Choose Your Loan Term Carefully

Short-term loans are less risky and, as a result, have lower mortgage rates. The trade-off for these kinds of loans are larger monthly payments since you’re paying off the principal in a shorter time. With a longer-term loan, you spread the payments over a longer period of time, leading to lower monthly payments with a higher interest rate.

Short-term loans will generally save you more money in the long run, but long-term loans may leave you with more disposable income every month. If you’re looking specifically for low mortgage interest rates and savings over the life of the loan, a short-term loan is your best bet.

Should You Consider Getting A Variable Rate Mortgage

Remember that variable mortgage rates closely follow the BoCs prime lending rate?

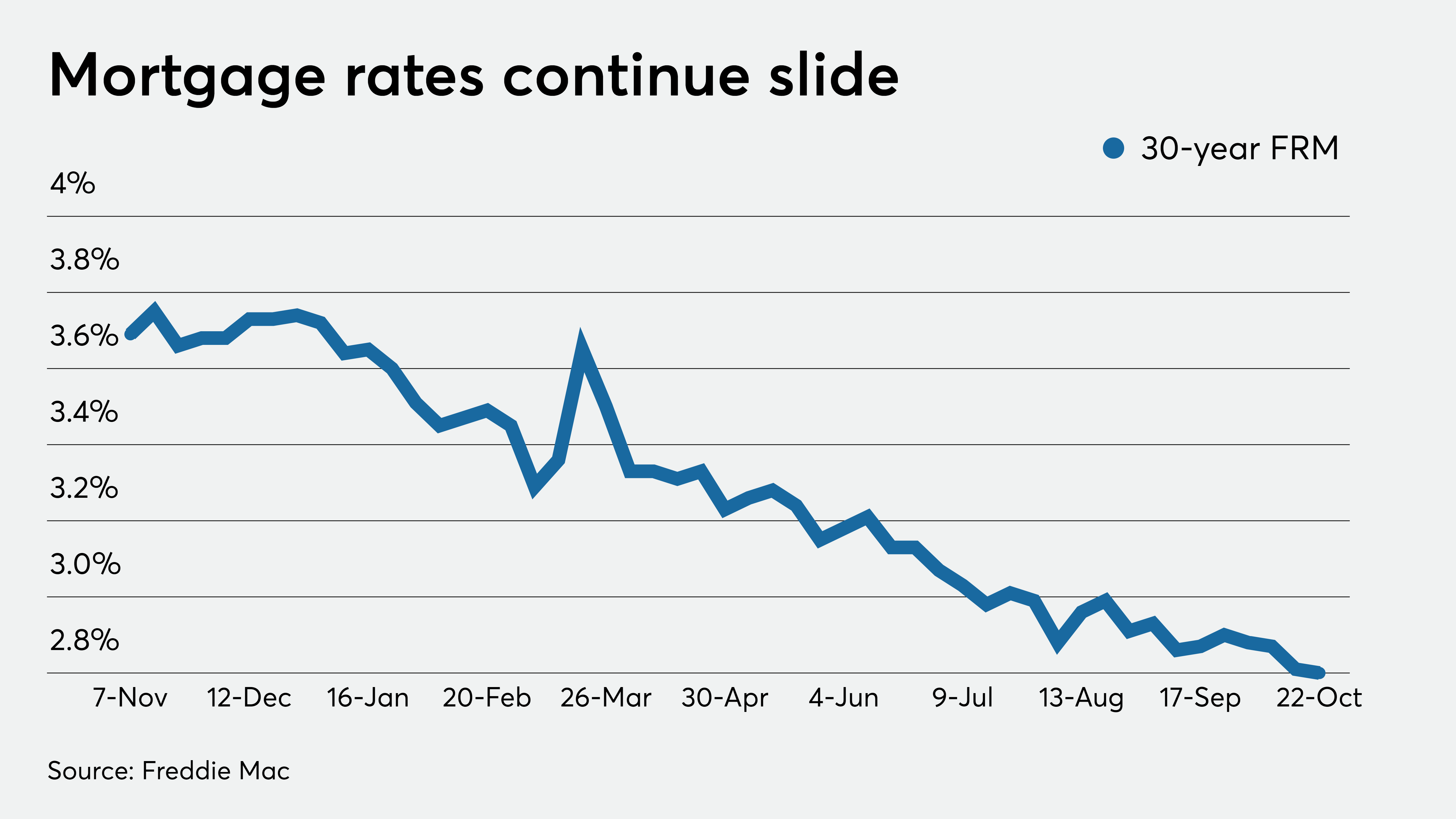

The Bank of Canada, in response to the pandemic, has reduced its overnight lending rate to 0.25%, lowering it by a total of 150 basis points from 1.75% in January.

