What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

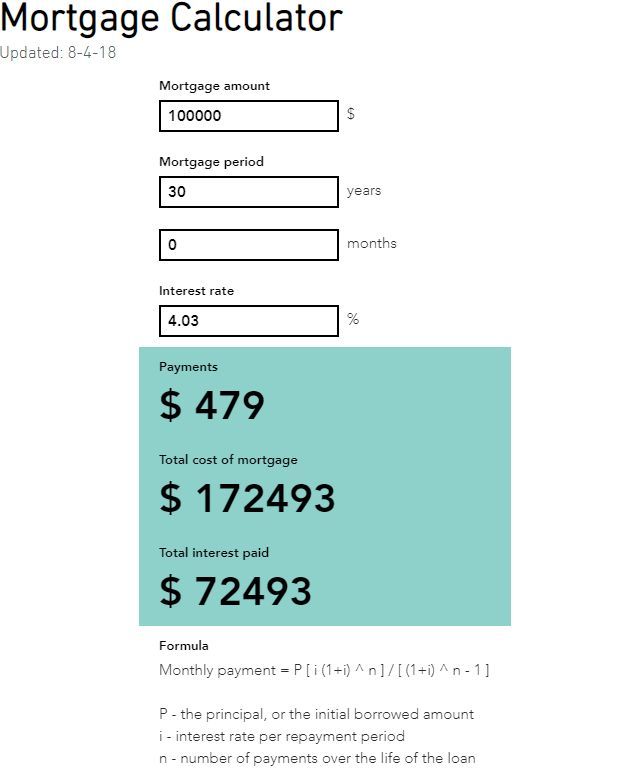

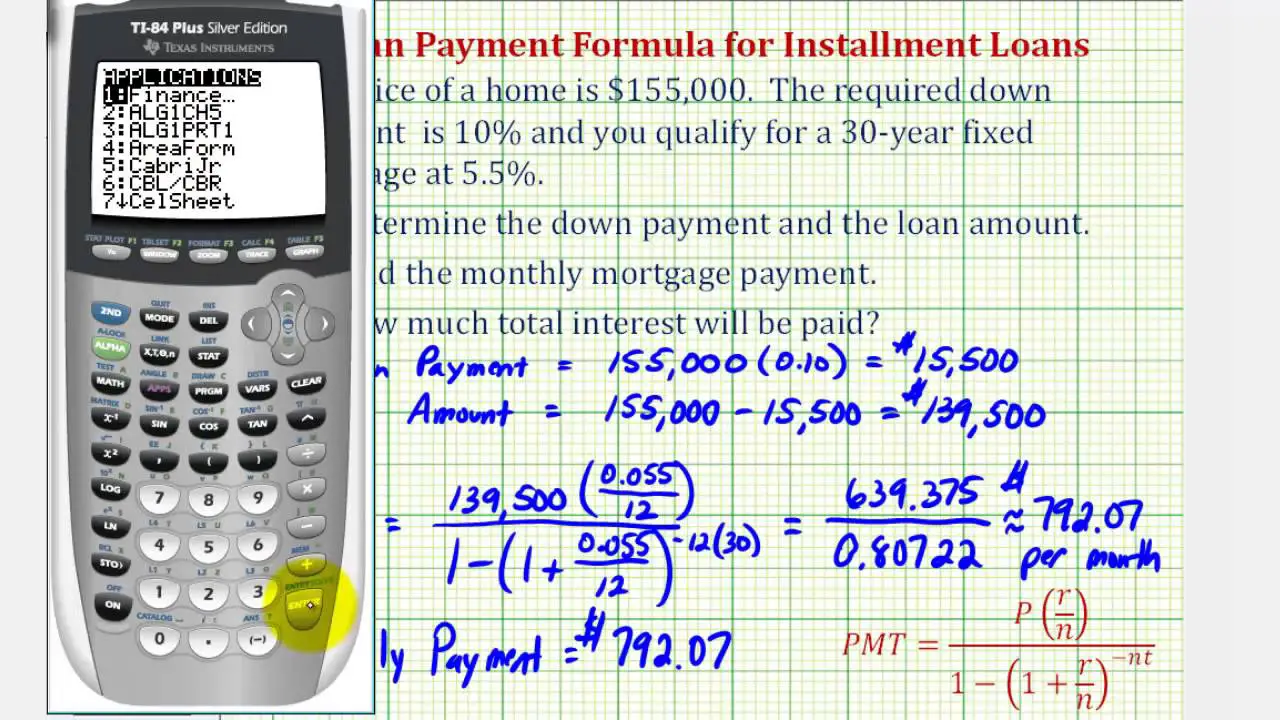

How Are Mortgage Repayments Calculated

To calculate a mortgages monthly repayment, youll need to know the value of the home youre buying, your deposit, the interest rate and the length of term.

