How To Get The Best Deal On A Loan

This one is simple: get a loan that helps you manage your monthly payments.

Now that you know how to calculate your monthly payment, and understand how much loan you can afford, it’s crucial you have a game plan for paying off your loan. Making an extra payment on your loan is the best way to save on interest . But it can be scary to do that. What if unexpected costs come up like car repairs or vet visits?

The Kasasa Loans® is the only loan available that lets you pay ahead and access those funds if you need them later, with a feature called Take-BacksTM. They also make managing repayments easy with a mobile-ready, personalized dashboard. Ask your local, community financial institution or credit union if they offer Kasasa Loans®.

Taking out a loan can feel overwhelming given all the facts and figures , but being armed with useful information and a clear handle on your monthly payment options can ease you into the process. In fact, many of the big-ticket items like homes or cars just wouldn’t be possible to purchase without the flexibility of a monthly loanpayment. As long as you budget carefully and understand what you’re getting into, this credit-building undertaking isn’t hard to manage – or calculate – especially if you keep a calculator handy.

What Is Your Principal Payment

The principal is the amount of money you borrow when you originally take out your home loan. To calculate your mortgage principal, simply subtract your down payment from your homes final selling price.

For example, lets say that you buy a home for $300,000 with a 20% down payment. In this instance, youd put $60,000 down on your loan. Your mortgage lender would then cover the cost of the remaining amount on the loan, which is $240,000. In this case, your principal balance would be $240,000.

Your principal is the most important factor in deciding how much home you can afford. The principal you borrow accumulates interest as soon as you take it out.

If you arent sure how much home you can afford, a good place to begin is with our mortgage calculator. Simply enter your purchase price, down payment and a few other factors. The calculator will then give you a rough estimate of your monthly mortgage payment. When deciding on a mortgage payment thats in your comfort zone, dont forget that youre also responsible for maintenance, repairs, insurance, taxes and more.

Don’t Miss These Hot Deals

Popular Home loans

Important information about this website

Who we are

InfoChoice is one of Australias leading financial services comparison website. We’ve been helpingAussies find great offers on everything from credit cards and home loans to savings and personalloans and more for over 25 years.

InfoChoice lists more than 2,000 financial products from 145 Australian banks, credit unions,building societies and non-bank lenders.

We are not owned by a bank or an insurance company. InfoChoice, its directors, officers and/orRepresentatives do not have any ownership of any financial or credit products or platform providersthat would influence us when we provide general advice. We may receive fees and commissions fromproduct providers for services we provide as detailed below.

Important Information

If InfoChoice refers you to a provider, you will be dealing with that provider directly and not withus. InfoChoice accepts no liability in respect to any financial or credit product which you elect toacquire from any provider.

Please consider whether it is appropriate for your circumstances, before making a decision topurchase or apply for any product. If you are considering acquiring any financial product you shouldobtain and read the relevant Product Disclosure Statement or other offer document prior to making aninvestment decision.

Always free for you

How we make money

Recommended Reading: Does Prequalifying For A Mortgage Affect Your Credit

How To Calculate Mortgage Insurance

This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.There are 7 references cited in this article, which can be found at the bottom of the page.wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status. This article has been viewed 351,924 times.

Private mortgage insurance is insurance that protects a lender in the event that a borrower defaults on a conventional home loan. Mortgage insurance is usually required when the down payment on a home is less than 20 percent of the loan amount. Monthly mortgage insurance payments are usually added into the buyer’s monthly payments.

How Long Youll Stay In Your Current Home

When you refinance, there are origination and other closing costs associated with taking out the new loan. Because of this, its important to have a decent idea of the number of years you might stay in the home.

Your time in the home will help you calculate the breakeven point and determine whether its worth it for you to do the refinance. For instance, if it takes you 2 years to break even in payment and interest savings after paying closing costs, you know you have to stay in the home longer than that for the refi to make sense.

The key here is to have an idea of your situation. If you have some sense of what your future plans might be, then you can sit down and do the math.

