Movement Mortgage Best For Quick Closing

Overview

The South Carolina-headquartered Movement Mortgage was founded in 2008. Its a licensed mortgage lender in all 50 states and has over 650 branches nationwide.

What to keep in mind

It offers all of the most popular types of mortgages from conventional loans to FHA loans, and niche options, such as reverse mortgages. But if you want any type of home equity loan or line of credit, youll have to go with another lender.

Movement Mortgage prides itself on quickly closing loans, and claims that 75% are closed within seven business days. It also gives a large amount of its profits to charity.

Bmo Homeowner Readiline Line Of Credit

BMO customers who want to access the equity in their home can do so with BMO’s Homeowner ReadiLine line of credit.

This readvanceable HELOC allows homeowners to access up to 80% of the value of their home. Those funds can then be used for everything from home improvements/renovations or consolidating high-interest debt, to funding a business and investment purposes.

Like all other banks, a HELOC requires the homeowner to have at least 20% equity in the home and only 65% of the home’s value can be in the form of a revolving line of credit. Payments on the line of credit can be as low as interest-only. You can also have locked-in portions that are just like regular mortgages.

The best part about having a mortgage in a ReadiLine is readvanceability. That means, as you pay off the mortgage portion, those funds are available to reborrow from the line of credit portion. This can come in handy as a low-cost source of funds for investing, a second property down payment, etc.

More Than The Monthly Payment

If youre trying to figure out how much to spend on a home, remember that theres more to your home purchase than the monthly mortgage payment.

Taxes and insurance are often added to your monthly payment automatically. Your lender collects funds from you, places the money in escrow, and pays required expenses on your behalf.

Homeowners Association dues might also be a significant monthly expense. Those costs cover a variety of services in your community or building, and skipping those payments can lead to liens on your property, and potentially even foreclosure.

Other costs of homeownership can be surprisingly high. You might not pay those expenses monthly, but its helpful for some people to budget for a monthly savings amount for those costs. You need to maintain your property, replace appliances periodically, and more.

Some people suggest a budget of 1% of your property value each year for maintenance. But its easy to go higher than that, especially with older properties. If you need to buy furniture or make upgrades before moving in, you face additional up-front costs.

You May Like: Can You Refinance To A 10 Year Mortgage

Is It Worth Working With A Mortgage Broker

There are advantages to getting a mortgage directly from a lender as well as getting a mortgage through a broker, but there are differences. While going directly to your current bank lets you consolidate your financial products, using a broker allows you to shop around quickly and easily, at no cost to you.

Luckily, you donât need to choose one of the other. You can speak to multiple banks and multiple mortgage brokers if you want to. Ratehub.ca is a great place to start, as we compare the best mortgage rates in Canada from multiple lenders and mortgage brokers. Once youâve compared your options, we can put you in contact with your chosen provider.

Gather Info On Your Income And Employment History

Lenders generally want to see two consecutive years of steady income and employment to ensure you can afford your mortgage payments and repay the loan over the long haul. If youre a salaried employee, lenders ask for W2 forms and federal tax returns for the past two years to verify your income. Lenders also check with your employer to verify how long youve worked there. If your earnings have gone down or youve had gaps in employment in the last two years, lenders are skeptical of your ability to afford a mortgage and you might have trouble getting a mortgage preapproval.

Similarly, self-employed borrowers have to jump through more hoops to get a mortgage. If you are self-employed, expect to pay higher interest rates than what you see online those rates are for borrowers who are considered more creditworthy because of their steady, verifiable incomes and excellent credit scores. Lenders also generally have stricter rules for verifying self-employment income. Not only will you need to provide federal tax returns for two years, youll also need to submit a signed statement from an accountant, a profit/loss sheet, and other documentation to show sufficient business income.

You May Like: Is A Home Equity Line Of Credit Considered A Mortgage

What Drives Changes In 10

Fixed mortgage rates follow government bond yields, with 10-year fixed rates following 10-year government bond yields. Bond yields are driven by economic conditions, and the spread between bond yields and lender-posted mortgage rates vary by a lender’s marketing strategy and general credit market conditions.

Comparing The Best Mortgage Rates In Ottawa

The tables on this page list the up-to-the-minute best rates currently available from Ottawa mortgage brokers, big banks, and other mortgage providers. Having them all in one place makes it harder to miss out on a great deal.

