Can I Get A Car Loan With A Fair Credit Score

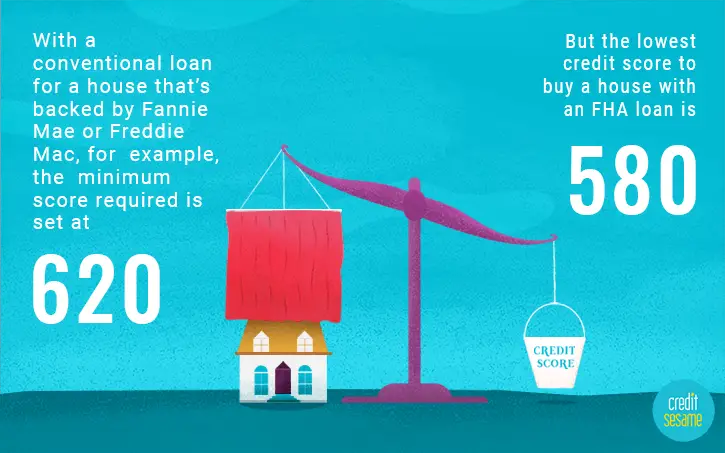

In fact a lot. For many mortgages, the minimum loan requirement is 620. And if you have enough credit, you qualify for a car loan, so you don’t have to limit your car purchase to one type of vehicle..

Auto loan credit scoreWhat’s a good credit score for an auto loan?Pity: 300579 Scholarship: 580669Good or first: 670739Very good: 740,700Exceptional: 800850Is 680 a good credit score for a car loan?With a credit score of 650680, you can get a car loan at the best interest rate, meaning your credit score will exceed the minimum premiums. With a credit rating of 680 preferably you get easy financing at a g

Is 520 A Good Credit Score

If youre checking your credit score on Experian or TransUnion, a credit score of 520 is categorised as Very Poor. This means most mortgage lenders wont offer you a mortgage. so we recommend working with a specialist mortgage broker to help. Get in touch and we can help with that.

If youre checking on Equifax, 520 is categorised as being Excellent. That means you shouldnt struggle to get a mortgage offer.

Using Home Equity Lines Of Credit To Invest

Some people borrow money from a home equity line of credit to put into investments. Before investing this way, determine if you can tolerate the amount of risk.

The risks could include a rise in interest rates on your home equity line of credit and a decline in your investments. This could put pressure on your ability to repay the money you borrowed.

Also Check: Can You Get A Reverse Mortgage On A Mobile Home

How Your Mortgage Rate Is Set

Interest rates are set partly based on your riskiness as a borrower. The riskier you are to a lender, the higher your interest rates will be. Mortgage lenders use credit scores to determine whether you qualify for the mortgage and to determine risk and the likelihood that you will default on your mortgage loan. The higher your credit score, the lower the risk that youll default on your loan, and the lower the interest rate youll qualify for.

A high credit score demonstrates responsibility with your previous credit obligations. Youve made your payments on time, youve kept your balances low, and youve avoided major credit blunders like debt collections and charge-offs.

A low credit score, on the other hand, is the result of falling behind on credit card payments, keeping high balances, and perhaps having major delinquencies on your credit record.

This chart illustrates the relationship between credit scores and interest rates, and how one impacts the other:

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, there is a minimum credit score youll likely need to buy a house.

Recommended Reading: What Does Rocket Mortgage Do

You Should Have A Decent Income

The new mortgage stress test implemented by the Ministry of Finance at the end of 2016 looks exclusively at income to determine your ability to pay back a mortgage. This test looks at your income and assesses whether or not you could make monthly payments based on their posted rate, which is typically much higher than the interest rate you’d be approved for by your lender. This prevents you from running into trouble if there was ever a significant interest rate hike on your mortgage. There are two ways to get around this. You can increase your income, or save up to make a 20% deposit which allows you to bypass the test. Unfortunately, with housing prices as high as they are in Canada, saving 20% of the purchase price is very difficult.

