How To Get A Mortgage: A Step

You probably already know that a mortgage is a type of loan that you use to buy a home. Its a good idea to learn as much as you can about getting a mortgage before you start shopping for a home.

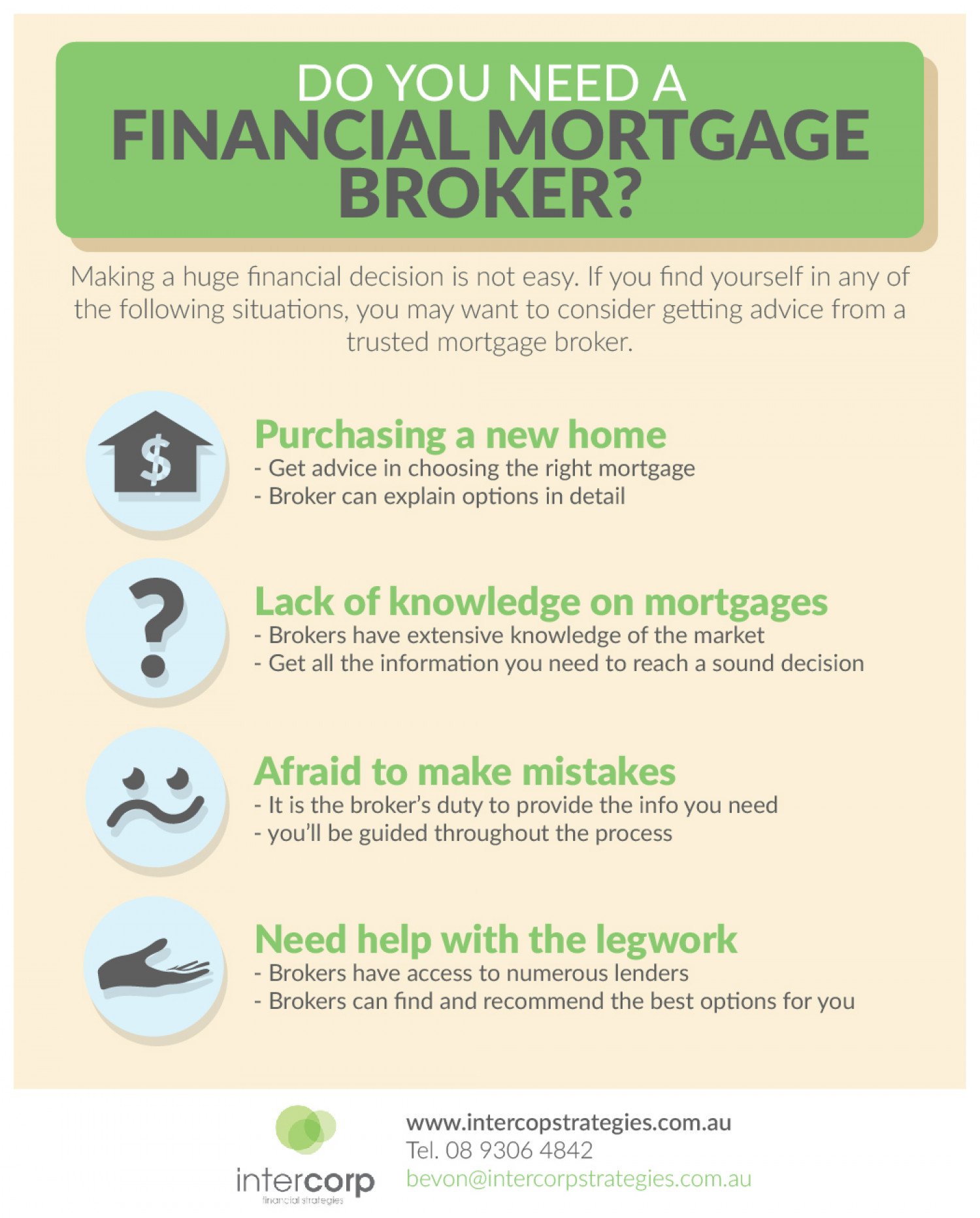

The best way to avoid wasting time is to know the players and the process. That means working with a lender to get the best possible loan.