With this key move conducted by the central bank, the prime lending rate of Canadas big banks has been pushed down from 3.95% to 2.45%. As a result, variable rates are now much lower.

The table below shows how the reduction in the BoCs rates have impacted variable mortgage rates:

| 2.45% |

The lower the BoCs rate becomes, the more variable rates will drop. As the BoCs rate is currently at its lowest, now may be the best time to get a variable mortgage rather than a fixed mortgage. Furthermore, experts think that the BoC benchmark rates will not go up by much or will do so with sluggish speed in the future due to the state of the economy and the huge debt amassed by both individuals and the government.

The Fall Of The Market In The Fall Of 2008

Mortgage crisis. . Bank collapse. Government bailout. Phrases like these frequently appeared in the headlines throughout the fall of 2008. This period also ranks among the most horrific in U.S. financial market history. Those who lived through these events will likely never forget the turmoil.

So what happened, exactly, and why? Read on to learn how the explosive growth of the subprime mortgage market, which began in 1999, played a significant role in setting the stage for the turmoil that would unfold just nine years later in 2008 when both the stock market and housing market crashed.

Read Also: Rocket Mortgage Loan Types

Fed On Track To Raise Rates In March

Despite these lower interest rates, the Federal Reserve is still expected to raise the federal funds rate in March in order to control rising inflation.

“Markets have their eyes on mounting inflation and expect the Federal Reserve to proceed with a 25 basis point hike at its upcoming mid-March meeting,” Ratiu said. “Market volatility and rising oil prices are likely to push bond yields into larger swings, while inflation will keep upward pressure on mortgage rates.”

To determine if a mortgage refinance is the right financial move for you, you can contact Credible to speak to a home loan expert and get all of your questions answered.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at and your question might be answered by Credible in our Money Expert column.

What Does That Mean For You As A Borrower

It means you should take low rates as they come. Whether youre buying a home or refinancing, todays lowest rates represent a great deal one not worth passing up in hopes of slightly lower rates later on.

And borrowers shouldnt try too hard to time the market.

Mortgage rates are unpredictable right now. So keep a laser focus on your own personal goals, and lock a mortgage rate when the time is right for you regardless of what the market might do.

You May Like: 10 Year Treasury Yield Mortgage Rates

What The Latest Mortgage Rates Mean For Homebuyers

A drop in mortgage rates might come as a relief to homebuyers who have been worried with the big jumps the past several weeks, but the dip might not last long. Its important to consider that while rates are up compared to what they were in 2020 and 2021 years that were, in many more ways than one, unprecedented they arent far off from where they were before the pandemic and are lower than they were a decade or so ago.

Mortgage rates are important and big increases can cut into home affordability, which is already strained by the high cost of homes right now. A report on monthly housing market trends by Realtor.com found the national median listing price for homes was $392,000 in February, a 12.9% increase from last February and a 26.6% jump from the year before. When interest rates go up, that means you can afford less home, Wilson-Spotser told us. You have to rethink what you can afford, what is a comfortable monthly payment for you.

NextAdvisors mortgage calculator can help you find out what you can afford as the housing market changes.

Does Refinancing Still Make Sense

Some mortgage borrowers still have the potential to reap savings by refinancing a home loan. But if you already have a low interest rate on your mortgage, refinancing may not pay off.

As of this writing, the average 30-year refinance rate is around 4%. So if your existing mortgage interest rate is 4.25%, you’re not going to enjoy a whole lot of savings by refinancing — especially when you factor in closing costs.

Just as you pay closing costs when you take out a mortgage to buy a home, so too do those fees apply when you refinance a home loan — and they can be substantial, as much as 5% of your mortgage amount.

