Who Cant Get Rid Of Pmi

Its possible that your lender has marked you as a high-risk borrower. A high-risk borrower is someone who doesnt pay off parts of the loan on time or at all. The property owned by the borrower then gets marked as a high-risk property.

If you no longer wish to have this title, make sure all of your payments are on time. After that is when you can ask your lender for a PMI removal.

If Your Lender Refuses To Cancel The Pmi

Most lenders recognize that there’s little point in requiring PMI after it’s clear that you’re making your mortgage payments on time and that you have enough equity in your property to cover the loan if the lender has to foreclose. Nevertheless, many homebuyers find their lenders to be frustratingly slow to wake up and cancel the coverage. The fact that they’ll have to spend time reviewing your file for no immediate gain and that the insurance company might also drag its feet are probably contributing factors.

If your lender refuses, or is slow to act on your PMI cancellation request, politely but firmly request action. Contact the lender by letter or email. Copies of such communication are important not only to prod the lender into motion but also to serve as evidence if you’re later forced to take the lender to court.

You can also submit a complaint online to the Consumer Finance Protection Bureau . This U.S. government agency, which the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 established, promises to forward your complaint to the company and work to get a response.

If nothing else works, and court action becomes your best option, small claims court can be a good avenue, and you won’t need a lawyer to accompany you. For more information, including how to write polite but forceful demand letters, see Everybody’s Guide to Small Claims Court, by Cara O’Neill .

Canceling Mip On Fha Loans

Depending on when you applied, FHA guidelines may allow for MIP to be canceled if you:

- Applied between January 2001 and June 2013: Please contact us when you meet all three of the following conditions, and we will review your loan for MIP removal eligibility:

- Applied after June 2013: If your original loan amount was less than or equal to 90% LTV, MIP will be removed after 11 years.

- Closedbetween July 1991 and December 2000

- Closed before December 28, 2005 on a condo or rehabilitation loan

- Applied after June 2013 and your loan amount was greater than 90% LTV

You May Like: Monthly Mortgage On 1 Million

How To Remove Mortgage Insurance Premiums From Fha Loans

FHA loans are mortgages offered by private lenders and backed by the Federal Housing Administration . Every homeowner who gets an FHA loan is required to pay an upfront mortgage insurance premium as well as annual mortgage insurance premiums.

If you made a down payment of 10% or more on most recent FHA loans, you may be able to cancel the MIP payments after 11 years. If you made a down payment of less than 10%, you will need to pay MIP for the full term of the mortgage. The rules for MIP are different for FHA loans that closed before June 3, 2013. You can find details about the older MIP rules on the HUD website.

The value of your home equity does not affect your FHA mortgage insurance premiums and having 20% home equity will not allow you to cancel it. As a result, homeowners with FHA loans sometimes think about refinancing their mortgages to remove mortgage insurance premiums.

One way you can do this is to refinance your FHA loan to a conventional mortgage. As discussed above, you need to have at least 20% home equity when you refinance with a conventional loan or you will need to pay for private mortgage insurance. So check the value of your home equity before considering this refinance.

How Long Do You Pay Mortgage Insurance On A Conventional Loan

Traditional loans can only be insured until the original application has been filed. The interest rate is only imposed for home equity percentages equal to 20% of your homes total value until you reach it. Purchasing insurance may be canceled after your monthly mortgage payment includes principal repayment in time.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

Request Pmi Cancellation At 80% Ltv

If you werent able to put down 20% when you purchased the property, you can have PMI waived once youve built up enough equity over time.

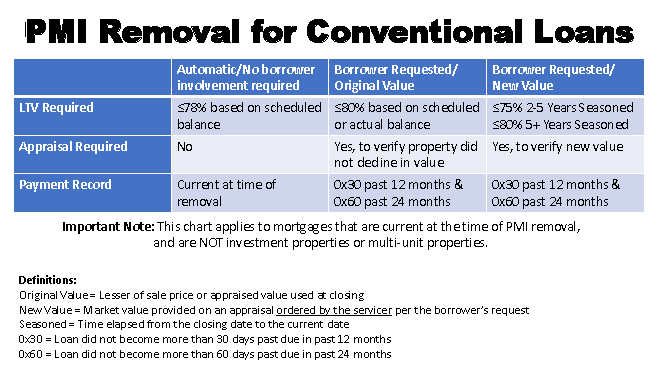

But your lender isnt going to automatically cancel your PMI premium once youve reached 80% LTV. Youll have to reach out and request it. Your lender may require some form of appraisal to verify the property hasnt lost value, but thats not always the case.

To drop your PMI requirement, you may also be able to prove that the home has increased in value through appreciation or property improvements. In this case, you shouldnt just go and get an appraisal without communicating with your lender first, because when you waive PMI with a reappraisal a seasoning period is likely to apply. Call the loan servicer first and ask about getting the PMI removed, and theyll tell you what their process is, Dye says.