In this article, well get you ready to go mortgage shopping by going over what lenders are looking for, the paperwork involved and the five steps it takes to complete the mortgage process.

Costs To Change Lenders

Make sure you find out the costs of changing lenders, such as:

- setup fees with the new lender, which may include discharge, registration, transfer and/or assignment fees from your current lender

- an appraisal fee to confirm the value of your property

- other administration fees

Ask if your new mortgage lender is willing to pay for some or all of your costs to switch.

What You Need To Apply For A Mortgage

Before filling out the mortgage application, its smart to collect the necessary documents and information ahead of time, particularly if a mortgage lender is assisting you in person or by phone. Here are the documents youll want to have at the ready:

- Employment information

- Income information

- Additional income information from the past two years

- Bank statements from the past three months or other retirement accounts)

- Form 4506-T or 4506T-EZ from your loan officer authorizing the lender to access your tax returns

- Signed purchase contract

If youre self-employed, own a business or get paid through commissions, youll likely also need to provide additional information, such as:

- Federal tax returns from the past two years, including business tax returns

- Business records from the past several years

Note your lender might request more documents during the underwriting process. This is common and expected sometimes, a lender just needs more information so that they can clearly understand your risk level and determine your ability to repay.

Read Also: What Happens With A Reverse Mortgage When Owner Dies

Evidence Of Where Your Deposit Is Coming From

This is important as lenders will need to see Proof of Deposit to understand where your deposit is coming from.

- If your deposit is from your savings, youll need to provide evidence via bank statements and any large payments will need to be explained. The bank statements will also need to show your name and address.

- Gifted mortgage deposits will usually require a signed letter from the person who is gifting you the money. At NatWest, we require a signed letter or email from the gifting party, confirming the gift is either non repayable or repayable.

Documents Needed For A Self

If you are self employed, then the documents required to confirm your income can vary. I have written a couple articles about self-employed mortgages. I encourage you to read these articles as well:

To start the mortgage pre-approval process when you are self-employed, then you should provide the following documents:

- 2 years of Personal Income Tax Returns

- 2 years Notice of Assessments

With these documents, your lender will take the income number on line 150 of your return and average that income over the 2 years to determine how much mortgage you qualify for.

In some cases, the income reflected on line 150 of your income tax return can be increased by 15%. Some lenders may add some non-cash expenses to your income to help more closely reflect your real cash flow.

Don’t Miss: How To Get A Million Dollar Mortgage

Documents You Need To Qualify For A Mortgage

KIKI BERG | Nov 24, 2017

Being fully pre-approved means that the lender has agreed to have you as a client and the lender has reviewed, approved ALL your income and down payment documents prior to you going house hunting. Many bankers will say youre approved, you go out shopping and then they sorry youre not approved due to some factor. Get a pre-approval in writing! It should have your amount, rate, term, payment and date it expires.

Excited! Of course you are, you are venturing into your first or possibly your next biggest loan application and investment of you life.

What documents are required to APPROVE your mortgage?

Being prepared with the RIGHT DOCUMENTS when you want to qualify your mortgage is HUGE just like applying for a job or going for a job interview. Come prepared or dont get hired .

Why is this important?

You can have a leg up against the competition when buying your dream home as you can have very short timeline for financing subjects.Think? Youre the seller and you know the buyer doesnt have to run around finding financing and the deal may fall apart? This is the #1 reason deals DO fall apart. You will likely get the home over someone who isnt fully approved and has to have financing subjects. The home is yours and nobodys time is wasted.

Read carefully and note the details of each requirement to prevent you from pulling your hair out later.

Here is the list for the average T4 full-time working person with 5-15% as their down payment :

What If My Mortgage Pre

If you are denied for a mortgage pre-approval, you will want to find out the reason for the decline. There could be a credit issue. There could be an income issue or you could have too much debt. By finding out the reason, you can then create a plan to fix the issue and get qualified asap.

If you have been denied, connect with us and get a second opinion. We have helped many clients to get back on track and purchase a home sooner than they expected.

There are solutions and options if you have had some blemishes on your credit. If you have too much debt, we may be able to offer you an action play to reduce the debt or restructure so that that payments are lower.

If your income was an issue, we may have another lender who would look at your income differently than the lender you spoke with.

