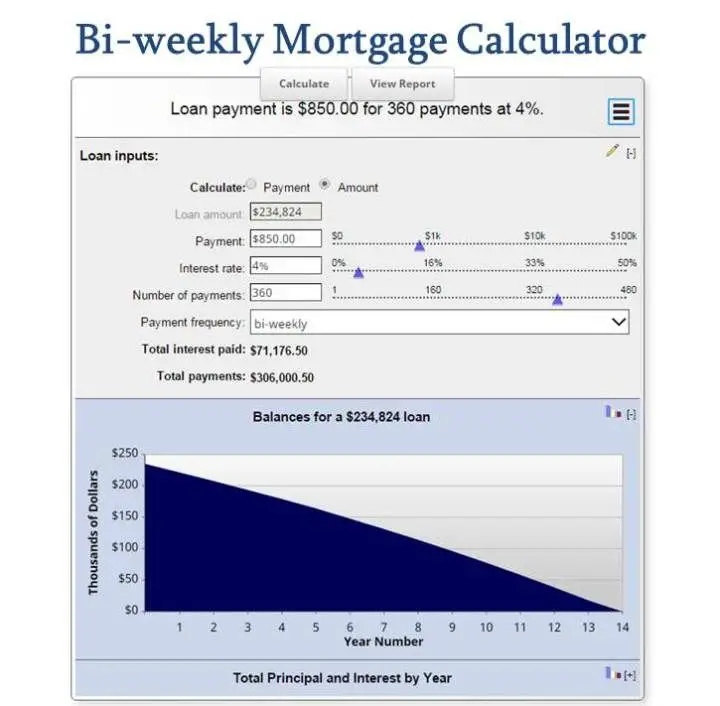

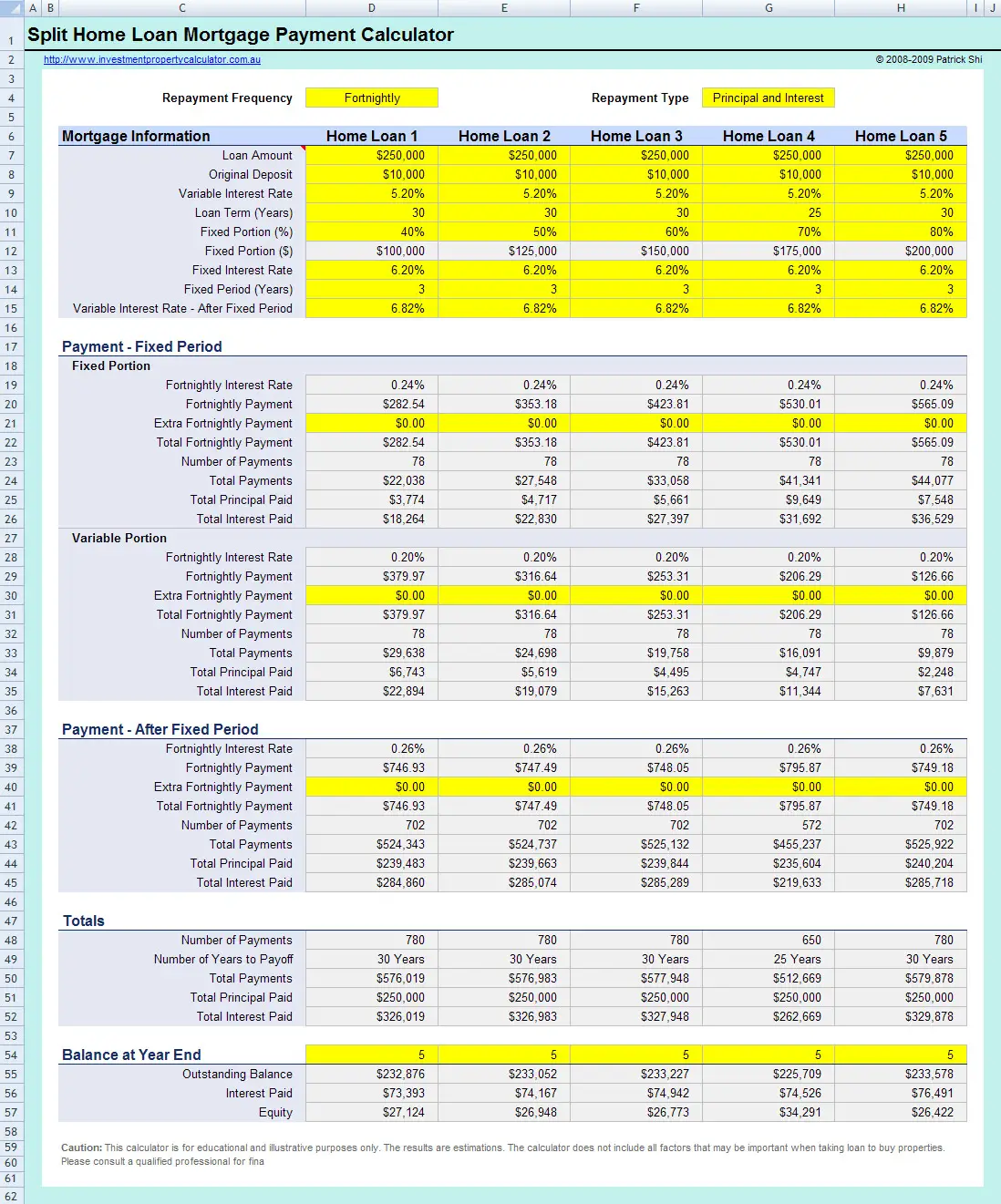

As you can see from some of the earlier examples, even small changes to your repayments can save you thousands of dollars in the long run. A saving of just 0.25% on your home loan will make a giant dent in the total interest paid over 30 years or switching to bi-weekly or fortnightly payments can decrease the amount of time it will take to pay off your loan.

Small adjustments can lead to major changes, so testing different options in the mortgage repayment calculator is worth the effort. And while its still best to speak to a professional, which you can do for free here, this calculator is an ideal starting point. You can also try testing our Borrowing Power Calculator to have an idea of how much you can afford to borrow.

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

Example Monthly Pmi Costs

Here is a chart of estimated monthly PMI costs based on a rate of 0.55%.

| 3.5 | 2.5 |

If the value of your home increases significantly during the loan, you may be able to get PMI removed quicker than shown in the above charts if the bank recognizes the increased value of your home. To do so, you will have to contact your lender when your LTV is below 80% to request the removal of PMI.

Don’t Miss: How Does A Mortgage Loan Modification Work

Mortgage Legal Issues In New York

