How Credit Scores Affect Mortgage Interest Rates

Your credit score can have a major impact on the overall cost of your loan. Each day, FICO publishes data that shows how your credit score could affect your interest rate and payment. Below is a snapshot of the monthly cost of a $200,000, 30-year fixed-rate mortgage in August 2021:

| 4.161% | $973 |

That’s an interest variance of over 1.5% and a $177 difference in monthly payment from the 620 to 639 credit score range to the 760+ range.

Those differences can really add up over time. According to the Consumer Financial Protection Bureau , a $200,000 home with a 4.00% interest rate costs $61,670 more overall over 30 years than a mortgage with a 2.25% interest rate.

Do You Qualify For A Mortgage

You can check your own credit score online, and talk with a lender to see whether you qualify for a mortgage based on your current score.

Popular Articles

Step by Step Guide

What’s A Good Credit Score To Have How To Get It

Advertiser Disclosure

Advertiser Disclosure: ValuePenguin is an advertising-supported comparison service which receives compensation from some of the financial providers whose offers appear on our site. This compensation from our advertising partners may impact how and where products appear on our site . To provide more complete comparisons, the site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

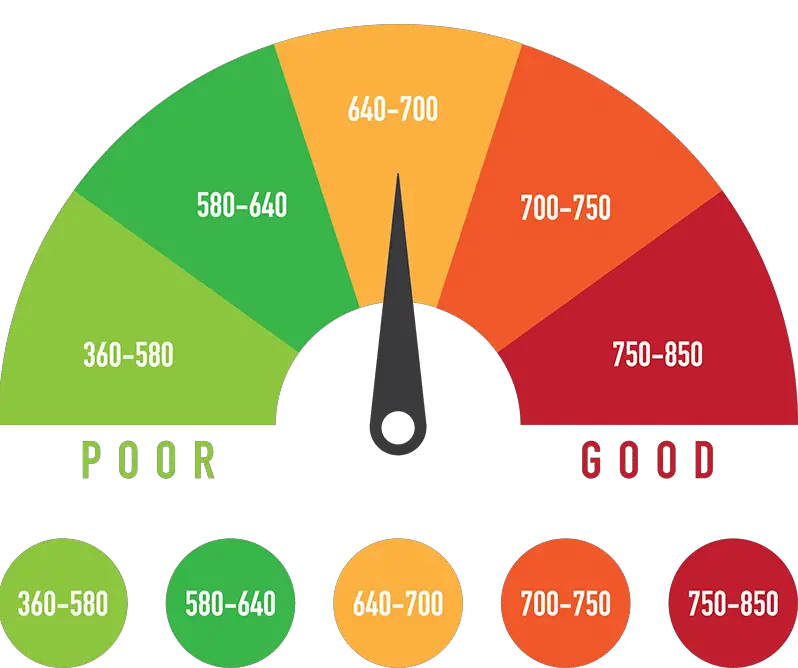

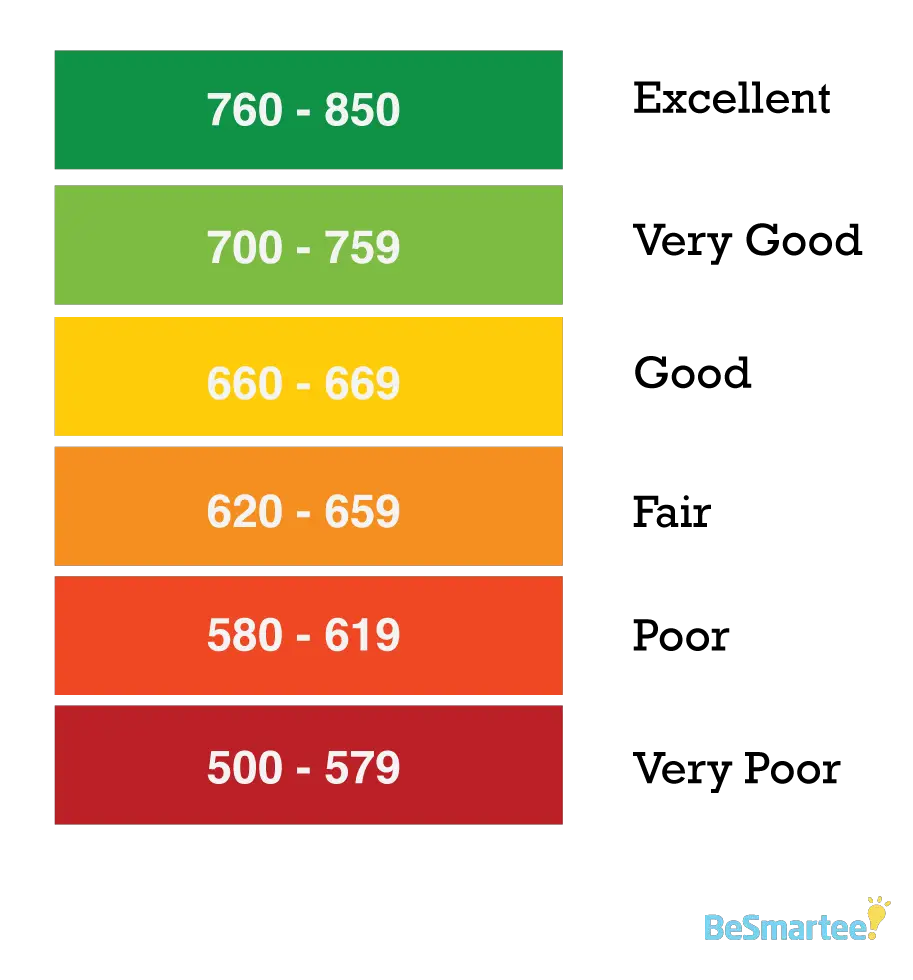

A good typically ranges between 680 and 750. Consumers who fall within this spectrum tend to qualify for excellent interest rates, and loans. However, what constitutes a good credit score is far more nuanced. In reality, the range of scores will depend on both the exact credit scoring model being used and its purpose.

Recommended Reading: How To File A Complaint Against A Mortgage Lender

What Credit Score Do Mortgage Lenders Use

As explained above, the most commonly used mortgage credit scores are the FICO credit scores that you have with the UKs main three credit reference agencies: TransUnion, Experian, and Equifax.

Mortgage lenders will normally look at your credit score from each of the CRAs when you apply for a mortgage. If a borrower has three different scores according to each scoring system, then they will use the middle credit rating to assess your application.

But, if two credit agencies agree on your credit score, the mortgage lender will just use that credit rating in their assessment.

Mortgage Rates By Credit Score

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Your credit score is one of the most important factors when applying for a mortgage. It influences your monthly mortgage payment, the total amount of interest you pay on your mortgage loan, and ultimately the total amount you pay for your home. Because your interest rate is based on your credit score, you should make sure your credit is in the best shape possible before applying for a mortgage.