Recommended Reading: Is Nationwide A Good Mortgage Lender

Loan Application Information Required

The first thing youll do when applying for a mortgage is complete a federally required mortgage application. Regardless of whether the application is in the paper format linked here, an online form, or done verbally with your loan officer, this linked document contains the application with the information youll need to provide, including:

- Full name, birth date, Social Security number, and phone number

- Residence history for at least two years. If youre a renter, your rent payment is needed. If youre an owner, all mortgage, insurance and tax figures are needed for your primary residence and all other properties owned.

- Employment history for at least two years, including company name, address, phone number, and your title.

- Income history for at least two years. If you receive commissions, bonuses, or are self-employed, you must provide two years of bonus, commission, or self-employed income received. Most lenders average variable and self-employed income over two years.

- Asset account balances including all checking, savings, investment, and retirement accounts.

- Debt payments and balances for credit cards, mortgages, student loans, car loans, alimony, child support, or any other fixed debt obligations.

- Confirmation whether youve had bankruptcies or foreclosures within the past seven years, whether youre party to any lawsuits, or you co-sign on any loans.

- Confirmation if any part of your down payment will be borrowed.

Calculate The Total Cost Of Your Mortgage

The lender or the broker will do this for you, but make sure they explain all the charges and fees, including any conditional charges and fees, such as early repayment penalties.

Some brokers will charge a fee for advice, receive a commission from the lender or a combination of both. They will tell you about their fees and the type of service they can provide at your initial meeting. In-house bank and building society advisers dont normally charge a fee for their advice.

You will be shown the total yearly cost of a mortgage expressed as a percentage of the loan. This will be shown as an Annual Percentage Rate of Charge calculation and includes any fees such as valuation or redemption fees associated with your mortgage. This APRC will help provide a more thorough comparison between the different mortgages deals available.

Getting a mortgage is about more than just the monthly payments. You also need to budget for the other costs such as solicitor fees and Stamp Duty.

Find out more in A guide to mortgage fees and costs

Recommended Reading: What To Expect When Applying For A Mortgage Loan

Negotiate For A Better Interest Rate

Negotiate with your current lender. You may qualify for a discounted interest rate that is lower than the rate quoted in your renewal letter. Tell your lender about offers you received from other financial institutions or mortgage brokers. You may need to provide proof of the offers you receive. Make sure you have this information on hand.

If you dont take action, the renewal of your mortgage term may be automatic. This means you may not get the best interest rate and conditions. If your lender plans on automatically renewing your mortgage, it will say so in the renewal statement.

When Would You Need A Hardship Letter

A financial hardship letter may be needed when unfortunate events outside of your control keep you from being able to pay your mortgage. This letter aims to let the lender know why you failed to fulfill your monthly responsibilities.5 Some examples of situations your mortgage lender may consider a financial hardship include:

- Serious illness or injury that results in extensive medical expenses

- Natural or man-made disaster

Read Also: What Is Overage Shortage In A Mortgage

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

Be Prepared When You Apply For A Mortgage

Dont let this list scare you! Its designed to give you a general sense of the types of things you may need to apply for a mortgage. Chances are you have many of them on hand or easily accessible already! Plus, this list will enable you to gather what you need for the mortgage application process ahead of time, so things can move along smoothly when you are ready to move forward with pursuing a home loan.

Interested in learning more about preparing to apply for a home loan? Contact the experienced mortgage professionals at Maple Tree Funding today! Our team would be happy to answer any questions you may have on the application process.

Read Also: Can You Combine 2 Mortgages Into One

Proof Of Assets And Liabilities

Your lender might ask you for some or all of the following when they verify your assets:

- Up to 60 days worth of account statements that confirm the assets in your checking and savings accounts

- The most recent statement from your retirement or investment account

- Documents for the sale of any assets you got rid of before you applied, such as a copy of the title transfer if you sold a car

- Proof and verification of any gift funds deposited into your account within the last 2 months

Your lender may also ask you for supplemental information on any debts you owe, like a student loan or an auto loan. Cooperation with your lender only makes the process easier, so be sure to provide any requested information as soon as possible.

