Speak With Your Home Loan Expert Or Lender

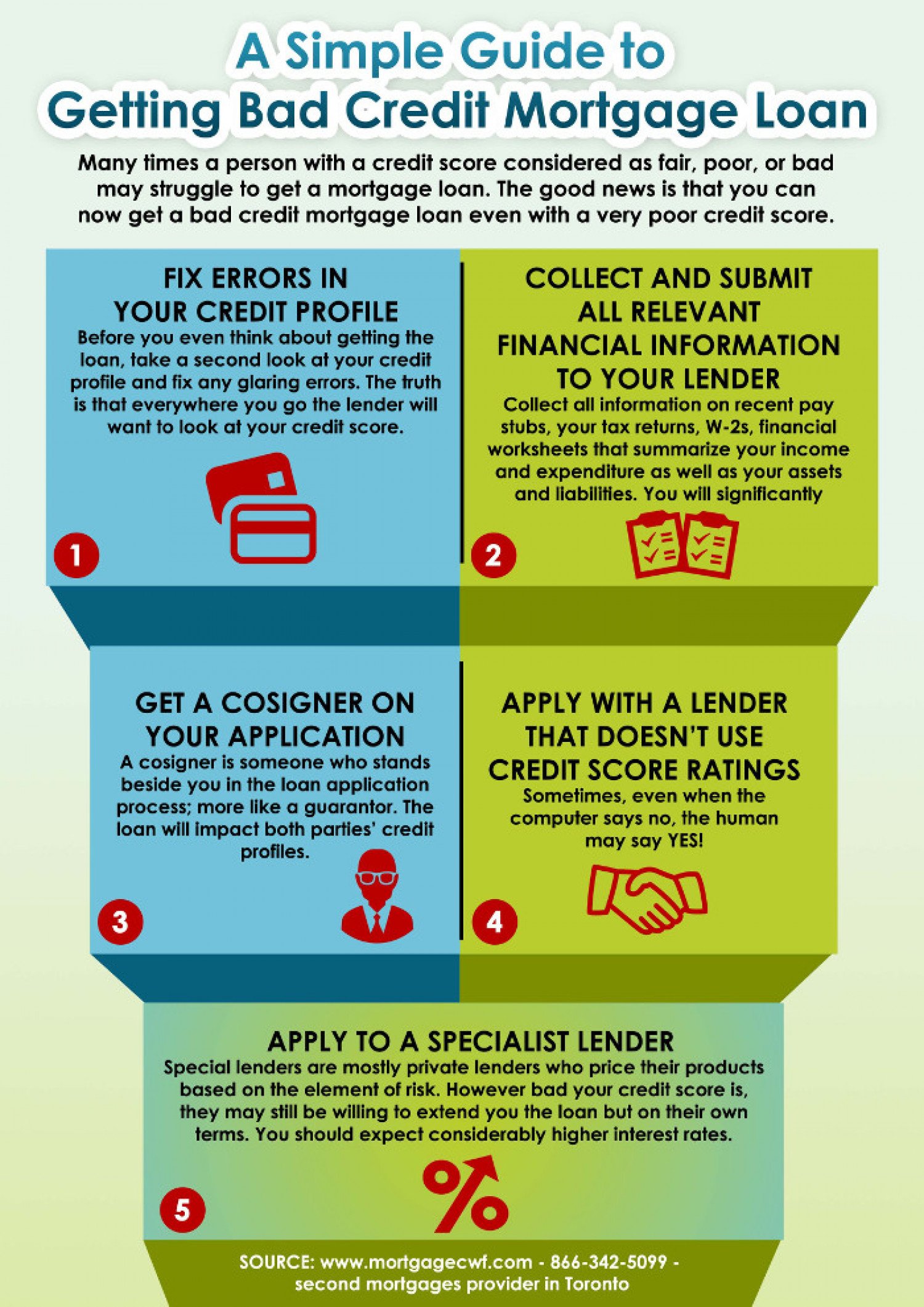

Explain the whole story of your credit issues to your Home Loan Expert or lender. Perhaps you have a high income, and your credit was damaged because of past mistakes, or you were a victim of identity theft.

Lenders can consider these factors and work with you to provide alternative solutions. Make sure you have income and financial documentation with you when you explain your credit issues, as these things may help you build a stronger case.

Can I Get Approved For A Home Loan With A 500 Credit Score

One of the first things a lender will do when you apply for a mortgage is check your credit score. This can range from 300 850 for base scores and from 250 900 for industry specific score.

The better your credit score, the more chance you have of qualifying for better rates. This is typically in the range of 700 or higher. If your credit score falls below this, you will find it more difficult to get a mortgage loan, and youll probably have to pay unfair rates for the ones you do qualify for. Though, if your score drops below 620, you could find yourself in the difficult position. To prevent this from happening, consider using a top credit monitoring service. This will safeguard your credit and let you know of any suspicious activity.

While it is possible to get a home loan with a score in the 600s, the CFPB warns that these loans tend to be attached to higher interest rates which could put you at risk of default. This is because if you are paying higher interest rates, then it will be more difficult to repay. For this reason, it makes sense to look into some of the leading credit repair companies and try to improve your credit before you buy a house.

Who Will Finance A Home With Bad Credit

While many mortgage lenders dont offer loans to people with bad credit, some lenders do lend to people with lower scores.

You may hear these types of loans referred to as subprime mortgages, which essentially means youre paying a higher interest rate than a prime mortgage because lenders see the loan as riskier. You may only have the option to take out an adjustable-rate mortgage where the rate can change over time.

While avoiding subprime loans is important because of the risks, finding an affordable mortgage with bad credit is possible.

Recommended Reading: What Is The Mortgage On 800k

Whats A Typical Bad Credit Mortgage Term Length

Bad credit mortgages are only meant to be used as a temporary stopgap measure while you get your finances in order. You wouldnt want to stay with a bad credit mortgage lender for long either. Thats why youll usually see bad credit mortgages with term lengths from 6 months to 2 years. Youll need to have an exit plan when applying for a bad credit mortgage so that you can transition back to aB lenderor A lender.

How Your Scores Are Calculated

|

How Your Credit Score is Calculated |

|

|

Payment History 35% |

Payment history is how well you pay your bills on time. This includes late payments and collection accounts. |

| 30% |

The amount of available credit you’re using is called your . Try to keep your credit utilization ratio below 25%. |

|

Length of Credit 15% |

The longer your accounts stay open, the better your score will be. Don’t close credit cards is possible. |

|

Types of Credit 10% |

A mix of credit accounts such as credit cards, auto loans, mortgages will help improve your credit score. |

| 10% |

When a lenders pulls your credit it creates a hard inquiry. Multiple inquiries hurt your score count against you for 12 months. |

Also Check: What Is A 30 Year Fixed Jumbo Mortgage Rate

Va Loan Requirements After Chapter 13 Bankruptcy Discharged Date

Most VA lenders will require a one-year to a two-year waiting period after the Chapter 13 Bankruptcy discharged date due to their lender overlays.

- There is no waiting period requirement after the Chapter 13 Bankruptcy discharged date to qualify for VA Loans

- If the Chapter 13 Bankruptcy discharge has been less than two years, it needs to be a manual underwrite

Timely payments during Chapter 13 Bankruptcy is required. Re-established credit is required. Capital Lending Network, Inc. has no waiting period requirements after the Chapter 13 Bankruptcy discharged date.

Best Mortgage Lenders Of 2021 For Low Or Bad Credit Score Borrowers

A home loan with bad credit is possible, even if youre a first-time home buyer. These low credit score mortgage lenders specialize in serving borrowers with credit challenges.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit score tells lenders how likely you are to pay back the money you borrow. A high score sends all the right signals, while a low credit score, sometimes referred to as bad credit, can keep you from getting approved. A bad credit score generally falls below 630.

The depends on the type of loan. Government-backed loan programs FHA, VA and USDA generally have lower credit score requirements than conventional mortgages. But its the lender that ultimately decides what the minimum credit score will be for each loan product.

If your is at or near a lender’s minimum, they could demand a bigger down payment, charge a higher interest rate or require you to pay more fees. In short, you could end up paying more for your home loan. The best way to avoid these penalties is to elevate your credit score before you apply.