Also Check: What Salary Is Required For A Mortgage

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How Your Credit Score Affects Your Mortgage Eligibility

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Don’t Miss: What Is Loss Mitigation Mortgage

Can You Get A Mortgage With Bad Credit

Maybe. You can still be approved for a mortgage to buy a property if you have a poor credit score. However, someone with a poor credit score will probably have a higher interest rate than someone whose credit score is good. Buyers with a low credit score may also need to pay a bigger deposit.

There is no minimum for the credit score that you have to have in order to be approved for a mortgage. When you apply for credit, mortgage lenders will instead make their decision based on their companys lending criteria.

The better your credit score is, the more likely you will be approved for a mortgage loan. This is because there is less risk involved with giving you credit when you have a high credit score.

Here is a short video on this subject.

You can see the original video here.

Why Do Credit Scores Matter

Ultimately, your credit score is important in many ways. To give just a few examples:

- Your credit score determines the types of loans you can get

- It determines the mortgage interest rates you pay

- It affects how large of a house or how expensive of a car you can afford

- Insurers in most states use credit scores to set premiums for auto and homeowners coverage. Policyholders with bad credit scores often pay more

- Landlords use credit scores to decide who gets to rent their apartments

- Cell phone companies might require a deposit if your credit is too low

Whether youre looking for a mortgage or any other financial product, your credit score makes a big difference. Thats why its so important to know yours before you apply.

Recommended Reading: How To Recruit Mortgage Loan Officers

What Should My Credit Score Be To Buy A House

You might be surprised at the minimum . On paper, mortgages backed by the Federal Housing Administration otherwise known as FHA loans allow a minimum credit score of 500, so long as you’re making a 10% down payment. That’s about as low as it gets.

However, with all types of mortgages, lenders can set their own minimum credit scores. So if your credit score could use some work, or if you’re close to the dividing line between two , you should get quotes from multiple lenders. While your score might not qualify for the loan type you want with one, it could be high enough for another.

Bear in mind that your credit score isn’t all lenders look at when they’re considering you for a home loan. Your debt-to-income ratio, employment history and the size of your down payment all play a role in determining how much you’ll be approved to borrow.

Where To Check Your Fico Score Before Applying For A Mortgage

Many free credit services dont use the FICO scoring model, which is the one your mortgage lender will be looking at.

