What Are Todays Fair Credit Mortgage Rates

Mortgage rates today are low and affordable even if you have fair credit.

Check todays mortgage rates and get approved for a home purchase or refinance. You could be surprised at what you can qualify for.

Popular Articles

Resources

Can I Get A 658 Credit Score Mortgage

Yes. You can get a mortgage with a credit score of 658. If your credit score is 658 and you checked your score with Experian, it means your score is categorised as Poor, which means youll have less mortgage lenders willing to lend to you than if you had an Excellent score, but you still have options.

A Poor credit rating often means youll need a specialist lender because theyll be willing to consider your application on a case-by-case basis. Often, specialist lenders are only available through a specialist mortgage broker. Thats where we can help. We have a network of specialist mortgage brokers who can help get you a mortgage even if you have a Poor credit rating. Get in touch now and get matched to the perfect broker.

If your credit score is 658 and you checked with TransUnion or Equifax, it means you have an Excellent credit score and you should have lots of mortgage options available to you.

Usda Loan Credit Score Requirements

USDA loans have different credit score requirements depending on the program and the lender. Section 502 Guaranteed Loans, for example, dont have a minimum credit score requirement. USDA mortgages are available to low- to moderate-income borrowers who want to buy a home in an area with a population of less than 35,000.

Also Check: What Banks Look For When Applying For A Mortgage

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

Also Check: How Do You Calculate Self Employed Income For A Mortgage

How Mortgage Lenders Pull Your Credit Score

There are three main credit bureaus Experian, Equifax and TransUnion. When applying for a mortgage, lenders usually pull all three of your credit reports and scores using each bureau’s scoring model . Gage reports that her lending company uses the middle of your three credit scores for borrower applications. Other mortgage lenders may have their own proprietary scoring system.

If you’re on furlough, or you’ve been recently laid off, it may feel like there’s not much you can do to improve your chances of getting a mortgage. But there are some active steps you can take to improve your credit score while you look for a new job.

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

You May Like: How To Sell A Mobile Home With A Mortgage

Tips For Getting A Mortgage With Bad Credit

How Does Your Credit History Affect Getting A Mortgage

Lenders use your credit report to get information on how reliable you have been at paying back debts in the past. When you apply for a mortgage you will have to supply payslips, P60s and bank statements to show how much you earn and what your monthly budget might look like. This shows lenders your current financial situation, but to predict how you might behave in the future they will also look at your credit report.

Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly youve borrowed in the past. Special introductory rates or other attractive mortgage offers might only be available to people whose credit history meets certain criteria.

Read Also: How Much Mortgage Do You Pay A Month

Why Should I Check My Credit Score Before Applying For A Mortgage

Some soon-to-be borrowers make the mistake of applying for loan or mortgage products without knowing their credit score and their chosen lenders stance on whether theyll lend to someone with their circumstances.

Always check your eligibility before applying for any line of credit to avoid damaging your credit report. Lenders can see your previous loan applications when accessing your credit report and a recent rejection for credit can hinder your ability to get approved for a future loan.

Remortgaging With Bad Credit

It’s usually possible to remortgage with bad credit, but it’s worth trying to improve your credit score if you have time.

Making your monthly mortgage repayments on time will help you build a stronger credit history . If your credit rating has gone up after a period of time with a specialist lender, it may be possible to remortgage with a high-street lender.

Whether youre able to secure a better rate will depend on your credit score, your income, your propertys current value and the equity you hold in it. The prospective lender will also run affordability calculations to ensure youll be able to afford payments at the new rate in the future.

- Find out what your monthly payments might be with our mortgage repayment calculator

A range of remortgaging deals are available on the high street, with rates similar to those in the home movers tables above, so its worth shopping around. You generally have to pay fees to remortgage, which you should also factor into your decision-making.

Best two-year fixed-rate deals for people remortgaging

If you’re struggling to get accepted for a remortgaging deal, you could consider getting a second-charge mortgage. Our news story from March 2019 outlines the pros and cons of second-charge mortgages.

You May Like: What Is Tip In Mortgage

How This Site Works

We think it’s important you understand the strengths and limitations of the site. We’re a journalistic website and aim to provide the best MoneySaving guides, tips, tools and techniques, but can’t guarantee to be perfect, so do note you use the information at your own risk and we can’t accept liability if things go wrong.

- This info does not constitute financial advice, always do your own research on top to ensure it’s right for your specific circumstances and remember we focus on rates not service.

- We don’t as a general policy investigate the solvency of companies mentioned , but there is a risk any company can struggle and it’s rarely made public until it’s too late .