For example:

- Deposit – £50,000

- Mortgage amount – £200,000

- Mortgage term 30 years

- Mortgage rate 2%

If the mortgage rate in this example was fixed for the length of the 30-year term, youd pay 360 monthly instalments of £739.24. This pays off the £200,000 loan in full, along with a total interest amount of £66,126.

Its important to remember that, as you begin to pay off your mortgage, the interest owed begins to fall in line with the outstanding amount on your mortgage thats owed. This means youll slowly be charged less in interest as the years go on. During a fixed term however, youll be charged a fixed, regular amount.

| Year of mortgage |

comparethe.com is a trading name of Compare The Market Limited. Registered in England No. 10636682. Registered Office: Pegasus House, Bakewell Road, Orton Southgate, Peterborough, PE2 6YS. Compare The Market Limited is authorised and regulated by the Financial Conduct Authority for insurance distribution . Energy and Digital products are not regulated by the FCA.

*To obtain a reward, a qualifying product must be taken out. 1 membership per year.Rewards T& Cs apply. Meerkat Meals: App only. Participating outlets. Restrictions, limitations & T& Cs apply.

Meerkat Movies: Participating cinemas. Tues or Weds. 2 standard tickets only, cheapest free.

How Much Deposit Do I Need For A Mortgage

In an ideal world, as much as possible. This means youll need to borrow less, so youre likely to pay less interest overall. To see what kind of impact having a larger or smaller amount of deposit could make to you, simply use the sliders on the deposit amount in section 2 How much will I pay?

Youll see the monthly amount you need to pay going up or down according to the size of potential deposit.

This is because one of the most important things for mortgage lenders to consider is the loan to value ratio the amount youre borrowing compared to the overall cost of the property. Often, the lower the LTV, the lower the rate of interest you might be charged. The higher it is, the riskier it is for a lender as they might not get all their money back if they had to sell the property, should you default on the loan.

Some lenders will have different rates for 100% mortgages, 95% mortgages, 90%, 85%, 80% mortgages and so on. Being able to move down to a lower band could save you money over time. Its worth checking to see if increasing your deposit, even by a few thousand pounds to help you switch to a different band, could positively impact your monthly payments.

Also remember that your deposit isnt the only factor that lenders consider when deciding what rate to offer you.

Also Check: Reverse Mortgage Manufactured Home

Determining The Right Down Payment Amount

A purchase calculator can help you determine the down payment you need. There are minimum down payments for various loan types, but even beyond that, a higher down payment can mean a lower monthly payment and the ability to avoid mortgage insurance.

On the flip side, a higher down payment represents a more significant hurdle, particularly for first-time home buyers who dont have an existing home to sell to help fund that down payment. The calculator can show you options so that you can balance the amount of the down payment with the monthly mortgage payment itself.

Do I Qualify For A Mortgage

A mortgage calculator can be helpful when estimating your home buying budget. But remember even if you can afford the monthly payments, you still need to qualify for a home loan.

To see if you qualify for a mortgage, a lender will check your:

- : Borrowers with higher credit scores tend to have more loan options. But mortgages are secured loans, which means you dont always need stellar credit to qualify. Some lenders can approve FHA loans for borrowers with FICO scores as low as 580

- Loan-to-value ratio : LTV measures your loan amount against your new homes value. For example, borrowing $200,000 to buy a $200,000 home equals 100% LTV. Lenders can offer VA or USDA loans at 100% LTV, but not everyone is eligible for these programs. FHA loans cant exceed 96.5% LTV, which leaves 3.5% as the minimum down payment. Conventional loans can reach 97% LTV, meaning they allow a 3% down payment

- Home appraisal: A home appraisal identifies the homes value. Lenders wont approve loan amounts that exceed the homes value, regardless of the homes listing price or agreed-upon purchase price

- Personal finances: Lenders must verify your income to make sure you can afford the loan payments. Theyll check W-2s, bank statements, and employment records. If youre self-employed, a lender will likely ask to see tax records

You can ask for a mortgage pre-approval or a prequalification to see your loan options and real budget based on your personal finances.

