Is Mortgage Protection The Same Thing As Life Insurance

Yes and no. Like life insurance, mortgage protection policies pay out a benefit when the policyholder dies, but the beneficiary is always the mortgage lender â not your family or some other beneficiary who you designate. It’s helpful to consider mortgage protection as a limited type of life insurance with more specific rules about who and how much is paid by the policy.

What Is The Average Monthly Mortgage Payment

6 Minute Read | September 24, 2021

Are you trying to decide if you can afford a mortgage? Or are you already on the hunt for the perfect home? Either way, if you know what the average monthly mortgage payment is, it might help put your own home purchase into perspective.

How much is the average American paying per month for their mortgage? Lets break it down and find out how much home sweet home really costs.

What Is Mortgage Insurance And Why Do We Pay It

Taking a risk is something we are all familiar with in life. Whether you take a risk by accepting that new job offer or by going sky diving as a thrill seeker, it is a risk. Just as we take risks in our personal lives mortgage lenders also take risks when lending money to their customers. As a way to mitigate the risks that comes with lending such a large amount of money, lenders usually charge a fee, or mortgage insurance, when a lender puts less than 20% down on a home loan. There are some loans that start out with a mortgage insurance premium and then can be removed over time, some loans however require the mortgage insurance to be paid throughout the life of the loan. The cost of the mortgage insurance can vary depending on the type of loan that is acquired.

Why Do We Require Mortgage Insurance?

Do We Get to Keep the Mortgage Insurance?

Although the lender requires mortgage insurance to be paid on loans with less than 20% down, the lender does not keep the money that is paid for the insurance. The mortgage insurance company that covers the loan on the property keeps the money and if the loan defaults, the mortgage insurance company will take the property or pay off the bank for the insured amount. With FHA loans, the mortgage insurance is paid to the federal government and they insure the loan. If an FHA loan defaults and it goes into foreclosure, the home is taken back by the government and becomes a HUD home.

How Much is Mortgage Insurance?