New York has a long history of being a buyer beware state, but some of those concerns have been remedied throughout the years. Currently, sellers must fill out a property condition disclosure statement that contains several pages of questions ranging from whether the property is located in a floodplain to the last date of sewage pumping. The seller only has to disclose what she knows to the best of her knowledge and isnt required to verify statements with an inspection. That due diligence falls on the seller, who is warned at the top of the document that the disclosure is not a substitute for any inspections or tests. Youll still have to research the property using your own means. The disclosure is just one of the pieces of information available to you.

If youre curious how foreclosure works in this state, you might be relieved to know that its favorable for homeowners. New Yorks foreclosure process is judicial, which means the lender has to sue the borrower in order to enforce their rights. This is generally considered more favorable for the homeowner than a non-judicial foreclosure, which means no court involvement and has a quicker timeline from initiation to home auction. With a judicial foreclosure, the lender has to win the lawsuit in order to sell the property at auction. The moment a lawsuit is filed is when the homeowner is considered in foreclosure.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Read Also: How To Be A Mortgage Loan Originator

Comparing Commercial Mortgages With Residential Loans

There are many similarities between residential mortgage requirements and commercial real estate loans. Both need satisfactory credit scores, credit background checks, and the right down payment amount to secure financing. However, there are many differences between these two loans.