The 14 Documents You Must Have To Get A Mortgage

Find out which documents are needed for a mortgage. Mortgages 101

To make your dreams of homeownership come true, youll have to jump through a series of hoops known as the mortgage process. Regarded as lengthy, the application part of the mortgage process requires you, as a borrower, to submit a series of documents to prove everything from your identity to your current income to your ability to pay back the loan. To get your mortgage application approved without any hiccups, its best if you gather everything you need ahead of time, so youre ready when the lender requests information to help get your mortgage loan approved.

Also Check: How Much Is Mortgage On 1 Million

What Can I Do To Maintain A Good Credit Score

My goal here isn’t to go into great detail about credit in this article. There are 2 things you can do to improve your credit or maintain it:

- Make you minimum monthly payments on time, every time.

- If you hold a balance on your credit cards or lines of credit, keep the balance under 75% of the credit limit.

- maintain at least 2 pieces of active credit. 2 credit cards, or a credit card and loc, or a credit card and loan

You want to have 2 pieces of active credit in good standing. When it comes to credit, time heals all wounds. If you had issues with your credit in the past, then the more time you wait, the more your credit score will improve provided you are maintaining 2 pieces of active credit in good standing.

I plan to write a more details article about credit. In the mean time, you can visit a friends website that talks about credit, how to improve it and how to fix it. His website is called .

The Credit Advice section of his website is very good.

In addition to checking your credit, your broker will want to take a look at your income documents. Let’s look at a summary of what you will need to provide based on the type of income you earn.

What Can You Afford

Once you have a picture of your credit score and finances, you need to consider how much you can afford for a down payment. Down payments have a wide range, from 3% to 20% of the homes price, so you will want to know your loan options first. Consider your savings situation and what you are comfortable with, and remember your loan officer can offer advice.

Lastly, your loan officer will want to know if you have any special circumstances that can make buying your home more affordable. This includes if youre active duty or a veteran, or if you need a low down payment.

After digging into your finances and getting comfortable with what you find, you will be ready to talk to your loan officer and get started on your application.

You May Like: Can I Sell My House Back To The Mortgage Company

Account Statements For Deposit And Investment Accounts

Certain assets, like bank and retirement accounts, can be used to qualify for a mortgage if you own and have access to the funds. You’ll generally have to provide two months of account statements for assets you’re using to qualify for the mortgage. If you’ve recently made large deposits into your bank account, the lender will ask for additional documents verifying the source of the deposits.

If you don’t receive a statement for securitieslike stocks and bondsyou can provide other evidence that you own the security and verify the current value.

A Clear Understanding Of The Mortgage Application And Approval Process Can Help You Move Forward And Make Decisions With Confidence

The process of successfully obtaining mortgage financing can be broken down into 7 steps which we divide into 3 distinct stages. The first stage is to have an initial assessment discussion with a trusted mortgage broker to diagnose your situation and determine the best course of action. The second stage is the pre-approval in which a formal application with supporting documents is submitted and reviewed. Finally, in the approval stage, financing is formally requested and the details of the mortgage contract are finalized.

Each step is explained individually below.

Our mortgage application and approval process is an organized and sequential procedure that helps you progress towards your goals with confidence and clarity. A plan helps you define the scope of your objective and anticipate commonly encountered pitfalls. How long the mortgage approval process takes depends on how busy lenders are and how quickly you can provide the requested documents. We use checklists and diligent communication to keep things moving along. The approximate number of business days to complete each step are shown in brackets.

Recommended Reading: How To Negotiate Lower Interest Rate On Mortgage

Documents Needed For An Hourly Employee Who Also Works Overtime

As an employee who can work overtime, if you want to include your overtime income when you qualify for a mortgage, then you must provide documents to verify how much additional income you earn. Lenders want to see that you can maintain this level of income over at least 2 years.

Therefore, they will want to see how much you have earned over the last 2 years. As an hourly employee with no guaranteed hours or an hourly employee with lots of over time, you must provide the following documents:

- Letter of Employment, dated within 30 days

- recent pay stub, dated within 30 days

- last 2 years of Notice of Assessments or T4’s

If you have worked for a company for 2 years and earn overtime but you didn’t start January, so the income on your income tax return isn’t really correct, then you will want to provide more documents.

I would suggest that you speak with your broker to review what would be needed to confirm your income in this case. Your broker will want to build a case for your income with the lender.