Townhouses Are Much Easier To Purchase Than Condos

Given the HOA complications and the loan limitations, its easier to purchase a townhouse than a condo.

But either way, youll need a good credit score and a good income, now and in the future, no matter which type of house you decide to buy. Condos and townhouses also must be appraised upfront to make sure the value is reasonable for the purchase price.

His suggestion to finding a good lender who knows about condos is to ask a local title company.

They know who turns in the most condo loans and who closes the fastest and which ones have the most excuses for being late, he says.

Lee Nelson

MyMortgageInsider.com Contributor

Think Youre Buying A Townhome/rowhousethink Again

In the world of real estate transactions involving condos and townhouses, if it looks like a duck, talks like a duck and walks like a ducksometimes its not a duck.

Frequently enough, some home buyers want to split hairs between single family residence living and the condo life. They make a slight compromise on privacy for the sake of limited maintenance. They seek a larger floorplan perhaps. There are many reasons but in the end, they seek a townhome or row house. Excitedly, the purchase agreement is executed, the inspection is scheduled and its often at this point, . . they find out that they just technically bought a condo.

Sorting out the difference between a townhouse/row house vs. a condo is rather simple one just has to know what to look for. The determinative difference, from a lending perspective, lies in the legal description of the property. And its easy. From a mortgage lending perspective, if the property has a Lot Block legal description, its a townhome or row house. If it has a Common Interest Community legal description, its a condo. Regardless of what a property may appear to be to the eye, when it comes to the mortgage youll use to buy itit all comes down to the legal description.

Knowing this difference has great implications on mortgage financing. Here are 3 examples of potential unforeseen pitfalls:

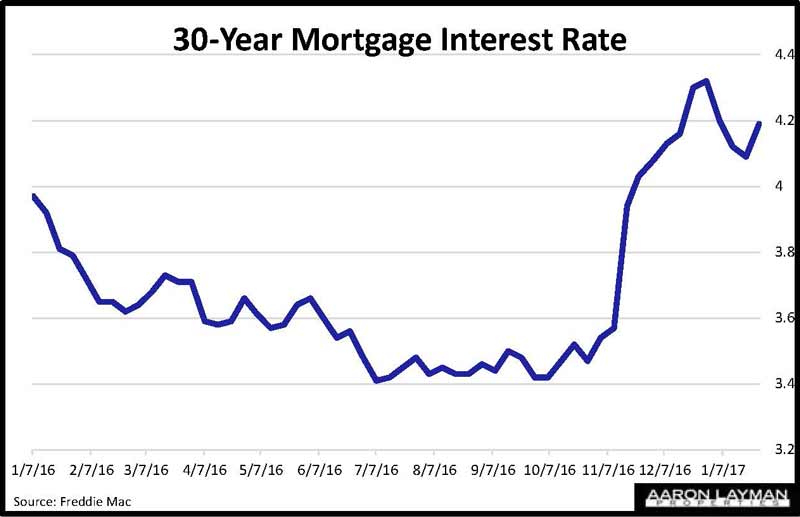

Home Prices Are Also Rising

Adding to the struggles of homebuyers: This run-up in mortgage rates comes as homes are selling for a lot more than they were a few years ago. The median U.S. home listing price broke $400,000 for the first time in March and was up 26.5% over two years earlier, per data from Realtor.com. The problem with housing prices? Supply and demand, experts say. Its just that there arent enough homes for everybody who wants one, Daryl Fairweather, chief economist at Redfin, told us.

The financial crunch on buyers means you might need to be creative during your home search, looking at places that might not be your first choice and taking your time, experts say. I think you want to be strategic and you want to be patient, Robert Dietz, chief economist at the National Association of Home Builders, told us.

Also Check: How Much Can My Mortgage Payment Be

What Is A Condominium

Condos are usually one larger unit divided into two different living spaces. In some cases, there may be enough space for the condo to be split into more than two homes. Each individual portion has all the amenities of a traditional house , but some spaces may be shared, such as a driveway, backyard, gym, etc.

Condos also have at least one shared wall, if not more. Homebuyers may find more in common between an apartment and a condo rather than a house and a condo. However, condos can be owned, and often feature a variety of beneficial common areas such as dog parks, a pool, basketball courts, or a gym. The ownership will likely only apply to the interior unit, not the land it sits on.

Another thing to keep in mind is the potential for wallet straining HOA dues. As a condo owner, you may not be in charge of mowing the lawn or paying for roof repairs, but you will usually pay more in fees than if you lived in a house or an apartment. The responsibilities and extra costs that come with owning a condo will vary from place to place.

What Is A Condo

First, what is a condo? A condo is defined by the type of ownership. Condos are usually in a building with similar units side by side, almost exactly like an apartment building. The difference is that you own the interior of your unit instead of just renting it.

All the residents share the rest of the building and pay fees to a homeowners association . The HOA covers necessary upkeep and insurance for anything outside your unit. That includes things like the building itself, landscaping and common areas like swimming pools or recreation halls.