First, commercial mortgages require a stricter underwriting process. It also takes a lot longer compared to the average residential loan. Next, commercial mortgages entail higher costs compared to residential loans. They also usually have a higher interest rate compared to housing loans.

To detail the differences between commercial loans and residential mortgages, we came up with the table below:

| Loan Details |

|---|

| VA loans: 40-50 business days |

Common Sources Of Commercial Mortgage Financing

There are many sources of commercial financing in the market. Commercial loans are offered by banks, credit unions, insurance companies, and government-backed lenders. Private investors also lend commercial mortgages but at much higher rates.

The right kind of commercial loan for your business depends on the loan features you need. You must also factor in your business strategy, the type of commercial property, and your credit availability.

Below are several common types of commercial loans and where you can obtain them:

Also Check: How Much Take Home Pay For Mortgage

What To Do After Calculating Your Loan Repayment

Once you have calculated your monthly loan payments for a potential lender, you should check and see how that amount will fit into your monthly budget. If the potential payments are too high, you might want to compare other lenders or even reconsider the type of loan you are applying for. If you have less than stellar credit and are having trouble finding a reasonable interest rate, you may want to look into lenders that offer loans for bad credit borrowers. These lenders typically have more flexible requirements and lower interest rate caps.

What Is A Million Dollars Today

Remember the song âIf I Had $1,000,000â by the Barenaked Ladies? When the band released the song in 1992, $1 million had some serious purchasing power. Fast forward a couple of decades and itâs a different story.

Thanks to inflation, money loses its value over time. Inflation is the yearly increase of the cost of goods and services, affecting everything from food and electronics to wages and real estate. Because of inflation, what might have cost a million dollars in 1992 will cost much more in 2012.

Hereâs a table showing what $1 million is worth over time â starting from the release of the song:

| Year |

As you can see above, inflation has a serious impact on the value of $1 million over 40 years.

Recommended Reading: Rocket Mortgage Qualifications

Read Also: What Determines The Interest Rate On A Mortgage

Getting A 15 Million Commercial Mortgage

Business mortgages of this amount are available if you meet the right criteria. Commercial mortgages are used when business loans, usually capped at £25,000, dont provide the funding needed. Such circumstances might include purchasing a new property to trade from.

Commercial mortgages can be divided into two types

- Owner-occupier mortgages: Used to buy a property that will serve as a trading premise for your firm.

- Commercial investment mortgages: Typically used to invest in commercial property that you might be planning to let out.

Whether you are eligible for a £1.5m commercial mortgage is a question that one of the advisors we work with can answer. Theyre experts on high value commercial mortgages, have contacts with specialist lenders and can help you find the best deal.

You can find out more in our complete guide to commercial mortgages.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Also Check: How Much Of Your Monthly Income For Mortgage

Costs To Expect When Buying A Home In New Jersey

One thing to consider when buying a home in New Jersey are costs that will only occur during the initial home-buying and closing phase. When you find a property youd like to buy, one of the first things youll need to arrange is a home inspection. In New Jersey, you can expect to pay an average between $300 and $500. Most home inspections dont include additional testing. Youll have to request for additional tests such as termite inspections, mold and other potential home hazards. Its the buyers responsibility to arrange and pay for any additional inspections. Add-on tests can cost you around $85 and up. Usually your primary home inspector will offer those services as additional options to a home inspection, but thats not always the case. One last consideration is that you should check to see if the property is in one of New Jerseys radon high potential areas. Even if the home isnt in a tier 1 location, New Jerseys Department of Environmental Protection recommends testing all homes for radon concentrations.

Once its time for closing, youll have to pay a number of fees to different entities to complete the deal. These are called closing costs and can vary based on the location and value of the home, along with a number of other factors.