What You Should Know

- The minimum credit score required for a mortgage is 600 for banks, 550 for B lenders, no minimum for private lenders, and600 for CMHC insured mortgages

- If you have bad credit, B lenders and private lenders are generally your only options, but they can require you to have a large down payment or home equity

- Typically, the lower your credit score, the higher your mortgage interest rate

- Youll want to aim to have a credit score above 680 to gain access to lower mortgage rates

- If you’re a senior with a low credit score, a reverse mortgage can be an option that allows you to receive a steady stream of income

Don’t Miss: Can You Get A Reverse Mortgage On A Manufactured Home

How To Get Approved For A Mortgage After Bankruptcy

Tips for Approving a Mortgage After Bankruptcy 1 Open a secured credit card account. A secured credit card is easy to obtain and a great way to grow your money again. 2 Pay your bills on time. 3 Apply for a loan carefully. 4 Do not close accounts. 5 Keep your credit reports. Beware of credit repair scams.

Tips Before You Get A Home Equity Line Of Credit

- Determine whether you need extra credit to achieve your goals or could you build and use savings instead

- If you decide you need credit, consider things like flexibility, fees, interest rates and terms and conditions

- Make a clear plan of how you’ll use the money you borrow

- Create a realistic budget for your projects

- Determine the credit limit you need

- Shop around and negotiate with different lenders

- Create a repayment schedule and stick to it

- What do they require for you to qualify

- Whats the best interest rate they can offer you

- How much notice will you be given before an interest rate increase

- What fees apply

Also Check: Can You Refinance A Mortgage Without A Job

Mortgages Without A Credit History

Mortgage lenders accept borrowers without any credit history in certain circumstances. Some major banks, such as TD and CIBC, offer specialmortgage programs for new immigrantsthat have a limited or no Canadian credit history, or for foreign workers on a work permit. Private mortgage lenders may also accept borrowers without any credit history.

What Should You Not Do When Closing On A House

While waiting for the closing of a house, you need to preserve your financial situation as stable as possible to the best of your ability. Any big debt added to your finances will mean the lenders are going to underwrite your mortgage application all over again. This also means that you might not be able to close on schedule.

You should not incur new debt. Credit card transactions are acceptable as long as you pay them in full every month by the due date. Late payments can trigger an underwriting process.

You should keep your sources of income steady. Do not change your job, or change your employment industry. This puts your income at risk and the entire qualification process that you have gone through.

You should pay your existing debt payments on time. Late payments can trigger a reassessment of your mortgage application since it could signal a detrimental change in your borrowing habits.

Best of all, always keep in touch with your mortgage broker if you are considering any big transactions while waiting for the closing on your house. As a professional, your mortgage broker has the experience and knowledge to guide you through the process safely until the closing date.

& #128274 SAFE | SECURE | PRIVACY PROTECTEDLic. #11108 Matrix Mortgage Global

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

What Are Credit Reference Agencies Do Lenders Look At

UK mortgage lenders tend to use three credit reference agencies Experian, Equifax and TransUnion, although there are many others that are referred to by lenders across the UK.

If youve ever checked your credit score before, you may already know that each of these agencies and the many others that provide information about your credit history, use different scoring systems.

This can be frustrating because one lender may refer to Experian and use their scoring system whereas another may use data from Transunion.

What Credit Score Is Needed To Buy A House In Arizona

In general, you must have a credit rating of 620 or higher to qualify for a home loan. This is the minimum credit rating that most lenders have for a traditional loan. How Do I Qualify for an Arizona FHA Loan? How to Get Involved: Buy a home anywhere in Maricopa County, including the city of Phoenix.

Conventional loan requirementsHow much down payment is required for a conventional loan? Traditional loans traditionally require a down payment of 5-20% of the purchase price. The down payment reduces the risk to the lender, as borrowers are often less exposed to the risk of default when their own money is at stake.What is the minimum credit score for a conventional loan?Conventional loans are best suited to bor

Read Also: Reverse Mortgage On Condo

Register To Vote Or Your Chances Might Be Scuppered

This is a potential dealbreaker. While you can have a perfect credit score without being on the electoral roll, it’s very difficult to get a mortgage without it. Lenders use electoral roll data in identity checks .

Your credit file will say if you’re on the electoral roll or not, but you can also check with your local council. Do this as early as possible. While you can usually be added within a month, in late summer and early autumn it could take longer.

