How Do Your Credit Scores Affect Your Rate

Your credit scores influence your mortgage interest rate. Lenders call it risk-based pricing. Higher credit scores indicate a lower risk that youll default on a loan so you get a better interest rate. The lower your credit scores, the higher your interest rate.

» MORE:Mortgage rates and credit scores: Dont make a $30,000 mistake

What The Forecast Means For You

Lending has become increasingly more costly for homeowners and borrowers alike as mortgage rates continue to rise. Mortgage rates jumped 1.5 percentage points during the first three months of the year, the biggest quarterly climb in 28 years.

Higher interest rates mean higher monthly payments for borrowers. For example, on a $400,000 home with a 5.10% interest rate, the monthly mortgage payment is around $2,172. This doesnât include insurance, taxes or other loan costs. If the rate rises to 6%, the monthly payment jumps to $2,398.

This means time is running out for homeowners who hope to lock in a lower interest rate by refinancing.

What Is The Difference Between Interest Rate And Apr

Interest rate is a percentage of the total loan balance paid to the lender on a monthly basis . The annual percentage rate, or APR, is the total borrowing cost as a percentage of the loan amount, which includes the interest rate plus any additional fees like discount points and other costs associated with procuring the loan.

Don’t Miss: Can You Have A Second Mortgage With An Fha Loan

Va 30 Year Fixed Mortgage Rates

Since VA loans are guaranteed by the government, VA loans provide access to special benefits, including:

Why Do Mortgage Rates Vary So Much

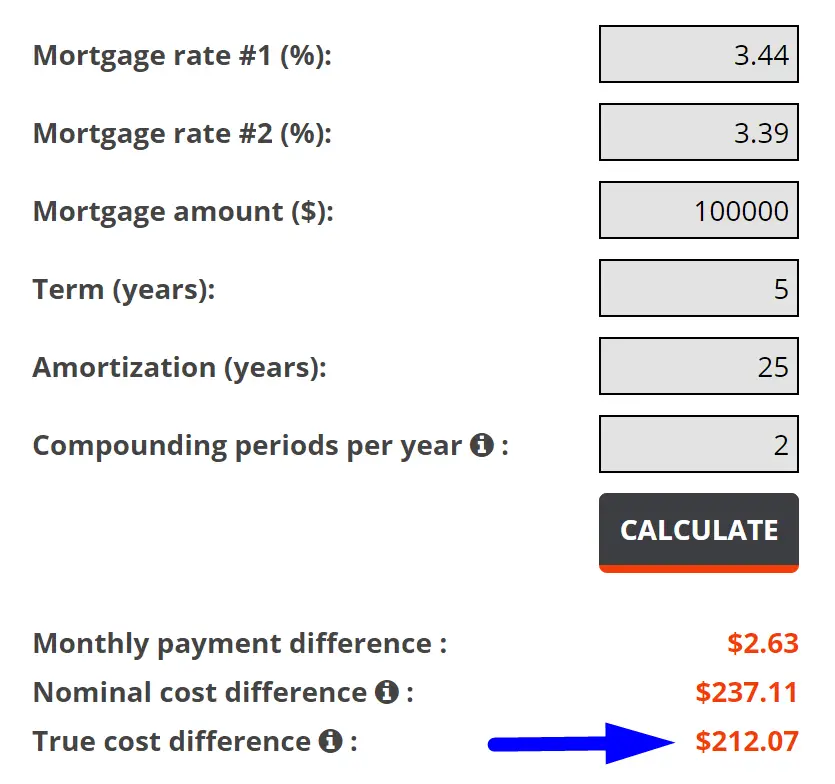

Mortgage rates differ between home lenders. The same borrower may be offered many different rates by competing lenders, even for exactly the same loan. Thats because lenders are competing businesses with individual pricing policies.

Mortgage rates also differ between borrowers. The same mortgage lender may offer varying interest rate quotes to different applicants even for the same loan product. Thats because every borrower carries an individual risk profile.

Home loan rates can vary by property type and other risk factors. For example, a mortgage secured by a rental or investment home is more likely to go into foreclosure than the same loan for a primary residence. For this reason, rates for investment property are higher.

The home loan program also affects the rate you get. VA loans, for example, are guaranteed by the Department of Veterans Affairs. This means that banks are unlikely to take a loss. By contrast, conventional loans are not guaranteed. Less risk means a lower rate.

