How To Find Out If There Is A Lien On A Property: Property Lien Search By Address

Liens are a matter of public record, so its simple to find out if theres one on your property, or on anyone elses property for that matter.

In most states, you can typically search by address with the county recorder, clerk, or assessors office online. The search for liens is free, though you may have to pay a small fee for a copy of the report, which will vary by county.

Another easy place to start? Property Shark has a portal where you can simply type in a propertys address to find any liens on it.

You can also hire a title company to do the legwork for you, but there will be a charge, and for the most part its going to do the exact same thing youd do anyway. If you have your eye on a property, its a good idea to conduct your own search as well so you dont run into any surprises at the last minute.

Can I Use A Home Equity Loan For Anything

A home equity loan can be used to purchase anything lenders typically dont have rules for its usage. Home equity loans can be used to pay for things like medical expenses or your dream wedding.

Although you can use it to finance those things, its better to use it for refinancing high-interest debt or home-renovation projects. Using it for the former can help you get out of debt quicker, provided you secure a lower interest rate. Using it for the latter can increase the value of your home.

If you use it for other purposes, such as investing or funding a business, theres no guarantee that youd see a good return on investment, and you could lose money.

Additional Immediate Costs When Buying A Home

Before finally deciding how much to spend on a property, you need to be sure you will have enough money to pay for all the additional one-off costs of the purchase. These include:

- survey fees – if you or your mortgage lender require a survey in addition to the survey provided by the seller in the Home Report

- valuation fees – if you or your mortgage lender require a valuation in addition to the survey provided by the seller in the Home Report

- VAT

- removal expenses

- any final bills, for example, gas and electricity, from your present home which will have to be paid when you move.

You should be aware that even if your bid for a property is not accepted you may still have some one-off costs. For example, you may have to pay for a valuation and/or survey. If the solicitor has started any legal work you may also have to pay for that work unless you have a special deal with the solicitor. A special deal may be possible if you are continuing to instruct the same solicitor until you have secured a purchase of a property.

Don’t Miss: Why Do I Pay Escrow On My Mortgage

Can You Afford A Mortgage

Lenders must make sure you only take out a mortgage you can afford. This means that they’ll ask you for lots of information and proof on your income, outgoings and spending habits.

Lenders will check to see if you can meet the initial mortgage repayments and other property costs. They also consider how you would cope financially if interest rates were to go up in the future, or if there was a change in your income because, for example, you wanted to start a family or retire.

Things A Title Search Can Tell You About A Property

InfoTrack

12 December 2018

There are many circumstances in life when you may need to conduct a title search to get a Certificate of Title buying or selling property, proving ownership, refinancing your mortgage and the list goes on. But what exactly is a Certificate of Title and what can it tell you about a property?

Recommended Reading: Would I Be Eligible For A Mortgage

How To Find A Property

There is a number of ways in which someone could find a property to buy:

- using estate agents or solicitorsâ property departments

- visiting the local solicitorsâ property centre

- looking at property pages in local newspapers

- contacting property building companies for details of new properties being built in the area.

Search Online Public Records

Many counties and cities maintain a searchable online database of public home ownership information. San Francisco, for example, lets members of the public search property information by typing the property address into the search bar or by highlighting the subject property on the city map. If you’re using this search tool, scroll down the results page and click on the link to Recorded Documents. This will pull up a list of all the recorded transfers, mortgages and trust deeds relating to the subject property. Click on the most recent mortgage to discover the name of the note holder.

Recommended Reading: What Is The Minimum Down Payment Required For A Mortgage

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

How To Estimate Affordability

There is a rule of thumb about how much you can afford, based on the calculations your mortgage provider will make. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32% of your gross household income, and where your total debt load is no more than 40% of your gross houshold income. This rule is based on your debt service ratios.

Lenders look at two ratios when determining the mortgage amount you qualify for, which generally indicate how much you can afford. These ratios are called the Gross Debt Service ratio and Total Debt Service ratio. They take into account your income, monthly housing costs, and overall debt load.

The first affordability guideline, as set out by the Canada Mortgage and Housing Corporation , is that your monthly housing costs mortgage principal and interest, taxes, and heating expenses – should not exceed 32% of your gross household monthly income. For condominiums, P.I.T.H. also includes half of your monthly condominium fees. The sum of these housing costs as a percentage of your gross monthly income is your GDS ratio.

Also Check: What Banks Look For When Applying For A Mortgage

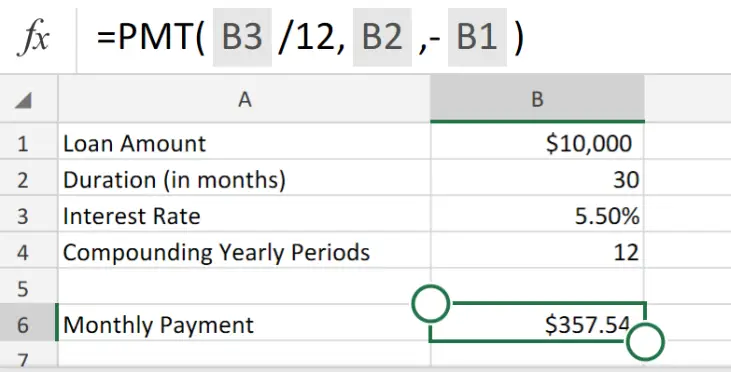

Calculate The Balance Remaining On Any Mortgage

This mortgage balance calculator will figure the remaining balance of your…show instructions

To use this calculator just enter the original mortgage principal, annual interest rate, term years, and the monthly payment. Then choose one of the three options for calculating the number of mortgage payments made to determine the remaining balance.

Note: this mortgage balance calculator is only for fixed rate mortgages where the terms are constant. Don’t use for any mortgage where the terms will vary over time .

Does My Neighbor Have A Mortgage

Does my neighbor have a mortgage? This is one of those questions that goes through most peoples minds when they see their neighbors new car, an expensive vacation, or a new roof on their home. How do you go about finding this information though?

You can find out whether or not your neighbor has a mortgage by searching your local public records. You can also ask your realtor since they have easy access to the MLS and online property search databases to find this information.

In this blog post, well explain step-by-step how to find out the answer to this question, using publicly available information. Well also discuss some of the reasons why you might want to know this information and what it could mean for you.

You May Like: Who Should You Get A Mortgage From

Is My Apartment Building Financed By Freddie Mac

Renters may use our property search tool to find out if they live in a property that has a mortgage loan purchased or securitized by Freddie Mac.

Tenants who live in a property with a mortgage loan purchased or securitized by Freddie Mac may be eligible for certain tenant protections.

These protections could include:

- Protection from eviction solely for nonpayment of rent

- Giving the tenant at least a 30-day notice to vacate

- Not charging the tenant late fees or penalties for nonpayment of rent

- Allowing the tenant flexibility to repay back rent over time and not in a lump sum

The protections that apply may include protections under the CARES Act, under state or local law, or if the property is in forbearance .

To better understand the protections and assistance that may be available, please visit .

In addition, certain Manufactured Housing Communities that received financing via Freddie Mac’s Manufactured Housing Community Loan offering may provide tenant protections above and beyond the minimum required by law. Renters can consult their leases and/or community rules and regulations to determine if these protections are currently active in their community.

A Word About Credit Scores

There may be some confusion about how liens affect your credit score and which ones actually show up on your record. Some mechanics liens and judgment liens are reportable, which means they often end up on your credit report. Thats because they factor into your repayment history, which makes up more than a third of your credit score.

To report them, the creditor must have a minimum amount of identifying information from a debtor, including their date of birth or Social Security number . A lien may still show up on your credit report even if its paid offusually for up to seven years.

However, not all liens put a dent in your . For example, a consensual lien that you have on a home or car that youre still paying off wont show up on your report.

The same applies to tax liens. The three major Equifax, Experian, and TransUnionremoved tax liens from their credit reports as of April 2018. The agencies stopped reporting them because of the number of errors, inconsistencies, and disputes they received.

To see if theres a lien against you, request a free credit report from Experian, Equifax, or TransUnion at AnnualCreditReport.com. The Fair Credit Reporting Act requires each of these credit reporting companies to provide you with a free copy of your credit report, at your request, once every 12 months.

Recommended Reading: Is Biweekly Mortgage Payments A Good Idea

The Information Youll Get

Its important to know that youll only be able to find out the original amount of the mortgage taken out on the property. Youll see any new loans if the owner refinanced as well. What you wont see is the current balance of the loan at the time of the search. The only record you would see as an update to the mortgage is if the owner paid the loan off in full.

