Overages And Shortages And The Annual Escrow Analysis

Caliber will estimate the amount that will have to be paid for your real estate tax and homeowners’ insurance bills. This estimate, provided during closing, is based on either the taxing authority and insurance company or previous tax and insurance bills. Each year, well analyze your account to make sure youre paying the right amount to maintain the minimum required balance. Because its based on an estimate, the amount can be overestimated or underestimated. This is called an escrow overage or shortage.

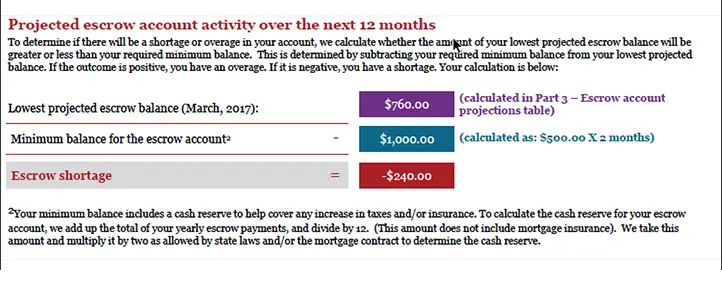

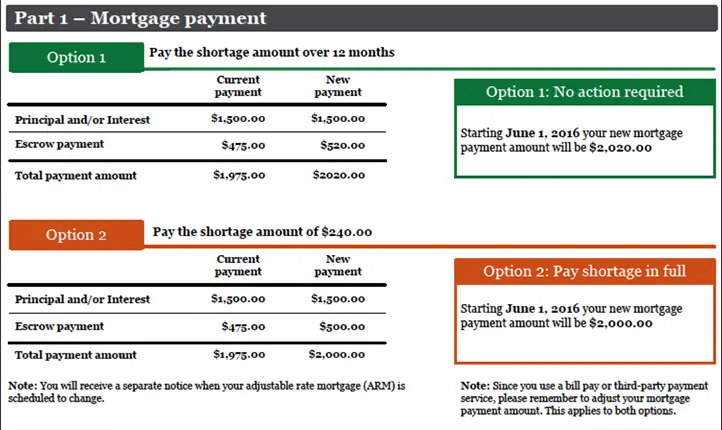

If theres an overage, youll get your money back. If theres a shortage, you usually have a couple of options for paying the remainder. You could pay the full shortage upfront or pay the shortage over a period of 12 months, along with your regular payments. However, some types of loans may not allow for this second option.

What Are Escrow Fees

It’s common for the escrow agent involved in the sale of a home to take a fee of 1 percent of the purchase price, though this percentage can vary widely depending on location.

In addition, some mortgage lenders might allow you to waive the escrow requirement and pay your insurance and tax bills directly – for a fee.

What Is An Overage In Accounting

Accountingoverageoverage

. Considering this, what is overage and shortage?

is that shortage is a lack or deficiency an insufficient amount while overage is a surplus of inventory or capacity or of cash that is greater than the amount in the record of an account.

Similarly, how do you record cash overage? To record the cash register overage the business needs to enter the cash over of 14 as part of the journal entry used to record the sales as follows. The cash overage/shortage account is an expense account in the income statement of the business.

Likewise, what type of account is cash overage?

The term cash over and short refers to an expense account that is used to report overages and shortages to an imprest account such as petty cash. The cash over and short account is used to record the difference between the expected cash balance and the actual cash balance in the imprest account.

Is cash shortage a debit or credit?

If a surplus or shortage is discovered, the difference will be recorded in Cash Short a debit balance indicates a shortage , while a represents an overage .

Recommended Reading: What’s The Average Mortgage Payment

What Is An Escrow Cushion

An escrow cushion is an extra amount that your mortgage lender collects as a reserve to minimize the impact of increasing costs of insurance premiums and property taxes. This cushion amount may vary by state.

Furthermore, your state may also prohibit the collection of an escrow cushion. Speak to your lender if you have any questions about an escrow cushion.