You are different from your neighbor, after all, so your loan will be different from your neighbors.

But if you insist on finding a ballpark interest rate, you can find a ton of them online those mortgage rate surveys.

Also Check: How To Write A Hardship Letter To My Mortgage Company

When To Lock In Your Mortgage Rate

How do you know when to lock in a mortgage rate if theyre constantly fluctuating?

Fortunately, it is easier than it seems.

Youll likely have a brief opportunity to compare rates before its time to lock and close the deal.

And at that period, you should anticipate rates to stay the same. Typically, day-to-day fluctuations are negligible.

Therefore, the decision is less about the time of your rate lock and more about selecting the appropriate lender.

Since even seasoned economists have difficulty predicting the movement of mortgage rates, you will likely save more by shopping around than by trying to play the market.

Popular posts

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan and is built into your monthly payment. Mortgage fees are usually paid upfront and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

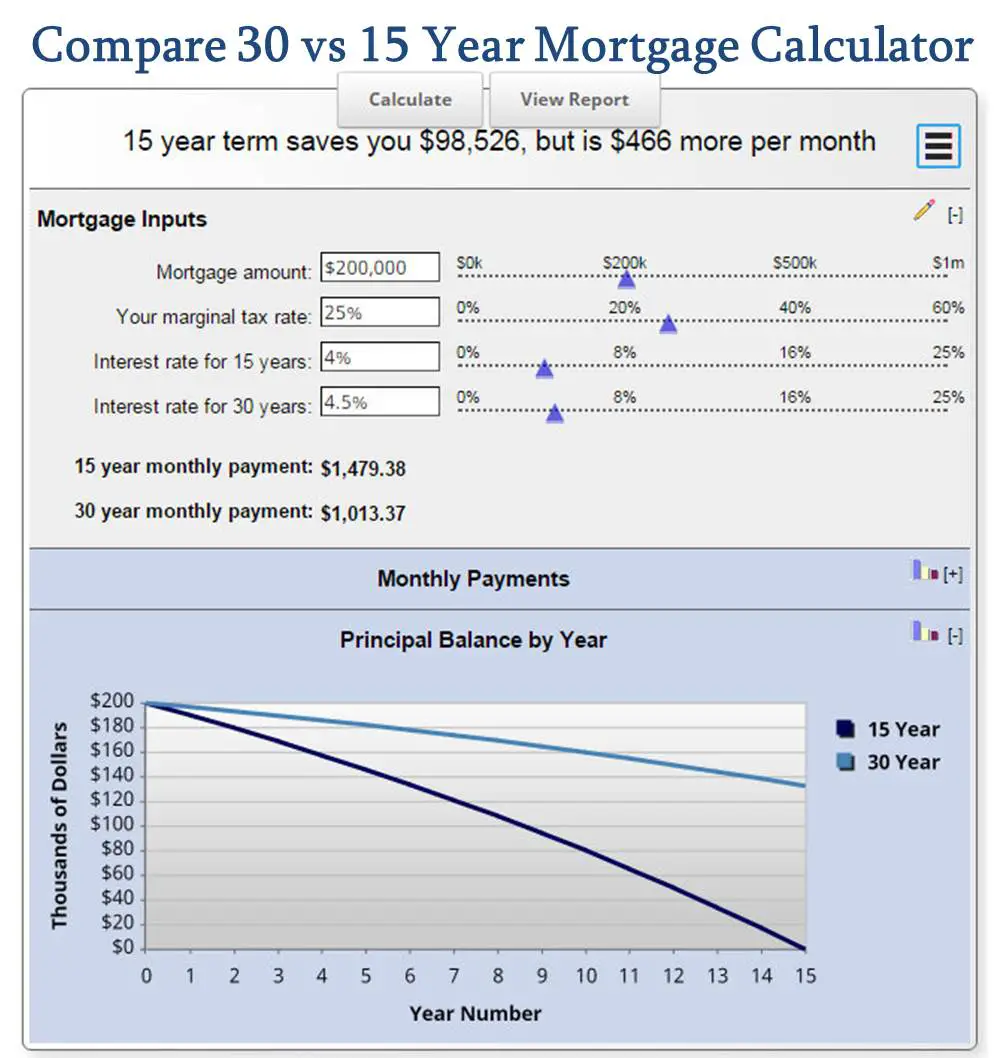

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

Don’t Miss: Can I Get A Mortgage With A 651 Credit Score

Scoring A Low Interest Rate

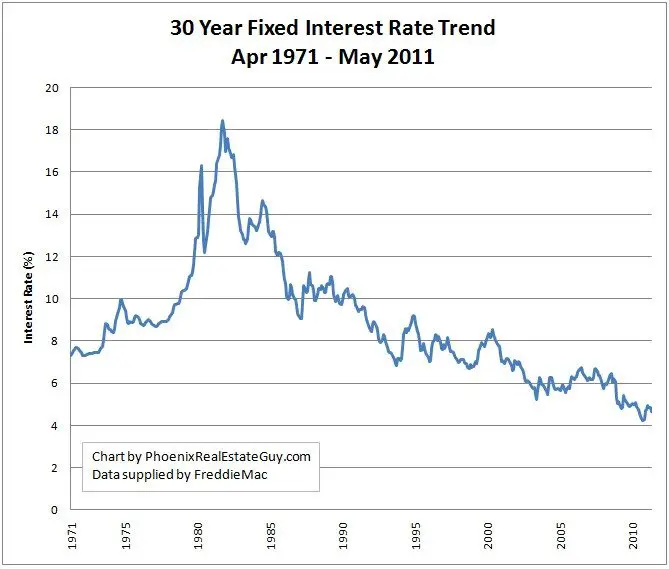

If you are looking to purchase a home, applying for a home mortgage now might be a good idea. Currently, interest rates are historically low, but as the employment situation and economy improve, you can expect those rates to spike soon.

While the aforementioned factors impact the average interest rate, you can control certain elements and help secure a lower interest rate for a home loan.

How Do You Get Preapproved For A Mortgage

Borrowers can get preapproved for a mortgage by meeting the lenderâs minimum qualifications for the type of home loan youâre interested in. Different mortgages have different requirements. For example, a conventional mortgage usually has higher credit score and down payment requirements than government loans, such as Federal Housing Administration and Veterans Affairs mortgages.

The most important task for a prospective homeowner seeking a preapproval letter is to gather all the financial paperwork needed to give the lender a solid picture of your income, debts and credit history. This information helps underwriters estimate how much of a loan you can afford and the costs of the loan.

The preapproval process will cover:

Don’t Miss: How To Use Plastiq To Pay Mortgage

The Driving Force Behind Mortgage Rates

Mortgage rates are a substantial element of the home buying process. While you likely know what a mortgage rate is if you have begun your home purchase journey, understanding what drives those rates may not be familiar territory.

The average interest rates affixed to home mortgages often fluctuate based on a few different factors. Understanding these can help you better comprehend when your chances increase for a lower interest rate.

What Is A Mortgage

A mortgage is a type of secured loan that is used to purchase a home. The word mortgage actually has roots in Old French and Latin.. It literally means death pledge. Thankfully, it was never meant to be a loan you paid for until you died , but rather a commitment to pay until the pledge itself died .

You can also get a mortgage to replace your existing home loan, known as a refinance.

Read Also: How Much Should You Put Down On A Mortgage

Check Out Daily Mortgage Rates On Lender Websites

- If you dont have access to lender rate sheets

- Visit lender websites to access their daily mortgage rates

- Keep track of them over time and make note of any changes

- To determine their direction or any obvious trends

If youre a consumer without access to mortgage lenders rate sheets, you can check their websites for purchase and refinance rates, though these arent nearly as reliable, and are typically just advertised rates with lots of assumptions.

While probably closer to national averages, you can at least glean some information, like mortgage rate trends if you see that theyre rising or falling over time.

Prospective home buyers may want to bookmark some mortgage lenders pages that feature todays mortgage rates to chronicle them over time and stay in the know.

Youll be able to get a better idea of monthly payments and hone in on the rent vs buy question.

Anyway, to answer the initial question, yes, mortgage rates can change daily, but only during the five-day workweek.

Mortgage rates do not change during the weekend, though pricing can definitely change between Friday and Monday depending on what happens on Monday morning.

In other words, pricing you receive on Friday could certainly differ from the pricing you receive on Monday morning depending on what transpires between then.

This is similar to the stock market or any other financial market for that matter. Its constantly in flux and as such, things change, a lot.

The Three Elements That Influence Mortgage Rates

Three elements affect the interest rate on your mortgage or refinancing.