Also Check: Rocket Mortgage Loan Requirements

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly and over the life of the loan

- Tallying how much you actually pay off over the life of the loan versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

Recommended Reading: Does Getting Pre Approved Hurt Your Credit

How To Calculate Mortgage Payments

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

How To Calculate Your Mortgage Payment

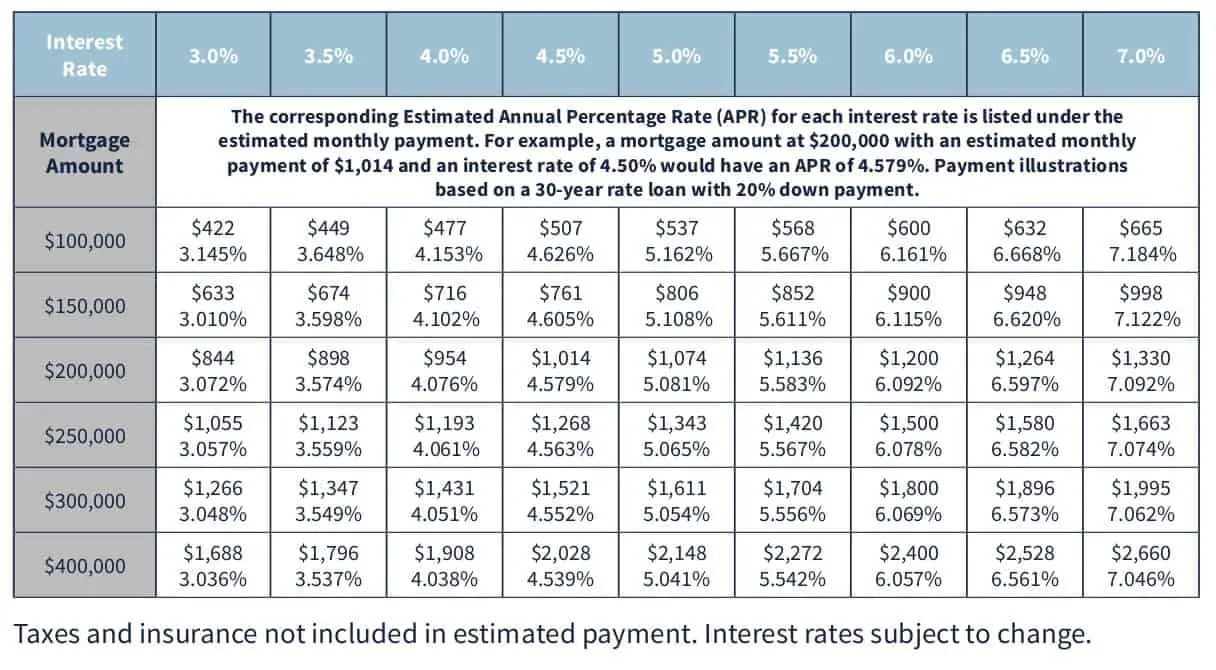

Three main factors determine your monthly mortgage payment: loan size, interest rate, and loan term. Your and your homes location will also affect your interest rate and, in turn, how much you pay.

Additional expenses such as homeowners association fees, closing costs, property taxes and homeowners insurance should be factored in with your monthly housing expenses.

Formula to calculate your monthly mortgage payments

While our calculator takes the computing out of your hands, math whizzes can do it themselves with the following formula:

M = P*/

M your monthly mortgage payment

P the principal loan amount

i the monthly interest rate, which should be divided by twelve since lenders give an annual rate

n the number of payments over the life of the loan , or amortization schedule. For instance, for a 30-year mortgage, n would be 360 payments, .

Don’t Miss: What Does Gmfs Mortgage Stand For

How To Lower My Mortgage Payment

Buying a less expensive home will mean lower monthly payments. Putting more money down upfront also reduces the amount you need to borrow. Finally, longer loan terms will reduce your monthly payment . A better rate also means a lower monthly payment, so if you're not in a rush, do what you can to increase your credit score.

