Daryl Fairweather Chief Economist At Redfin

Fairweather believes the long-term trend will be rising mortgage rates. The Federal Reserve has said it plans to taper their bond purchases and to start raising interest rates next year, Fairweather says. If that were to happen, then you should expect mortgage rates to rise. With the mortgage spike in late September, it seems like its already happening. Her advice to homebuyers wanting to lock in a low rate is to consider buying sooner rather than later.

But in many areas, the housing market is challenging for buyers. One reason competition is stiff is because housing demand has outstripped supply. The good news is that buyers arent facing quite as much competition right now as they were earlier in the year. Roughly 59% of home offers faced competing bids in Aug. 2021, which is down from 72% in April, according to Redfin. But that doesnt mean you should expect to scoop up a home at a discounted price. Prices arent going to come back down. Theyre high. Theyre going to stay high, Fairweather says.

However, with less competition, you might have more flexibility with your offer terms and be able to include buyer protections, such as an appraisal contingency, which wouldnt have been an option a few months ago.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Translating The Fed’s Words Into English

Let’s unpack the previously quoted excerpt from the Fed’s Sept. 22 statement. The full sentence reads: “If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

The beginning, “If progress continues broadly as expected,” refers mainly to employment and wages. “Progress” means more jobs and rising incomes.

When the Fed talks about “a moderation in the pace of asset purchases,” it means that when the central bank stops buying government and mortgage debt, it won’t do it cold turkey. It will reduce the purchases by several billion dollars one month, then several billion more the next month, and so on, until the purchases end.

Most people interpret “may soon be warranted” as meaning these reductions are likely to begin in early November, shortly after the Fed’s next regularly scheduled meeting.

Mortgage rates will probably keep rising as the reductions draw closer. Then, as the Fed reduces its subsidy of mortgage rates month by month into next spring, rates are likely to continue rising.

Don’t Miss: Why Are Mortgage Rates Lower Than Prime

What Is A Good Mortgage Rate

A good mortgage rate depends a lot on your personal situation and the type of mortgage youre getting. Loans for second homes or investment properties typically have higher rates. And if youre doing a cash-out refinance, you should also expect to have a slightly higher interest rate.

Right now, average 30-year fixed rates are around 3%, and the 15-year fixed rate average is about 2.3%. Even though these are slightly higher rates than we had six months ago, from a historical perspective they are still amazing. Your credit score and loan-to-value ratio factor into what rate youre eligible for. But even if your credit score is lower than youd like, an interest rate of 3.5% or 4% is still an affordable rate compared to what rates have been in the past.