- The economic climate

- Your mortgage lender

Each of these characteristics will be described in depth below. But heres a quick summary of how these three factors interact to determine your mortgage rate:

- The strength of the U.S. economy mainly determines mortgage rates. When the economy is robust, interest rates tend to increase. When the economy is sluggish, interest rates tend to decline.

- Individual factors impact whether your mortgage rate is on a high or low end of the spectrum. For instance, suppose the economy is in a low-rate phase, with average 30-year loan rates hovering around 3%. A borrower with excellent credit and a substantial down payment may receive a rate closer to 2.5%, but a person with poor credit may be given 3.5%.

- Lenders provide varying interest rates to various customers based on the sorts of loans they specialize in and their capacity for new business. Therefore, it is essential to compare mortgage rates from many lenders.

This final aspect is likely the most crucial if you are comparing mortgage or refinancing rates.

You cannot alter the rate environment as a whole. And until you have a few months, it isnt easy to significantly improve your credit score or save for a larger down payment.

However, you may always compare multiple lenders.

There is a lesser rate available than your initial one. You must search for it.

Also Check: What Questions To Ask A Mortgage Lender

Consider Different Types Of Home Loans

The 30-year fixed rate mortgage is the most common type of home loan, but there are additional mortgage options that may be more beneficialdepending on your situation.For example, if you require a lower interest rate, adjustable-rate mortgages offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts after a set period of time . Given that ARM loans are variable, the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. A 15-year fixed rate mortgage, on the other hand, may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed rate mortgage. Consider all your options and choose the home loan that is most comfortable for you.

Current Mortgage Refinance Rates

Refinancing became a bit more expensive today as 30-year fixed and 15-year fixed refinance mortgages saw their mean rates trend upward. Shorter term, 10-year fixed-rate refinance mortgages also moved up.

The refinance averages for 30-year, 15-year, and 10-year loans are:

Check out mortgage rates that meet your distinct needs.

You May Like: Does Ally Bank Do Mortgages

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower rate and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. , and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but the fees can vary. When comparing APRs between lenders, ask which fees are not included for better comparison.

Read Also: How Large Of A Mortgage Can I Get

You May Like: How Mortgages Work In Usa

What Are Closing Costs

Youll likely owe more when you close on the house than just the down payment on the mortgage. There are other expenses that have to be paid to make this big transaction go through. Closing costs often entail taxes and fees associated with the purchase that arent included in the sale price.

Expect closing costs to total around 3% to 6% of the purchase price, so youre looking at between $8,250 and $16,500. They might include fees charged by the lender like loan origination fees, points paid to get a lower mortgage rate, fees associated with the property such as an appraisal or inspection, or prepaid costs such as property taxes or homeowners association dues.

How Do Us Treasury Bonds Track Mortgage Rates

The yield on US treasury bonds are the interest rate that the government pays when someone buys a 10 year treasury bond. The 10 year bond yield is considered a benchmark rate for other financial instruments like mortgages. Since the 10 year bond yield is considered a forward-looking market gauge, when it moves up or down you will usually see mortgage rates quickly follow in the same direction.

Also Check: What Is The Monthly Payment On A 75000 Mortgage

How To Get The Best Mortgage Rate

Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower’s personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:

How Do I Choose A Mortgage Lender

A mortgage is likely the largest debt youll take on in life one that will take decades to repay. So its critical to make sure you choose a mortgage lender and mortgage that work best for your needs and financial situation.

Here are some tips to help you choose a mortgage lender:

If youre trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

Don’t Miss: Are Mortgage Rates Higher For Townhomes

What Factors Influence The Growth And Decrease Of Mortgage Interest Rates

In normal circumstances, mortgage interest rates are heavily influenced by investor expectations.

Good economic news hurts interest rates because an active economy boosts inflation fears.

Inflation causes fixed-income instruments such as bonds to lose value, which increases their yields .

For example, imagine you purchased a $1,000 bond with 5% annual interest two years ago. .

Your interest rate: $50 annually divided by $1,000 equals 5%

Summary Of Current Mortgage Rates

Mortgage rates moved lower this week

- The current rate for a 30-year fixed-rate mortgage is 6.49%, a of 0.09 percentage points from a week ago. The 30-year rate averaged 3.11% this week last year.

- The current rate for a 15-year fixed-rate mortgage is 5.76%, down 0.14 percentage points week-over-week. The 15-year rate averaged 2.39% a year ago this week.

Don’t Miss: Can I Get A Mortgage Based On Rental Income