Close On Your Mortgage

To complete your homebuying journey, youll sign dozens of papers in front of a notary. This process traditionally took place in an office, but now you may be able to do it in your home with a mobile notary or remote online notarization.

Youll need to provide your ID and possibly your fingerprint. Soon after that, youll get the keys and the real excitement of moving into your new home can finally begin!

Amy Fontinelle is a mortgage and credit card authority and a contributor to Credible. Her work has appeared in Forbes Advisor, The Motley Fool, Investopedia, International Business Times, MassMutual, and more.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Recommended Reading: How To Calculate Home Mortgage Interest

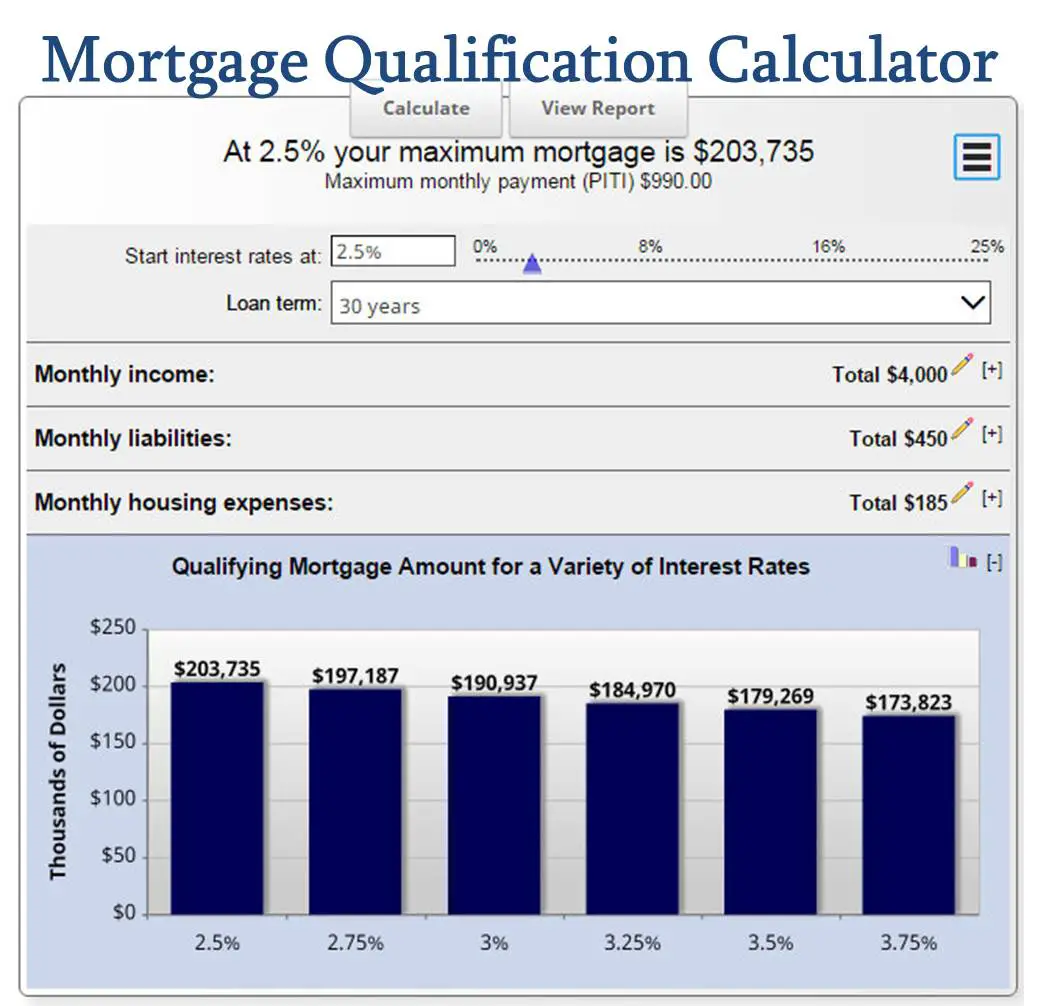

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

New Mortgages Interest Only Mortgages And Interest Rate Rises

Itll give you a simple, ballpark figure to show you the monthly payments youd pay on:

- intertest only mortgages

- your mortgage if there was an interest rate rise.