You May Like: How Much Does Mortgage Coach Cost

Is It A Condo Or A Townhouse Or Something Else It Matters If You Need A Mortgage

Now lets talk about mortgages with regard to condos and townhomes. Things can get tricky fast here, especially because the terms are often used interchangeably.

We discussed a lot of the aesthetic attributes of condos and townhomes, since thats what most people are interested in, but you might hear that the latter is a type of property rather than a form of ownership.

Thats technically true, especially since townhomes can be rented as opposed to owned, but my assumption is most home buyers are concerned with the layout/style of the property in question, not its legal description.

However, when it comes to home loan financing, it can actually make a big difference.

For example, Fannie Mae has a pricing hit for condos if the loan-to-value ratio is above 75%.

So if you dont put down at least 25% when buying a home, or have 25%+ home equity when refinancing an existing mortgage, your mortgage rate will be higher, all else being equal.

One exception to this rule is detached condominiums, including site condos, which are exempt from this pricing adjustment.

However, this adjustment only applies to mortgages with terms greater than 15 years.

So those who elect to take out 15-year fixed mortgages wont have to worry about this pricing hit, which is something to consider. Freddie Mac has the same rules.

So certain types of financing may not even be an option to begin with depending on the building in question.

Condo Vs Townhouse: Which Is Right For Me

The choice between condo or townhouse is driven by so many factors, many of which are personal.

Reasons to buy a condo:

- Condos tend to cost less than townhouses of comparable square footage

- You may find an active social scene in a condo community, especially for adults

- Condos are often located in downtown neighborhoods

- Many condos come with luxury amenities

- An HOA relieves you of responsibility for exterior maintenance

Reasons to buy a townhouse:

- Townhouses can offer more privacy in general

- A townhouse might offer private outdoor space

- Townhouses are typically located in more suburban areas

- Families might find more outdoor play opportunities for kids in a townhouse

- Many townhouses have no homeowners association fee

Recommended Reading: How To Figure Out How Much Mortgage You Qualify For

Townhouse Versus Condo: Which Property Is Best For Me

If youve thought about owning a home, but feel thered be too much space to maintain, you need to evaluate townhouse vs. condo purchases.

First-time home buyers with little money saved and no time for home maintenance may benefit the most from starting in a condo or townhouse and upgrading to a house later on. Baby Boomers and seniors can also benefit from the little upkeep and lower costs that a condo or townhouse have.

They are often less expensive than single-family homes in regard to both the initial investment as well as monthly payments, even when factoring in various fees.

Lets compare the two, so you can understand which is the better fit for you.

Raise Your Cash Commitment

Another option to buy a home with a higher rate is to spend more cash up-front. You can use cash to:

- Increase your down payment as a percentage of your loan amount

- Pay for builder upgrades out of pocket

- Buy down your rate by paying discount points

Discount points are an up-front fee that you can choose to pay to lower your rate and payment.

These strategies can help to offset the effect of higher rates, says Michael Mesa, branch manager and mortgage planning specialist at Fairway Independent Mortgage in Lacey, Wash.

Is the buyer looking at financing the builder upgrades into the price of the home or are they paying cash for them? Mesa says. How much of a down payment does their mortgage plan call for? Are discount points worth the expense?

Youll need to crunch some numbers with your lender to understand whether more cash will help your situation.

Recommended Reading: What Does It Mean Points On A Mortgage

Condo Mortgage Rates Vs Single

Condo mortgages tend to have slightly higher interest rates compared to a loan for a single-family home, because lenders need to compensate for the additional risk of financing property in an association.

If youre planning to buy a condo to live in, you can finance it in the same way youd finance a single-family home. Your options include:

- Conventional loans 3 percent or 5 percent down, with a 620 minimum credit score

- FHA loans 3.5 percent down with a 580 minimum credit score, or 10 percent down with a 500 minimum credit score must be an FHA-approved condo

- VA loans No minimum down payment or credit score must be an eligible service member or veteran must be a VA-approved condo

- USDA loans No minimum down payment or credit score must be in an eligible location

What Is A Townhouse Just A Style

Now lets talk about a townhouse, also known as a townhome, which is similar to a condo and a single-family dwelling, but perhaps best described as a hybrid of the two.

After all, theres a reason it has the word house in its name. It must resemble one!

It differs from a condo because it typically consists of multiple stories, such as an upstairs and downstairs, and often doesnt share a ceiling, nor have any neighbors residing below.

The land directly beneath the structure of most townhomes is considered part of the individual unit in terms of ownership too, which is important.

This might be evident on a plat map and/or in the legal description of the property.

A townhome may also have its own entrance, such as an exterior door, along with its own garage, which can also be accessed via the interior of the property.

Want a fast, free rate quote? Quickly get matched with a top mortgage lender today!

Picture a condo that has a staircase, or potentially two staircases, one leading down to a garage, and one leading up to a bedroom.

Or envision a house that has adjoining homes on both sides it if youre outside facing the front of it, as seen above.

