How To Calculate Your Monthly Mortgage Payment

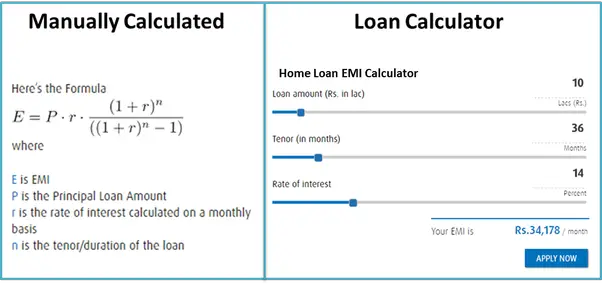

You can calculate your monthly mortgage payments using the following formula:

M = P /

In order to find your monthly payment amount “M,” you need to plug in the following three numbers from your loan:

- P = Principal amount

- I = Interest rate on the mortgage

- N = Number of periods

A good way to remember the inputs for this formula is the acronym PIN, which you need to “unlock” your monthly payment amount. If you know your principal, interest rate and number of periods, you can calculate both the monthly mortgage payment and the total cost of the loan. Note that the formula only gives you the monthly costs of principal and interest, so you’ll need to add other expenses like taxes and insurance afterward.

Also keep in mind that most lender quotes provide rates and term information in annual terms. Since the goal of this formula is to calculate the monthly payment amount, the interest rate “I” and the number of periods “N” must be converted into a monthly format. This means that you must convert your variables through the following steps:

Example

N = 30 years X 12 months = 360

How To Calculate Your Home Loan Repayments

To find how much a lender will likely charge you per month for a home loan, including principal and interest, you can use a slightly more complex variation of the previous formula:

P x x n ÷ )n -1)) = A

I promise, its simpler than it looks.

So, using the previous example of a $500,000 loan to be repaid in monthly instalments at an annual interest rate of 3 per cent over a term of 30 years , heres what this would look like:

$500,000 x 360 ÷ 360 -1)) = A

Whipping out a calculator to handle some of the operations , we get

$500,000 x = A

Which gives us

$500,000 x 0.004216040337289 = $2108.02

This means that by paying around $2108 per month for 30 years, youll be able to gradually pay off not only your home loan, but the lenders interest charges.

While more than half of your initial monthly repayment will be made up of interest charges , this will change over time, as each repayment shrinks your mortgage principal, little by little.

If you make extra repayments onto your mortgage, such as when you get a tax refund, or your variable interest rate falls but you keep making the same higher repayments, they will go directly onto reducing your mortgage principal. The faster you can shrink your principal, the more you can lower your interest charges, potentially saving you more money and helping you pay off your property sooner.

How Credible Mortgage Rates Are Calculated

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage rates. Credible average mortgage rates and mortgage refinance rates are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage rates will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Read Also: How Much Per 1000 On Mortgage

And How Do Investors Determine How Much The Rate Of Inflation Will Be

Investors have certain expectations of inflation. And that expectation is typically linked with the rate of economic growth in a country

For countries like the US, Japan and Germany, that are fairly well developed, those rates of economic growth are not that high. Citizens of these countries already own a lot of what they need, to live comfortably. So they dont end up buying a lot more every year.

On the other hand, for developing countries like China and India, where economies are expected to expand a lot more in the coming years, there is more expectation of growth. A large fraction of the population dont already own what they need, to have good lifestyles. So there is significantly more scope for economic activity and growth. As a result, rates of inflation in these countries are higher.

How Do Lenders Calculate Your Mortgage Rate

Would you believe it if we told you that the biggest determinant of your mortgage rate has nothing to do with your own financial situation? That is a surprise to many who hear about it. But it is true. Here we explain what that factor is and then talk in detail about all the other major factors.

We have been hearing a very common question lately: The Fed has dropped the mortgage rates to zero. Will my mortgage rate go down as well? Its a very obvious question to ask. Mainly because from past experience, people have observed that the two do move together, at least somewhat.

What many may not know is how the two are related and connected. Additionally, people also wonder why their mortgage rate is higher while someone else they know is getting a lower rate, even though both have approximately the same credit scores.

The truth is that there are so many factors that go into how your mortgage rate is calculated that it often becomes complicated for one to understand. Lets take a closer look and understand how it all works.

Also Check: How To Get A 15 Year Fixed Mortgage

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

Read Also: Who Should You Get A Mortgage From

A Quick Primer On Repayment Vs Interest Only Mortgages

There are two main types of mortgage: repayment and interest only. Both types usually assume repayment of the capital over the length of the mortgage, which in and of itself is usually twenty-five to thirty years.

Interest only mortgages tend to be most popular for buy to let purchases or investment properties. The main benefit of these types of mortgages is that monthly repayments tend to be relatively low since you will only be paying off the interest and not any capital in the property. Characteristically, repayment is via an arrangement with a pension plan or investment savings scheme. With a few exceptions, the number of home loans of this type has declined over recent years due to lenders concerns about inadequate repayment planning.

