Are Second Home Mortgage Rates Higher

If you have a mortgage for your primary residence , you might expect to get the same interest rates or loan offers on your second home. But thats not often the case.

Whether youre buying a second home, vacation home, or investment property, youll pay slightly higher interest rates and may have to meet stricter guidelines to qualify. Heres what you can expect and what you can do to get a lower second home mortgage rate.

In this article

How Many Mortgages Can I Have On My Home

Lenders generally issue a first or primary mortgage before they allow for a second mortgage. This additional mortgage is commonly known as a home equity loan. Most lenders dont provide for a subsequent mortgage backed by the same property. Theres technically no limit to how many junior loans you can have on your home as long as you have the equity, debt-to-income ratio, and credit score to get approved for them.

What Is An Investment Property

An investment property is a home that is not your primary residence, and that you buy with the intention to generate rental income or sell for profit. Most commonly, these include one- to four-unit rental homes or houses that you buy to fix and flip. For the purposes of this article, we are not including commercial investment properties like apartments or office buildings.

You May Like: How To Choose The Right Mortgage Lender

Alternative Investment Property Financing

Your seller may be happy to have an income stream from you without the hassles of being a landlord. Seller financing can be cheaper than banks or brokers. The seller may be more interested in unloading the property than in profiting from your mortgage. But make sure you get the home appraised and inspected before buying.

Alternatively, there are lenders that specialize in financing commercial residential property from homes to apartment buildings. As long as the property income is sufficient to cover the mortgage and other expenses, they may finance you for less.

Should You Hire A Property Management Company

You need to decide whether you want to handle property repairs, tenant management and maintenance yourself or if youll hire a property management company to manage the daily maintenance on your behalf.

Property management companies take both scheduled and emergency repair calls and check up on your property with both drive-bys and scheduled visits to make sure that tenants respect your space. They can also collect rent on your behalf. Some property management companies also offer tenant placement services and eviction processing for an additional fee. In exchange, the property management company takes a percentage of your monthly rent. If you live far away from your property or you dont have the home repair skills to fix your own property, hiring a property management company may be a great choice.

You May Like: When Will My Mortgage Be Paid Off With Extra Payments

You May Have To Pay Off The Mortgage Sooner

In some cases, the loan may have a shorter term than the typical 30-year term offered on the purchase of a primary home. But, just like with other types of mortgages, a rental property loan can either be fixed or variable, depending on the loan and the borrowerâs relationship with the lender, says Tom McCormick, regional officer of branch administration at Trustco Bank in Saratoga County, New York.

Second Home Vs Investment Property

Are you buying a second home, or are you making an investment?

This might be confusing, especially if youre thinking about occasionally renting out the property using it regularly for vacation, for example, but also making it available on Airbnb for some of the time youre not using the property.

Earning some money from your property doesnt automatically make it an investment, however. Accurately defining the piece of property depends on how much time you spend in it.

Elliot Pepper, co-founder, CFP and director of tax at Northbrook Financial in Baltimore, says that you need to pay attention to what he calls the 14-day limit rule.

Very broadly speaking, if you personally live in your second home for 14 days or fewer or less than 10 percent of the days it is rented during a year, then it would be considered a rental property and the income earned would be taxable, Pepper says, but you would also deduct the expenses associated with the property.

On the flip side, if you use the property for more than 14 days or more than 10 percent of the time its rented, any rental income you receive isnt taxable, but you also cant deduct expenses, Pepper says.

In general, a second home is like a vacation home one you purchase for enjoyment purposes and live in during part of the year. In contrast, an investment property is one you plan to rent out with the goal of generating income.

You May Like: How Much Mortgage Can I Get For 1400 A Month

Is It Hard To Find Investment Property Loans

As a rule, it gets easier to find an investment property mortgage when the economys doing well and more difficult when its struggling. Thats because lenders see investment property loans as riskier than primary home loans. And they may restrict access to moderate their risk level in tough times.

For example, when the Covid-19 pandemic choked the economy, many lenders made qualifying for one of these loans very tough.

So how easily youre going to find the loan you want will depend on the economic environment when you apply. But, during normal and good times, there are usually plenty of lenders willing to help out.