What Happens If I Have An Escrow Overage

An escrow overage is when youve paid too much into escrow. This can happen because your mortgage company overestimated how much money they would need to cover taxes and insurance payments. When this happens the mortgage company will send you an overage check.

If you do end up getting a check from the lender because of an escrow overage, its a good practice to deposit the money directly into your savings so it will be there if you end up in an escrow shortage situation.

Read Also: How Much Does A Mortgage Payment Increase For Every 100000

How Do I Reduce My Escrow Payment

Escrow accounts are based entirely on things like property taxes and insurance premiums, so you have limited options to lower your escrow payment, but there are some things you can do.

As mentioned above, you can shop around for homeowners insurance coverage. You may be able to find a deal for similar levels of coverage with a different provider. Some providers will also give discounts if you bundle policies together, so that could be worth looking into.

Theres not much you can do to change your taxes, but at the same time, its worth a periodic review to check that you are only paying what you owe. Make sure youre applying for every property tax exemption you might qualify for. Most areas have something called a homestead property tax exemption where you get a discount if the property serves as your primary home. Additionally, there are often tax exemptions available for the disabled or veterans of the U.S. military. If youre unsure of what might be available in your area, its worth talking to your local tax authority. You can also speak with a financial advisor and/or tax preparation professional.

This should help you feel much more able to handle an escrow shortage. If youre ready to take that newfound confidence and buy or refinance a home, you can do so online through Rocket Mortgage® or give us a call at 980-6716.

Apply for a Mortgage with Quicken Loans®

What Happens If My Escrow Account Is Short

If you have a shortage in your escrow account, youll have to pay it back. When your escrow analysis is completed and your servicer sends you the report, youll have a couple of options:

- Pay off the shortage in full: You can make a one-time payment to your mortgage company that would cover paying back any existing deficiency and/or getting you back up to the required minimum balance based on your new monthly escrow payment. This lump sum payment is applied directly to your escrow account.

- Pay off the shortage over the next 12 months: If you dont want to or cant pay your shortage in a lump sum, you have the option of spreading the payments out over the next year in order to pay it back over time.

You should also know that even if you pay off your shortage in full, your monthly escrow payment will often increase. The reason for this is that your shortage is usually caused by an increase in the amount due for taxes and/or hazard insurance. The amount due for escrow will change to reflect the new amounts due.

Don’t Miss: What Is The Average Interest Rate On Home Mortgages

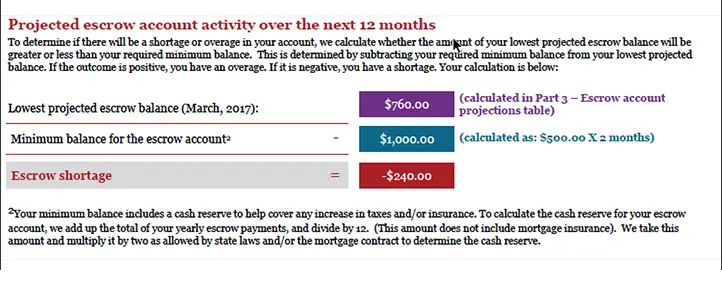

What’s A Minimum Balance

Sometimes taxes and insurance are higher than expected. To be prepared, you’re required to keep a minimum balance in your account at all times. This helps make sure any unexpected increases are covered. Your minimum balance varies by state but is calculated to not be more than 2 months of escrow payments. Learn more about how escrow accounts work.

What In The World Is An Escrow Shortage

If youre like a majority of homeowners today, you have a mortgage with an escrow account. And like most of those homeowners, you understand the basics of escrow, but when it comes to shortages and overages, it can be difficult to keep it all straight.

As a quick refresher, an escrow account is an account that holds the funds you need to pay your property taxes and homeowners insurance. Its not an account that you manage directly. Its simply a holding account that contains the funds you pay every month to ensure your taxes and insurance bills are paid.

Recommended Reading: What Would The Payment Be On A 100 000 Mortgage

What You Need To Know About Escrow Accounts

Youve probably heard of escrow accounts and have a vague idea of what they are. Its a fairly simple concept. An escrow account acts as a savings account that Caliber, as your mortgage servicer, manages for you. A portion of each mortgage payment will go into your escrow account to cover your estimated real estate taxes and insurance premiums so that when those payments come due, you already have the cash on hand to pay them.