In contrast, monthly repayment mortgages look to progressively reduce the outstanding loan balance to zero by the end of the mortgage term. To achieve this, each payment includes some capital as well as interest. During the first few years of the mortgage term, a large portion of the monthly payment amount relates to interest charges. As mortgage payments progress, the proportion of interest decreases. Correspondingly, the ratio of capital repayment increases until in the final year or two, almost all the monthly payments relate to repaying the principal loan.

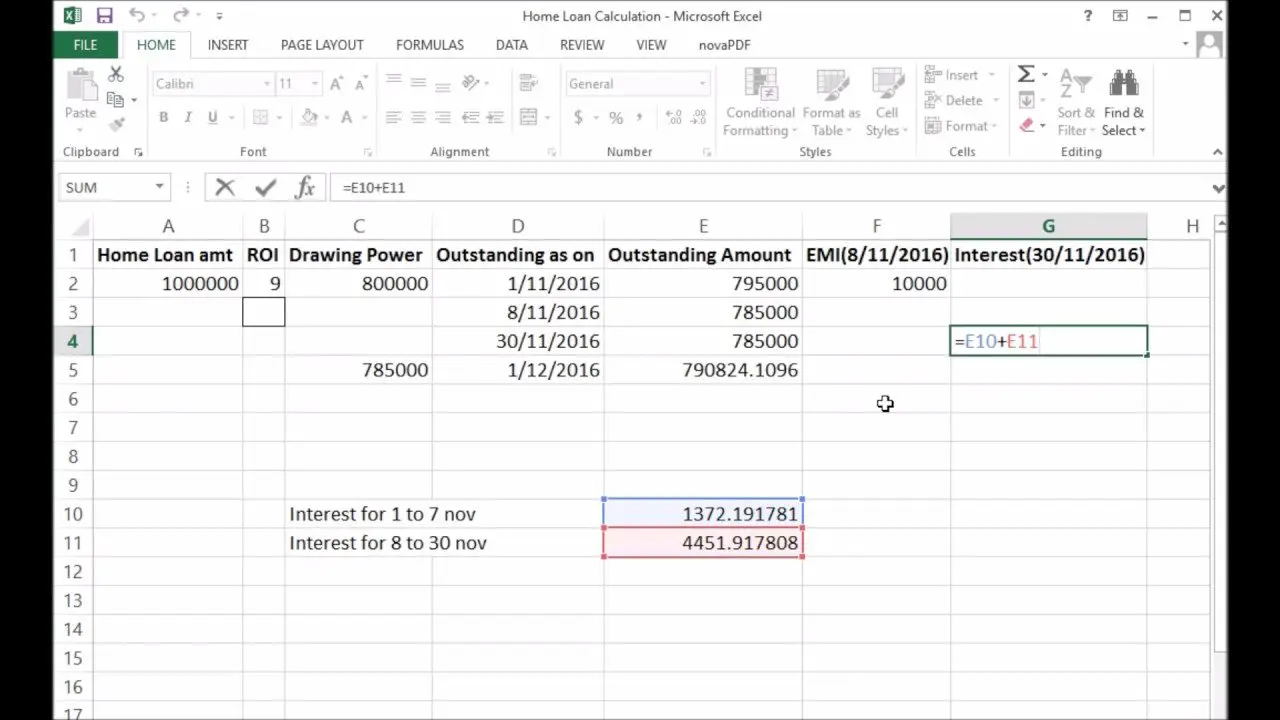

Daily Interest And Annual Interest Mortgages

As mentioned, most lenders work out your interest on a monthly basis and advertise the rate on an annual calculation.

With a daily interest or simple interest mortgage, interest will be added to your balance each month based on the number of days in the coming month.

Youâll see a decreasing monthly balance which will take into account the amount you paid last month and the amount of interest added for the coming month. Thereâs not a huge amount in it between daily and monthly interest, with the difference between the longest and shortest month being just 3 days.

On an annual interest mortgage, your lender will take your balance on 31st December of the previous year, calculate the amount of interest they expect you to pay in the coming year, and divide that amount by 12.

In the first year of your mortgage, theyâll take the balance from the date they lend it to you and calculate what they expect you to have to pay until 31st December.

Don’t Miss: What’s An Average Mortgage Interest Rate

How The Fed’s Actions Affect Mortgage Rates

When the Fed cuts interest rates, especially by a large or repeated percentage-point drop, people automatically assume that mortgage rates will fall.

But if you follow mortgage rates, you will see that most of the time, the rates fall very slowly, if at all. Historically, when the Feds have dramatically cut rates, mortgage rates remain almost identical to the rates established months before the cut as they do months after the cut. The Feds moves arent totally irrelevant, though. They tend to have a delayed and indirect impact on home loan rates.

For example, when investors worry about inflation, this concern will push rates up. When Congress wants to stimulate action and raise money for a deficit, it will create more U.S. Treasuries for folks to buy. This added supply of new Treasuries can also cause mortgage rates to move higher.

Even more crucial is when a buyer is in the process of making a decision whether to lock a loan just before a Fed rate cut. Say a buyer is in a contract and is thinking the Fed is going to lower rates next week. The buyer might be tempted to wait before locking the loanbig mistake.