If you’re not on it, you can register on the electoral roll for free. If you’re not a UK, Irish or EU national and thus can’t get on the electoral roll to vote, then you can put a notice of correction on your file, saying you have other proofs of address and ID you can offer lenders .

Jermaine Hinds Mortgage Broker Offers Personalized Solutions For Home Buyers And Homeowners

Jermaine Hinds, Mortgage Broker believes in delivering results to clients with their best rate and solutions possible. He has built his reputation around helping people and getting them mortgage financing that fits their situations for the long term. The collective knowledge and experience from Jermaine and his team will help you achieve generational wealth through real estate.

Don’t Miss: How Much Is Mortgage On 1 Million

What Are The Requirements For A 5% Down Payment In Alberta

In addition to creditworthiness, there is an additional requirement for a loan for the purchase of a home in Alberta with a 5% down payment. To purchase a property with a 5% down payment, the applicant’s credit report must show that there are at least 2 different loan types* active for a minimum of 24 months.

Is 560 A Good Credit Score

Learn more about your credit score. Every growth process has to start somewhere, and the FICO 560 score is a great place to start if you want to improve your credit score. Updating your score in the stock market area gives you access to more loan options, lower interest rates, and lower fees and conditions.

Don’t Miss: Recasting Mortgage Chase

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 91 votes.

Which Credit Report Do Mortgage Lenders Use

Before underwriting a loan, mortgage lenders check each prospective borrowers credit score. However, the score mortgage lenders use could be quite a bit different than the score you expect to see on your application. In her article This is the credit score lenders use when you apply for a mortgage for CNBC, Megan DeMatteo elaborates. She notes which credit score lenders use and explains how they calculate that score.

DeMatteo notes that most lenders use your FICO Score or VantageScore credit report when deciding whether to offer you a loan. This score is calculated by the Fair Isaac Corporation. According to DeMatteo, the score mortgage lenders use could be different from the one you see when monitoring your credit. This is because banks use a slightly different credit scoring model when evaluating mortgage applicants.

FICO Models Used for Mortgage Lending

Lenders usually use the FICO® 8 model for credit checks for car loans and credit cards. Instead, mortgage lenders use the FICO® Score 2, FICO® Score 5 and FICO® Score 4 models. These are from the three credit bureaus: Experian, Equifax and TransUnion respectively. While borrowers applying for mortgages are still evaluated on the same core factorsthe categories are weighed a little bit differently. Instead of focusing on high balances on revolving credit lines like the FICO® 8 model, other models put less emphasis on credit utilization ratio.

Recommended Reading: How Does Rocket Mortgage Work

Is There A Minimum Credit Score For A Mortgage

One of the most common mortgage myths we hear is that there is a minimum credit score needed to get a mortgage. Put simply – that isnt true.

Your credit score can certainly impact your choice of lenders as banks use it to get a better understanding of your financial history and the likelihood of your defaulting on your loan.

Usually a higher score suggests that you’re more likely to be a responsible borrower and make your payments on time and in full.

However, every lender has different rules which affect what they define as a low credit score or bad credit and other factors such as your income and age can affect a lenders decision too.

Whats Considered Good Credit For A Mortgage

Although its possible to buy ahouse with only fair credit, youll get a lower mortgage rate and better loanterms with a higher score.

So whats considered good creditfor a mortgage? FICOs credit tiers are a good starting point, as FICO is thestandard scoring model used by mortgage lenders.

- Exceptional credit:800-850

- Fair credit: 580-669

- Poor credit: 300-579

Fortunately, you dont need anexceptional score in the 800-850 range to get a prime mortgage rate. Mosthome buyers dont have credit anywhere near that high.

In fact, the average credit score for closed mortgage loans in 2020 was just under 750.

Fannie Mae and Freddie Mac give the best rates to borrowers with scores above 740

Mortgage lenders understand thatperfect credit is not the norm, and they arent expecting sky-high scores.

Fannie Mae and Freddie Mac, the agencies that back most home loans, give the best rates to borrowers with scores above 740 which means the average buyer in 2020 qualified for prime rates.

You May Like: 10 Year Treasury Vs Mortgage Rates

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles