Will Mortgage Rates Keep Rising In 2021

Nobody can ever be certain about the future direction of mortgage rates. But, if inflation does take hold, its beyond highly likely that mortgage interest rates will keep rising.

They may well climb higher even if the Fed is right about inflation cooling off within a few months.

Thats because economic growth typically brings higher mortgage rates. And nearly all economists believe a boom is imminent.

Could mortgage rates fall in 2021?

Rising rates seem likely, but arent guaranteed. Why? Because there are plenty of threats to the U.S. economy that could arrest increases and perhaps even send rates lower.

For example, suppose some future variant of SARS-CoV-2 emerges that turns out to be resistant to vaccines.

If that were also highly transmissible, it could set back all the progress and recovery weve made since March 2020 at least until new vaccines are developed.

Or imagine if enough investors suddenly decided that the stock market is an overinflated bubble and pop it. That, too, would be an enormous setback for the economy thats entirely independent of the pandemic.

Now, you may think those threats are way less likely than either more inflation or a boom. And this writer would agree with you. But neither the two threats above nor others are unthinkable. Its possible they could happen.

And thats why future mortgage rates can never be predicted with absolute certainty.

Bonds And Mortgage Rates

The same goes for the bond market and its something weve seen quite a bit recently.

Last year, Covid comes into the United States economy, shocks it, and the stock market does a bit of a nosedive, Dhingra says.

Investors pull out that money, and then they look for a safer place to put it someplace not as volatile. Bonds are a place that typically are allocated for such funds. So investors will put their money there, and this ultimately pushes down mortgage rates because the price of bonds goes up.

Calculating A Mortgage Rate

Interest rates on home loans are built up using an index based on the current market, such as the bond market, and a markup that represents the lender’s profit. If you’re looking at published rates, note that they tend to represent an average, and you may find that rates in your specific geographical area vary.

The rates you’re offered will also be impacted by your credit score range. Lenders price your mortgage loan based on your risk profile.

If you have a great credit score, it’s much less likely statistically that you’ll default on your loan, so you’ll get a lower interest rate. If you have a lower credit score, your lender will want more interest to compensate for the additional risk of you defaulting on the loan, so you’ll have to pay a higher interest rate. Use the mortgage rate calculator below to get a sense of what your monthly payment could end up being.

Read Also: Why Is My Mortgage So High

Why Mortgage Rates Move

Unlike most other interest rates, those for mortgages are largely determined by the supply of money into the market from investors and the demand for such loans from consumers. That supply is heavily affected by the amount of risk investors are prepared to sustain in their portfolios. When spooked by economic uncertainty, they tend to buy safer assets, including mortgage securities, which can result in an increased supply of product that drives down the price . When theyre more confident, they tend to invest in riskier but more profitable assets, which reduces the supply of money for home loans, and pushes up rates. A second influence is perceptions of how inflation rates are likely to move over the long term, but that usually tends to be a less important factor in daily and short-term movements. None of this is to suggest the Federal Reserve doesnt affect mortgage rates, merely that it does so only indirectly by influencing investor sentiment.

The Constant Maturity Treasury Rate

Constant Maturity Treasury rates, or CMT rates, refer to a yield thats calculated by taking the average yield of different types of U.S. Treasury securities with varying maturity periods, and using it to adjust for a number of time periods.

Some lenders will use this rate to determine interest for adjustable-rate mortgages . If the CMT rate goes up, you can expect any loans tied to it to increase their interest rates as well.

Read Also: Do Multiple Mortgage Pre Approvals Affect Credit Score

What Does That Mean For Interest Rates In 2022

Dinghra along with most housing and finance experts believes rates will continue to rise in 2022. There are a few main reasons for this:

As Dhingra puts it, Its fair to say that mortgage rates are going to trend a little bit higher into this next year.

Just how high will mortgage rates go? No one can say for sure. But many expert mortgage rate predictions put 30-year fixed rates in the high-3% or low-4% range by the end of next year.

Mortgage Rates This Week

Mortgage rates fell across the board in the week ending July 21, but fixed rates are still more than two percentage points higher than at the beginning of the year.