Don’t Miss: How To Apply For A Home Mortgage

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

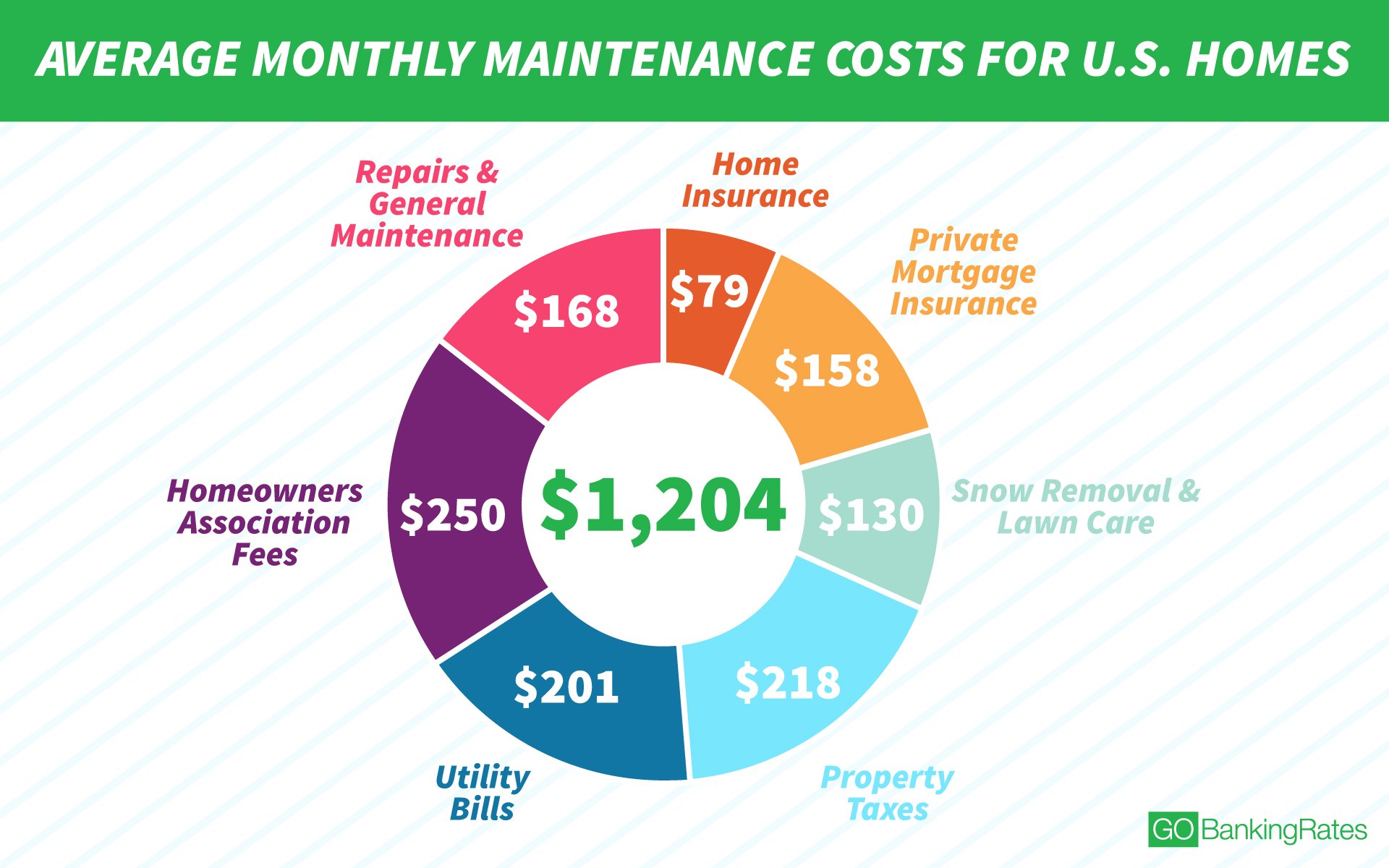

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

When Is Mortgage Life Insurance A Good Idea

Mortgage life insurance makes sense if you have any health conditions that could make term life insurance overly expensive. While the benefits will go entirely to your mortgage lender rather than your surviving family, mortgage life insurance is ideal if your main goal is to make sure your home loan is paid off no matter what happens to you.

Recommended Reading: Can Non Permanent Resident Get Mortgage

How To Pay Lmi

There are two ways you can pay for LMI. Some lenders will allow you to capitalise LMI onto your loan so it can be paid gradually over time with your mortgage repayments. However, this means that interest will accrue on the LMI, costing you more over time.

The alternative is to pay LMI as an upfront cost, which is generally preferred by lenders.

How Much Does It Cost

The following table provides you with a general idea of the premiums charged by CMHC. The exact premium will be calculated when you apply for a mortgage and provincial sales tax may apply.

| Up to and including 65% | 0.60% |

| Up to and including 75% | 1.70% |

| Up to and including 80% | 2.40% |

| Up to and including 85% | 2.80% |

| Up to and including 90% | 3.10% |

| Up to and including 95% Traditional Down Payment Non-Traditional Down Payment | 4.50% |

CMHCs online Mortgage Calculator can also help you with your estimations.

*The minimum down payment requirement for mortgage loan insurance depends on the purchase price of the home. For a purchase price of $500,000 or less, the minimum down payment is 5%. When the purchase price is above $500,000, the minimum down payment is 5% for the first $500,000 and 10% for the remaining portion. Mortgage loan insurance is available only for properties with a purchase price or as-improved/renovated value below $1,000,000.

**Premium savings may be available if you are porting an existing CMHC-insured mortgage or if you are using CMHC-insured financing to purchase an energy-efficient home or purchase an existing home and make energy-saving renovations. Ask your mortgage professional or visit www.cmhc.ca for more details about mortgage loan insurance, such as down payment requirements, portability, etc.

Canada Mortgage and Housing Corporation offers a variety of publications, calculators and online tools to help you make informed and responsible homebuying decisions.

Recommended Reading: Why Are Mortgages So Hard To Get

Understanding Private Mortgage Insurance

PMI benefits the lender , and it can add up to a sizable chunk of your monthly house payments. Typically, you send one payment to your lender each month to cover both the mortgage and the insurance premium. PMI rates can range from 0.5% to 1.5% of the loan amount on an annual basis. A mortgage calculator can be a good resource to budget for the monthly cost of your payment.

Your PMI rate will depend on several factors, including the following.

What Is Mortgage Protection Insurance

Mortgage protection insurance is basically what it sounds like: life insurance thatâs designed to protect your family from burdensome mortgage payments if the primary breadwinner is no longer around to provide an income.

Mortgage protection insurance is broadly similar to term life insurance in how it works. You buy a policy, pay regular premiums, and at the end of the policy term, your coverage ends. If you die during the term of the policy, a death benefit is paid out to your beneficiaries.