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Don’t Miss: Chase Recast Calculator

What Does Piti Stand For

Most loans are repaid in two parts: principal and interest . This includes repaying the money you borrowed along with interest to the bank.

But when it comes to a mortgage loan, P& I arent your only expenses. You also have to pay for homeowners insurance and property taxes.

All these homeownership costs are bundled together in one monthly payment, often referred to as PITI.

The PITI acronym stands for:

- Principal The amount of your mortgage loans principal balance repaid each month

- Interest The amount of interest your mortgage lender collects on the loan

- Taxes Property taxes required by your city and county government

- Insurance Homeowners insurance and, if required, private mortgage insurance premiums

If you want to know how much house you can afford, you need to consider your entire PITI payment not just principal and interest.

Budgeting for taxes and insurance as well as P& I will get you much closer to the loan amount a lender will actually approve you for.

Calculating Taxes And Insurance

Property tax information is typically public, and records are usually maintained by a county assessor or similar office. If you’re interested in a certain property, look it up on the assessor’s website, or ask your real estate agent to get the information for you. Once you know the annual tax on the property, simply divide that amount by 12 to get the portion you’ll pay each month.

Warning

Property tax is based on a home’s assessed value, which should be listed in the property tax records. The assessed value is the tax authority’s estimate of what the home is worth. If you buy a home for more than the assessed value, don’t be surprised to see the assessment and your taxes rise as a result.

Talk to your insurance agent about how much it would cost to insure the home for a year. If you don’t have an agent, call around for quotes. Once you get a number, divide it by 12 to get your monthly payment for insurance.

Recommended Reading: What Does Rocket Mortgage Do

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

Read Also: Rocket Mortgage Conventional Loan

Creating An Amortization Schedule

What Is Pmi And How Is It Calculated

When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance private mortgage insurance.

When do you have to pay private mortgage insurance and how much will it cost you? It depends on your loan-to-value ratio. Find out when you have to pay PMI and learn how to calculate the cost.

Also Check: Can You Do A Reverse Mortgage On A Condo

The Length Of A Home Loan Term

The loan term refers to how long you have to pay off a loan. Shorter terms mean higher monthly payments with less interest. Longer terms flip this scenario, meaning more interest is paid, but the monthly payment is lower.

When youre looking at monthly payments, its important to balance dueling goals of affordability while at the same time trying to pay as little interest as possible.

One strategy that might be helpful is to put extra money toward the monthly principal payment when you can. This will result in paying less total interest over time than if you just made your regular monthly payment.

You can also take a look at recasting your mortgage to lower your payment permanently. When you recast, your term and interest rate stays the same, but the loan balance is lowered to reflect the payments youve already made. Your payment is lower because the interest rate and term remain.

One thing to know about recasting is that sometimes theres a fee, and some lenders limit how often you do it or if they let you do it at all. However, it can be an option worth looking into, because it might be cheaper than the closing costs on a refinance.

How To Lower Your Mortgage Payments

Once youve calculated your potential monthly payment and find that you cant afford the mortgage, you have a few options aside from purchasing a less expensive home.

Extending your loan term will reduce the amount you pay each month. For instance, youll make smaller payments with a 30-year fixed mortgage compared to a 15-year loan. You can crunch numbers using our calculator above to see the impact of a 30-year versus 15-year loan on your monthly mortgage payments.

Another option is to make a larger down payment. If you put at least 20% down, you wont have to pay PMI, which lowers your monthly borrowing costs. Plus, borrowers who have higher credit scores and lower debt-to-income ratios tend to qualify for lower interest rates, saving them money on mortgage payments.

Before applying for a loan, check your credit scores and take proactive steps to boost them. You can lower your DTI ratio by paying down existing debt or increasing your income.

Dont forget to shop around with multiple lenders to compare rates and loan terms. Lenders can also help you explore different home loan programs to ensure youre choosing the best loan option for your specific situation.

Recommended Reading: Rocket Mortgage Launchpad