Recommended Reading: Recast Mortgage Chase

Tips For Buying An Affordable Home

- Set aside funds for home maintenance and emergencies. Unexpected expenses are par for the course for homeowners, so youll want to make sure you can cover them without taking on debt. Whether its a broken appliance or a pipe that springs a leak, home repairs always seem to happen at inconvenient times and wind up costing more than youd expect. State Farm recommends setting aside 1 percent to 4 percent of your homes value for emergency repairs each year.

- Plan for income changes. If you or your partner or co-borrower wants to switch up the employment situation after moving, youll want to make sure to factor that into your budget. You dont want to wind up taking out a mortgage that you can no longer afford.

- Shop around to save on homeowners insurance. Comparing mortgage offers isnt the only way to save. Youll also want to solicit quotes from multiple insurers to make sure youre getting the best deal.

- Stay within your means. A lender might be willing to offer you a larger mortgage than youre comfortable with or able to pay. Dont buy a house just because the bank tells you you can afford it only commit to monthly payments that actually fit into your overall budget.

| Loan Type |

|---|

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

Don’t Miss: Reverse Mortgage Mobile Home

Private Mortgage Insurance :

Depending on the type of mortgage loan you choose and the amount of your down payment, you may need to pay private mortgage insurance. This insures the lender should a borrower discontinue making payments and default on their home loan. Depending on the type of loan you choose, youll pay PMI until your home equity reaches twenty percent or for the life of the loan.

Why Use A Mortgage Payment Calculator

When planning to buy a home, it’s easy to focus on the headline figures, like the final purchase price or your overall mortgage amount. But in many way, the most relevant number for your mortgage will be your regular repayments. After all, your mortgage payments are the amount that you’ll need to take from your pay cheque each month to keep your mortgage under control.

Using a mortgage payment calculator like the one above takes the guess work out of your mortgage payments. Our calculator lets you understand how much you’ll need to pay each month for any size of mortgage, with any rate. This means you can compare homes and mortgage products with confidence, all the while knowing exactly how much you’ll be on the hook for in each scenario.

Also Check: Mortgage Recast Calculator Chase

What Other Expenses Does Homeownership Entail

It’s important to recognize that the estimated total cost of your home purchase is only an estimate and not necessarily representative of future conditions. There are many factors that are not taken into account in the calculations we illustrated above we include a few below for your consideration.

Taxes

While these fixed fees are charged regularly, they have a tendency to change over time, especially in large metropolitan areas like New York and Boston. New-home purchases often have their values reassessed within a year or two, which impacts the actual taxes paid. For that reason, your originally forecasted tax liability may increase or decrease as a result of new assessments.

HOA Dues

For buyers considering condos, homeowners associations can increase their monthly dues or charge special HOA assessments without warning. This can make up a large portion of your housing expenses, especially in large cities with high maintenance fees. You might also be subject to increased volatility in HOA fees if the community you live in has issues keeping tenants or a troubled track record.

Maintenance Costs

Finally, typical mortgage expenses don’t account for other costs of ownership, like monthly utility bills, unexpected repairs, maintenance costs and the general upkeep that comes with being a homeowner. While these go beyond the realm of mortgage shopping, they are real expenses that add up over time and are factors that should be considered by anyone thinking of buying a home.

How Much Should You Save For A Down Payment

We recommend putting at least 10% down on a home, but 20% is even better because you wont have to pay private mortgage insurance . PMI is an extra cost added to your monthly payment that doesnt go toward paying off your mortgage.

Saving a big down payment takes hard work and patience, but it’s worth it. Here’s why:

- Youll have built-in equity when you move into your home.

- You can finance less, which means you’ll have a lower monthly payment.