-

The 30-year fixed-rate mortgage averaged 5.59% APR, down 11 basis points from the previous week’s average.

-

The 15-year fixed-rate mortgage averaged 4.73% APR, down six basis points from the previous week’s average.

-

The 5-year adjustable-rate mortgage averaged 4.4% APR, down five basis points from the previous week’s average.

Meanwhile, the median existing-home sale price hit a record high in June at $416,000, up 13.4% from June 2021, according to the National Association of Realtors. Existing homes are properties that were owned and occupied before they were listed for sale.

Homes sold briskly in June, staying on the market an average of just 14 days, down from 16 days in May and the shortest period since the NAR began keeping track 11 years ago.

But there is a nugget of good news for home buyers in the NAR’s latest data. The number of unsold homes on the market increased to 1.26 million. At the current sales pace, it would take three months for all of the properties to sell, up from 2.6 months from the previous month and 2.5 months in June 2021.

Generally, real estate agents consider it a balanced market, with roughly equal numbers of buyers and for-sale homes, when that figure is more like six months. So sellers still have the advantage today, but can’t call the shots as much as they could in the spring.

Read Also: Can You Combine 2 Mortgages Into One

Stock Market Is Dipping Bond Prices Increase Yields And Fixed Rates Decrease

On the other hand, when the Canadian economy becomes less stable and stocks do not look as enticing, investors are more likely to invest in safer investments such as bonds. Thus the demand for bonds increases, meaning that the price of bonds increases, and the bond yield decreases. As such, fixed rates will likely decrease.

One More Thing To Consider: The Trade

As you shop for a mortgage, youll see that lenders also offer different interest rates on loans with different points.

Generally, points and lender credits let you make tradeoffs in how you pay for your mortgage and closing costs.

- Points, also known as discount points, lower your interest rate in exchange for an upfront fee. By paying points, you pay more upfront, but you receive a lower interest rate and therefore pay less over time. Points can be a good choice for someone who knows they will keep the loan for a long time.

- Lender credits might lower your closing costs in exchange for a higher interest rate. You pay a higher interest rate and the lender gives you money to offset your closing costs. When you receive lender credits, you pay less upfront, but you pay more over time with the higher interest rate. Keep in mind that some lenders may also offer lender credits that are unconnected to the interest rate you payfor example, a temporary offer, or to compensate for a problem.

There are three main choices you can make about points and lender credits:

Learn more about evaluating these options to see if points or credits are the right choice based on your goals and financial situation.

Don’t Miss: How To Cut A 15 Year Mortgage In Half

Higher Home Prices May Be Here To Stay

There has been a lot of speculation, but little evidence, about what higher rates tell us about home price appreciation. Our look at the historical evidence shows that sharply higher mortgage rates tend to slow home price appreciation and may weigh on housing market activity. But nominal home price appreciation does remain positive. And during these periods of sharp interest rate increases, we did not have the acute housing supply shortage we have today, which could slow the deceleration in home price appreciation. In short, despite a sharp drop in affordability because of higher mortgage rates, home prices are unlikely to decline. Rather, affordability challenges are likely to persist.

The Urban Institute has the evidence to show what it will take to create a society where everyone has a fair shot at achieving their vision of success.