How Can I Lower My Escrow Payments

There are few ways to lower your escrow payments:

- Dispute your property taxes. Call your local assessor if you think your property tax bill is too high, and ask about the process to dispute your bill.

- Shop around for homeowners insurance. Online home insurance comparison sites are a good place to start if you think your homeowners premium is too high.

- Request a cancellation of your private mortgage insurance. If home values are rising in your area, ask your loan servicer about their process for removing private mortgage insurance . For the cost of an appraisal, you may get rid of this part of your monthly escrow payment.

You May Like: Who Has The Best Mortgage Loan Rates

What Is A Mortgage Escrow Account

A mortgage escrow account is an account used to pay a homeowners property taxes and homeowners insurance premiums, and at other times to hold an earnest money deposit when the homeowner first purchases their home.

Instead of scheduling payments and paying insurance and tax bills separately with a checking account, the money for these payments is collected by the mortgage lender or servicer through installments as part of the homeowners mortgage payment. The lender or servicer holds these funds in an escrow account and pays these bills as they are due on the homeowners behalf.

The key difference between an escrow account and any other financial account you may have is that you dont manage this one yourself. Thats because escrow is facilitated by a neutral third party in this case, your mortgage lender or servicer.

An escrow account is likely not optional if youve put a down payment of less than 20 percent on your home. FHA loans and USDA loans require escrow accounts, but VA loans do not.

Here Are A Few Tips On How To Prepare For An Escrow Shortage

Recommended Reading: How To Get A Job In Mortgage Lending

Can You Pay Your Escrow Shortage With A Credit Card

Policies will vary depending on who your mortgage servicer is, but many of them, including Rocket Mortgage®, wont allow you to make mortgage or escrow payments with a credit card.

The primary reason for this is that mortgage and escrow payments deal with large amounts of money. A credit card finance charge of 2% 3% on a mortgage payment adds up to a lot more than it does if you charge a cup of coffee in the morning.

Would You Like To Join Ask Sawal

Ask Sawal is a fast growing question and answer discussion forum.

15 lakh+ questions were answered by our Ask Sawal Members.

Each day 1000s of questions asked& 1000s of questions answered.

Ask any question and get answer from 2.5 Lakh+ Ask Sawal Members.

Constant moderation and reporting option makes questions and answers spam free.

And also, we have free blogging platform. Write an article on any topic.

We have 10000+ visitors each day. So a beneficial platform for link building.

We are allowing link sharing. Create backlinks to your blog site or any site.

Gain extra passive income by sharing your affiliate links in articles and answers.

Don’t Miss: Can You Add Someone To Your Mortgage Loan Without Refinancing

How Escrow Works When Buying A Home

When you make an offer on a house, youll typically include a personal check of 1% 2% of the purchase price. This is called earnest money, and shows the seller of the home that youre a serious buyer. The check wont be deposited until the seller accepts your offer.

If your offer is rejected, youll get your money back. If the offer is accepted, the money will go into an escrow account to be held until its time to close. Then, the money will be used toward your down payment and closing costs.

In this scenario, the escrow account acts as a neutral place where the money sits until all paperwork is finished and the home is officially yours.

Why Am I Required To Have An Escrow Account

Most of the time, escrow accounts are required if your down payment was less than 20%. There are benefits to having an escrow account, even if it isnt required. It helps you manage large expenses like property taxes and insurance premiums so you dont have to save for them separately. You make 1 combined mortgage and escrow payment each month and we deposit a portion into your escrow account. When your property tax and insurance bills are due, we pay them on your behalf.

Don’t Miss: Do Multiple Mortgage Applications Hurt Credit

What Is The Difference Between An Escrow Shortage And An Escrow Deficiency

With an escrow shortage, you still have money left in your escrow account, but not enough to pay your tax and insurance bills.