Keep in mind that your personal rate could be different than the ones in the table above. This is because the rate your qualify for is affected by a lot of factors, including your credit score, down payment, as well as the purchase price of the property and what it will be used for.

To properly understand what rates you’re likely to be approved for, you’ll need to source quotes that are tailored to your actual financial situation. We can help you get personalized quotes from multiple lenders in just a couple of minutes. Use the tools at the top of this page to get started.

You May Like: How Much Can You Get On A Reverse Mortgage

What Is A Mortgage

A mortgage is a type of secured loan provided by a financial institution to cover the cost of buying a home should you not have enough cash to pay for it upfront. You pay back the lender over an agreed-upon amount of time, including an additional interest payment, which you can consider the price of borrowing money.

Because a mortgage is a secured loan, it means you put your property up as collateral. Should you fail to make your payments over time, the lender can foreclose on, or repossess, your property. Learn more about how a mortgage works here.

Consider Private Mortgage Insurance

Though they do count towards the overall cost of your mortgage, closing costs are a one-time hit. But there’s another bite that keeps on biting. If your down payment is less than 20%, youre considered a higher risk, and you may be required to carry private mortgage insurance, or PMI.

This makes you a safer bet for the lender. Trouble is, you’re the one paying for itto the tune of 0.5% to 1% of the entire loan each year. That can add thousands of dollars to what it costs to carry the loan. If you do end up having to pay for PMI, make sure it stops as soon as you’ve gained enough equity in your house to be eligible.

Don’t Miss: How To Remove Pmi From Your Fha Mortgage

How Much Can I Save Comparing 10

Your mortgage is likely to be the largest financial commitment youll ever make, and getting a better rate can save you thousands over a 10-year term. Even a slightly lower mortgage rate can result in big savings, especially early on in your mortgage.

For example, on a $500,000 mortgage with a 25 year amortization period, a rate of 3.00% would see you pay $127,033 interest over 10 years. With a 2.75% rate youd pay $115,980 interest over the term. So, a difference of just 0.25% can save you $11,053 over your 10-year term.