So let’s say refinancing today means saving $50 a month on your monthly payments. If you pay $6,000 in closing costs to save that $50 a month, it will take you 120 months, or 10 years, to break even. That just wouldn’t make sense.

Don’t Miss: Chase Mortgage Recast Fee

Can You Refinance Into A Shorter Term

If you have 20 years left on your mortgage and you refinance into a new 30-year mortgage, you may not save money over the long run .

However, if you can afford to refinance that 20-year mortgage into a 15-year mortgage, the combination of a lower interest rate and a shorter term will substantially reduce the total amount of interest youll pay before you own the house free and clear.

-

Negatively impacting your long-term net worth

High Ltv Refinance Option And Freddie Mac Enhanced Relief Refinance

High loan-to-value mortgage loans are those in which the amount owed on the mortgage is nearly equal to or exceeds the home’s appraised market value. These high LTV loans are considered high risk to lenders since a default or nonpayment by the borrower could result in the lender losing money if the bank forecloses and sells the home for less than the loan amount given to the borrower.

Unfortunately, Fannie Mae and Freddie Mac have temporarily suspended mortgage loan refinances under the high loan-to-value programs. All high LTV refinances must have had their applications dated on or before June 30, 2021, and must be purchased or securitized on or before Aug. 31, 2021. Historically, these Fannie Mae and Freddie Mac programs were designed to replace theHome Affordable Refinance Program , which expired on Dec. 31, 2018.

HARP was set up to help homeowners who could not take advantage of other refinance options because their homes had decreased in value. Its goal was to improve a loans long-term affordability to help prevent people from losing their homes to foreclosure. Only mortgages held by Fannie Mae or Freddie Mac were eligible. Still, they also had to have a loan origination date on or after Oct. 1, 2017, and borrowers had to be current on their payments.

Don’t Miss: Reverse Mortgage On Condo

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s credentials, ask for its NMLS number and search for online reviews.

Video Result For Did Mortgage Rates Drop Today

Mortgage Rates and Housing Market Update For March 9…

Mortgage Rates and Housing Market Update For March 8…

Mortgage Rates and Housing Market Update| What’s the…

greatwww.nerdwallet.com

ratesmortgage

ratesmortgage

tipwww.msn.com

mortgage

mortgageratesdrop

topwww.cnbc.com

mortgage

trendwww.fool.com

mortgage

bestwww.realtor.com

didmortgageratesmortgagerates

mortgageratesdrop

ratesmortgageratesdrop

mortgage

mortgageratesmortgagerates

ratesdrop

mortgagedrop

greatwww.mortgagenewsdaily.com

mortgage

bestwww.fool.com

didmortgageratesdroprates

greatwww.zillow.com

mortgagemortgage

bestwww.hsh.com

mortgageratesmortgage

Mortgage Rates and Housing Market Update For March 9…

Mortgage Rates and Housing Market Update For March 8…

Mortgage Rates and Housing Market Update| What’s the…

Mortgage Rates and Housing Market|PEACE TALKs sending…

Mortgage Rates and Housing Market Update | Mortgage…

Also Check: Monthly Mortgage On 1 Million

How To Find Personalized Mortgage Rates

To find a personalized mortgage rate, talk to your local mortgage broker or use an online mortgage service. Make sure to take into account your current finances and your goals when searching for a mortgage. Specific mortgage rates will vary based on factors including credit score, down payment, debt-to-income ratio and loan-to-value ratio. Generally, you want a higher credit score, a higher down payment, a lower DTI and a lower LTV to get a lower interest rate. Aside from the mortgage rate, factors including closing costs, fees, discount points and taxes might also impact the cost of your house. Be sure to shop around with multiple lenders — like credit unions and online lenders in addition to local and national banks — in order to get a mortgage that works best for you.

What Is A Mortgage Rate Lock

A mortgage rate lock allows you to lock in the interest rate your lender quotes you for a certain period of time. This gives you a chance to close on the loan without risking an increase in the mortgage interest rate before you finalize the loan process.

Once you find a rate you like, lock it in as soon as possible because rates can change overnight. If they rise, then you could end up paying more on your mortgage.

If you get a floating rate lock, then you can lock in a lower interest rate if rates fall, but you wont be obligated to pay higher interest rates than you were quoted if they go up.

While 30-day rate locks are typically included in the cost of a mortgage, a floating rate lock could cost extra. Depending on how volatile the rate environment is, you might find that a floating lock is worthwhile.

Read Also: Rocket Mortgage Requirements

Will Homebuyers Be Discouraged By The Higher Rates

While some potential buyers may no longer be able to qualify for a mortgage due to the higher rates, demand isnt expected to drop off of a cliff.

Borrowers are often shocked by the increases, says Mike Villano, the national sales director of Veterans Lending Group. The mortgage lender specializes in Veterans Affairs loans with nearly two dozen locations across the country. Many of his borrowers think rates are still under 3%.

They may not be able to qualify for loans as large as they could have just a few weeks ago now, diminishing their buying power at a time when home prices are still going up. But Villano hasnt seen buyers making any big changes, at least not yet.

If rates do creep up into the mid-4% or even 5% , people will either have to spend less or theyll go into cheaper areas, he says.

Right now, the rise in rates could lead to a short-term burst in interest as those who were thinking of purchasing a home later in the year want to close before rates go up even higher.

Even with high prices and rates, owning a home is still more affordable than renting one in many parts of the country, if buyers can save up the down payment, find a home, and have their offer on it accepted. Nationally, the monthly mortgage payment on a median-priced home is $1,260compared with the typical rent of $1,540, according to NAR. And rents have been rising rapidly over the past year.

Plus, there are more folks reaching peak homebuying years in the market.