You can also adjust the mortgage term, interest rate and deposit to get an idea of how those affect your monthly payments.

To get started all you need is the price of your property, or the amount left on your mortgage.

MoneyHelper is the new, easy way to get clear, free, impartial help for all your money and pension choices. Whatever your circumstances or plans, move forward with MoneyHelper.

Also Check: Is 5.375 A Good Mortgage Rate

Factors In Your Massachusetts Mortgage Payment

On top of your principal and interest payment, you have to pay property taxes to the city or town your home is in four times a year in Massachusetts. While the Massachusetts average property tax rate seems manageable at 1.17%, the median property tax bill is $4,899. Thats due to the states strong housing market and high home values, which lead to a higher overall tax bill.

Your property taxes are based off of your homes assessed value and the areas tax rate. The Bay State assesses residential real estate each year to determine the market value. Your property bill will be based off of that number, so if you have any issue with the assessment, you can file an abatement application. This isnt guaranteed to get accepted but if it is, youll receive a refund for a portion of your property taxes. Senior citizens, veterans and blind residents can apply for property tax exemptions. The complete list of qualifying exemptions can be found on Massachusetts Department of Revenue property tax information website.

Another ongoing cost that accompanies your property tax and mortgage payments is homeowners insurance. In Massachusetts, the average annual premium is $1,485, according to Insurance.com data. That makes it one of the most expensive states for homeowners insurance premiums.

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Recommended Reading: What Is A Mortgage Bond

Commercial Real Estate Interest Rates

Commercial loan rates are often slightly higher than residential mortgages. It is usually around 0.25 percent to 0.75 percent higher. If the property needs more active management such as a motel, the rate can increase. Depending on the establishment and type of financing, commercial mortgage rates typically range between 1.176 percent up to 12 percent.

Commercial real estate loans are fairly considered illiquid assets. Unlike residential mortgages, there are no organized secondary markets for commercial loans. This makes them much harder to sell. Thus, higher rates are assigned for purchasing commercial property.

How A Mortgage Calculator Can Help

As you set your housing budget, determining your monthly house payment is crucial it will probably be your largest recurring expense. As you shop for a purchase loan or a refinance, Bankrate’s Mortgage Calculator allows you to estimate your mortgage payment. To study various scenarios, just change the details you enter into the calculator. The calculator can help you decide:

Also Check: Can I Get A Mortgage With A 575 Credit Score

Wait For The Benefits

When it comes to retirement, the longer you wait, the more you can get. For example, Medicare doesnt kick in until youre 65 years old. And, youll receive penalties if you withdraw your retirement income before 59 1/2.

When youre thinking about retirement, often times the best thing to do is wait until youre 65 so your benefits will immediately kick in.

But, if you want to retire early, youll need to make sure that you can fund your medical costs, bills, and other needs before you reach that age.

Also Check: What Does Gmfs Mortgage Stand For

Determine What Your Ideal Down Payment Amount Should Be

A down payment is a portion of the cost of a home that you pay up front. It demonstrates your commitment to investing in your new home. Generally, the more you put down, the lower your interest rate and monthly payment. There are also low or no-down payment options available on certain types of mortgage products, to qualified home buyers. Use this down payment calculator to help you answer the question how much should my down payment be?.

Estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down-payment of 20% would result in an estimated monthly payment of $1,058.04 with an Annual Percentage Rate of 3.946%.1

Read Also: Is 15 Or 30 Year Mortgage Better