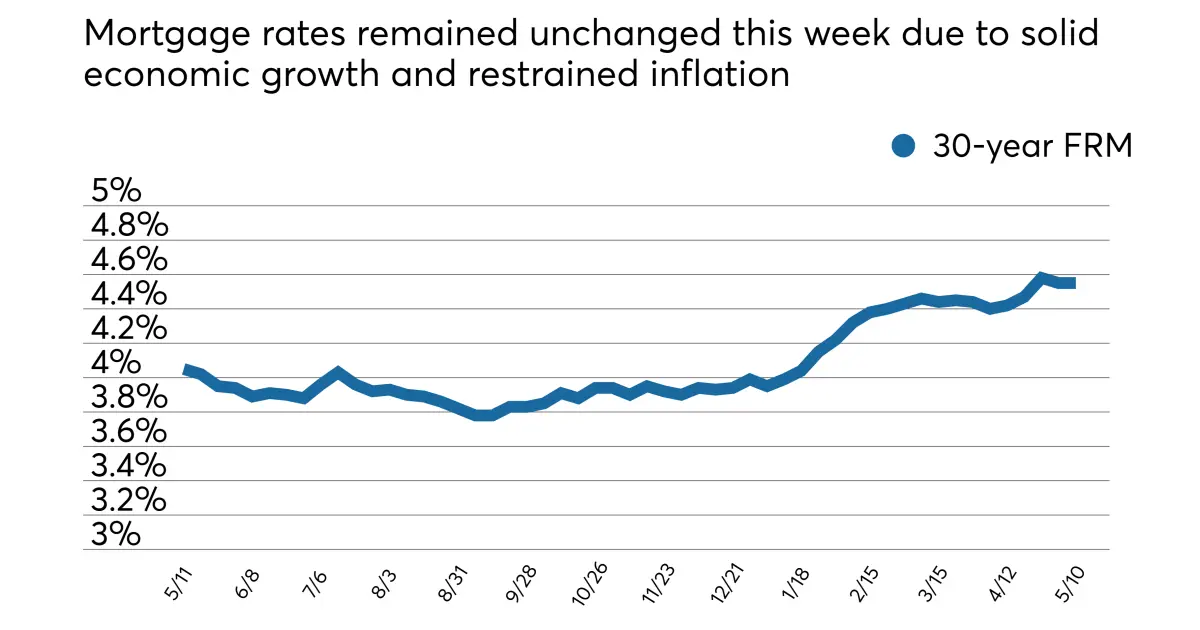

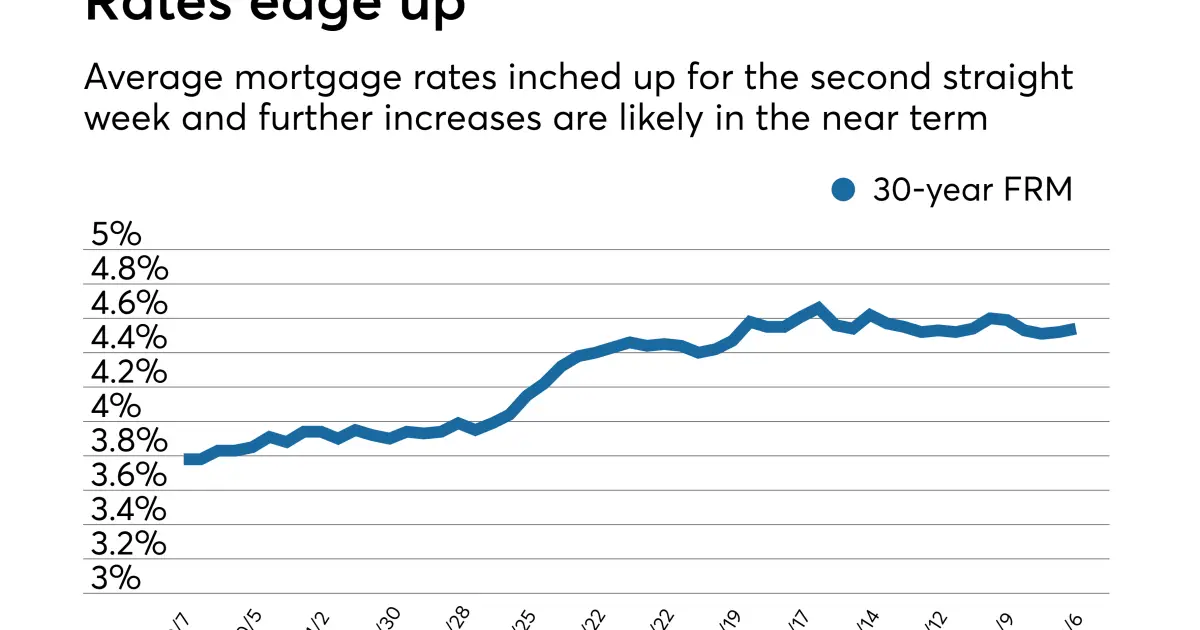

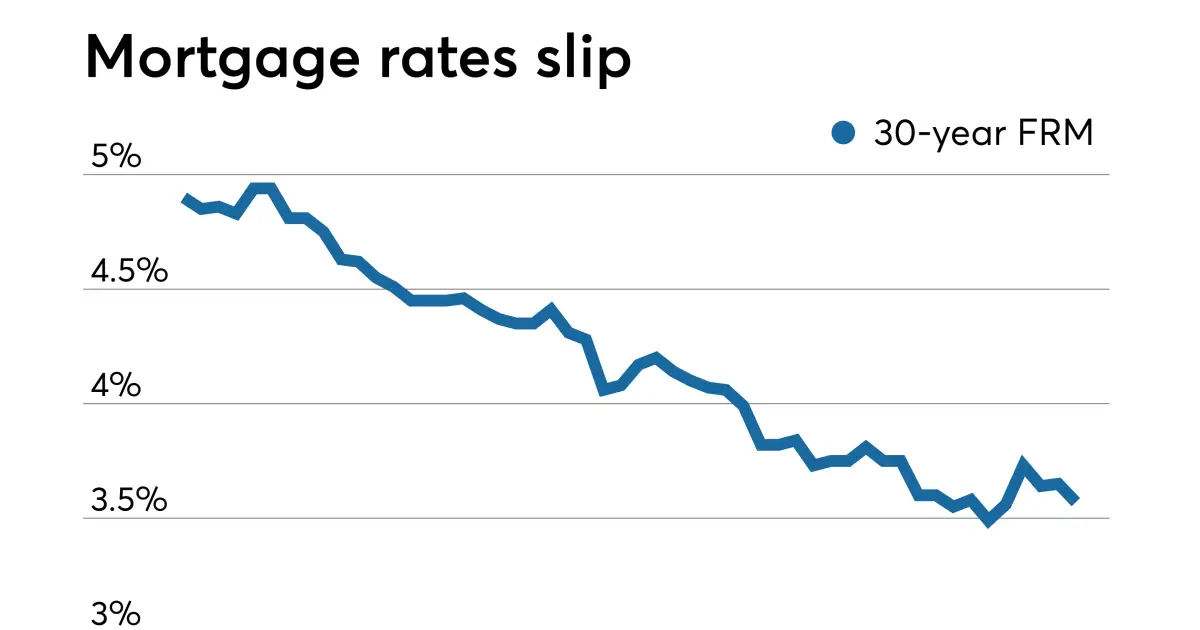

Current Mortgage Rate Trends

The mortgage or refinance rate you get depends a lot on your personal finances, and well explain why below. But overall mortgage rates provide the context for your personal rate.

Average mortgage rates have been low for months. This climate has allowed the most qualified borrowers to access historically low rates. But theres no guarantee rates will remain low in 2022 and beyond.

To see where 30-year mortgage rates may be going, lets check where theyve been:

Average mortgage rates by loan type

| 3.13% |

Where will rates go from here? No one can predict the future, but most experts including Freddie Mac and Fannie Mae anticipate a gradual increase in rates going into 2022.

Don’t Miss: Does Mortgage Prequalification Affect Credit Score

Comparing The Best Calgary Rates Vs Banks

If youre a Calgarian in the market for a mortgage, you might be considering a mortgage from your bank thinking the convenience of having all your accounts in one place seems appealing. Well, you might want to think again.

These days, roughly 90% of consumer banking is done online and banks no longer have a monopoly on convenience. In fact, youd be remiss to complete the mortgage process without first comparing rates. There are two key reasons for this: its easy, and it can save you a bundle of money.

If you compare Calgarys best mortgage rate against the worst rate, that difference can span a full percentage point or more. If you took the first offer from your bank at the mid-part of that range, youd be leaving thousands of dollars on the table given an average size mortgage.

Its a well-known fact that Canadas big banks are not the most transparent companies when it comes to pricing mortgages. Getting the best rate in Calgary truly requires legwork and comparison. That said, banks do tend to have lower pricing on uninsured mortgages and HELOCs versus competitors.

One option is to work with a mortgage broker. Theyll shop several lenders for you to find you the best mortgage rate in the city. But keep in mind brokers dont get paid from all lenders, so they wont offer a comprehensive market picture.