Recommended Reading: How Late Can You Be On Your Mortgage

How Homebuyers Can Cope With Higher Mortgage Rates

Lenders consider several factors when deciding whether to approve a home loan application, including the borrowersâ income and debt as well as housing costsâwhich include the price of the home and interest rate.

As mortgage rates rise, monthly housing costs get more expensive, making it increasingly challenging for buyers to get approved for homes in the same price range they were looking for last year. Many people will have to either look in a more affordable area, come up with a larger down payment or search for homes in a lower price range to fit their budget.

What To Know About Condo Mortgage Rates

Mortgages for a condo tend to have higher interest rates than loans for single-family homes thats because lenders view them as a riskier bet. Both you and the condo association need to be in sound financial health.

In addition to mortgage rates, your insurance and home appraisal can cost more, too. There is a special condominium appraisal that costs more because of the additional data an appraiser has to provide about the condominium association.

You May Like: How To Calculate How Much Your Mortgage Will Be

Determine If The Property Is A Pud

Lastly, if the property is part of a Planned Unit Development , it can be exempt from the pricing hit, underwriting guidelines, and the HOA review process typically required for an attached condo or townhome.

A townhome may or may not be part of a PUD, just like it may or may not be a condo.

Its generally considered a PUD unit if you own the structure and the land beneath it, which includes a designated lot in the complex or subdivision.

Additionally, properties in a PUD can be attached or detached, further obscuring the situation.

As mentioned, condos typically only include the interior of the property, and the land they sit on is considered undivided ownership, which means they own it but arent assigned a given percentage. As such, these arent PUDs.

If it is a PUD, its mostly treated like a single-family residence when it comes to mortgage loan financing. And that can make it easier to obtain a home loan.

For example, you can get an FHA loan on a PUD unit without worrying about whether the complex is FHA-approved.

To sum it up, its very important to determine how the subject property is legally defined, along with how the underwriter interprets the property type.

In other words, dont take the real estate listing pages word for it.

To err on the side of caution, make sure you can get financing on the property based on it being a condo, even if it turns out not to be one.

How Does A Loan For A Condo Typically Work

Whether you’re shopping for your first property or looking to downsize from a house, buying a condo can be more affordable and offer flexibility, amenities and convenience you usually don’t get from a single-family house. However, since these properties have higher risks than regular houses, you’ll find that condo mortgage rates tend to be a bit more than house mortgage rates when you’re seeking a conventional loan. The good news is that you may be able to avoid the impact if you pursue a Federal Housing Administration loan, make a large down payment or pay an upfront fee for a conventional loan.

TL DR

For FHA loans, mortgage rates tend to be the same for houses and condos. However, you’ll often find a difference of at least .125 percent to .25 percent for conventional condo loans.

You May Like: How Much Should Your Monthly Mortgage Be

Are Mortgage Rates Higher For Condos

Mortgage Q& A: Are mortgage rates higher for condos?

If youre in the market for a new condo or a townhouse , youre probably looking to save some money on your mortgage payment each month.

After all, condos tend to be a lot cheaper than single-family homes in similar areas because you get limited space and forgo things like a nice green yard to play in.

But you may be in for a surprise when you start shopping mortgage rates.

What Is A Mortgage Rate Lock

A mortgage rate lock is a guarantee that the rate youre offered in your mortgage application acceptance is the one you will eventually pay, assuming you close within a normal period of time and make no changes to your application.

In a period of rising or volatile interest rateslike the current oneit may be wise to lock in a rate that seems affordable for you.

Also Check: Are House Taxes Included In Mortgage

Which Properties Are Easiest To Finance

Homes in PUDs and most townhomes are financed like the traditional house with its picket fence. They come with lower interest rates and more lenient underwriting standards

Condominiums must comply with different sets of requirements, depending on the type of loan , and the condo type.

Larger and more established communities can be easier to get approved than brand-new developments or communities with four or fewer units.

Co-ops can be financed, but, like condominiums, there are strict guidelines the community must meet.

Expect to pay more to finance a co-op or condo, because the risk to the lender is higher.

Resale Value And Financing

If youre thinking about purchasing a condo or townhouse, you want to know that your property will hold its value when it comes time to sell. But is one type of property more valuable than another?

Home value often depends on market conditions as well as conditions of the space itself. Neither is intrinsically more valuable, as buyers preferences often dictate lifestyle choices, says Garrett Derderian, managing director of market analysis for CORE Real Estate. Newer, updated spaces often command a higher value than an outdated space. This is true for condos as well as townhomes. However, outside of the home itself, condo owners must also be aware of their common area finishes, and if they are as modernized as their condo or not, which could impact value.

The extent to which you care for and upgrade your home will be a crucial factor in determining its resale value. If you buy a townhouse, youll be wholly responsible for putting in the work necessary to retain its value. But if you buy a condo, youll only be responsible for maintaining your specific unit.

However, if purchasing a condo, youll also want to make sure that its in a reputable building thats updated and well-maintained. If buyers are turned off by the state of the building, it wont matter how well youve cared for your individual home.

You May Like: Can You Combine 2 Mortgages Into One