Can Anybody Get A Mortgage

Mortgage lenders will need to approve prospective borrowers through an application and underwriting process. Home loans are only provided to those who have sufficient assets and income relative to their debts to practically carry the value of a home over time. A persons credit score is also evaluated when making the decision to extend a mortgage. The interest rate on the mortgage also varies, with riskier borrowers receiving higher interest rates.

Mortgages are offered by a variety of sources. Banks and credit unions often provide home loans. There are also specialized mortgage companies that deal only with home loans. You may also employ an unaffiliated mortgage broker to help you shop around for the best rate among different lenders.

Also Check: How To Buy A House At Auction With A Mortgage

How Can I Apply For A Mortgage

When applying for a mortgage for a primary residence, second home or investment property, here are some common steps:

Choose a mortgage lender and apply: When you first start looking for mortgages, you may see offers from lots of lenders. Compare rates and services before choosing the one that’s right for you.

Make A Bigger Down Payment

The surest way to get a lower interest rate on your investment property is to make a bigger down payment. Much of the added cost goes away if you can put at least 20% down.

It might be worth borrowing against the equity in your current home to increase your down payment. You can also buy a cheaper house or find a foreclosure you can buy at below-market value. You could even consider if this is an exceptional investment borrowing against your 401.

Recommended Reading: What Is The Going Mortgage Interest Rate

What Are Investment Property Mortgage Rates Today

Typically, investment rates are 0.5% higher than those for primary residences when you make a 25% down payment, and 1.5% higher if you put down 20%, according to Rueth.