Average Mortgage Interest Rate By Year

Mortgage rates are constantly in flux, largely affected by what’s happening in the greater economy. Generally, mortgage interest rates move independently and in advance of the federal funds rate, or the amount banks pay to borrow. Things like inflation, the bond market, and the overall housing market conditions can affect the rate you’ll see.

Here’s how the average mortgage interest rate has changed over time, according to data from the Federal Reserve Board of St. Louis:

| Year |

Recommended Reading: How To Get A Second Mortgage To Buy Another House

Determine What Mortgage Is Right For You

When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget. Most borrowers opt for 30-year mortgages, but thats not the only choice. Typically, 15-year mortgages have lower rates but larger monthly payments than the more popular 30-year mortgage. Adjustable-rate mortgages usually have lower rates to begin with, but the downside is that youre not locked into that rate, so it can change over the life of your loan.

Who Determines Interest Rates

Interest rates are typically determined by a central bank in most countries. In the United States, a forum is held once per month for eight months out of the year to determine interest rates. At this time, the economic status of the country is assessed, and interest rates are adjusted according to the needs of the country. The panel that determines interest rates consists of representatives of the Federal Reserve Board and the Federal Reserve Bank. Together, the representatives from both form the Federal Open Market Committee.

You May Like: Is A Reverse Mortgage Good Or Bad

Where Can I Compare Mortgage Interest Rates

There are many price comparison sites that allow you to compare mortgage interest rates, based on your own personal criteria.

It’s important, however, to not focus solely on the rate that a lender offers, but the total cost of the mortgage across the term of the deal. This way, you’ll factor in any fees and cashback associated with the deal as well as the interest being charged.

