Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage

Using equity to pay off your mortgage may help you save money on interest or complete your mortgage payments ahead of schedule.

Edited byChris JenningsUpdated August 19, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

As a homeowner, youve built equity over the years by paying down your mortgage and watching your home value increase. In some cases, it could make sense to tap that equity to zero out what you owe on the first mortgage.

You might be able to reduce your monthly mortgage payments, save on interest, and pay off your home ahead of schedule.

Heres how to know if using a home equity loan or HELOC to pay off your mortgage is a viable option for you:

What Is The Difference Between A Heloc And A Mortgage

A mortgage is a one-time loan where the entire amount is loaned upfront and then repaid over a period, with payments going to both the principal and interest.

In the case of a TD Home Equity FlexLine, you get a revolving credit amount which lets you make withdrawals as needed and then pay it back at your own pace with a minimum monthly interest payment. You can also add an optional Term Portion which acts more like a traditional mortgage loan.

Can I Take Out A New Mortgage On A Paid

When you have a mortgage on your home and you want to get a new loan with better terms and pull out some cash, you might do whats called a cash-out refinance. You get a new mortgage thats larger than the balance on your current one, with the balance paid to you in a lump sum of cash.

Even when you have no mortgage on the property and just want to get a mortgage to pull the equity out as cash, its still referred to as a cash-out refinance.

However, the cash-out refinance could require a higher interest rate than a standard mortgage. This is in part because the lender has no way of knowing whether the cash taken out is being put back into the home. Closing costs may also be higher in a cash-out refinance than on an equity loan. In addition, if you borrow more than 80% of the equity in your home, your lender might require you to purchase private mortgage insurance which only benefits the lender.

On the plus side, the fixed interest rates and monthly payments can make it easier to budget for this type of loan than a variable rate HELOC. Average interest rates on refinance mortgages are still generally lower than comparable home equity financing over the long run.

Don’t Miss: Can I Get A Mortgage With A 575 Credit Score

Other Mortgage Payoff Options

Here are a few other ways you might be able to speed your way out of mortgage debt faster than expected.

- Start by checking out our Mortgage Payoff Calculator. It lets you play with the numbers of both how much and how often you send payments. It can help you get a clear idea of how quickly you can pay off your home.

- Consider making an extra house payment each quarterthis is like the biweekly accelerator program on steroids!

- Brown-bag your lunch at the office. Seriously, just look at your food budget or your takeout receipts and add up what you spend monthly eating lunch out. Say its $100. If you brought home-cooked meals to work and sent the savings toward your mortgage, it could mean about an extra monthly payment a year.

- Downsize. Yeah, we said it. Painful as it might sound, selling the home youre already in and getting something more modest could either finish off your mortgage or speed the process way, way up! Hey, you said you wanted to accelerate your way out of debt, right!

- Look into refinancing your mortgage. This could really help your efforts, depending on your situation. For instance, if youre in a 30-year mortgageas many people areyou can refinance it into a 15-year loan with a better interest rate! That immediately cuts the life of your mortgage in half and will motivate you all the more to make payments with all your might and speed.

About the author

Ramsey Solutions

Real Estate Investor From Tempe Az

A friend of mine was selling a system that did this back in the depths of the recession. That’s 7-8 years ago, so I don’t remember the name of the program. But I created an excel spreadsheet to act in the same capacity, and yes it pays off the mortgage early and with less total interest payments.

But so does putting every available dollar of income you have towards the mortgage. That’s essentially what this does. You are left with no net savings in your savings account, because every penny has been put towards the mortgage, albeit through the scheme of the HELOC.

It works, but I pass.

Also Check: How To Get A Mortgage After Chapter 7

What Is A Home Equity Loan

A home equity loan is a secured loan that lets you borrow against your home equity with a fixed interest rate and repayment term. Your interest rate depends on your credit score, payment history, loan amount and income. If your credit improves after youve obtained a home equity loan, you might be able to refinance to a lower interest rate.

How you use the money from a home equity loan is up to you. Some use it to pay for major repairs or renovations, like adding a new room, gutting and remodeling a kitchen or updating a bathroom. You can also take out a home equity loan with a low, fixed rate to pay off high-interest credit card debt.

How Do You Get A Heloc Or Home Equity Loan

While eligibility requirements for home equity products may have tightened up as a result of the coronavirus pandemic, there are still options available for eligible borrowers:

- Considerable equity in your home: Youll likely need to have at least 20 percent equity in your home, or an 80 percent loan-to-value ratio, meaning your mortgage balance and any existing home equity loans total no more than 80 percent of your homes value.

- Good credit: Although lender requirements vary, in general, youll want to have a credit score in the mid-600s to qualify and a score above 700 to get the best interest rates and terms. Some lenders also require a higher credit score for higher loan amounts.

- Low debt: Many home equity lenders require a debt-to-income ratio of 43 percent or below. This means your monthly debt payments make up no more than 43 percent of your gross monthly income.

- Sufficient income: You need to prove you can repay your loan, although most lenders dont disclose their income thresholds.

- Reliable payment history: A long history of on-time payments on other bills can help you qualify for a home equity loan or a HELOC. A history of late payments makes it harder to qualify.

Read Also: Does Bank Of America Do Mortgage Loans

Is A Home Equity Loan A Better Option

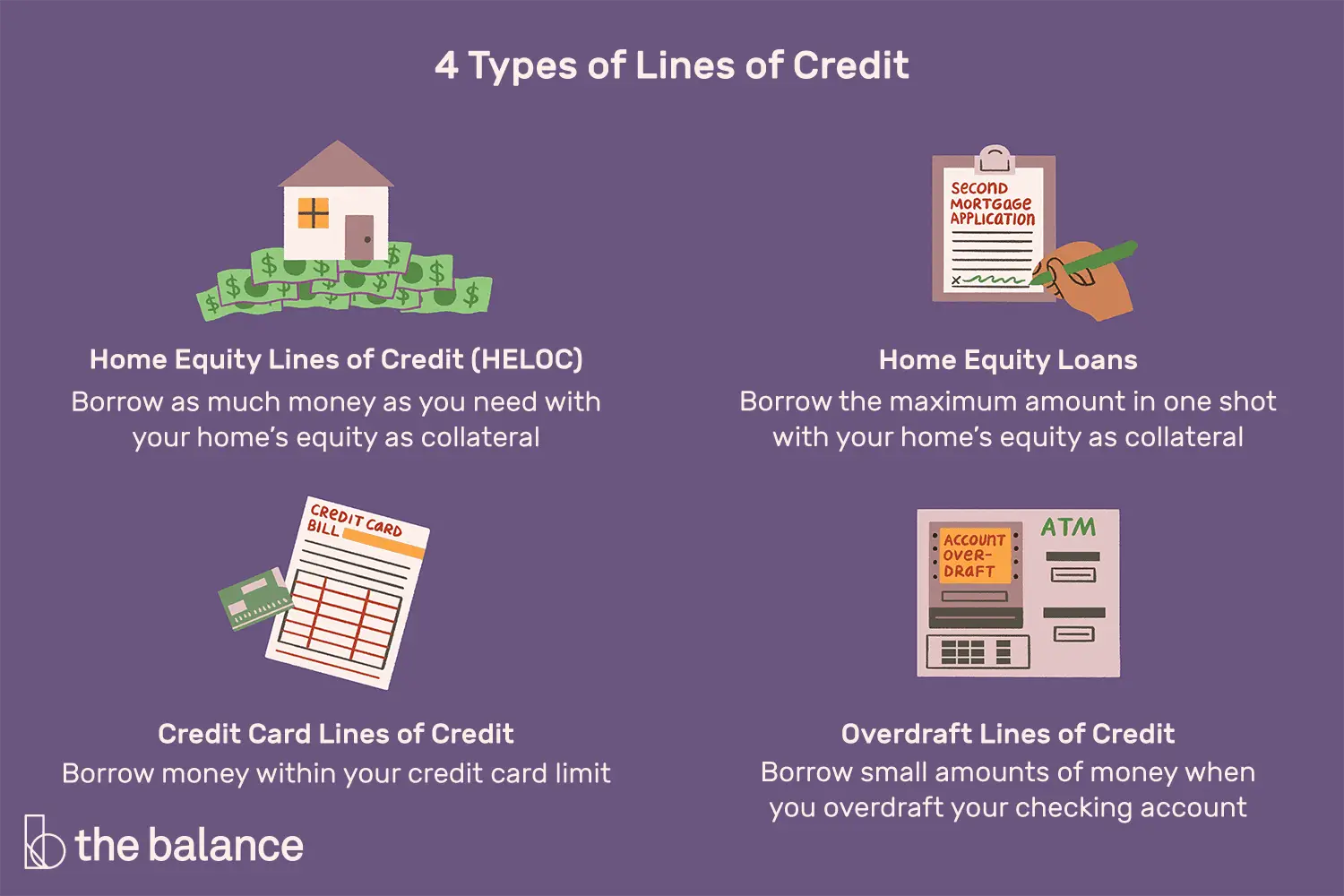

Many confuse HELOCs with home equity loans. While both are considered second mortgages, a HELOC is simply more flexible, letting you use your homes value in the exact amount you need. On the other hand, a home equity loan provides a lump-sum withdrawal.

Another difference: home equity loans are usually issued with a fixed-rate interest charge which prevents any surprise increases in future monthly payments if interest rates were to rise.

What Is The Fastest Way To Pay Off Your House

In the reports scenario, the original house had a $228,305 balance, which was scheduled to be paid off in 25 years, with a 4.48% fixed rate and a monthly payment of $1,266.40.

The HELOC strategy paid off the balance in 10 years and 8 months. Thats a faster payoff than the 30-year mortgage, but only if you make extra payments with the surplus of $1,233.29.

If youd kept the 30-year mortgage and made the same extra payments of $1,233.29, the house would be paid off in 9 years and 4 months. That shaves 16 months off the Velocity Banking strategy, without a new contract, higher interest rate, and riskier terms.

Also Check: How Do You Refinance Your Mortgage

Lump Sums Vs The Long Term

With a home equity loan, you get one lump sum, one time. This can be useful if you have a project with a fixed cost that you need to cover upfront, like if youre replacing your roof. If youre doing a single, expensive home improvement project , it might not make sense to get a HELOC, since youll only need the money once, rather than having to continually borrow it.

A HELOC, on the other hand, is great if you have longer-term borrowing needs. For example, say youve purchased an investment property that you want to do significant renovations on. This will likely be an ongoing process with a variety of different costs, and you may not know upfront how much youll need to borrow in total. In this case, getting a lump sum with a home equity loan wouldnt make as much sense as opening a HELOC.

What Are The Disadvantages Of A Home Equity Line Of Credit

The main drawback of a HELOC is that it increases the risk of foreclosure if you cant pay the loan. Regardless of your goal, avoid a HELOC if:

Your income is unstable. If its possible that your income will change for the worse, a HELOC may be a bad idea. If you cant keep up with your monthly payments, your lender could force you out of your home.

You cant afford the upfront costs. A HELOC may require an application fee, title search, home appraisal, attorneys fees and points. These charges can set you back hundreds of dollars.

The upfront costs of a HELOC may not be worth it if you need only a small line of credit.

You arent looking to borrow much money. A HELOC’s upfront costs may not be worth it if you need only a small line of credit. In that case, you may be better off with a low-interest credit card, perhaps with an introductory interest-free period.

You cant afford an interest rate increase. HELOCs have adjustable rates. The loan paperwork will disclose the lifetime cap, which is the highest possible rate. Could you afford a monthly payment with that much interest? If not, think twice about getting the loan.

Youre using it for basic needs. If you need extra money for day-to-day purchases, and youre having trouble just making ends meet, a HELOC isnt worth the risk. Get your finances in shape before taking on additional debts.

Recommended Reading: Can You Pay Back A Reverse Mortgage Early

Discover Home Loans Offers 10 15 20 And 30 Year Home Equity Loans In Amounts From $35000 To $200000

Discover Home Loans offers 10, 15, 20 and 30 year home equity loans in amounts from $35,000 to $200,000. The term of your loan dictates whether you have a high or low monthly payment. The longer the loan term, the lower the monthly payment. With a traditional home equity loan, once the term of your loan has ended, you should have paid off all borrowed funds and interest.

With Discover Home Loans, your combined loan-to-value CLTV) ratio must be less than 90%. You can calculate CLTV by taking your desired loan amount plus mortgage balance, then dividing that number by your home value.