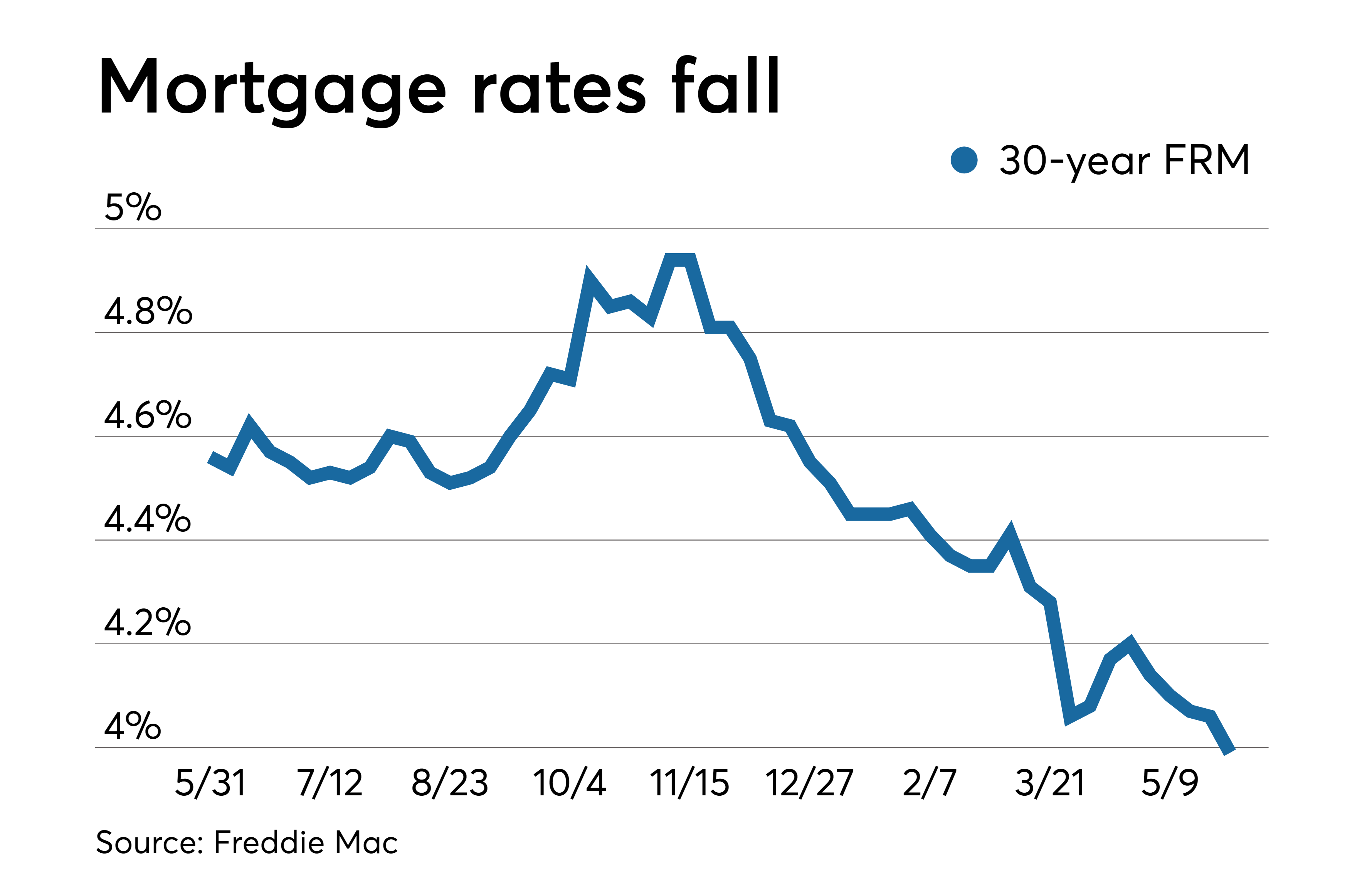

Historical Mortgage Rates: Heres How Todays Rate Compare

Heres a visual look at how current mortgage rates compare to the last 22 years.

Mortgage rates breaching 5% is a big deal, as they havent been at this level in more than a decade. If you go back to before the Great Recession, however, rates well above 5% were commonplace. Overall, 5%, if you zoom out historically, is still very low in terms of mortgage rates, Bivenour says.

Don’t Miss: What Is Bps In Mortgage

The Type Of Home Youre Buying

A house is a house right? The literal structure may be, but the use of the house means a great deal to lenders. Borrowers who plan to occupy the home as a primary residence will receive the best mortgage rates.

Youll have a higher rate if youre buying a second home. Also known as a vacation property, a second home is a place you plan to live in at some point in the year that wont be rented out to others.

If you do plan to rent out your second homeeither long term or short termthat is considered an investment property, which tends to come with the highest rates.

Youll also pay a higher interest rate if youre buying a condo or townhome, as opposed to a single-family house.