To be sure the score you check is comparable to what a mortgage lender will see, you should use one of these sites:

- AnnualCreditReport.com This is the only official source for your free credit report. Youre typically entitled to one free credit report per year, but the site is offering free reports each week during the coronavirus pandemic

- MyFico.com

Whether its free, or you pay a nominal fee, the end result will be worthwhile.

You can save time and energy by knowing the scores you see should be in line with what your lender will see.

As long as you continue to make your payments on time, keep your credit utilization relatively low, and you dont go shopping for new credit you dont need, over time your score is going to be pretty high for every credit scoring model.

Also Check: What Does It Mean Refinance Mortgage

Work With A Trusted Mortgage Loan Officer

Your mortgage lender is the ideal resource for asking questions about any part of the homebuying process before you are even ready to apply.

The professional loan officers at Homefinity can get you pre-approved so you can solidify your budget and take the proper next steps. or apply now to get started.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Read Also: What Does A Cosigner Do For A Mortgage

How Credit Scores Are Calculated

There are several factors that each credit bureau uses to calculate your credit score, and understanding them can help you maintain or improve your credit. These factors are:

Of those five categories, payment history and credit utilization carry the most weight. Length of credit history, new credit, and credit mix all play a smaller role. They’re still important, but not as important as the top two.

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Don’t Miss: Should I Refinance My 30 Year Mortgage

Benefits Of An Excellent Credit Score

Excellent credit makes life easier and less expensive. Here are the biggest benefits of having an excellent credit score:

- You can qualify for the best credit cards. These cards tend to have more perks than credit cards for consumers with lower credit scores. Your credit score doesn’t guarantee an approval, but it’s one of the most important factors credit card companies look at during the application process.

- You can get lower interest rates and potentially be approved for larger amounts on loans. This includes all types of loans, including personal loans, auto loans, and mortgages.

- You have a better chance of passing a credit check with a rental company, which helps when looking for a house or apartment to lease.

- In most states, car insurance companies can use your credit when determining your premiums. Excellent credit can get you lower car insurance rates.

- Utilities companies are less likely to require a security deposit to set up service with them.

Your credit score is almost certainly going to play a major role in your life. That’s why a high credit score is a smart financial goal.

What Exactly Is A Credit Score

Simply put, a credit score is a number between 300 850 that depicts a consumers creditworthiness. The greater the score, the better the person aiming to borrow money or open a credit card seeks to the possible loan provider. A credit score is based upon credit report, which consists of:

- Number of open accounts

- Age of credit history

- Any derogatory marks

Lenders utilize credit scores to assess the probability that an individual will pay back loans on time and completely . Its worth keeping in mind that its not constantly a clever concept to close a credit account that is not being utilized due to the fact that doing so can lower your credit score by impacting your credit rating age & quantity of open credit offered to you.

The credit score model was developed by the Fair Isaac Corporation , and it is utilized by banks like banks. While other credit-scoring systems exist, the FICO score is without a doubt the most typically utilized.

Having issues with your credit? There are a number of methods to improve your score, consisting of repaying loans on time, settling credit cards every month, and keeping financial obligation low. We will get into raising your credit score even more in the article.

Also Check: Can There Be A Cosigner On A Mortgage

The Best Mortgages For Buying A House With Lowcredit

If you have a low credit score, or past red marks on your credit report, the first type of mortgage you should look at is an FHA loan.

FHA loans

FHA loans are mortgages insured bythe Federal Housing Administration. This insurance protects mortgage lenders,making it possible for them to lend to borrowers with lower credit scores andsmall down payments.

In fact, the FHA mortgage programwas specifically designed for credit-challenged home buyers. It allows thelowest credit score of any loan program 500 although you need a 10% downpayment if your score is below 580. Those with a score above 580 onlyneed to put 3.5% down.

Conventional/conforming loans

Conventional loans also allow amodest credit score of 620 with a down payment of just 3%.

However, the cost of privatemortgage insurance can make conventional loans unattractive forlower-credit borrowers with less than 20% down.

Conventional and FHA loans both require mortgage insurance. The difference is that FHA charges the same mortgage insurance premiums for all borrowers, regardless of credit.

Conventional mortgages, on the otherhand, have steeply increased PMI rates for borrowers with low credit and alow down payment. As a result, FHA financing can sometimes be cheaper forborrowers with credit in the low- to mid-600s.

VA loans

For veterans and active-duty service members, a VA mortgage is normally the best bet.

Mortgages Without A Credit History

Mortgage lenders accept borrowers without any credit history in certain circumstances. Some major banks, such as TD and CIBC, offer specialmortgage programs for new immigrantsthat have a limited or no Canadian credit history, or for foreign workers on a work permit. Private mortgage lenders may also accept borrowers without any credit history.

Recommended Reading: What Banks Look For When Applying For A Mortgage