- Do note, while we always aim to give you accurate product info at the point of publication, unfortunately price and terms of products and deals can always be changed by the provider afterwards, so double check first.

- We often link to other websites, but we can’t be responsible for their content.

- Always remember anyone can post on the MSE forums, so it can be very different from our opinion.

MoneySavingExpert.com is part of the MoneySuperMarket Group, but is entirely editorially independent. Its stance of putting consumers first is protected and enshrined in the legally-binding MSE Editorial Code.

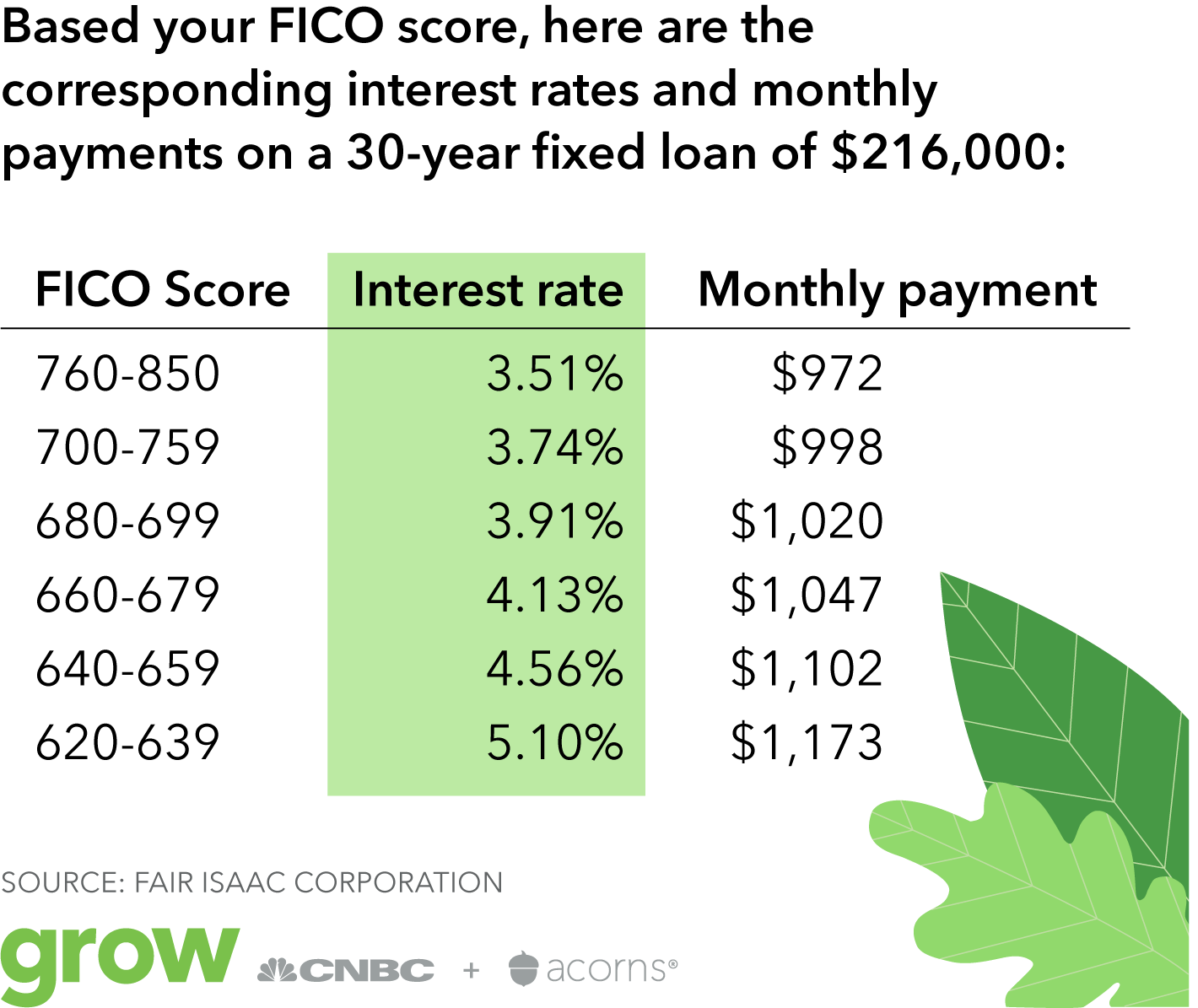

What Mortgage Rate Can I Expect With My Credit Score

In the table below, you can see how much your interest rate might be depending on your credit score, how much your monthly payment might be, and how much youd likely pay in total interest.

This is based on a $200,000, 30-year loan and the interest rates as of Aug. 13, 2020.1

Keep Reading: 750 Credit Score Mortgage Rate: What Kind of Rates Can You Get?