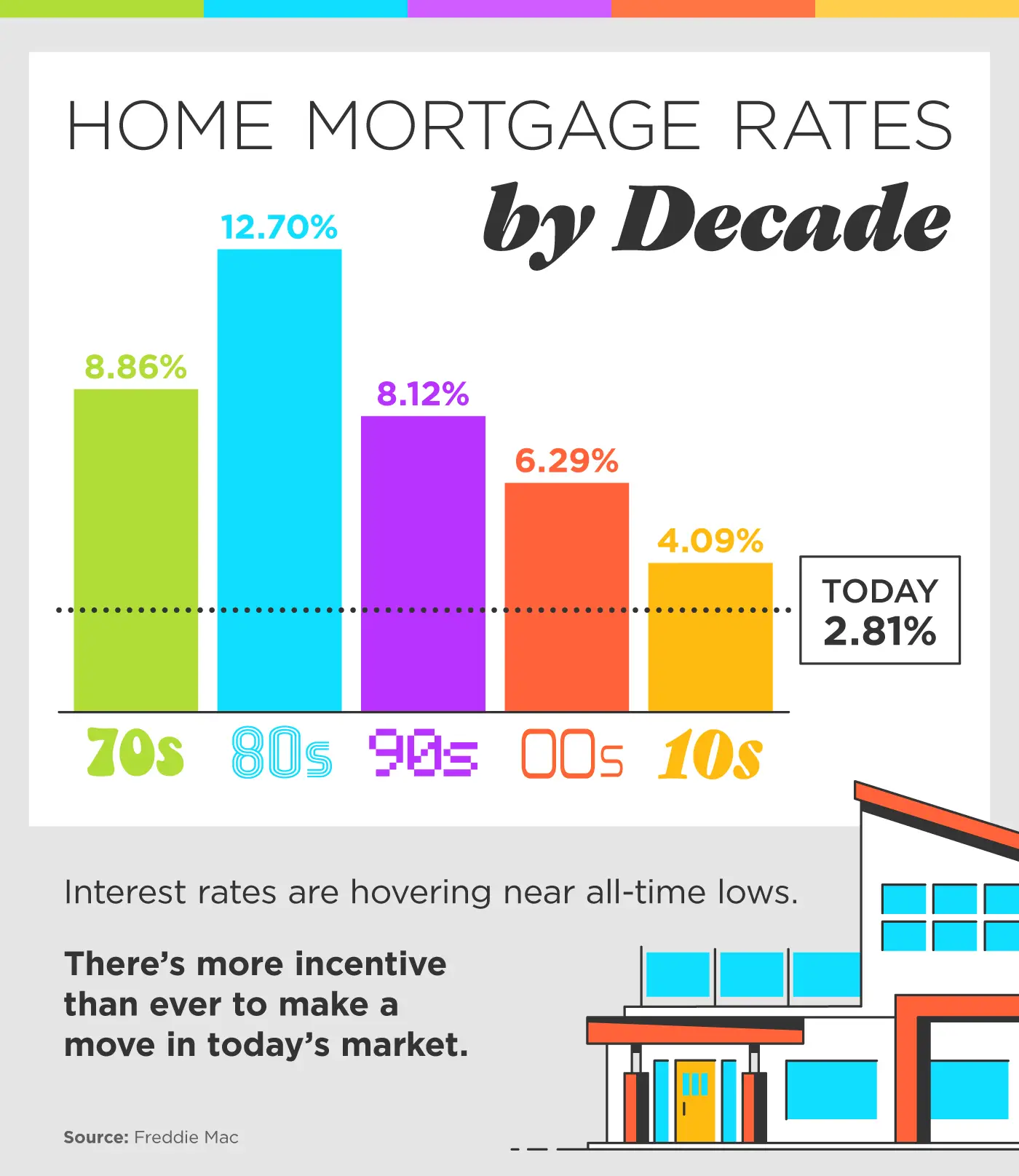

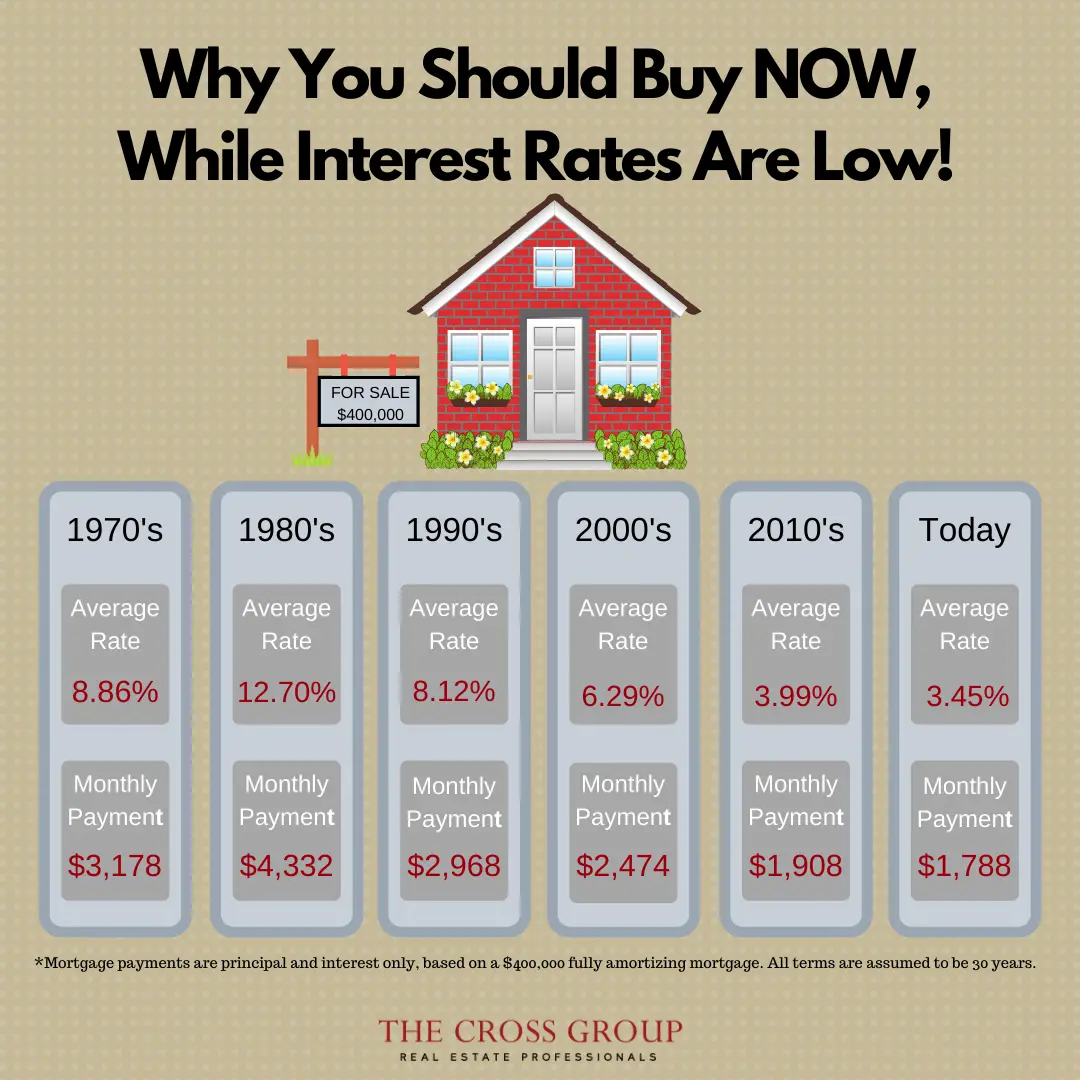

The average current mortgage rate is about 3% according to Freddie Mac .

Based on that average, an investment property borrower with excellent credit who qualifies for the most competitive investment property rate might receive 3.5%. Someone who receives a rate at the higher end of the spectrum might get a rate of around 4.5%.

While your interest rate may be higher than on your primary home, the gains you make could far exceed what you pay.

Of course, itâs always preferable to get a lower rate. But even 3.5% is still lower than rates have been for primary residences in recent years. Locking in an investment property mortgage rate under 4% before rates rise can create significant opportunities for growth and profit over time, particularly if the property is in an in-demand market where home values and rents are rising.

Buying an investment property now gives you a chance to earn rental income that, depending on rental rates in your local market, could cover your mortgage payment. Your tenants would effectively be paying your mortgage, while you build equity in the property.

The equity you build in this property can help you finance the next investment and the next one after that. So while your interest rate may be higher than on your primary home, the gains you make could far exceed what you pay.

Conventional Rental Property Mortgages

Most new real estate investors think first of conventional mortgages, when brainstorming loans for investment properties. You probably worked with one when you bought your own home, so you instinctively call up the same mortgage lender.

But these lenders limit the number of mortgages allowed on your credit report. They typically stop lending to you once you have four mortgages reporting on your credit.

That makes conventional loans for investment properties a good fit for your first rental property or two, but not scalable after that.

Expect a down payment requirement in the 20-30% range for conventional loans for investment properties.

Todays Conventional Rental Property Mortgage Rates:

- 15-Year Fixed-Rate Loan: 5.75% 8.9%

- 30-Year Fixed-Rate Loan: 6.375% 9.5%