Factors That Affect Mortgage Rates

Most of the factors that affect mortgage rates are out of your control: there are larger forces at work in the economy and in the countrys biggest financial markets. There are some factors in your control like , or loan-to-value ratios and well get to those later. But first, its important to understand the bigger forces at work.

Don’t Miss: Can You Refinance An Arm Mortgage

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

What Are Todays Mortgage Rates

Mortgage rates are rising, but borrowers can usually find a better deal by shopping around. Connect with a mortgage lender to find out exactly what rate you qualify for.

1Today’s mortgage rates are based on a daily survey of select lending partners of The Mortgage Reports. Interest rates shown here assume a credit score of 740. See our full loan assumptions here.

Selected sources:

You May Like: What Are The Best Mortgage Lenders

Should You Refinance Your Mortgage When Interest Rates Drop

Determining whether it’s the right time to refinance your home loan or not involves a number of factors. Most experts agree you should consider a mortgage refinancing if your current mortgage rate exceeds today’s mortgage rates by 0.75 percentage points. Some say a refi can make sense if you can reduce your mortgage rate by as little as 0.5 percentage points . It doesn’t make sense to refinance every time rates decline a little bit because mortgage fees would cut into your savings.

Many of the best mortgage refinance lenders can give you free rate quotes to help you decide whether the money you’d save in interest justifies the cost of a new loan. Try to get a quote with a soft credit check which won’t hurt your credit score.

You could increase interest savings by going with a shorter loan term such as a 15-year mortgage. Your payments will be higher, but you could save on interest charges over time, and you’d pay off your house sooner.

How much does the interest rate affect mortgage payments?

In general, the lower the interest rate the lower your monthly payments will be. For example:

- If you have a $300,000 fixed-rate 30-year mortgage at 4% interest, your monthly payment will be $1,432 . You’ll pay a total of $215,608 in interest over the full loan term.

- The same-sized loan at 3% interest will have a monthly payment of $1,264. You will pay a total of $155,040 in interest a savings of over $60,000.

Mortgage Interest Rates Forecast For July 2022

Rising inflation and the Federal Reserves monetary policy are all putting pressure on mortgage rates. As inflation increases, the Fed reacts by applying more aggressive monetary policy, which invariably leads to higher mortgage rates.

Experts are forecasting that the 30-year, fixed-mortgage rate will vary from 5% to 7% by the end of 2022. Here are their more detailed predictions, as of late May 2022:

- Mortgage Bankers Association Associate Vice President of Economic and Industry Forecasting Joel Kan: High inflation and rates above 5% are both headwinds for the housing market in the coming months. MBAs new forecast anticipates that sales of new and existing homes will fall below 2021 levels.

- National Association of Realtors Chief Economist Lawrence Yun: Mortgage rates bouncing along near 6% is certain for the remainder of the year. They could go up even close to 7%, especially if oil and gas supply further lags behind and pushes up the critical energy prices during the winter heating season.

- Realtor.com Chief Economist Danielle Hale: I expect mortgage rates to move toward 5.5% by the end of 2022.

- Zillow Vice President of Capital Markets Paul Thomas: Given current conditions and Federal Reserve guidance, mortgage rates are not likely to decline significantly in the near term.

