Mr Cooper Mortgage Rates

- They notably do not advertise their mortgage rates

- But they do talk about them on their website

- They say they want to find you the lowest rate possible

- But that the best option might not be chasing a rock bottom rate

It appears Mr. Cooper is doing some heavy branding to become a household name in the mortgage business.

As such, they probably wont offer the lowest mortgage rates around, seeing that branded companies selling a commodity can usually fetch a higher price for it.

Its not to say their mortgage interest rates will be higher than the competition, its just possible that youll be able to find a lower price elsewhere if you take the time to shop around.

If they felt their rates were second to none, theyd probably prominently display them for all to see.

This doesnt mean you shouldnt include them in your home loan search, it just means you should consider a variety of companies and gather multiple quotes.

What To Know About Fha Loans In Muscle Shoals Al

If youâre looking for a loan with flexible credit requirements and a potentially lower down payment, a Federal Housing Administration loan may be a good option for you. This government-insured loan type is behind nearly 1 in 5 of all homebuyers. The loan program is primarily designed to help homebuyers who cannot afford the traditional 20% down payment that is often required by private lenders. With a down payment that can be as low as 3.5%, an FHA loan can end up being a perfect match for buyers who aren’t eligible for conventional loans.

In Muscle Shoals, Mr. Cooper has watched FHA loans rise in popularity alongside increases in student loan debt and rental costs â two things that can make it tough to save enough money for a down payment. Another perk to FHA loans is that they’re usually available to borrowers with lower credit scores. Wherever you are on your journey, Mr. Cooper can walk you through the ins and outs of FHA loans and figure out the best financing option for your needs.

Option #: Autopay Setup

When you sign up for AutoPay, you will basically put your monthly payment on autopilot since the payments will occur each month on the same day from the account you choose. Signing up for AutoPay is free and simple, and you can cancel it whenever you want.

Heres how to do it:

Step #1:Choose Set Up AutoPay. Its located near the Payment Due tally.

Step #2: Select your payment date. If the date you choose is a short time away from your next payment date, you may need to make an extra one-time payment. This stipulation will be made abundantly clear to you if its applicable.

Step #3: Choose, if you wish to, the length of time you want AutoPay to be in effect. If you skip this step, then AutoPay will remain activated indefinitely until you decide to stop it.

Step #4:You can modify the amount you pay each month, should you wish to do so. Go to Pay to Principal and, in the appropriate area, key in the extra amount you want to pay. If you dont want to change your payment tally, look under the How would you like to pay area and choose the account you wish to use.

Step #5:Review your entries to ensure everything is as it should be.

Step #6:Look through the Terms and Conditions section, click the I have read the terms and conditions box, and submit.

Recommended Reading: Can I Get A Reverse Mortgage On A Condo

An Overview Of Mr Cooper

Mr. Cooper was founded in February 2001 as Nationstar Mortgage, LLC. It is headquartered in Dallas, Texas, and has almost 10,000 full-time employees.

Nationstar announced its transition to Mr. Cooper in the first half of 2016. It intended to do more than just rebrand its name. Instead, it wanted to transform the entire customer experience and the way that it does business. In August 2017, the company formally changed its name from Nationstar to Mr. Cooper.

Over the last 20 years, Mr. Cooper has grown to 3.5 million customers nationwide. It is now one of the top 15 mortgage originators in the U.S., the 4th largest loan servicer, and the largest non-bank mortgage servicer. Mr. Cooper is publicly traded on NASDAQ as Mr. Cooper Group, Inc. under the ticker symbol “COOP.

The Company Serviced 38 Million Customer Loans Last Year And Wrote $40 Billion In New Ones

By Paul O’Donnell and Steve Brown

4:21 PM on Sep 2, 2020 CDT

Coppell-based Mr. Cooper, one of the nations largest mortgage servicers, plans to hire an additional 2,000 employees by the end of this year as record low interest rates spur home purchases and mortgage refinancings.

The company said the jobs range from loan officers and mortgage underwriters to customer service and home advisers, who serve hybrid roles servicing existing loans and originating new ones, and are work-from-home positions until at least 2021 because of the COVID-19 pandemic. About 97% of Mr. Coopers more than 9,000 employees have worked remotely since March.

About half of the new positions will be filled in the Dallas area.

Mr. Cooper recently reported a record-breaking second quarter with loan originations generating pretax income of $433 million. Its revenue topped $2.6 billion last year. It serviced 3.8 million customers with loans totaling $643 billion and wrote $40 billion in new loans in 2019.

Thanks to our team members, Mr. Cooper produced the strongest operating results in our history last quarter, said CEO Jay Bray in a statement. While we continue to grow and expand …, we remain committed to developing our team and providing them with the resources they need to succeed.