Read Also: How Do You Know If You Can Get A Mortgage

What Is A Credit Score

In Canada, your is a number between 300 and 900 assigned to you by a credit bureau Canadas two major credit bureaus are Equifax and TransUnion. This number is used to tell lenders how youve dealt with available credit in the past. The higher your credit score the better, because a high credit score helps you qualify for the lowest possible mortgage rates.

| Score |

*These categories will vary by lender

What Does Your Credit Score Mean

Your credit score is a number that reflects your creditworthiness. Banks, credit unions and other financial institutions use your credit score to determine your risk level as a borrower. To calculate your credit score, credit bureaus use formulas that weigh factors like:

- How many loan and credit card accounts you have and the remaining balances

- The age of your loan and credit card accounts

- If you pay your bills on time

- How much debt you have

- The number of times you’ve recently requested more credit

It’s easy to assume that you have just one credit score, but that isn’t the case. In fact, several organizations have their own credit scoring models. Lenders may rely on one or more to assess your creditworthiness, but mortgage lenders typically use the Fair Isaac Corporation model.

Lenders use credit scores to determine which home loans borrowers qualify for. In most cases, borrowers with a high credit score are eligible for home loans with lower interest rates and more favorable terms.

Read Also: Who Has The Best Mortgage Loan Rates

Check Your Credit Report And Credit Score

Your first step toward getting a mortgage with bad credit is to find out exactly what information is contained in your credit report . You can do this by requesting a copy of your from one of the three major credit bureaus Experian, Transunion or Equifax.

You would normally be able to get one free credit report per year from each one of the credit bureaus. However, because of the economic impact of the pandemic, you are able to request a free weekly report until April 2022.

Learning to read your credit report is important because youll be able to verify that all the information included is correct. If you do spot errors, you can remove items from your credit report, which can provide a boost to your score.

Your next step is to find out what your credit score is. You can buy this information from any of the credit reporting bureaus, but you can also get it for free from sites such as Credit Karma. Some credit card and bank loan statements will also include the information at no cost.

Va Mortgage: Minimum Credit Score 580

VA loans are popular mortgage loans offered toveterans, service members, and some eligible spouses and military-affiliated borrowers.

Withbacking from the Department of Veterans Affairs, these loans do not require a down payment, nor any ongoing mortgageinsurance payments. They also typically have the lowest interest rateson the market.

Technically, theres no minimum credit score requirement for aVA loan. However, most lenders impose a minimum score of at least 580. And many startat 620.

Similar to FHA loans, VA loans dont have risk-basedpricing adjustments. Applicants with low scores can get rates similar to thosefor high-credit borrowers.

Don’t Miss: What To Expect When Applying For A Mortgage Loan

Va Loan Credit Score Requirements

VA loans have the most generous credit score requirements: theres no minimum credit score. No other mortgage offers this benefit, but these loans are only open to eligible military service members, veterans and surviving spouses.

Like FHA loans, theyre more forgiving of negative credit events, but again, lenders can set their own minimums and might require a higher score. The average homebuyer who closed on a VA loan within the last year and a half had a credit score in the low 700s.

Financing Options To Consider

Because bad credit home loans can charge high interest rates, borrowers like to do what they can to keep those rates down. One way to do this is with an adjustable-rate mortgage . With an ARM, you get a lower initial interest rate than on a fixed-rate mortgage

The initial rate is typically locked in for a period of 3-7 years, after which it begins to readjust to reflect the current market for mortgage rates. That means your rate could go higher. But if you’ve kept up with your mortgage payments and other bills, your credit will have improved and you should be able to refinance to a fixed-rate loan without a bad-credit rate adjustment added in.

You want to be sure your financial situation is stable before committing to an ARM, since you don’t want to get stuck with it if another blow to your credit should prevent you from refinancing down the road. However, if you see possible financial problems ahead, you probably shouldn’t be buying a home in the first place though it still might make sense to refinance your current one.

Don’t let less-than-sterling credit make you give up your dream of homeownership before you start. You do have options. Research your choices and do some homework. Your dream could be closer to a reality than you realize.

Don’t Miss: What Is Mortgage Debt To Income Ratio

Whats The Lowest Credit Score For A Mortgage

Theres no cut-off credit score you need to achieve to get a mortgage. Thats because theres no such thing as a single credit score that all lenders use. When you apply for a mortgage, the lender will look at your credit record and apply its own credit scoring.

But there are some things you can do to improve your credit score with all lenders:

- Pay utility bills on time

- Dont miss any repayments for loans or credit cards

- Pay off loans and credit cards if you can Close down unused credit, for example a credit card you no longer use

- Get on the electoral register

How Are Mortgage Rates Set

Mortgage rates are determined based on economic conditions and individual factors. Lenders look at factors such as the prime rate to calculate their rates. The prime rate usually follows the Federal Reserves federal funds rate.

Lenders also look at market trends from the 10-year Treasury bond yield. Mortgage rates usually go down if the yield goes down, and vice versa. Borrowers can use the 10-year Treasury yield to gauge mortgage rates because most home loans tend to be paid off or refinanced after 10 years.

Individual factors that influence how lenders set mortgage rates include your credit score and the amount of debt you have. Lenders look at credit scores to determine how risky a borrower may bethe lower the score, the higher the risk, reflected in a higher rate. Lenders also look at whats called a debt-to-income ratio, or DTI, to determine whether a borrower can afford mortgage payments. This ratio looks at the percentage of debt payments you have compared to your gross income. Most lenders dont want a DTI higher than 43%.

You May Like: Should I Take Out A Mortgage

How Can You Maintain Your Credit Score Once Its Fixed

After taking the time and effort to raise your credit score, make sure you do everything in your power to keep it up or get it even higher!

You might not be looking for another loan or line of credit at the moment, but you never know what your financial future will look like. Perhaps you rent an apartment now, but want to buy a house further down the road.

What Is A Good Mortgage Rate For Bad Credit

A good mortgage rate for borrowers with bad credit will depend on individual factors such as income, debts, down payment amount, and credit history. Lenders tend to advertise the lowest possible rates offered to encourage borrowers to contact them, so your quoted rate may be higher than what you see advertised.

Recommended Reading: Do You Have To Pay Fees To Refinance A Mortgage

Home Possible And Homeready Loans

The Home Possible and HomeReady loan programs were created for low-income first-time homebuyers. To qualify, you need a 620 or higher credit score, and your income cannot exceed 100% of the median income in the area. They are exclusively for first-time homebuyers and require a 3% down payment.

- 620 credit score required

- Income must be below 100% of AMI

What Types Of Home Loans Are Available For Those With Bad Credit

While there are bad credit loan options out there for other purposes, bad credit mortgage loans can be more tricky to work out. To start, we suggest you avoid a subprime loan because of its risks. Here are the details of some viable alternatives if you are looking for a mortgage with bad credit:

Read Also: How Many Times Can Refinance A Mortgage

Loan Options For Buying A House With Bad Credit

Recently, the median FICO Score for newly originated mortgages hit 786, which is higher than the average credit score. Fortunately, buyers with scores well below those numbers or with adverse events in their credit history can pursue homeownership through one of these low credit score home loans.

| Loan Program |

*Some programs may permit a higher DTI under certain circumstances.

What Type Of Mortgage Can I Get With Bad Credit

While some lenders make conventional loans to home buyers with bad credit, you will often secure more affordable financing if you get a poor credit mortgage insured by a government agency. These mortgages not only have relaxed credit requirements but also require lower down payments than most conventional mortgages do.

There are three primary options for government-backed loans that could be available to borrowers looking for bad credit mortgage loans.

Also Check: What Documents Are Needed To Get Pre Approved For Mortgage

Are Interest Rate And Apr The Same

Interest rates and APRs are not the same. The interest rate is the base cost of what youll pay to borrow money. An annual percentage rate, or APR, includes fees in addition to the interest rate associated with your mortgage. Fees for home loans can include application fees, origination fees, broker fees, mortgage points, and lender credits.

The APR tends to be higher than the interest rate because of these additional fees. If you get quoted an APR thats close to the interest rate, that means the lender isnt charging you as many fees compared to lenders who have a higher APR.