You May Like: 10 Year Treasury Yield And Mortgage Rates

Which Home Mortgage Option Is Right For You

With so many mortgage options out there, it can be hard to know how each would impact you in the long run. Here are the most common mortgage loan types:

- Adjustable-Rate Mortgage

- Federal Housing Administration Loan

- Department of Vertans Affairs Loan

- Fixed-Rate Conventional Loan

We recommend choosing a 15-year fixed-rate conventional loan. Why not a 30-year mortgage? Because youll pay thousands more in interest if you go with a 30-year mortgage. For a $250,000 loan, that could mean a difference of more than $100,000!

A 15-year loan does come with a higher monthly payment, so you may need to adjust your home-buying budget to get your mortgage payment down to 25% or less of your monthly income.

But the good news is, a 15-year mortgage is actually paid off in 15 years. Why be in debt for 30 years when you can knock out your mortgage in half the time and save six figures in interest? Thats a win-win!

Variable Rate Mortgage Penalty Interest Rate

Most lenders determine the mortgage break penalty for a variable rate mortgage by calculating three months of interest. The interest rate that they use can depend from lender to lender, but is usually either yourcurrent mortgage interest rateor the lender’sprime rate.

| Based On Your Mortgage Rate | Based On the Lender’s Prime Rate |

|---|---|

| RBC | SimpliiLaurentian |

Read Also: Rocket Mortgage Vs Bank

Los Angeles Homebuyers Can Refinance At Historically Low Mortgage Rates Today

The spread of coronavirus caused financial market volatility, with the 10-Year Treasury Notes reaching all-time record lows. Mortgage rates tend to follow 10-Year Treasury movements. Savvy homeowners across the country are taking advantage of this opportunity to refinance their homes at today’s attractive rates.

As Seen In

Get A Handle On What A Loan Costs You Each Month

If you own a home, you probably know that a portion of what you pay the lender each month goes toward the original loan amount while some gets applied to the interest. But figuring out how banks actually divvy those up can seem confusing.

You may also wonder why your payment stays remarkably consistent, even though your outstanding balance keeps going down. If you understand the basic concept of how lenders calculate your payment, however, the process is simpler than you might think.

Don’t Miss: Rocket Mortgage Requirements

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Choosing The Mortgage Term Right For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

Don’t Miss: Chase Recast Calculator

What Is Mortgage Interest

Interest is charged by lenders in exchange for allowing you to borrow money. For borrowers, mortgage interest is charged based on your mortgage principal balance. The mortgage interest charged is included in your regular mortgage payments. This means that with every mortgage payment, you will be paying both your mortgage principal and your mortgage interest.

Your regular mortgage payment amount is set by your lender so that youll be able to pay off your mortgage on time based on your selected amortization period. This is why your mortgage payment amount can change when yourenew your mortgageorrefinance your mortgage. This can change your mortgage rate, which will impact the amount of mortgage interest due. If you now have a higher mortgage rate, your mortgage payment will be higher to account for the higher interest charges. If youre borrowing a larger amount of money, your mortgage payment may also be higher due to interest being charged on a larger principal balance.

However, mortgage interest isnt the only cost that youll need to pay. Your mortgage might have other costs and fees, such as set-up fees or appraisal fees, that are necessary to get your mortgage. Since youll need to pay these extra costs in order to borrow money, they can increase the actual cost of your mortgage. Thats why it can be a better idea to compare lenders based on theirannual percentage rate . A mortgages APR reflects the true cost of borrowing for your mortgage.

Mortgage Balance Calculator Terms & Definitions:

- Mortgage Loan â A debt instrument, secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments.

- Mortgage Balance â The full amount owed at any period of time during the duration of the mortgage.

- Principal â Denoting an original sum of money lent.

- Annual Interest Rate â Money paid regularly at a particular rate for the use of money lent â in this case, it’s a percentage.

- Monthly Payment â The action or process of paying someone or something on a monthly basis â in this case, a mortgage.

- Loan Term â The length time it takes to pay off a loan â in this case, a mortgage.

Also Check: Can I Get A Reverse Mortgage On A Condo

Whats Included In My Mortgage Payment

A typical monthly mortgage payment has four parts: principal, interest, taxes and insurance. These are commonly referred to as PITI.

The mortgage payment estimate youll get from this calculator includes principal and interest. If you choose, well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment.

This calculator doesnt include mortgage insurance or guarantee fees. Those could be part of your monthly mortgage payment depending on your financial situation and the type of loan you choose.