Summary Of Current Mortgage Rates

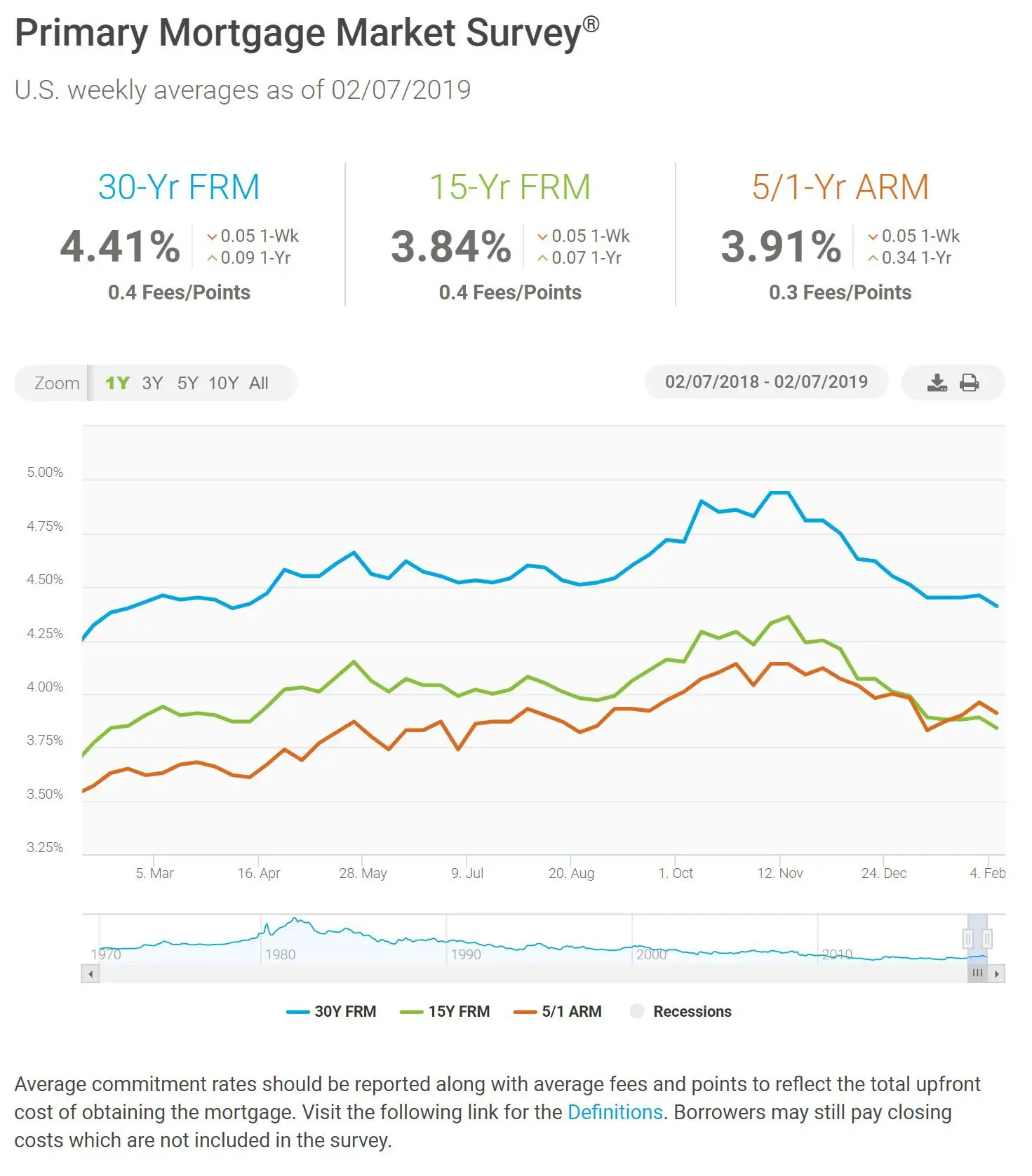

This week’s rate averages were lower for all loan types:

- The current rate for a 30-year fixed-rate mortgage is 3.05% with 0.7 points paid, 0.07 percentage points lower week-over-week. Last year, the average rate was 2.66%.

- The current rate for a 15-year fixed-rate mortgage is 2.30% with 0.7 points paid, a of 0.04 percentage points from last week. A year ago the average rate was 2.19%.

- The current rate on a 5/1 adjustable-rate mortgage is 2.37% with 0.4 points paid, down by 0.o8 percentage points from last week. The average rate was 2.79% last year.

- Categories

Read Also: What Does Gmfs Mortgage Stand For

How Big Of A Down Payment Do I Need

Nowadays, mortgage programs dont require the conventional 20 percent down.

In fact, first-time home buyers put only 6 percent down on average.

Down payment minimums vary depending on the loan program. For example:

- Conventional home loans require a down payment between 3% and 5%

- FHA loans require 3.5% down

- VA and USDA loans allow zero down payment

- Jumbo loans typically require at least 5% to 10% down

Keep in mind, a higher down payment reduces your risk as a borrower and helps you negotiate a better mortgage rate.

If you are able to make a 20 percent down payment, you can avoid paying for mortgage insurance.

This is an added cost paid by the borrower, which protects their lender in case of default or foreclosure.

But a big down payment is not required.

For many people, it makes sense to make a smaller down payment in order to buy a house sooner and start building home equity.

Brief Drop In Mortgage Rates Sparks Mini Refinance Boom

- The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances decreased to 4.09% from 4.15% for loans with a 20% down payment.

- Demand for refinances jumped 9% last week compared with the previous week.

- Applications for a mortgage to purchase a home increased 9% from the previous week but were 7% lower than the same week one year ago.

After rising steadily for months, mortgage rates made a U-turn last week, and borrowers jumped to take advantage. The crisis in Ukraine rattled financial markets and caused a run on the relatively safer bond market. Yields fell and mortgage rates followed.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances decreased to 4.09% from 4.15%, with points remaining unchanged at 0.44 for loans with a 20% down payment, according to the Mortgage Bankers Association. The rate was 83 basis points lower one year ago.

As a result, demand for refinances jumped 9% last week compared with the previous week, but application volume was still half of what it was the same week one year ago, when rates were lower.

“The average loan size remained close to record highs, with higher-balance loan applications continuing to dominate growth,” added Kan.

Read Also: Mortgage Recast Calculator Chase

Why Does My Mortgage Interest Rate Matter

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, a borrower with a good credit score and a 20 percent down payment who takes out a 30-year fixed-rate loan for $200,000 with an interest rate of 4.25% instead of 4.75% translates to almost $60 per month in savings in the first five years, thats a savings of $3,500. Just as important is looking at the total interest costs too. In the same scenario, a half percent decrease in interest rate means a savings of almost $21,400 in total interest owed over the life of the loan.

Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whos suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you dont have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wont show up on your credit report as its usually counted as one query.

Finally, when youre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Recommended Reading: Can You Refinance A Mortgage Without A Job