In most cases, the borrower will be responsible for the cost of the appraisal, which can easily be around $500. Dye recommends borrowers run the numbers to make sure they are actually saving.

Is Getting Rid Of Pmi Enough Reason To Refinance

Yes — in many cases, it’s worth refinancing your home loan to get rid of PMI.

But refinancing isn’t free. You’ll likely have to pay:

- Origination fees

- Other closing costs

Costs can vary dramatically among mortgage refinance lenders, but expect to pay a few thousand dollars to refinance. The question to ask yourself is, “Will savings from refinancing will outweigh the costs?”

Let’s say you’re paying $200 per month for PMI. You refinance with the exact same interest rate — but without PMI — for $6,000 in closing costs. You’ll save $200 per month this way. In 30 months, you’ll have saved $6,000, the same amount you paid to refinance. It’s only after that you’ll start seeing the benefits of getting rid of PMI. So, as long as you’re planning to stay in your home for longer than that, it could make sense.

Of course, a real-world situation will likely be a bit more complex. The refinancing rates you’re offered may not be exactly the same as your current interest rate. And if you replace a mortgage you’ve been paying down for years with a fresh 30-year loan, you should consider the difference in payoff length.

Don’t Miss: Recasting Mortgage Chase

How Do I Get Rid Of Pmi After Purchase

Option : Reappraise Your Home If It Has Gained Value

In a hot real estate market, your home equity could reach 20 percent ahead of the loan payment schedule. In this case, it might be worth paying for a new appraisal. If youve owned the home for at least five years, and your loan balance is no more than 80 percent of the new valuation, you can ask for PMI to be cancelled. If youve owned the home for at least two years, your remaining mortgage balance must be no greater than 75 percent.

Appraisals for a single-family home typically cost between $250 and $500, depending on your area. Some lenders might be willing to accept a broker price opinion instead, which can be a substantially cheaper option than a professional appraisal. On the flip side, professional appraisals are highly regulated and provide an unbiased assessment.

Who this affects: Borrowers who live in areas that are particularly red-hot might have seen their home values shoot up in the last couple years. In fact, the value might have increased enough to bump you out of the PMI range. If this is the case, its time to talk with your lender about getting a new appraisal and potentially cancelling your PMI requirement.

Recommended Reading: Does Rocket Mortgage Service Their Own Loans

How Do I Get Rid Of Fha Pmi

A borrower must have one of the following scenarios to eliminate PMI from an FHA loan:

- Put down 10% or more on an FHA purchase 11-year cancellation

- Borrow 90% or less on an FHA refinance 11-year cancellation

- Refinance to a conventional loan under 80% No PMI once closed on a new loan

- Pay off the mortgage in full stops when paid off

- Other potential options for FHA case files taken out prior to June 3, 2013 Contact us or your current servicer to check

Apply online now with our easy QuickStart App or talk to a licensed Mortgage Loan Officer to review which loan is the best option for you.

Examples Of Failure To Cancel Private Mortgage Insurance

- Being forced to continue paying for private mortgage insurance after the automatic termination dateset forth in your contract.

- A lender requiring an appraisal before automatically terminating your PMI, or refusing to cancel your PMI before the automatic cancellation date even though your loan-to-value ratio is at or below 80%.

Dont Miss: Can You Get A Reverse Mortgage On A Manufactured Home

Also Check: Can You Get A Reverse Mortgage On A Condo

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

How Can You Get Out Of Paying Pmi

In most cases, when you buy a home with a down payment of less than 20% of the purchase price, you have to pay private mortgage insurance. If your down payment gives you more than 20% equity, then congratulations. PMI probably wont be something you have to worry about.

Many homebuyers, however, cant afford to make that large of a down payment at the time of purchase. If this is your situation, dont stress. Make extra mortgage payments to the principle until you owe just 80% of your home value.

But your lender wont simply remove PMI when you hit the 20% equity mark. You have to ask, and the lender can say no for a while. A lender has to drop PMI when you reach 22% equity based on the original purchase price of the home .

You could also look for a loan that doesnt require PMI. Although most do, USDA and FHA loans require mortgage insurance instead of private mortgage insurance. A VA loan is another option if you meet the eligibility requirements.

Read Also: 10 Year Treasury Yield Mortgage Rates

How To Get Rid Of Pmi On Usda Loans

USDA loans are an amazing option for buyers looking for a no money down purchase. In addition to that, the monthly PMI is cheaper than FHA. FHA requires 3.5% down payment and USDA requires none. How is USDA PMI cheaper? Good question, but it is!

USDA calls its monthly PMI an annual fee. USDAs fee is based on a .35 factor compared to FHAs .85 . Over 40% cheaper than FHA! Just like FHA, USDA PMI continues for the life of the loan. Yet, the amount does decrease each year as the mortgage balance decreases. Eventually going to zero when the mortgage is paid off.

There are no options to remove or avoid the USDA annual fee unless the mortgage is refinanced to another product or the mortgage is paid off. Learn more about USDA household income limits or property eligibility.

Remove Your Mortgage Insurance For Good

PMI is a big cost for homeowners often $100 to $300 extra per month.

Fortunately, youre not stuck with PMI forever. Once youve built up some equity in your home, there are multiple ways to get rid of PMI and lower your monthly payments.

Some homeowners can simply request PMI cancellation others will need to refinance into a loan that doesnt require mortgage insurance.

With mortgage rates near historic lows, its a great time to get rid of your PMI and lock in a lower interest rate on your loan.

Don’t Miss: Bofa Home Loan Navigator

What Is Private Mortgage Insurance

Private mortgage insurance is an insurance policy you may have to purchase when you get a conventional mortgage from a private lender.

Generally, you have to have PMI if you put less than 20% down. For example, if you buy a $400,000 home, your down payment will need to be at least $80,000 if you want to avoid PMI. Plus, you’ll need to budget for closing costs.

Private mortgage insurance protects private mortgage lenders if a borrower doesn’t repay a conventional loan. Sometimes, PMI is confused with mortgage insurance that you may have to pay for with other types of mortgages:

- Mortgage insurance premium protects lenders if a borrower doesn’t repay their Federal Housing Administration mortgages.

- U.S. Department of Agriculture loans require an upfront and monthly premium payment for mortgage insurance.

- Department of Veterans Affairs loans don’t require mortgage insurance, but you may pay an upfront funding fee to get the loan.

PMI is also different from homeowners insurance, which protects you in case your home or belongings are damaged or stolen. PMI protects the lender.

One important distinction is that you can’t remove mortgage insurance on mortgages that are government-backed or -issued unless you refinance to a loan that doesn’t require mortgage insurance. You can get rid of PMI, however, or get a mortgage from a private lender without PMI if you have a large down payment.

When Can You Drop Pmi From Mortgage

To reduce your loan-to-value ratio to 78 percent, the lender and servicer must automatically cease PMI on a mortgage balance exceeding 78 percent of that original purchase price. This may be granted to you as long as your payment history is good and you have not missed a mortgage payment.

Don’t Miss: Rocket Mortgage Loan Requirements

Refinance Your Home Loan

Finally, you can use a mortgage refinance to get rid of PMI. When you refinance your home, you might end up with a lower LTV, and that can provide you with a way to get rid of PMI. In fact, depending on the situation with your FHA loan, refinancing might be your only option for how to get rid of PMI on an FHA loan.

Not only can you save on PMI, but you might be able to save on your monthly payment and save in interest when you refinance your home loan.

Mortgage refinance rates are near record lows, so this might be a good time to reap the savings. Refinancing with bad credit, though, might not be as beneficial.

Other Requirements To Cancel Pmi

Requirements for discharging PMI depend on the type of loan.

For example, for Fannie Mae-owned loans, if youve had it between two and five years and its your primary or second home, you could get PMI removed if the home value has appreciated enough to move the current LTV ratio to 75%

Also, if you have a loan for an investment property through Freddie Mac and your home value increased enough to request PMI removal, you would need to have a current LTV rate of 65% and have made mortgage payments for at least two years. You also shouldnt have any 30-day late payments for the last year or 60-day late payments for the last two years.

Fannie and Freddies regulations also change if youve had the loan for less than two years but have made significant improvements on the home that has increased its value.

You May Like: Can You Do A Reverse Mortgage On A Condo

Piggybacking A Second Loan

You may be able to only put 5% or 10% down on a home purchase and take out a second loan to avoid PMI. The lender is generally only concerned about the LTV on the first mortgage loan, says Thomas Bayles, senior vice president at the Los Angeles-based Mortgage Capital Partners. Bayles has worked with homebuyers who avoided PMI with a 10% down payment by financing the other 10% with a home equity line of credit.

If this is a strategy youre considering, youll need to do your homework and make sure the math works out. Second mortgages have higher rates than traditional home loans, and a HELOCs rate is usually adjustable, meaning it can increase after an introductory period. A HELOC will typically have a shorter repayment schedule than a traditional mortgage, and may have a large balloon payment at the end or prepayment fees. So you always need to understand how a HELOC will affect your monthly payments down the road.

If you think piggybacking loans to get rid of PMI is good for you, make sure you understand all the ins and outs of a second loan. Otherwise, stick with one of the more traditional methods of avoiding PMI.