Read Also: How To Stop Paying Pmi On Mortgage

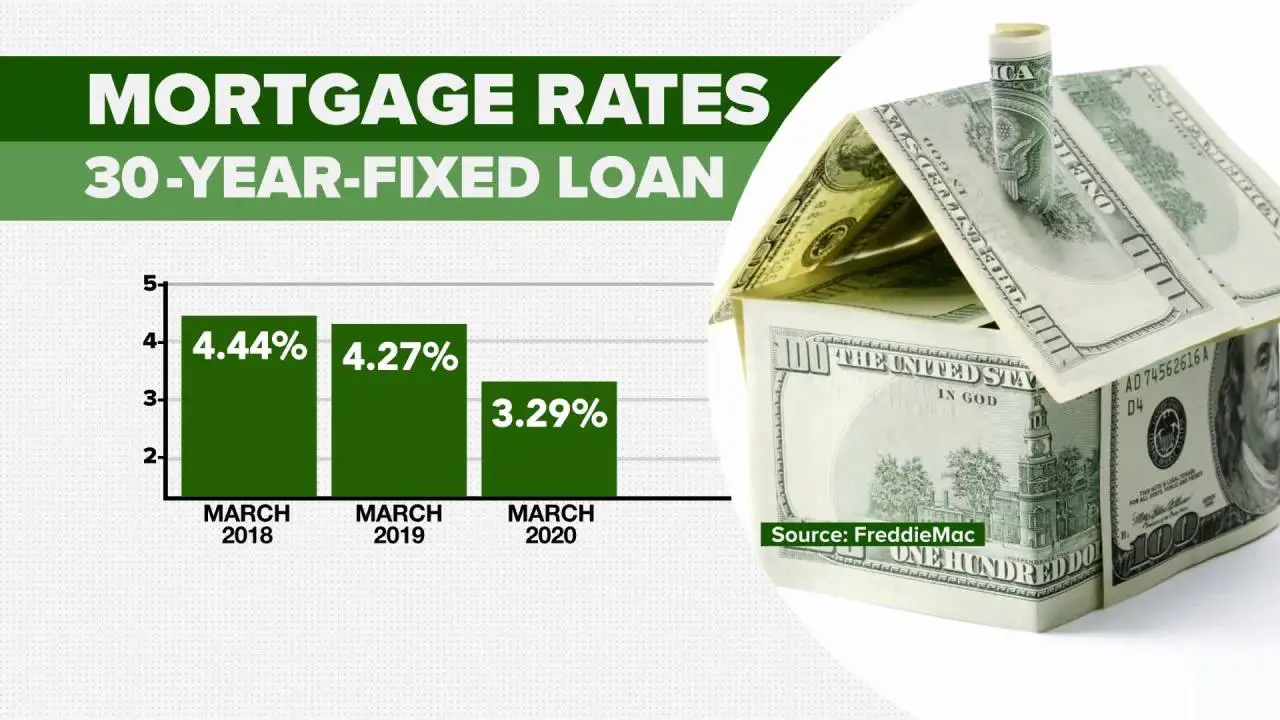

Mortgage Rates And The Pandemic

It looked like a puzzle: As the COVID19 pandemic spread, central banksincluding the Bank of Canadaquickly cut interest rates to cushion the blow. But rates on new mortgages didnt decline much, and some actually went up. Why?

Remember that your lenders funding cost determines most of the mortgage rate. The cost of funding jumped in the early days of the pandemic as investors became nervous. Many simply wanted to hold on to their cash given how uncertain everything was. So, the funding that is normally easy for lenders to get slowed to a trickle. This drove up the funding cost, even as the Bank of Canadas policy interest rate fell.

The Bank of Canada has taken many steps to help financial markets work better during the pandemic, along with the federal government and other public authorities. The goal is to ease strains in funding markets, so lenders can keep supplying credit to households and businesses.

These steps include launching programs to make sure lenders can access the funding they need. As a result of these actions, funding costs fell and some mortgage rates on new loans started to decline.

Keep in mind: existing mortgages didnt become more expensive during the pandemic. They either have an interest rate that is fixed until its next renewal, or a variable interest rate that declined along with the Bank of Canada policy rate.

Try To Boost Your Credit Score

Consumers may be able to improve their credit score in less than a month, said Daniel Rodriguez, chief operating officer at the wealth management firm Hill Wealth Strategies. Start by checking for discrepancies on your credit report that could make your debt situation appear worse than it actually is, he said. Also, if you have the cash, pay down your debts to reduce your debt-to-credit ratio.

Once you’ve taken positive steps to improve your credit, consider asking your lender to initiate a process called a rapid rescore as a way to get positive changes to your credit updated quickly typically within a week as opposed to 30 to 60 days.

“Anything helps. Even if it’s only five points, it could make a big difference,” said John W. Mallett, president of MainStreet Mortgage, a mortgage broker in Westlake Village, California.

Don’t Miss: How Much To Earn For 200k Mortgage