However, mortgage protection insurance has a few key differences from term life insurance: your family members arenât your beneficiaries and the death benefit amount decreases over time.

Recommended Reading: Can You Take A Cosigner Off A Mortgage

What Is The Ltv Ratio

The LTV or loan to value ratio is the portion of the value of the house that you are borrowing through a mortgage. In other words, the percentage of your homes value that is financed by the mortgage.

Example – Imagine that you want to purchase a house that costs $100,000 and you can only afford to make a 10% down payment. What is your LTV ratio?

Down Payment = 10% * House Price = 10% * $100,000 = $10,000

Mortgage Amount = House Price Down Payment = $100,000 – $10,000 = $90,000

LTV ratio = Mortgage Amount /Home Value = $90,000/ $100,000 = 90%

You pass the halfway point of your mortgage term – On a 30-year mortgage, for example, PMI must be removed 15 years into the loan. This is true even if the mortgage balance exceeds 78% of the original purchase price of the house.

You refinance your mortgage –The last way to get rid of PMI is to refinance your mortgage such that the new loan balance is less than 80% of the homes current value. This will allow you to avoid paying PMI after the refinancing of the mortgage.

Fha’s Annual Mortgage Insurance Premium

The annual premium is divided by 12, and that amount is added to the borrower’s monthly mortgage payment. This system means the borrower doesnt have to pay the full amount all at once every year.

An individual borrowers MIP can vary from less than $60 to several hundred dollars per month, depending on the borrowers loan amount, loan term and down payment percentage. The borrowers credit score doesnt affect his or her MIP for FHA loans.

The monthly MIP calculation is complicated, so you should consult a mortgage professional for an FHA loan quote based on your situation.

Read Also: Can You Pay Back A Reverse Mortgage Early

How To Stop Paying Pmi

If certain conditions are met, your loan servicer will automatically cancel your PMI when your loan-to-value ratio reaches 78 percent of the original value of your home.

However, you can call or write a letter asking for it to be canceled when your LTV hits 80 percent, although you may be required to pay for a new appraisal.

Why Did My Home Insurance Go Up

There are a lot of reasons that home insurance premiums can change. If you have made changes to your coverage, your premium will likely change. If you filed a claim during your last policy term, you could see an increase in your premium at your renewal. Even if nothing has changed, you may still see some fluctuation in your home insurance cost. Insurance companies use new rates every year, so when your policy renews, the price may change even if everything else is the same. Companies base your homeowners insurance cost on several factors, including the number and amount of claims paid out in the previous year, the projected likelihood of claims in your area and the price of materials and labor in your state and ZIP code.

You May Like: Can I Have Multiple Mortgages

When Is It Required Knowing Your Loan

PMI is applied to address very specific circumstances so many buyers are unfamiliar with the concept. It is only those with low down payments who are compelled to add PMI, and even when it is required, there is light at the end of the tunnel for borrowers.

Loan-to-value ratio determines how long a mortgage is subject to PMI requirements. As a result, the original purchase price, down payment amount, appraised value, and other variables influence how PMI is handled. Once a home dips below a designated threshold, the mandate is lifted and PMI payments are discontinued. Borrowers carrying Private Mortgage Insurance are well-served to track payments and remain mindful of outstanding mortgage balances, so they do not leave money on the table covering premiums.

When a home’s loan-to-value ratio drops below 80%, home owners can reasonably request concessions from lenders, asking them to discontinue PMI and eliminate the need for the added payments. In fact, The Homeowners Protection Act guards buyers’ interests, requiring lenders to issue a PMI disclosure outlining the terms of the coverage mandate. The disclosure identifies the date at which mortgage holders reach their 80% ratio, enabling them to make timely cancellation requests. Of course, if additional principal payments were made during the life of a loan, the original projected date does not apply.

The following stipulations for lifting PMI requirements are in-place among most lenders:

How To Get Rid Of Your Pmi Payment

If you are currently making PMI payments, you have a few ways to get rid of them. Once you reach any of the equity requirements, you’ll need to request your mortgage provider to cancel the PMI payments via, this is not a typo, writing them a letter. They certainly don’t make it easy, do they? Here are the requirements you’ll need to reach to complete your request:

- Reaching 20% equity in your home â in this case, the payments do not have to be removed you can only request that they are.