Finding out if a property has a mortgage on it does require a little legwork, but you can get your hands on the information if you need it.

Other Considerations When Getting A Home Equity Loan

If you think youre ready to use your home equity, keep the following considerations in mind.

- Home equity rates are relatively low. Home equity loan rates and home equity line of credit rates are much lower than those for credit cards and other types of loans, and they may be easier to qualify for. This is because home equity loans are secured loans, meaning they use your home as collateral in case you fall behind on payments.

- Home values can crash. One reason to be careful with home equity loans is that home values fluctuate. If you take out a big loan and the value of your home drops, you could end up owing more than what your house is worth. This is a condition known as being upside-down or underwater. The housing crash of 2008 left millions of borrowers stuck in homes they could not sell because the value of their homes sank and their mortgage amounts were more than their homes were worth.

- Your house is on the line. If you bought your house or refinanced when rates were low, you have to ask yourself how wise it is to borrow against your home, especially if the rate youre now borrowing at is considerably higher than that of your first mortgage. If you fall behind on payments, youre at risk of foreclosure. A cash-out refi might be a better option if you can get a good rate, but youd be starting all over again with interest payments.

Read Also: Can You Apply For A Mortgage Before Finding A House

Ways To Find The Owner Of A Property

It can be a slog to find the right house. And when you do, it may not be up for sale. Take these ways to find out who owns a house so you can lure them to sell.

There are several ways to find the owner of the property youre interested in. Some ways are more direct than others, but any way will rely on your charisma to convince the owner to sell.

Standard And Collateral Charges

A mortgage is a loan secured by property, such as a home. When you take out a mortgage, the lender registers a charge on your property. The type of charge determines which loans your lender allows you to secure against your property.

Standard charge

A standard charge only secures the mortgage. It doesnt secure any other loans you may have with your lender, such as a line of credit. The charge is registered for the actual amount of your mortgage.

Collateral charge

With a collateral charge mortgage, you can secure multiple loans with your lender. This includes a mortgage and a line of credit.

The charge can be registered for an amount that is higher than your actual mortgage. This allows you to borrow additional funds on top of your original mortgage in the future. You avoid paying fees to discharge your mortgage and register a new one. You only have to make payments, including interest, on the money you actually borrow.

You May Like: Who Does 100 Percent Mortgages

Utilize The Resources Available To You

There are multiple resources you may check in your search for mortgage information. To start with, you can try real estate websites, which often display basic information about a property like its assessed value and sales/listing history. These sites may also still have photos up from old listings, along with other information that could aid your decision.

Its worth noting that real estate websites typically pull from the exact same sources, so youre likely to find identical information on each. Therefore, you generally only need to check one of them. Dont spend your time sifting through all of the real estate websites out there, as it simply wont reveal anything that one of these three sites arent already showing you.

Why Does Mortgage Information Matter

For commercial real estate and investment opportunities, figuring out the mortgage information for a given property can be paramount to even pursuing a deal. In an investors eyes, a property is only worth spending time on if they know that its free of a mortgage lien or that the mortgage on the home has certain terms .

In addition to knowing who the financing company is, you may also be able to figure out the title company involved along with the mortgage closing date and other financial information that could impact or prevent the closing process if you were to pursue the property. Of course, while public records can reveal a lot, they cant tell you everything.

Read Also: When You Sign A Mortgage You Are

Interest Rates And Fees If You Borrow On Amounts You Prepaid

You pay either a blended interest rate or the same interest rate as your mortgage on the amount you borrow. A blended interest rate combines your current interest and the rate currently available for a new term.

Fees vary between lenders. Make sure to ask your lender what fees you have to pay.

You may not have to make any changes to your mortgage term.

You Have A Reliable Source Of Income

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”>

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”> A reliable source of income is crucial to making monthly payments on your mortgage. Lenders will also consider your regular income when deciding how much they may be willing to loan you.

While there isnt a specific minimum income needed to buy a house, there are ways to gauge whether you might have enough cash flow to get a loan. One way is to calculate your debt-to-income ratio , which lenders use to determine whether borrowers are reasonably able to take on more debt.

Again, theres no fixed requirement when it comes to DTI, but lenders typically prefer borrowers with a DTI under 50%.

Also Check: What Is The Current Interest Rate On An Fha Mortgage