What Are Today’s Mortgage Rates

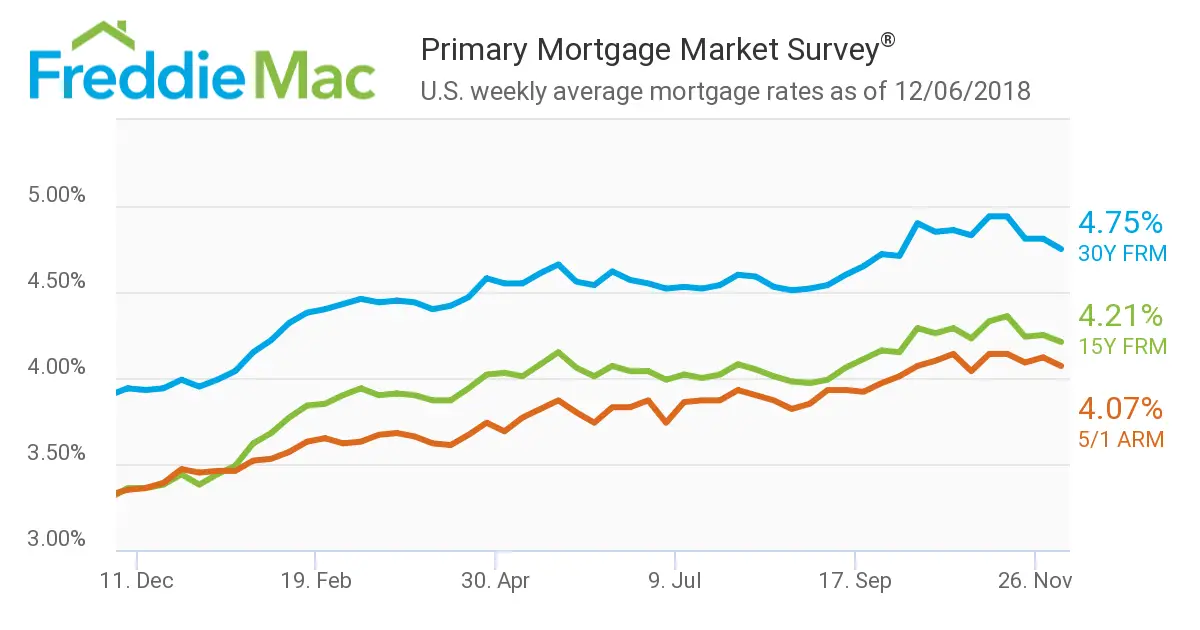

Mortgage rates have already hit historic lows. In fact, the U.S. weekly average mortgage rates were 2.99% for a 30-year fixed-rate loan 2.54% for a 15-year fixed-rate loan and 2.91% for a five-year adjustable-rate mortgage as of August 20, according to Freddie Mac.

These rates come on the tail end of a long downward mortgage rate trend, with rates at the same time last year at 3.55% for a 30-year fixed-rate loan 3.03% for a 15-year fixed-rate loan and 3.32% for a 5/1 ARM. Mortgage interest rates have repeatedly broken new records as they continued to plunge this year in response to the economic fallout of COVID-19. To see what kind of rates you currently qualify, plug your information into Credible’s free online tools.

And while Fannie Mae predicted in mid-July that mortgage rates would fall below 3.0% by the end of the year, that milestone has already been reached as average rates broke the 3% barrier in early August. Yet, even as rates have tumbled, real estate values have largely remained stable, creating an unprecedented refinancing opportunity as well as a chance for well-qualified buyers to save substantially on their home loans.

Also Check: What Will Be My Mortgage

Current Mortgage Interest Rate Trends

Mortgage rates were up slightly this last week. The average 30-year fixed rate is 2.88%, up from 2.87% the week prior, according to Freddie Macs weekly rate survey.

Per the survey, 15-year fixed rates increased slightly from 2.18% to 2.19%. And the average rate for a 5/1 ARM moved slightly down from 2.43% to 2.42%.

Overall, mortgage rates are still close to their lowest levels in history.

The lowest 30-year mortgage rate ever was just 2.65%, recorded by Freddie Mac in January 2021. So anyone who can lock in at or near todays mortgage rates is getting a fantastic deal on their home loan.

Also keep in mind that average rates are just that averages. Prime borrowers with great credit and large down payments often get lower interest rates than the ones shown here. And borrowers with lower credit or fewer assets may get higher rates.

High Ltv Refinance Option And Freddie Mac Enhanced Relief Refinance

High loan-to-value mortgage loans are those in which the amount owed on the mortgage is nearly equal to or exceeds the home’s appraised market value. These high LTV loans are considered high risk to lenders since a default or nonpayment by the borrower could result in the lender losing money if the bank forecloses and sells the home for less than the loan amount given to the borrower.

Unfortunately, Fannie Mae and Freddie Mac have temporarily suspended mortgage loan refinances under the high loan-to-value programs. All high LTV refinances must have had their applications dated on or before June 30, 2021, and must be purchased or securitized on or before Aug. 31, 2021. Historically, these Fannie Mae and Freddie Mac programs were designed to replace theHome Affordable Refinance Program , which expired on Dec. 31, 2018.

HARP was set up to help homeowners who could not take advantage of other refinance options because their homes had decreased in value. Its goal was to improve a loans long-term affordability to help prevent people from losing their homes to foreclosure. Only mortgages held by Fannie Mae or Freddie Mac were eligible. Still, they also had to have a loan origination date on or after Oct. 1, 2017, and borrowers had to be current on their payments.

Recommended Reading: How Do I Apply For A Usda Mortgage

Where Are Mortgage Rates Heading This Year

Mortgage rates sank through 2020. Millions of homeowners responded to low mortgage rates by refinancing existing loans and taking out new ones. Many people bought homes they may not have been able to afford if rates were higher.

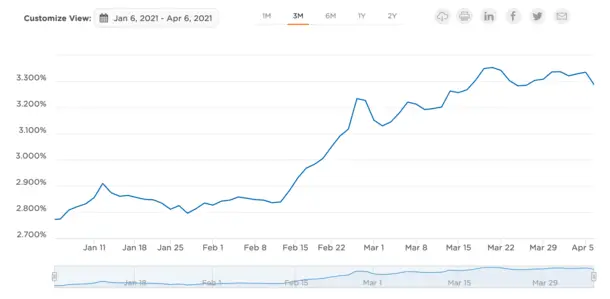

In January 2021, rates briefly dropped to the lowest levels on record, but trended higher through the month and into February.

Looking ahead, experts believe interest rates will rise more in 2021, but modestly. Factors that could influence rates include how quickly the COVID-19 vaccines are distributed and when lawmakers can agree on another economic relief package. More vaccinations and stimulus from the government could lead to improved economic conditions, which would boost rates.

While mortgage rates are likely to rise this year, experts say the increase wont happen overnight and it wont be a dramatic jump. Rates should stay near historically low levels through the first half of the year, rising slightly later in the year. Even with rising rates, it will still be a favorable time to finance a new home or refinance a mortgage.

Factors that influence mortgage rates include:

How Much Will I Need For A Down Payment

The minimum youll need to put down will depend on the type of mortgage. Many lenders require a minimum of 5% to 20%, whereas others like government-backed ones require at least 3.5%. The VA loan is the exception with no down payment requirements.

Generally, the higher your down payment, the lower your rate may be. Homeowners who put down at least 20 percent will be able to save the most.

Recommended Reading: How Much Per 1000 On Mortgage

Should You Consider Getting A Variable Rate Mortgage

Remember that variable mortgage rates closely follow the BoCs prime lending rate?

The Bank of Canada, in response to the pandemic, has reduced its overnight lending rate to 0.25%, lowering it by a total of 150 basis points from 1.75% in January.

With this key move conducted by the central bank, the prime lending rate of Canadas big banks has been pushed down from 3.95% to 2.45%. As a result, variable rates are now much lower.

The table below shows how the reduction in the BoCs rates have impacted variable mortgage rates:

| 2.45% |

The lower the BoCs rate becomes, the more variable rates will drop. As the BoCs rate is currently at its lowest, now may be the best time to get a variable mortgage rather than a fixed mortgage. Furthermore, experts think that the BoC benchmark rates will not go up by much or will do so with sluggish speed in the future due to the state of the economy and the huge debt amassed by both individuals and the government.

Is It A Better Time To Buy Or Sell A Home

There are more economic factors on balance, putting downward pressure on home prices than upward pressure. However, that was also the case in the first three months of 2021 when Canadians desperate for more living space pushed home values higher.

-

If you believe that the rise in buying activity is explained by Canadians seeking more living space, then the end of pandemic restrictions coming this summer might trigger an end to this economic real estate cycle.

-

If you believe that interest rates are the primary driver of home prices, then the forecasted rise in rates would indicate prices will moderate in the second half of 2021.

-

Population growth is also expected to remain below average in 2021, so population growth shoudnt come into play until 2022.

Homebuyer Advice

If you plan to buy in the next three years, be mindful that there is a risk that prices will fall in the short run, so that a wait-and-see approach may be appropriate.

The low mortgage rates provide more purchasing power for buyers who are still employed than in 2019, but less than six months ago. In a weakened market, low rates are a gift to homebuyers however, it inflates the value of a standard home in markets with low supply.

Home Seller Advice

Unemployment is still high, and if we use past recessions as a guide, there will likely be a weakening in home valuations.

Like this report? Like us on .

You May Like: How To Transfer A Mortgage To Someone Else

Logan Mohtashami Lead Analyst At Housingwire

We shouldnt expect skyrocketing rates in the coming weeks, according to Mohtashami. He says that rates have stayed in a very low range for 2021, and that should still be the case for the rest of the year. As long as other economies around the world are still struggling, that puts a limit on how high rates can go in the U.S.

Borrowers may still have time to lock-in a great rate, but buying a home doesnt look like it will be getting any easier. This housing market is the most unhealthy housing market post 2010, he says. Not because theres a bubble or a credit boom or anything like that, its just that the shortage of homes is facilitating forced bidding. The number of homes for sale has increased somewhat from recent lows, but inventory still isnt fully meeting the demand. We may see a seasonal dip in housing inventory this winter which will not make it any easier for buyers in the coming months.

Should You Buy Mortgage Points

Many lenders sell mortgage points . Buying points means youâd pay more up front to lower your mortgage rate which could save you money long-term. A mortgage discount point normally costs 1% of your loan amount and could shave 0.25% off your interest rate.

With a $200,000 mortgage loan, a point would cost $2,000. Buying two points would cost $4,000 which would be due, in cash, when you close the loan. These two discount points would translate into a 0.5% reduction to your interest rate.

Discount points could pay off but only if you keep the home loan long enough. Selling the home or refinancing the mortgage within a couple of years would short circuit the discount point strategy. But if you stayed in the loan indefinitely, you’d reach a break-even point after which the discount points would save you more and more over time.

Often, spending cash on a down payment instead of discount points saves more unless you know for sure you’re keeping the loan for years. If a larger down payment could help you avoid paying PMI premiums, put the money toward your down payment instead of discount points.

Read Also: What Is Tip In Mortgage

How To Use Our Mortgage Rate Table

Our mortgage rate table is designed to help you compare the rates youre being offered by lenders to know if it is better or worse. These rates are benchmark rates for those with good credit and not the teaser rates that make everyone think they will get the lowest rate available. Of course, your personal credit profile will be a significant factor in what rate you actually get quoted from a lender, but you will be able to shop for either new purchase or refinance rates with confidence.

What Is A Mortgage Rate

A mortgage rate is the amount of interest determined by a lender to be charged on a mortgage. These rates can be fixedmeaning the rate is set based on a benchmark ratefor the duration of the borrowers mortgage term or variable based on the mortgage terms and current rates. The rate is one of the key factors for borrowers when seeking home financing options since itll affect their monthly payments and how much theyll pay throughout the lifetime of the loan.

Recommended Reading: What Are Mortgage Rates Based On

Be Prepared To Move Quickly

While housing market inventory has increased from its record low, demand is still outstripping supply. So you should prepare everything for your home search in advance. Know how much house you can afford and what your must haves and would like to haves are. Once you find a property that you like, youll most likely need to make a quick decision on whether or not to put in an offer.

You should also be sure to get preapproved for a home loan. A full preapproval involves having a lender review your credit and other financial information. But once youre preapproved, youll know how much house you can afford, and having a preapproval letter shows the seller that youre a serious and qualified buyer.

Mortgage Interest Rates Forecast For Rest Of 2020

Mortgage rates are currently at or near record lows, but they could fall further. Check out this mortgage interest rates forecast to learn more.

With coronavirus sending the U.S. into a recession and causing record-high unemployment, the Fed set benchmark interest rates near zero to bolster the economy leading to a mortgage rates drop. Now homeowners and potential buyers want to know: What’s the mortgage interest rates forecast? Will rates drop further and is it worth waiting to score an even better deal?

The mortgage rate trend has been a boon for homeowners and would-be buyers. Current homeowners can potentially benefit by refinancing and may save substantially on their home loans. Anyone considering the purchase of a home could also potentially secure a more affordable loan than ever before. While those homeowners interested in further savings may wish to consider mortgage rate forecasts in making their decisions, many others will find that today’s rates are so low it’s not worth the risk of waiting only to see rates rise.

To decide what’s best for you, it can be helpful to explore your mortgage options available based on today’s rates. You can visit Credible to easily compare mortgages by rates and loan terms without affecting your credit.

Read Also: Is 3.99 A Good Mortgage Rate