Check Mortgage Interest Rates At: Credible

Pros:

- Lower interest: often lower investment property mortgage rates than portfolio lenders

Cons:

- Not scalable: most lenders only allow four mortgage loans on your credit report

- Conventional real estate investor loans are reported to credit bureaus, and too many mortgages on your credit report will wreck your credit

- They usually dont allow mortgage loans to LLCs and other legal entities

- Minimum credit score: most types of loan require a score of at least 620, often 660 or higher

- Lenders verify your personal income tax returns and check your debt-to-income ratio

- Slow to settle: minimum 30 days, typically

- Lots of paperwork and headaches

Read Also: Can I Refinance If I Have A Second Mortgage

What Are Todays Investment Property Mortgage Rates

Mortgage rates for investment properties are higher than those for primary residences because they are viewed as higher risk. Still, rental properties are usually a sound investment in the long run, and a slightly higher rate might not matter much when compared to the returns youll see on the property.

Every applicant is different. The best way to get your current investment property mortgage rate is to get quotes from multiple lenders and make them compete. Rates change all the time, so contacting lenders online is the quickest way to get a fist full of rates to compare.

What Type Of Loan Should You Get For An Investment Property

The type of loan you should get for an investment property varies based on your goals for the property. For example, a conventional bank loan might make the most sense for a buy-and-hold plan. But a hard money loan could be more appropriate for a flip. Ultimately, youll have to decide which lending option works best for your situation.

Don’t Miss: What Is The Monthly Payment On A 50000 Mortgage

What Are The Potential Rewards Of Property Investment

Return on investment

The ultimate goal of investing in property is enjoying a return above the original investment. There are two main ways to achieve this:

For example, if you bought a unit for $600,000 and later sold it for $750,000, your capital growth would be $150,000.