- Reaching 22% equity in your home â in this case, the payments are typically automatically canceled if not, make a request.

- Your home value has increased enough where you’d have 20% equity or more â This can be due to improvements you’ve made to your home or due to market conditions raising the value of your home. In either case, you’ll your home appraise to prove its value on the open market.

- Refinancing â If you refinance your home with an LTV of 80% or less, you’ll avoid paying PMI on the new loan.

Recommended Reading: What Is A Good Dti For A Mortgage

Understand That Mip Is Different

FHA loans charge borrowers mortgage insurance premiums rather than PMI. With MIP, borrowers must pay 1.75 percent of the borrowed amount upfront and then continue to pay MIP every month. FHA MIP rates range from 0.45 to 1.05 percent of your total mortgage amount every year. Depending on when you took out your loan and how much you put down, FHA MIP premiums may last for 11 years or for the life of your loan.

With permanent MIP, a $300,000 mortgage with a .8 percent MIP rate results in MIP payments of $2,400 per year. Over 30 years, this adds up to a jaw-dropping $72,000 of mortgage insurance premiums. It’s easy to see why most FHA borrowers refinance into a conventional mortgage without MIP or PMI as soon as they can.

How Much Is Fha Mortgage Insurance

The upfront mortgage insurance premium costs 1.75% of your loan amount and is due at closing. If youre borrowing $250,000, for example, your upfront MIP will be $4,375 .

The 1.75% UFMIP applies to most FHA loans, no matter the loan amount or term, except for the following:

- Streamline refinances and some simple refinances

- Hawaiian home lands

- Indian lands

Recommended Reading: What Portion Of Your Income Should Be Mortgage

Does My Home Insurance Cost Affect My Mortgage Payment

It might. If you have an escrow account for your home insurance, youll pay a portion of your premium each month with your mortgage payment. This amount will be collected in your escrow account, and your mortgage company will then use the money to pay for your insurance policy each renewal. If your insurance is escrowed, the higher your premium, the higher your monthly mortgage payment is likely to be since you pay a portion of your premium each month. If you do not have an escrow account and pay your insurance yourself, your policy premium should not affect your mortgage payment.

Us Department Of Agriculture Loans

The USDA offers several attractive loan programs. Most are limited to rural areas, and to people who have average or below-average income. If you live outside of an urban or suburban area, it pays to learn if you qualify for a USDA loan.

USDA Loan Insurer

Guaranteed by the U.S. Department of Agriculture, USDA loans do not require a down payment. USDA loans are designed to encourage rural development.

USDA Loan Insurance Cost

USDA loans have an upfront fee and annual fee. The upfront fee is 2 percent of the loan amount. The annual fee, paid monthly, is 0.4 percent of the loan amount. USDA fees are lower than FHA fees.

Read Also: Why Does My Mortgage Payment Keep Going Up

Can I Make Changes To My Home That Will Lower My Insurance Cost

Yes, you may be able to make some changes to your home that could save you money on your home insurance. Many companies offer a discount for having a new roof. Even if you do not get a discount, many companies simply rate newer roofs at a lower price because the likelihood of damage is lower. A security system that includes fire and burglar monitoring can also lower your premium. Some companies offer savings for other improvements, like updated plumbing, electrical and heating and cooling systems.

Why Do I Need To Pay For Pmi When It Is For The Lenders Benefit

The reason for this is because the lender is taking on additional risk by lending to you while youre putting up less money upfront and can default on future payments.

However, it is important to understand that it isbeneficial for you too because if PMI or insurance was not an option, lenders may not have offered a mortgage for anything less than a 20% down payment, preventing a lot of individuals from becoming homeowners.

PMI also has an additional benefit because lenders can give you a bettermortgage rateif you take PMI. The reason for this is because PMI allows lenders to recover a greater portion of their investment as compared to individuals who do not take PMI, allowing them to give you a better rate on your mortgage.

Read Also: What Is A Mortgage Holder

Have A Family Member Go Guarantor

A guarantor is someone who guarantees part or all of your loan so that in the event that you cant pay, the responsibility would fall to them. This eliminates much of the risk for a lender, but can place a great deal of risk on the person or people acting as the guarantor.

This decision should not be taken lightly. After all, the person going guarantor is potentially risking their own savings and assets, including their home in some cases. You can read more about going guarantor on a home loan here. Since it is a major decision to make, it may be a good idea to seek professional advice before making a decision.