Is There Anything Else That Lenders See As Risk

There is one more risk that the lenders end up facing. The risk of you prepaying the loan.

What? Why is that a risk? As a lender, wouldnt I be happy if the money is paid back in full and before time? In full, yes. All lenders love that. But before time, not really.

Banks and other lenders are in the business of making loans. The original principal is what they owe to depositors. Their revenue solely comes from the interest you pay them. If you pay back early, they will not be earning interest from you any more.

One would ask, well they can make a new loan and start earning interest again. A very fair point.

Unfortunately, people prepay and refinance their loan only when interest rates go down. For a bank to be paid the loan amount in full is bad because the new loan the bank will make will be at a lower rate than what you were paying him so far.

This type of risk is called reinvestment risk. Because most mortgages in the US dont have a prepayment penalty associated with them, people can refinance whenever rates fall. So lenders face that risk. Unfortunately, no one refinances when rates go up to make it even for the lenders.

That risk is not with specific borrowers only. Its a risk they face with all borrowers in general. If borrowers were prohibited from early payment, all of us would have had slightly lower mortgage rates. But most borrowers are fine to have the option to prepay for a small cost in the form of a slightly higher mortgage rate.

Read Also: How To Determine Ltv Mortgage

Looking For A Mortgage

Mojo Mortgages has been voted the UK’s best mortgage broker. Let’s get you the best rate you can… for free, all from the comfort of your sofa.

Put simply, an interest rateâs how much it costs to borrow the cash. Most mortgage interest rates are annual rates, however interest is calculated monthly, but itâs quite simple to work out how much youâll pay in interest:

Letâs look at a 3% rate on a £150,000 loan:

- Convert the rate into a decimal = 0.03

- Divide it by 12 because we are looking for the monthly interest = 0.0025

- Multiply .0025 by the loan £150,000 = £375

And thatâs what youâll pay in interest each month. Sort of…

Looking To Lower Your Home Insurance Rate

A home insurance policy can help cover unexpected costs you may incur during homeownership, such as structural damage and destruction or stolen personal property. Coverage can vary widely among insurers, so its wise to shop around and compare policy quotes.

Credible is partnered with a home insurance broker. If you’re looking for a better rate on home insurance and are considering switching providers, consider using an online broker. You can compare quotes from top-rated insurance carriers in your area it’s fast, easy and the whole process can be completed entirely online.

Have a finance-related question, but don’t know who to ask? Email The Credible Money Expert at [email protected] and your question might be answered by Credible in our Money Expert column.

As a Credible authority on mortgages and personal finance, Chris Jennings has covered topics that include mortgage loans, mortgage refinancing, and more. Hes been an editor and editorial assistant in the online personal finance space for four years. His work has been featured by MSN, AOL, Yahoo Finance, and more.

Recommended Reading: How To Mortgage Property In Monopoly

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

Also Check: Is 3.99 A Good Mortgage Rate

Mortgage Calculator: How To Calculate Your Monthly Payments

See Mortgage Rate Quotes for Your Home

There are quite a few factors that go into the calculation of your mortgage expenses, but most homebuyers like to begin by determining their monthly payments and the lifetime cost of the mortgage. Calculating these two figures is a good first step toward understanding all of your other expenses.

What Is A Mortgage Principal

A principal is the original amount of a loan or investment. Interest is then charged on the principal for a loan, while an investor might earn money based on the principal that they invested. When looking at mortgages, the mortgage principal is the amount of money that you owe and will need to pay back. For example, perhaps you bought a home for $500,000 afterclosing costsand made a down payment of $100,000. You will only need to borrow $400,000 from a bank or mortgage lender in order to finance the purchase of the home. This means that when you get a mortgage and borrow $400,000, your mortgage principal will be $400,000.

Your mortgage principal balance is the amount that you still owe and will need to pay back. As you make mortgage payments, your principal balance will decrease. The amount of interest that you pay will depend on your principal balance. A higher principal balance means that youll be paying more mortgage interest compared to a lower principal balance, assuming the mortgage interest rate is the same.

Recommended Reading: What Is Mortgage Rate Vs Apr

What Factors Affect The Amount Of Interest You Pay

The following factors will affect the amount of your interest payments:

- The mortgage interest rate. This is the rate at which the bank charges you interest on the loan. Even a small difference in the interest rate can add up to thousands over the life of the loan.

- The federal funds rate. The interest rate on your loan is loosely tied to the federal funds rate set by the Federal Reserve, which dictates the rate at which banks lend money to each other overnight. If you have a variable interest rate, paying attention to the federal funds rate can help you predict what your interest rate will do.

- The amount you borrow. The more you borrow from your bank, the more interest youll need to repay. For example, 5% of $1 million will always be a larger amount than 5% of $500,000.

- The outstanding loan amount. As you gradually pay off the money you borrow, you will be paying interest on a smaller loan amount and your interest payments will slowly reduce.

- The loan term. The time you take to pay off your loan will affect the amount of interest you pay paying your loan off over a shorter period of time will minimize your interest.