Less volatility

While no investment is ever 100 per cent safe, the property market is generally less volatile than other investment options, such as the share market, which can rapidly lose value due to circumstances beyond the investors control. Property transactions are also generally slower than share market transactions, so they can be more carefully considered.

Intergenerational wealth transfer

Some families make property investments in order to bestow wealth to their beneficiaries through these bricks and mortar assets.

Do The Math Before Applying For A Refinance

Before you make the decision to refinance any property, you should run the numbers on the length of time it will take to break even on the transaction. Start by researching refinancing rates from various lenders to confirm you can secure a lower rate than what you are currently being charged on the original mortgage loan.

You can then calculate the refinance break-even point by factoring in all the upfront costs of refinancing the loanthe lenders fees plus the other closing costsagainst how much you would save each month. Comparing these numbers will help determine approximately how long it will take to break even and begin saving money.

If you have no intention of owning the property for that length of time, then refinancing the investment property does not sound like the best financial move it will cost you more than the savings you can extract.

Recommended Reading: How Do You Figure Out Mortgage Interest

Second Home Mortgage Rates Vs Investment Property Mortgage Rates

Mortgage rates are higher for second homes and investment properties than for the home you live in.

Generally, investment property rates are about 0.5% to 0.75% higher than market rates. For a second home or vacation home, theyre only slightly higher than the rate youd qualify for on a primary residence.

- Second home mortgage rates: Up to 0.50% higher than primary home rates

- Investment property mortgage rates: Around 0.50% to 0.75% higher than primary home rates

Of course, investment property and second home mortgage rates still depend on the same factors as primary home mortgage rates. Yours will vary based on the market, your income, credit score, location, and other factors.

If your financial situation has changed since you bought your first home, your new mortgage rate might vary by a wider margin than average. This can be true for both home purchase and refinance rates for second homes and rental properties.

| Second Home |

| Starting at 500-620 |

Personal Vs Investment Property Mortgage: Whats The Difference

Youll typically pay marginally higher rates for an investment property than you will for a personal mortgage. This is because many lenders consider investment property mortgages as more risky. This is because theres a higher likelihood that a borrower will default on an investment property .

This risk factor means that investment properties often come with stricter lending requirements, tighter borrowing limits and higher rental property mortgage rates. That said, your risk factor can be reduced if you can show your lender that you have an excellent credit score, a high income, job stability, and significant equity in your primary residence.

Keep in mind that residential lenders cant fund investment properties where the owner doesnt spend at least two weeks per year in it.

Donât Miss: Columbia Business School Value Investing

Don’t Miss: How To Figure Out Mortgage Rates

Fund Almost Anything Else

Unlike some other types of loans, there are no limitations on what you can do with the money you take away from a refinance. You can:

- Grow a childs college tuition fund.

- Boost your retirement savings.

- Pay for a wedding.

- Buy a new car or boat.

Refinancing can give you access to an easy source of cash and you can use it for almost anything you need. If you can dream it, you can use the money from your home equity to make it a reality.

Think a refinance might be for you? Use our refinance calculator to see if refinancing your rental property can help you achieve your goals.

Get approved to refinance.

Investment Property Tax Implications

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-palmetto-mortgage.jpeg)

- The mortgage interest on an investment property is fully tax-deductible. You can also deduct many expenses related to the property, including property taxes, maintenance and insurance, as well as for depreciation.

- If you rent out the home for more than 14 days per year, the rental income is taxable.

Homeowners enjoy the ability to deduct mortgage interest, but Pepper points out that this can get a bit tricky if you own a second home, due to the $750,000 total debt limit for interest deductions. Essentially, if you have more than $750,000 in mortgage debt between the two properties, youve maxed out the amount you can use to deduct interest.

For an investment property, however, the rules are different.

Interest on a mortgage related to an investment property is fully deductible on Schedule E for a taxpayer and can therefore be used to offset any income generated from the property, Pepper says.

In addition to deducting mortgage interest, investment property owners enjoy the ability to deduct a wide range of expenses. The IRS says the following costs are deductible:

- Advertising the property to attract renters

Also Check: How To Become A Mortgage Underwriter In Arizona