Always be sure to factor in your first mortgage when calculating how much is available to you.

Heloc Interest Is Not Tax

What?

When I talked about this on social media, a few people came back and said they are deducting their interest. Their CPA said they could.

Well, you can deduct it if you want, but its not legal anymore!

Its only deductible if the HELOC is used for capital improvements

So you are swapping a loan where you can deduct interest for one where you cant.

Hmmm.

Just ask Elsa.

During the last real estate downturn, several people had their HELOCs frozen, reduced, or just cancelled.

HELOC is a nice option to have, but dont put yourself in a position where you are depending on it.

Its a big credit card that can be taken away on a moments notice.

Using a HELOC to pay off a mortgage is not a pay off, its a refinance. You still have a loan, but in a different, and potentially inferior form.

Went to a non-deductible loan and variable rate.

But.

What about using the HELOC to just get rid of private mortgage insurance .

This might be worth it.

You are charged PMI, usually each month, when your loan was made with less than 20% down.

You could try to calculate how much youd be saving over the course of the loan by putting it all on a spreadsheet and attempting to see if doing so saves you a large amount of money.

The only problem is, you cant really model this on a spreadsheet. If its variable interest, you cant be sure how to model out 3 of 5 years into the future. You also have to calculate the loss of interest rate deduction.

You May Like: Does Navy Federal Sell Their Mortgages

Things To Consider Before Borrowing Against Your Paid Off Home

When you take out a loan on a paid-off home, you introduce some financial risks into your life that you may not have had before. This includes the risk of foreclosure if youre unable to make your mortgage payments. Before you put your home on the line, you might want to ask yourself some of the following questions:

Is there another option?

There are other ways to get cash you might need to consolidate debt or pay for home improvements. Such options include personal loans and lines of credit. Unlike a home equity loan or mortgage, these won’t risk foreclosure on your home if you’re unable to pay them back.

Will the loan increase my overall wealth?

If the equity loan gives you money to use to increase your homes value, it might be worth taking on the added risks. If the loan is for something else, like a big-ticket purchase or vacation, you should evaluate whether that expense justifies the risk. Generally productive expenses like substantial home improvements, education and renovations fall under the category of productive spending as they have the potential to increase your wealth. Car purchases, vacations and weddings serve are non-productive expenses that sap at your ability to generate long-term investment returns on your home.

Are the payment terms reasonable?

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: What Score Do Mortgage Companies Use

Qualify For A Home Equity Line Of Credit

You only have to qualify and be approved for a home equity line of credit once. After youre approved, you can access your home equity line of credit whenever you want.

Youll need:

- a minimum down payment or equity of 20%, or

- a minimum down payment or equity of 35% if you want to use a stand-alone home equity line of credit as a substitute for a mortgage

Before approving you for a home equity line of credit, your lender will also require that you have:

- an acceptable credit score

- proof of sufficient and stable income

- an acceptable level of debt compared to your income

To qualify for a home equity line of credit at a bank, you will need to pass a stress test. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your contract.

You need to pass this stress test even if you dont need mortgage loan insurance.

The bank must use the higher interest rate of either:

- 5.25%

- the interest rate you negotiate with your lender plus 2%

If you own your home and want to use the equity in your home to get a home equity line of credit, youll also be required to:

- provide proof you own your home

- supply your mortgage details, such as the current mortgage balance, term and amortization period

- have your lender assess your homes value

Youll need a lawyer or a title service company to register your home as collateral. Ask your lender for more details.

Replace Your Mortgage Replacing One Form Of Debt With Another

The HELOC strategy is at its heart a debt strategy. Youre using a credit card and a HELOC to pay off your mortgage. In the short run at least, that means replacing long-term debt with short-term debt.

The only way to truly get out of debt is by paying it off out of your income or other assets. Using debt to pay off other debt has the real potential to go in an unexpected direction. For example, if after five years of using strategy your $200,000 mortgage is paid down to $100,000, but you now have $100,000 in credit card and HELOC debt, you will have accomplished nothing constructive.

Need help paying off credit card debt? Consider a 0% APR balance transfer credit card.

Don’t Miss: Are Mortgage Rates Going Down Again