If you have an escrow deficiency, that means that your escrow account has a negative balance. This can happen if your tax or insurance bills came due and you didnt have enough money in your account to cover them, so your lender had to pay the remaining balance for you using their own funds.

Why Do I Have An Increase In My Monthly Payment

If your taxes or insurance went up in the previous year, the escrow portion of your payment is likely to go up as well when youre paying your mortgage. Please remember that your monthly escrow deposit is calculated on 1/12th of your current tax and insurance payments to determine your new monthly payment, regardless of your escrow account balance. The escrow cushion is also part of this payment.

Theres more to learn. Continue reading about mortgages.

You May Like: How To Shorten A 15 Year Mortgage

Whats Included In An Escrow Account

An escrow account is meant to help you break down the cost of various items associated with homeownership into manageable monthly payments. There are several items that are typically included in an escrow account. You may be more familiar with some items that are in an escrow account than others:

For most people, the items included in an escrow account are property taxes, hazard insurance and other policies, along with any applicable mortgage insurance.

As An Adjective Overage Is

, title= Yesterdays fuel

, passage=The dawn of the oil age was fairly recent. Although the stuff was used to waterproof boats in the Middle East 6,000 years ago, extracting it in earnest began only in 1859 after an oil strike in Pennsylvania.

Antonyms

* glut* mountain

Related terms

Antonyms

Read Also: How Much Are Monthly Payments On A 200 000 Mortgage

Youre Covered When There Are Shortfalls

Your homeowners insurance premiums and property tax assessments can fluctuate over time. If your escrow account happens to be short due to your property tax bill increasing, for example, your servicer will typically cover the difference temporarily, and eventually increase your monthly mortgage payment to make it up.

What Is Overage Shortage In A Mortgage

Explain Below What Do You Want to report!

From: Thrissur/India

Increases or decreases in your annual tax or insurance bills may cause your monthly mortgage amount to change. If bills paid from your escrow account before the escrow analysis were higher than expected, your account may have a shortage. If they were lower than expected, your account may have an overage.

Explain Below What Do You Want to report!

Explain Below What Do You Want to comment!

From: Oakland/United States

A shortage occurs when escrow analysis shows that your account balance is lower than it needs to be to satisfy your upcoming property tax and homeowner’s

Explain Below What Do You Want to report!

Explain Below What Do You Want to comment!

From: Minneapolis/United States

Like most homeowners, you understand the basics of escrow, but when it comes to shortages and overages, it can be difficult to keep it all

Explain Below What Do You Want to report!

Explain Below What Do You Want to comment!

From: Albuquerque/United States

If your lender has underestimated your escrow payments, they may request you send an additional payment to make up the difference. In the event you are paying too much into your escrow account, your lender may release the overage amount directly to you.

Explain Below What Do You Want to report!

Explain Below What Do You Want to comment!

From: Omaha/United States

Explain Below What Do You Want to report!

Explain Below What Do You Want to comment!

From: Atlanta/United States

Recommended Reading: What Factors Go Into Mortgage Approval

Overage Clauses 10 Things To Think About For Buyers

Properties are sometimes sold subject to overage clauses also known as uplift or claw back provisions. The idea is that, if planning permission is subsequently obtained, the seller will be entitled to a share in the uplift in value. This sounds simple but provisions of this nature give rise to a wide range of legal problems and are often a dispute in the making.

As always, the devil is in the detail. Points to watch out for as a buyer are:-

1. How long do these provisions apply? They are commonly imposed for up to 25 years but this is a very long time. Arguably they should only apply where there is a realistic chance of obtaining planning permission within the next 5-10 years.

2. What percentage state in the uplift in value should the seller be entitled to? The seller often begins by asking for 50% of the uplift in value but this is likely to leave the buyer with little commercial incentive to develop the land. Bear in mind that the buyer will incur various costs planning costs in obtaining the permission, costs in selling the land and capital gains tax, for example. Some overage clauses allow costs to be deducted before the overage is calculated otherwise a 50% overage may leave the seller with a greater profit than the buyer.

3. What triggers the payment to the seller? From the buyers point of view, this should not be the grant of planning permission but either: