Will Uk House Prices Fall In 2022

There are a number of things that could cause house prices to fall:

- The end of the furlough scheme on 30 September 2021 as more people lose their jobs and cant afford their mortgages. If people sell their homes, housing supply will increase which could cause prices to fall.

- After the stamp duty holiday fewer people will be rushing to buy. The number of property transactions plunged 63% in July from June, according to figures from HMRC.

- If interest rates rise from their current record lows, it would also make mortgages rates more expensive. This could slow demand.

But generally speaking, house prices have risen faster than salaries over the years, making the housing market increasingly unaffordable.

Typical Home Price In North Dakota: $246588

- Typical single-family home value in 2021: $251,844

- Average mortgage rate, July 2021: 2.945%

- Average mortgage payment to median income: 25.0%

North Dakota homeowners have reasonable mortgage payments that take up a quarter of their income on average. This state’s housing prices are less expensive than prices across the country, and the median income is only 2% less than the national median.

Simple Tips To Secure A 175% Mortgage Rate

Secure access to The Ascent’s free guide that reveals how to get the lowest mortgage rate for your new home purchase or when refinancing. Rates are still at multi-decade lows so take action today to avoid missing out.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Read Also: What Is Tip In Mortgage

Typical Home Price In Arizona: $355540

- Typical single-family home value in 2021: $362,766

- Average mortgage rate, July 2021: 3.118%

- Average mortgage payment to median income: 38.1%

Mortgage payments take up a big chunk of homeowner’s budgets in Arizona. That’s due to a combination of high housing costs and a median income 6% below the national median.

Typical Home Price In California: $683996

- Typical single-family home value in 2021: $698,587

- Average mortgage rate, July 2021: 3.043%

- Average mortgage payment to median income: 56.2%

Californians probably aren’t surprised to see that it’s one of the hardest places to afford a home. Even though the median income is 22% higher than the U.S. median, extremely high prices put housing out of reach for many residents.

Recommended Reading: How Much Usda Mortgage Can I Qualify For

Costs Included In A Monthly Mortgage Payment

In the Census Bureau’s American Community Survey’s data, the monthly mortgage payment includes things like insurance and taxes. In part, it’s because that’s how mortgages actually work oftentimes, you pay for more than just the loan’s principal and interest in your monthly payment.

If your mortgage includes an escrow account, you’ll pay for two costs each month in your monthly mortgage payment:

- Property taxes: You’ll pay tax on your home to your state and local government, if necessary. This cost is included in your monthly payment if your mortgage includes escrow.

- Home insurance: To keep your home covered, you’ll need to purchase a homeowner’s insurance policy. The average cost of homeowners insurance is about $1,200 per year.

In addition, mortgage payments can also change based on several factors. Two different people could face very different homeownership costs for the same house, even. There are two big factors that change your monthly payment:

Another monthly cost to consider should be how much you’ll need to save for repairs. In general, the older your home is, the more you should keep on hand for repairs. Utilities like internet, garbage removal, and electricity will also add to your monthly costs of homeownership.

How Much Deposit Do You Need For A Mortgage

Technically, a mortgage can be obtained with a deposit of 5% of the propertys value. However, in todays market, you might need as much as 10%, as many lenders have withdrawn their low-deposit offers due to economic issues brought on by COVID-19. This will soon change, as many major banks have agreed to offer new 95% mortgages, which will begin in April 2021. Heres how much cash youd need to put down on a £200,000 property, based on different deposit sizes: 5% deposit: £10,000 10% deposit: £20,000 15% deposit: £30,000.

Recommended Reading: What Is Needed For Mortgage Application

Determine Your Total Debt Service

Your TDS is a measure of all your debt, which also includes your housing debt, relative to your income. Lenders typically prefer to see TDS ratios no more than 42%. Any higher than this figure puts you at a greater risk of failing to make your mortgage payments because of debt overload.

Your GDS and TDS ratios will give your lender a better idea of your ability to manage mortgage payments on top of all your other debts relative to how much you earn. It will also help them determine what type of interest rate to offer you if you are approved, as well as your maximum loan amount.

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Or you want to take cash out for a refinance and are not sure what loan amount you can qualify.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have too, because they want to make sure the loan is repaid. And they don’t just take into account what the mortgage payments will be, they also look at the other debts you’ve got that take a bite out of your paychecks each month.

- FAQ: To see if you qualify for a loan, mortgage lenders look at your debt-to-income ratio .

That’s the percentage of your total debt payments as a share of your pre-tax income. As a rule of thumb, mortgage lenders don’t want to see you spending more than 36 percent of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking. That’s the general rule, though they may go to 41 percent or higher for a borrower with good or excellent credit.

For purposes of calculating your debt-to-income ratio, lenders also take into account costs that are billed as part of your monthly mortgage statement, in addition to the loan payment itself. These include property taxes, homeowner’s insurance and, if applicable, mortgage insurance and condominium or homeowner’s association fees.

You May Like: Who Is Rocket Mortgage Owned By

What Are Todays Mortgage Rates

The average 30-year fixed mortgage rate rose to 3.05 percent, up 2 basis points from a week ago.The 15-year fixed mortgage rate rose to 2.30 percent, up 1 basis point from a week ago.To compare todays customized rates from a variety of trusted lenders, use Bankrates mortgage rates comparison tool.

| 3-month trend |

|---|

| 3.380% |

How Much Does It Cost To Buy A House

When buying a home, it is important to understand all the costs involved. The purchase price that you negotiate when buying a home is the starting point, not the final amount.

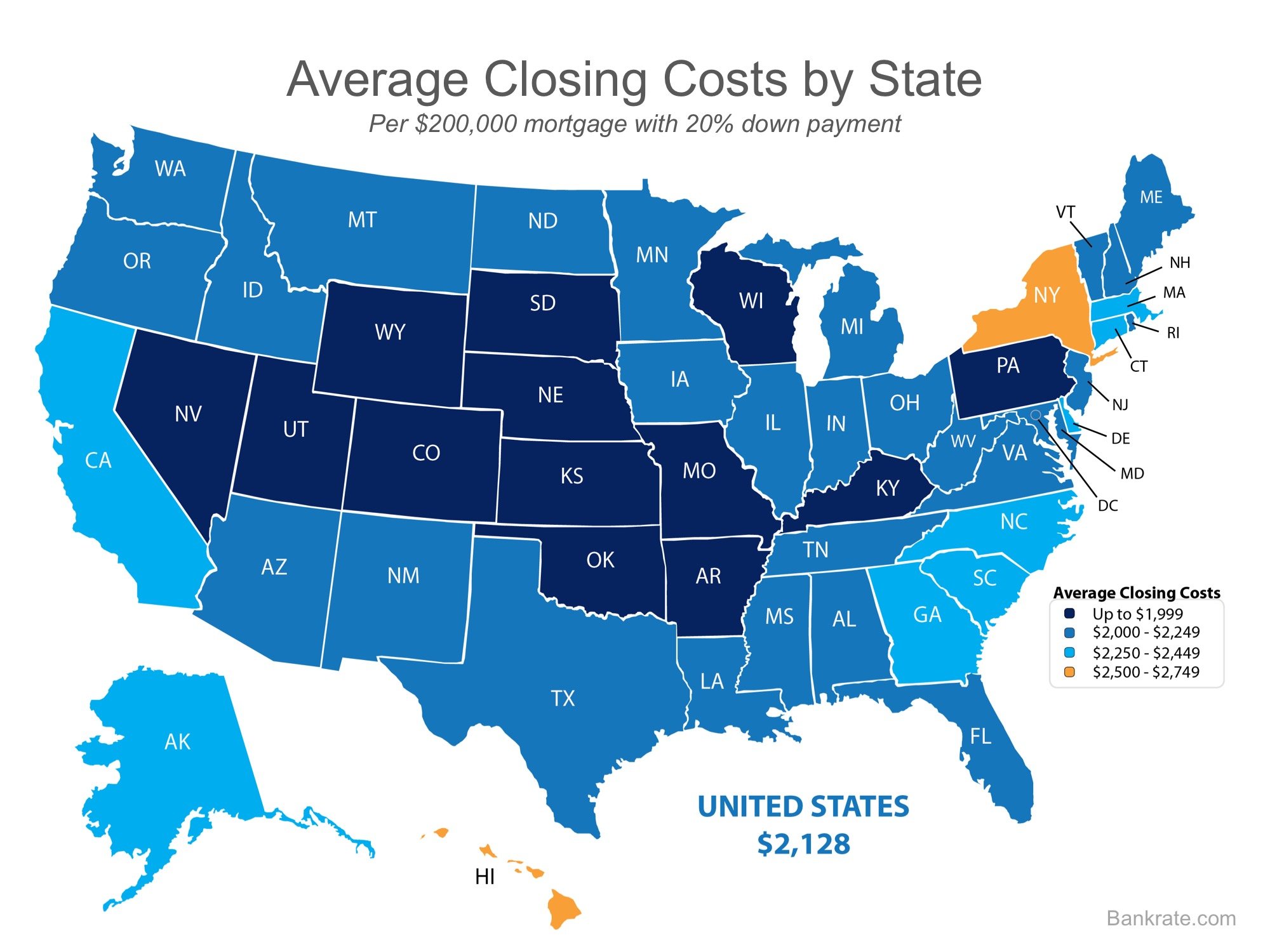

Most people immediately think of closing cost when assessing home ownership which generally makes up about two to five percent of the purchase price. Based on the median sales price of $321,100 for a home in the U.S. in 2017, you might pay between $6,422 and $16,066 in closing costs.

Moving will add, on average, an additional $1,100 to $5,630 to your tab, depending on whether youre relocating within the same or to another state, according to the U.S. News and World Report.

Typical buyers of existing homes spend around $8,233 on furnishings, appliances and remodeling during the first year after closing, according to the National Association of Home Builders. Buyers of new-construction homes, the group says, spend $10,601 in the first year after purchase.

In other words, buying a median-priced home could cost up to an additional $38,719, after you factor in the costs of closing, moving and furnishing. And there could be more.

Dont let the extra expenses come as a frustrating surprise. In this article, we break down the most common costs you need to anticipate when buying a house. Well highlight which are negotiable, which occur once, and which, as a homeowner, you might face throughout the life of your home.

Recommended Reading: Can I Use My Partner’s Income For A Mortgage

How Can I Calculate How Much My Ontario Mortgage Payments Would Be

Our Ontario Mortgage Payment Calculator will help you figure out how much youll pay with any rate you find on the site. It only takes a few minutes to use, so give it a try. You can modify the mortgage amount, mortgage term and type, amortization and payment type to see how your mortgage options and payment amount are impacted.

Mortgage Rate Forecast For July 2021

Rates have remained enticingly low throughout the first half of 2021 lower than many experts predicted six months ago. And the outlook for July doesnt call for a radical rate leap, either.But several factors are in play that can easily result in you paying at least slightly more for a purchase or refinance home loan in the coming weeks or months. Thats the consensus opinion among the group of industry pros Bankrate recently polled, who envision mortgage rates edging marginally higher at worst or standing pat over the next month.

Over the next month, rates may rise a bit but will likely be pretty close to where they are today around 3 percent for the 30-year fixed-rate mortgage, says Leonard Kiefer, deputy chief economist for Freddie Mac in McLean, Virginia. While inflation has ticked higher in recent months, many analysts consider much of the increase in consumer prices to be transitory. Thus, even with higher inflation rates, mortgage rates have held pretty steady. Id expect these near historically low mortgage rates to stay through at least early summer.

Learn more about specific loan type rates| Loan Type |

|---|

Recommended Reading: Can You Get A 30 Year Mortgage On Land

What Percentage Of Your Income Should Go Towards Your Mortgage

Your salary makes up a big part in determining how much house you can afford. On one hand, you may want to see how much you could afford with your current salary. Or, you may want to figure out how much income you need to afford the house you really want. Either way, this guide will help you determine how much of your income you should put toward your mortgage payments every month.

First: What Is A Mortgage Payment

Mortgage payments are the amount you pay lenders for the loan on your home or property, including principal and interest. Sometimes, these payments may also include property or real estate taxes, which increase the amount you pay. Typically, a mortgage payment goes toward your principal, interest, taxes and insurance.

Many homeowners make payments once a month. But there are other options, such as a twice a month or every two weeks.

Also Check: Can A Mortgage Include Renovation Costs

How To Cancel Pmi

You may need to pay a PMI premium when you first buy your home, but there are also four ways to get rid of PMI:

- Automatic cancellation: By law, your mortgage servicer can’t require you to pay for PMI forever. It must automatically cancel the policy when you’re scheduled to reach 22% equity , or when you’re halfway through the repayment term. The timeline is based on the original loan’s repayment schedule and value.

- Request cancellation: You may request a cancellation a little earlieronce you reach 20% equity based on the home’s original value. However, you may need to meet other qualifications, such as not having a second mortgage, and you may have to pay for an appraisal.

- Reappraise your home: While the above methods depend on the home’s original value, you may be able to pay for a reappraisal and request the PMI be canceled based on the current value and your equity. This can be beneficial if your home has quickly appreciated in value or if you’ve made home improvements that increased its value.

- Refinance your mortgage: Another option is to replace your mortgage with a new one. If you have at least 20% equity based on the current valuation, you may qualify for a conventional loan without PMI.

You may want to get rid of PMI as soon as possible to lower your mortgage payments. There’s little downside, as the insurance doesn’t protect borrowers.

Notes On Using The Mortgage Income Calculator

This calculator provides a standard calculation of the income needed to obtain a mortgage of a certain amount based on common industry guidelines. These guidelines assume that your mortgage payments, including taxes, insurance, association fees and PMI/FHA insurance, should be no greater than 28 percent of your monthly gross income.

- FAQ: These guidelines assume that your mortgage payment and other monthly debt obligations combined should not exceed 36 percent of your monthly gross income.

Those are the base guidelines however, borrowers with excellent credit and healthy financial reserves can often exceed those guidelines, going as high as 41 percent of gross monthly income for mortgage payments and debt obligations combined. You may wish to take that into account when considering your own situation.

You May Like: How To Determine What You Qualify For A Mortgage

Typical Home Price In Pennsylvania: $234684

- Typical single-family home value in 2021: $235,808

- Average mortgage rate, July 2021: 3.033%

- Average mortgage payment to median income: 24.4%

Pennsylvania residents can purchase homes with reasonable mortgage payments for their incomes . A typical home price 20% less than the typical U.S. price keeps mortgages budget friendly.

Typical Home Price In Utah: $465012

- Typical single-family home value in 2021: $474,233

- Average mortgage rate, July 2021: 3.001%

- Average mortgage payment to median income: 40.4%

The median income hasn’t been able to match home prices in Utah. That makes home ownership difficult for many residents because of high average mortgage payments.

Don’t Miss: Can I Get A Mortgage With A Fair Credit Score

Averages Change From City To City

Another aspect to this discussion is that the average mortgage payment in San Francisco, Los Angeles and San Diego is going to be vastly different then Stockton, Modesto or Riverside. This is an important fact to keep in mind when discussing the average mortgage payment in California.

As time goes on it will be interesting to see the changes in the average mortgage payment in California. Without a significant increase in personal income, it will be difficult for the average mortgage payment in California to further increase.

Typical Home Price In New Hampshire: $366129

- Typical single-family home value in 2021: $379,870

- Average mortgage rate, July 2021: 3.033%

- Average mortgage payment to median income: 31.0%

Buying a home in New Hampshire is doable, but many residents will find it challenging. Although the median income beats the U.S. median by 19%, the typical home price still leads to expensive mortgage payments.

You May Like: How Long Is The Mortgage Process

Typical Home Price In Washington: $519552

- Typical single-family home value in 2021: $529,327

- Average mortgage rate, July 2021: 3.058%

- Average mortgage payment to median income: 43.7%

Although Washington’s median income is 20% more than the U.S. median, that’s not nearly enough to match its home prices. Residents will have a hard time making the average mortgage payment work.

How Much Does It Cost To Buy A Home

On top of the home sale price, it can cost the average American over $20,000 to buy a home.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

If youre wondering how much it cost to buy a house, youre not alone. This guide can help you get started on preparing your savings account and your monthly budget for buying a new home.

Heres a breakdown of both the upfront costs of buying a house and the recurring costs of homeownership:

Recommended Reading: How Much Mortgage Do You Pay A Month

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Recommended Reading: Why Are Mortgage Rates Lower Than Prime