Mr. Coopers median pay was $54,242 in 2019, according to a regulatory filing earlier this year.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Buy A House In Morganton With Help From Mr Cooper

The mortgage professionals at Mr. Cooper are ready to walk alongside you as you buy a home in Morganton. However, we know that looks different for everyone. Some people are only interested in knowing today’s mortgage rates in Morganton. Others want to get preapproved for a mortgage in Morganton. And still others can’t wait to pack their moving boxes and close on a home as soon as possible! Whatever your unique needs and goals are, Mr. Cooper’s home buyer program in Morganton is here to make them a reality. Talk to a mortgage professional today.

- This is not a commitment to lend. All loans are subject to credit and property approval. This offer is nontransferable and may not be combined with any other mortgage offer. Advertised offer is subject to change. If a personal code is present on the advertised offer, you must provide such code to claim the offer. We may gather information about you including, but not limited to, credit bureau information, information for verification of income, information for appraisal and verification of property being used for collateral. We also verify your identity. Income, assets, and debt must meet eligibility requirements as established by Government and/or Lender guidelines.

All Your Mortgage Loan Bases: Covered

The Mr. Cooper mortgage holders who relied on the mobile app for managing their mortgage can expect an even better experience with the app update. Like before, users can make payments with a simple swipe, track their FICO score, and keep track of important mortgage documents. The ease of payment and close monitoring of FICO scores is a big plus. But having an easy place to access and store mortgage documents is a game-changer.

After all, buying and selling a home as well as paying off a mortgage often comes with tax implications. Having these documents easily accessible in a mobile app makes it quick and seamless when its time to share these sensitive documents with the IRS. Plus, the IRS can ask borrowers for documents proving tax deductions or credits as many as 3 years after the tax return is filed. Having these documents safely stored in a mobile app can save tons of time in those situations.

Still, taxes arent the only reason its great to have easy access to mortgage documentation. Home inspection reports, home warranty documentation, and seller disclosures can all come in handy when youre planning maintenance or renovations. In fact, these documents can end up saving homeowners lots of money, especially if somethings covered by the home warranty.

Don’t Miss: 70000 Mortgage Over 30 Years

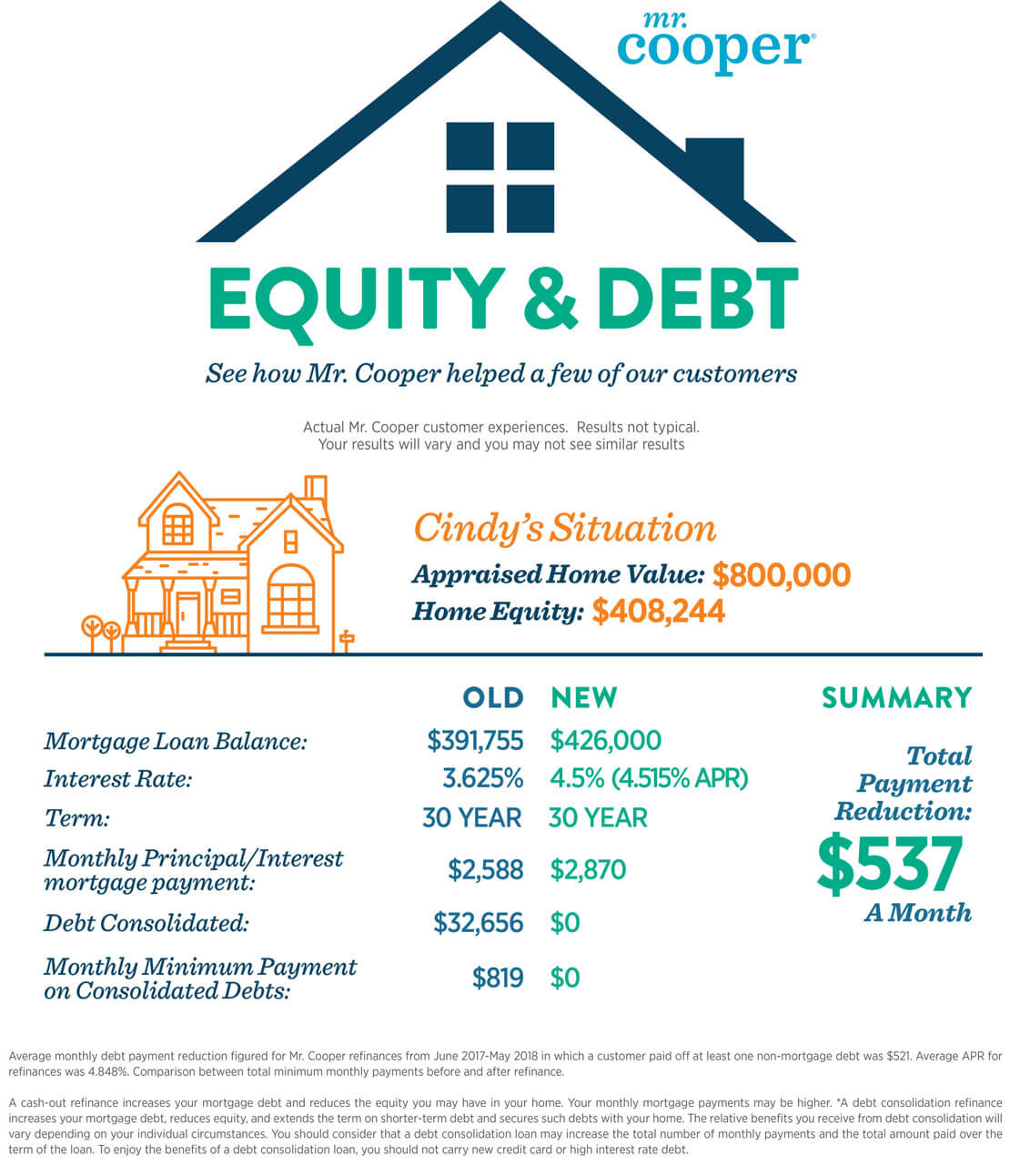

Refinancing With Mr Cooper

Refinancing a home loan may help you save money, borrow against your home equity, or adjust your loan term. Mr. Cooper offers the following types of refinance loans:

- Cash-out refinances: If you have enough home equity, you may be able to take out a new mortgage for more than you owe. Youll pay down the old loan and keep the rest of the money, which you can use for any expense. There are trade-offs, though, as your mortgage payments and payoff timeline will both increase.

- Rate-and-term refinances: A rate-and-term refi allows you to swap out your interest rate, new loan term, or both. Homeowners usually apply for rate-and-term refinances to save money or switch from an ARM to a fixed-rate loan.

- Streamline refinances: If you have an existing government-sponsored loan, you might be able to save money through the VA interest rate reduction refinance loan or the FHA streamline loan. These programs cut out some of the paperwork involved with a refinance and make it easier to save money.

How To Apply For A Mortgage With Mr Cooper

Start your application process with Mr. Cooper online or over the phone.

Read Also: Can You Get A Reverse Mortgage On A Mobile Home

Our Take On Mr Cooper Mortgage

Mr. Coopers footprint is where it truly stands out. The lender offers its mortgage products in many US territories that other lenders of its size cant or wont reach. Other than that, Mr. Coopers offerings are fairly standard, with no specialty mortgage products.

More importantly, Mr. Cooper has two government actions and a current Consumer Financial Protection Bureau investigation underway, which makes it hard to recommend the lender.

CFPB investigating unauthorized withdrawals

The Consumer Financial Protection Bureau issued a warning statement about Mr. Cooper on April 27, 2021. Recent complaints state that Mr. Cooper has been debiting borrowers bank accounts multiple times, resulting in duplicate payments, overdraft fees and other losses.

While its still investigating these withdrawals, the CFPB states that it will attempt to resolve the situation quickly. If Mr. Cooper services your mortgage, monitor your bank accounts and report any duplicate payments to Mr. Cooper. Or you can directly submit complaints to the CFPBs website.

What To Know About Fha Loans In Blackfoot Id

If youâre looking for a loan with flexible credit requirements and a potentially lower down payment, a Federal Housing Administration loan may be a good option for you. This government-insured loan type is behind nearly 1 in 5 of all homebuyers. The loan program is primarily designed to help homebuyers who cannot afford the traditional 20% down payment that is often required by private lenders. With a down payment that can be as low as 3.5%, an FHA loan can end up being a perfect match for buyers who aren’t eligible for conventional loans.

Around Blackfoot, Mr. Cooper has seen FHA loans surge in popularity at the same time as student loan debt and rental prices â two things that can make it hard to save money for a large down payment. Another benefit to FHA loans is that they’re often accessible to borrowers with lower credit scores. Whatever your situation, Mr. Cooper can walk you through the ins and outs of FHA loans and figure out the best financing option for your needs.

Recommended Reading: Rocket Mortgage Payment Options

Who Is Mr Cooper

- A new brand/image from the mortgage lender formerly known as Nationstar Mortgage

- It replaced their existing name and is intended to be warmer and more approachable

- The aim is trust, something not always present in the mortgage business

The new branding effort by Nationstar Mortgage, now Mr. Cooper, is supposed to encapsulate their renewed way of doing business.

They aim to be the friendliest and most trusted folks in the mortgage business, so well assume the Mr. Cooper moniker is a play on that old-timey nice customer service guy.

Im picturing the milkman of old, or perhaps the friendly neighborhood mailman.

Theres a good chance one of those people in your life was actually named Mr. Cooper.

And who could forget the 1990s TV show Hangin with Mr. Cooper, which featured a very likeable, friendly ex-NBA star turned P.E. teacher?

Simply put, Nationstar is trying to make mortgages cool again because they were cool once, right?

It sounds a little like something out of credit card issuer Discovers playbook, with their quirky customer service ads and customer-first approach.

Mr Cooper Home Loans In Blackfoot Id

Mr. Cooper here to ally with you in Blackfoot, ID as you plan your next home purchase. As one of the nation’s largest home loan servicers and a top-20 home lender in the country, we have the background to help you evaluate your loan options and chart a path for home buying success.

A Mr. Cooper mortgage professional can create a personalized strategy that will help you get smarter about your home loan options. We can help you determine everything from how much house you can afford to what today’s mortgage rates are in Blackfoot. Our mortgage professionals will evaluate your unique financial and living situation and will come up with a recommended plan for the best mortgage options that fit your needs. Keep reading to learn more about different home mortgages and in Blackfoot to start your journey. You can begin the pre-qualification process today. Get Started

You May Like: How Much Is Mortgage On 1 Million

Should You Pursue A Va Loan In Blackfoot

This nation’s service men and women, veterans, and their spouses deserve nothing but the best. If you think you might be eligible for a VA loan, Mr. Cooper can lend our expertise in helping you get qualified for a VA home loan in Blackfoot. Connect with Mr. Cooper if you’re looking to buy a home in Blackfoot and want to learn more about VA loans. This type of financing has many benefits and can make the home buying process simpler. Many times, interest rates are substantially lower than the rest of the mortgage market. You may not be required to put down a down payment, either. With a Mr. Cooper professional guiding you through the application process, checking your VA eligibility for a VA loan in Blackfoot is quick and easy.

Not Sure If Mr Cooper Is Right For You Consider These Alternatives

- LoanDepot mortgage review: This lender offers both an online option and more than 200 branches nationwide.

- Freedom Mortgage review: If youre looking for a HELOC, Freedom Mortgage might fit the bill.

- Rocket Mortgage review: This giant in the industry offers a convenient process and a trove of educational resources online.

- United Wholesale Mortgage review: This wholesale lender can be an option if youre working with a mortgage broker.

- Costco Mortgage Program review: The popular retailers offering lets you compare bids from multiple lenders.

Also Check: How Does Rocket Mortgage Work

How Do Nationstars Products Compare To Other Banks

Nationstar vs.Chase As we mentioned above, Nationstar is a nonbank. They dont have branch locations, so if customer service is an important feature for your lender, working with a regional bank with numerous physical locations might be in your best interest. Nationstar does not currently operate in Hawaii either, so depending on your location, Nationstar might not be the best fit. The user experience on Nationstars website is very good. Chase offers many financial products making their website convoluted. Nationstars primary business in refinance and first mortgages which means their mobile and desktop content is more tailored to your needs as a borrower.

Nationstar vs. USAA USAA has very specific qualifying terms. If you are eligible to qualify for USAA there still are a few questions youll need to ask yourself to determine if they are the best fit. USAAs technology is a work in progress, whereas Nationstar offers a mobile app, free online payment, and useful website. Home equity loans and lines of credit are currently unavailable at USAA too, but they are offered at Nationstar. USAA, however, offers a no-fee VA Interest Rate Reduction Refinance Loan which is tough for Nationstar to compete with.

Would You Qualify For A Mortgage From Mr Cooper

Mr. Coopers website doesnt specify what credit scores are required to qualify you for a loan with the company. In general, a 600 credit score is around the minimum for an FHA loan. A 600 falls in the fair category of .

| 800-850 | Exceptional |

If you want a conventional loan, the higher your credit score the higher your chances of approval. Usually conventional loans are offered to those with good or better credit scores. However, your credit score isnt the only number that Mr. Cooper will consider. Your income, debt levels and down payment savings also affect your ability to qualify for a Mr. Cooper loan.

A normal down payment is generally 20% of the cost of the home. You can put less money down if youre willing to pay private mortgage insurance, but that will increase your monthly costs. Youll also have to pay mortgage insurance for FHA loans, as they only require a 3.5% down payment. This is through government premiums called mortgage insurance premiums, or MIPs.

As for your income, your chances for qualifying dont go up with a higher income. What really matters to lenders is your debt-to-income ratio. Debt-to-income is considered a better indicator of your worthiness as a borrower. Your debt-to-income ratio is calculated by dividing your monthly debt by your monthly gross income. Its not set in stone, but many lenders prefer DTI at 30% or below for a conventional loan, and no more than 43% for other loan offerings.

Read Also: Can You Refinance A Mortgage Without A Job