Recommended Reading: Does Rocket Mortgage Affect Your Credit Score

Can I Check My Credit Score For Free

Yes. Sites like Clearscore let you see your monthly credit report for free. All you need to do is make an account and you can track how your actions are helping or hindering your credit score. Bear in mind that this score isnt definitive again, its just one agencys interpretation of your borrowing and repaying behaviours.

What You Should Know

- The minimum credit score required for a mortgage is 600 for banks, 550 for B lenders, no minimum for private lenders, and600 for CMHC insured mortgages

- If you have bad credit, B lenders and private lenders are generally your only options, but they can require you to have a large down payment or home equity

- Typically, the lower your credit score, the higher your mortgage interest rate

- Youll want to aim to have a credit score above 680 to gain access to lower mortgage rates

- If you’re a senior with a low credit score, a reverse mortgage can be an option that allows you to receive a steady stream of income

Also Check: How Much Do You Pay Back On A Mortgage

The Best Credit Cards For Fair And Average Credit

While you wait for economic circumstances to improve, you could use a new credit card to help raise your score.

While the best travel cards and rewards credit cards come with strict credit requirements, there are some cards made for people with average, or even poor, credit scores. These can be a good option when your goal is to improve your credit score, but only if you feel comfortable taking on a new line of credit.

A new credit card will add to your total available credit and improve your credit utilization rate. But if you worry that you could easily max it out and fall into deeper debt, then you can hold off on this option until you’re ready.

Here are some of CNBC Select’s picks for top credit cards for fair and average credit:

- Best for Travel: Capital One® Platinum Credit Card

See our full comparison here.

Note: While the above cards are generally marketed toward applicants with fair or average credit, there is no guarantee you’ll be approved. We recommend checking your approval odds before you submit a full application .

Find A Bad Credit Mortgage Lender

You need a minimum credit score for mortgage approval in Canada from a big bank, and that number is 600. If you have a credit score below 600, most of Canadas big banks will not approve you for a mortgage loan.

If you dont meet the banks threshold for the minimum credit score for mortgage approval, youll have to look for a B lender or subprime lender. These financial institutions, including trust companies, work almost exclusively with people that do not have ideal credit scores. If youve gone through a bankruptcy or consumer proposal within the last two years, you may even need to work with a private mortgage lender. If youre working with a mortgage broker, they should be able to put you in touch with a lender they know will work with you.

| Description |

*The exact cut-offs will vary by lender

**Other factors will also influence your mortgage rate

If you work with a B lender for your poor credit mortgage, youll most likely pay some extra fees that you would normally avoid with an A lender. First, your B lender may charge a loan processing fee of up to 1% of the mortgages value. Second, if you choose to find your lender through a poor credit mortgage broker, they may also charge you a fee, usually around 1%. This fee is levied because lenders dont typically compensate mortgage brokers for bad credit mortgage clients, so the cost is passed along to you. 2% may not sound like much, but it amounts to $10,000 on a $500,000 mortgage.

Read Also: How Do Mortgage Companies Decide How Much To Lend

When Are Credit Scores Too Low To Qualify For A Mortgage

Theres no credit score threshold that will definitely disqualify you from getting a mortgage, but the lower your score, the harder it will be to find a lender to underwrite your loan. Lenders generally view applicants with poor credit as more likely to default, which means the lender is less likely to get its money back plus interest. Each lender evaluates loan applications differently, though, and some will make loans to borrowers with low credit scores, while others will simply pass.

Minimum Credit Score Needed By Home Loan Type

Theres a different minimum credit score needed for each type of mortgage loan. Heres a quick overview:

| Loan type | ||

|---|---|---|

|

||

| FHA |

|

|

| VA | None |

|

| USDA |

|

See: How Your Credit Score Impacts Mortgage Rates

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Best Home Loan Options For Buyers With Bad Credit

The best home loan options for you if you have bad credit is going to depend on how bad your score is.

If you are in the 600 range, there are going to be more options available for you to choose from. If your score is below 600, you probably should look into an FHA loan or VA loan.

Of course, the best option will be to work on improving your credit score.

Home Loan Options For Buyers With Bad Credit

The two primary types of mortgage loans are going to be loans backed by the government and conventional loans.

The difference between the two is that a conventional loan isnt backed by or insured by the federal government, but government-backed loans are.

You will find that a loan backed by the government will have lower requirements for your down payment, your credit and your debt-to-income ratio.

These loans are also less risky for lenders.

Lets check out some of the loan options available and the average credit score requirements for each of them:

Recommended Reading: Is 720 A Good Credit Score For Mortgage