This is where the APRC can help.

How Do I Get The Best Mortgage Interest Rate

The right deal for you will depend on your circumstances and what you want from a mortgage. In most cases you’ll need to meet certain conditions to qualify for the most competitive rates on offer.

Follow these steps to increase your chances of getting a great deal:

- Have a good credit record. Lenders are very thorough in checking your credit history when assessing your application – they want to know that you are good at repaying debt, so the better your credit score, the better your chances of being approved. Find out more in our guide to how to improve your credit score.

- Build a bigger deposit. The best rates are reserved for people borrowing at a lower loan to value ratio – i.e. borrowing a relatively small percentage of the property price. You can achieve this by saving a bigger deposit, or, if you already own a property, increasing your equity by paying down your mortgage each month.

- Shop around. There are dozens of different mortgage lenders, from the big, high-street names you are familiar with to challenger brands that are exclusively online. Each will have a range of different products on offer, and it pays to take time working out the most suitable deal for you.

- Use an independent, whole-of-market mortgage broker. Not only are mortgage brokers familiar with the different products on offer and able to advise on the lenders most likely to accept you, but they have access to mortgage deals which you can’t get by applying directly.

You May Like: Does Rocket Mortgage Use Fico 8

Pay Attention To Mortgage Insurance

If your down payment is less than 20% of the purchase price, youll typically have to pay private mortgage insurance . And those premiums can add significantly to your monthly payments.

The cost of mortgage insurance will be reflected in your APR but not in your interest rate. The same goes for the mortgage insurance premiums on an FHA loan.

So make sure you learn about the cost and benefits of mortgage insurance before you commit to a loan.

Tips On Finding The Best Toronto Mortgage Rates

Just like any other city, getting the lowest mortgage rates in Toronto requires comparison shopping. One cannot rely on just one lender or one mortgage broker if they want to get the best deal.

The right place to start is with a good mortgage rate aggregator . That way, you see a large representation of the mortgage market, all at once. Its especially important to focus on rate sites that show all top lenders. Unlike rates.ca, most others dont.

If youre looking for a good roadmap to finding deals, heres a simple four-step process to securing the mortgage with the lowest borrowing costs:

1. Get solid advice on the right mortgage term given your five-year plan

- The term you pick has a huge effect on your interest costs

- You can get this advice online or in-person

- It never hurts to talk to an experienced mortgage advisor, but dont put too much weight in their opinions because some bankers and brokers have a bias to one term

2. Identify the lowest rates for that term

- You can easily do this on a rate comparison website

- Read the rate notes carefully because some of the cheapest rates come with lots of fine print and restrictions

3. Ask them to list all material features and limitations of the rate in question

- Things like the prepayment penalty calculation method, porting rules and refinance options can enormously impact your borrowing costs

- Pick the mortgage with the best combination of upfront interest savings and after-closing flexibility

Read Also: What Required To Refinance A Mortgage

What Is The Best Mortgage Loan Type

The best mortgage is the one that helps you meet your housing needs for as little financing costs as possible. There are a few factors to consider when it comes to getting the right mortgage.

Some experts recommend getting a 15-year mortgage because youll pay far less interest and be debt free in half the time compared to a 30-year loan. With a 30-year loan, your monthly payments can be significantly lower, but youll pay much more in interest over the course of your term. So its a tradeoff.

There are also tradeoffs in choosing a government-backed versus a conventional loan. For example, FHA mortgages can have lower credit score requirements than conventional loans. But unlike conventional loans, FHA loans require mortgage insurance even if your loan-to-value ratio drops below 80%.

If you want a set interest rate for the life of the loan, and more stable monthly payments, then a fixed-rate mortgage is ideal. The interest rate on a fixed-rate mortgage never changes. In exchange for this security, the rate can be a bit higher than with a similar adjustable rate mortgage . ARMs have a set interest rate for a certain number of years , and then the rate adjusts annually. An ARM might make sense if you plan on refinancing your mortgage in the future, or you might sell the house before the rate adjusts.

How To Find The Best Mortgage Rates

Looking for the best mortgage rates? A great place to start is a mortgage calculator, which lets you estimate your monthly house payment and get a better sense of how much house you can afford. Armed with that knowledge, you can narrow your home search and find the right mortgageand the best rates.

Also Check: Why Is My Mortgage Not On My Credit Report